Confessions of a Day Trader: Coal … it keeps the lights on!

Some happy coal miners yesterday. Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday November 7

Commodity prices went through the roof on Friday night, so my trio of RIOs, BHP and FMG come out of the traps fully loaded up. At their day’s end, they are up between 4.85% and 3.75%.

Full moon fever!

This leaves me with only having eyes for the banks and even still, I held off till the magical 11.00am time frame.

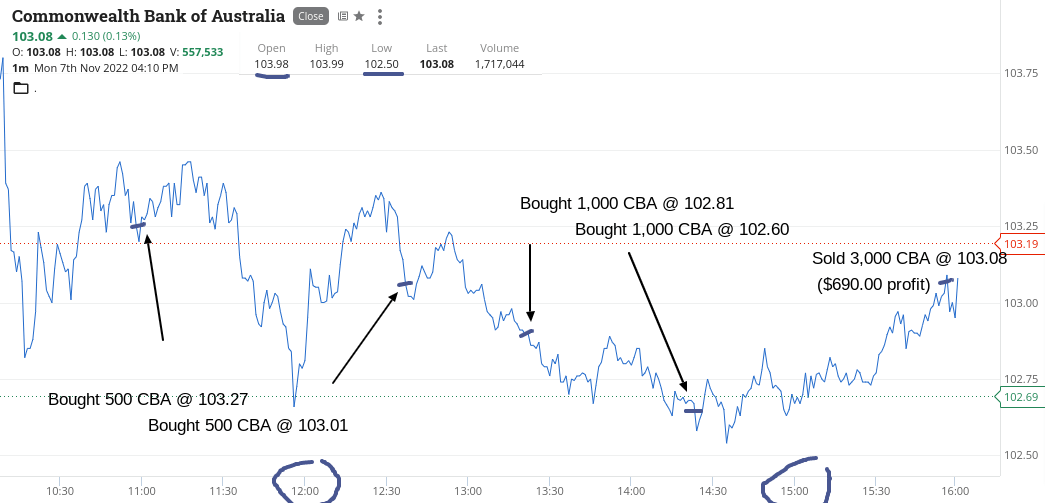

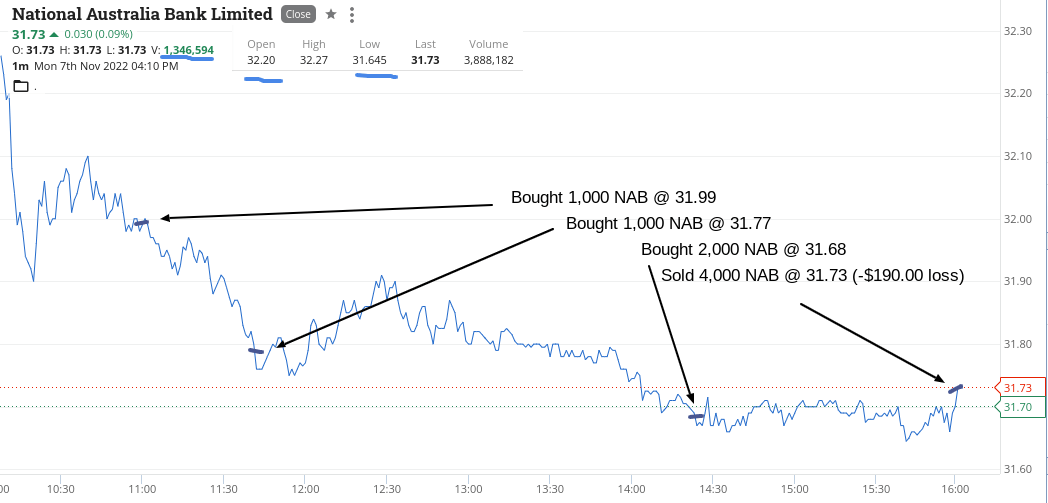

I endured a bit of pain a few times before CBA came good, though NAB didn’t manage a profit for me today. They just stayed down in the doldrums.

The first purchase in CBA was at $103.27, then $103.01, then $102.81 and finally $102.60 before selling out at $103.08.

Their day’s high was $103.99 and their low was $102.50 on 1.7m shares and had to wait till almost the death before running them out.

Up $500, though was staring at down $1,000 at one point and NAB not helping the cause.

Recap

Bought 1,000 NAB @ 31.99

Bought 500 CBA @ 103.27

Bought 500 CBA @ 103.01

Bought 1,000 NAB @ 31.77

Bought 1,000 CBA @ 102.81

Bought 2,000 NAB @ 31.68

Bought 1,000 CBA @ 102.60

Sold 3,000 CBA @ 103.08 ($690 profit)

Sold 4,000 NAB @ 31.73 ($190 loss)

Tuesday November 8

A reversal of yesterday, with banks up and miners down.

