Confessions of a Day Trader: Buy now, profit later… but keep your eye on the ball

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

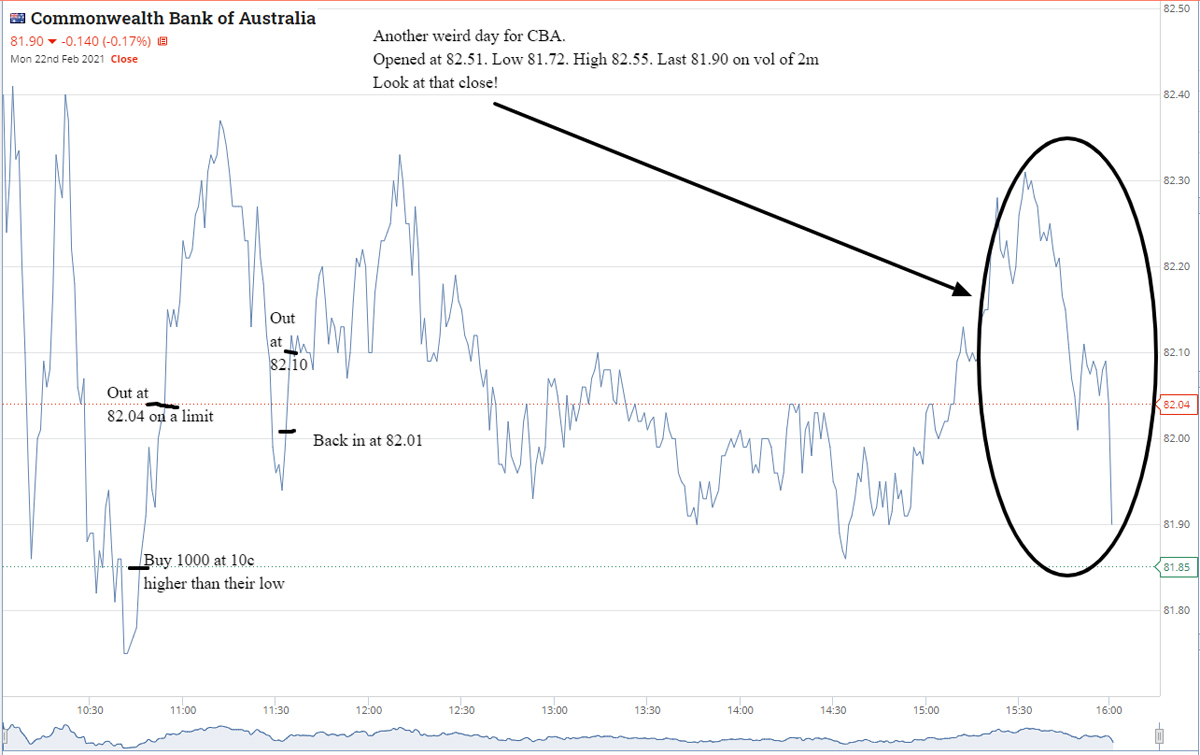

Monday February 22

Start off my Monday morning with a CBA trade. They fall down to below 82.00 and buy 1000 at 10c above their low. Buy 1000 at 81.55 and sell them on a limit at 82.04 2 mins later. They take off to 82.38 and then blow me down they fall back to 82.00. So buy another 1000 at 81.99 and sell them at 82.10 and they take off again.

RCW are biggest faller of day after their results. Never heard of them or ever traded them. Results look OK to me so buy 3000 at 4.40. Time is 11.46am.

Out of them on a limit at 4.45, 25 mins later. APT also fell like CBA, so bought 200 at 151.01 on a limit and sold them 152.05, 24 mins later.

All up +A$658 for the day. Not bad for start of the week. Let’s hope I can keep most of it!

+1000 CBA at 81.85; +1000 at 81.99; -1000 CBA at 82.04; -1000 at 82.10; Profit A$300

+3000 RWC at 4.40; -3000 RWC at 4.45; Profit A$150

+200 APT at 151.01; -200 APT at 152.05; Profit A$208