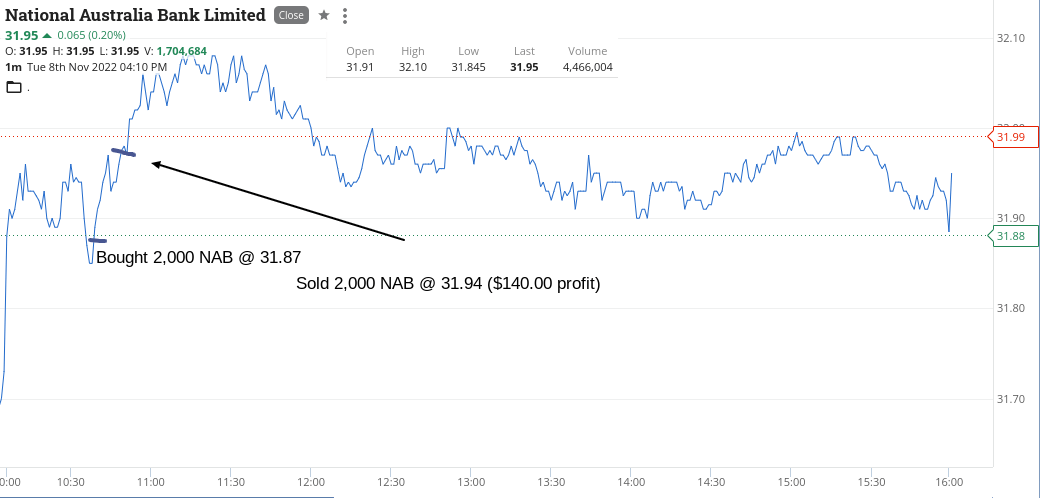

It got a bit hectic on the downside kicking off with some FMG and then ironically, NAB were a faller and they came up trumps for a quickie.

Both FMG and RIOs kick me in the ‘nads today and cause that special kind of pain. I cut the FMG when they have some sort of resurrection, thank Christ, and have to do the same in RIO, even after doubling down.

They keep flirting with $96.00 level and of course rallied after I had cut them, but too late in the day for me.

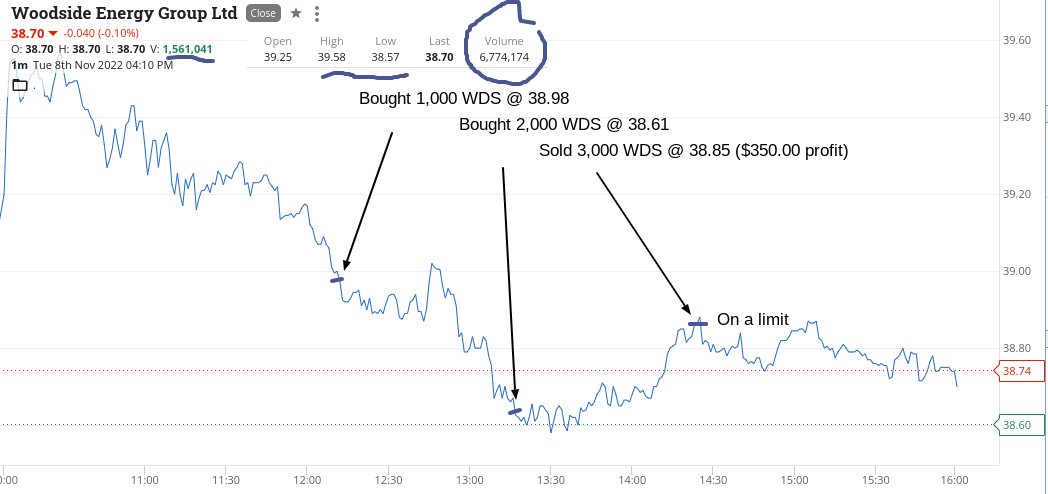

WDS save my bacon though but they also gave me pain before the gain. A bit of Madam Lash going on in them!

Overall up $395 thanks to NAB and WDS.

Recap

Bought 1,500 FMG @ 16.58

Bought 2,000 NAB @ 31.87

Sold 2,000 NAB @ 31.94 ($140 profit)

Bought 1,000 RIO @ 96.29

Sold 1,500 FMG @ 16.57 ($15 loss)

Bought 1,000 WDS @ 38.98

Bought 1,000 RIO @ 95.79

Bought 2,000 WDS @ 38.61

Sold 3,000 WDS @ 38.85 ($350 profit)

Sold 2,000 RIO @ 96.00 ($80 loss)

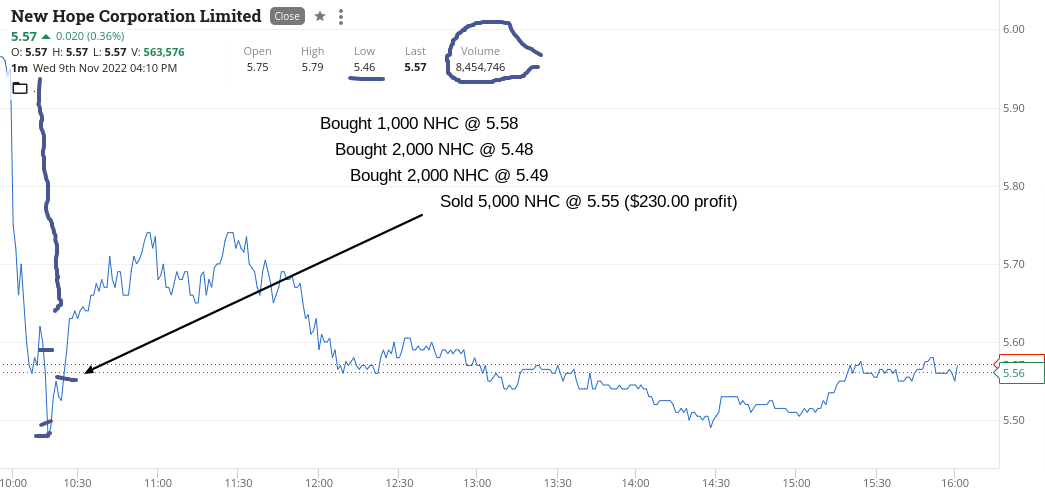

Wednesday November 9

No Hope Coal became Some Hope Coal today for me very early on, after they had a big fall in the first 15 mins of trading. Had a go once. Had a go twice. Had a go thrice and eventually they bounce.

Had them on a higher limit of $5.60 to sell, but made the mistake of watching the size of the bids and offers going through.

I suppose it was the fact that every 1c movement meant +/- $50 that I just adjusted my limit down to meet the bids, rather than hang out with an offer.

Anyway, happy to lock in $230 profit so quickly in the trading day, however, it left me with nothing really more to have a crack at. I had a lower limit in NAB, which never got hit (like missed it by 3c) and watched them gallop away by 40c or so.

The iron ore three amigos put in solid performances upwards, as did the banks. Bitcoin came under pressure and gold bounced and USA elections of some sort happening, so interested in what tomorrow will bring.

Recap

Bought 1,000 NHC @ 5.58

Bought 2,000 NHC @ 5.48

Bought 2,000 NHC @ 5.49

Sold 5,000 NHC @ 5.55 ($230 profit)

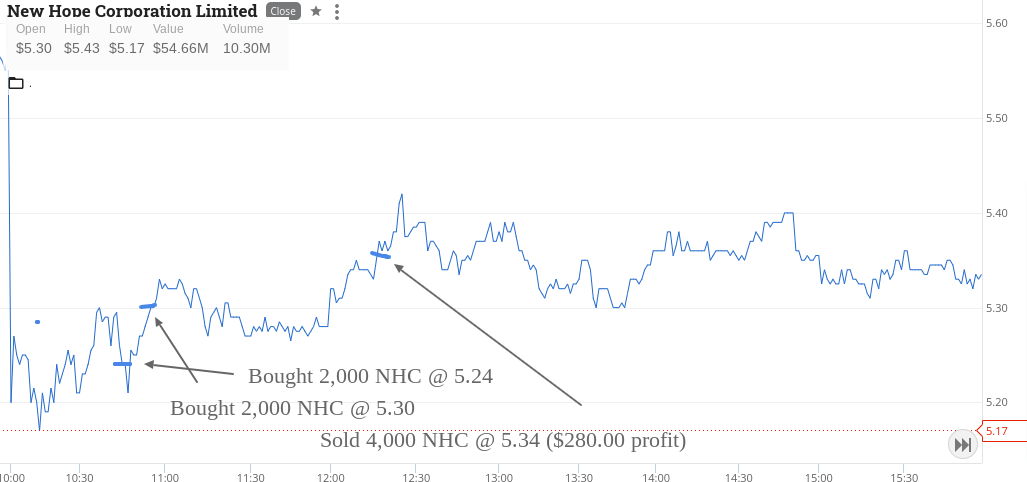

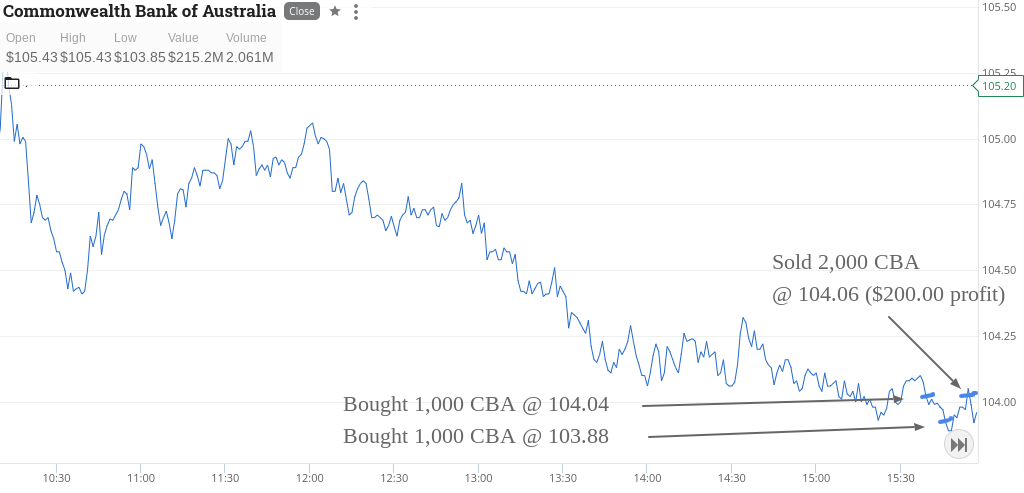

Thursday November 10

Only two trading opportunities I could find today. Went early again in NHC and then very late in the trading day, CBA headed to being below $104.

Picked up 1000 at $104.04 and then 1000 at $103.88, before selling them with a few mins to spare. Seeing as they had a high of $105.43, was happy to get a little bit aggressive.

Up $480 and think I have now clawed back all of my previous losses in NHC. Phew.

Recap

Bought 2,000 NHC @ 5.24

Bought 2,000 NHC @ 5.30

Sold 4,000 NHC @ 5.34 ($280 profit)

Bought 1,000 CBA @ 104.04

Bought 1,000 CBA @ 103.88

Sold 2,000 CBA @ 104.06 ($200 profit)

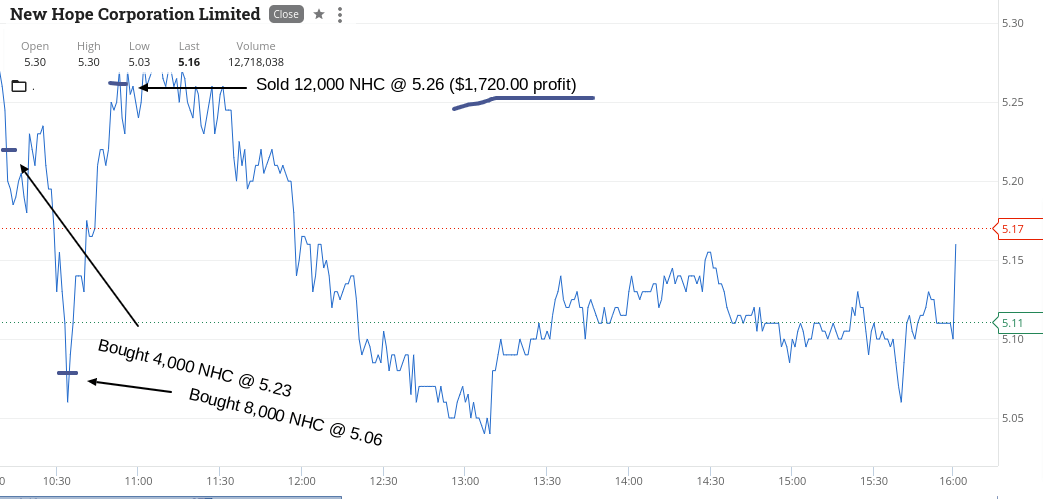

Friday November 11

The 11th of the 11th and today was one of those rare days where the market went through the roof and so my trading style doesn’t really work on these kind of days.

However, there was only one stock showing down and that was NHC. I re-read their buy back notice, closed my eyes and bought 4000.

They promptly fell 17c so I really doubled down in the belief that surely they are getting over-sold in this market.

Went for a walk and checked my phone and hit the bid as fast as I could at $5.26. Occasionally all of my painful trades fade away as one good trade (and early on and on a Friday) means that a well deserved long lunch can be organised without feeling guilty.

What a week. Finished up $3,325 gross and $2,861 net, so red wine, steak and oysters to end my early trading finish!

Recap

Bought 4,000 NHC @ 5.23

Bought 8,000 NHC @ 5.06

Sold 12,000 NHC @ 5.26 ($1,720 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.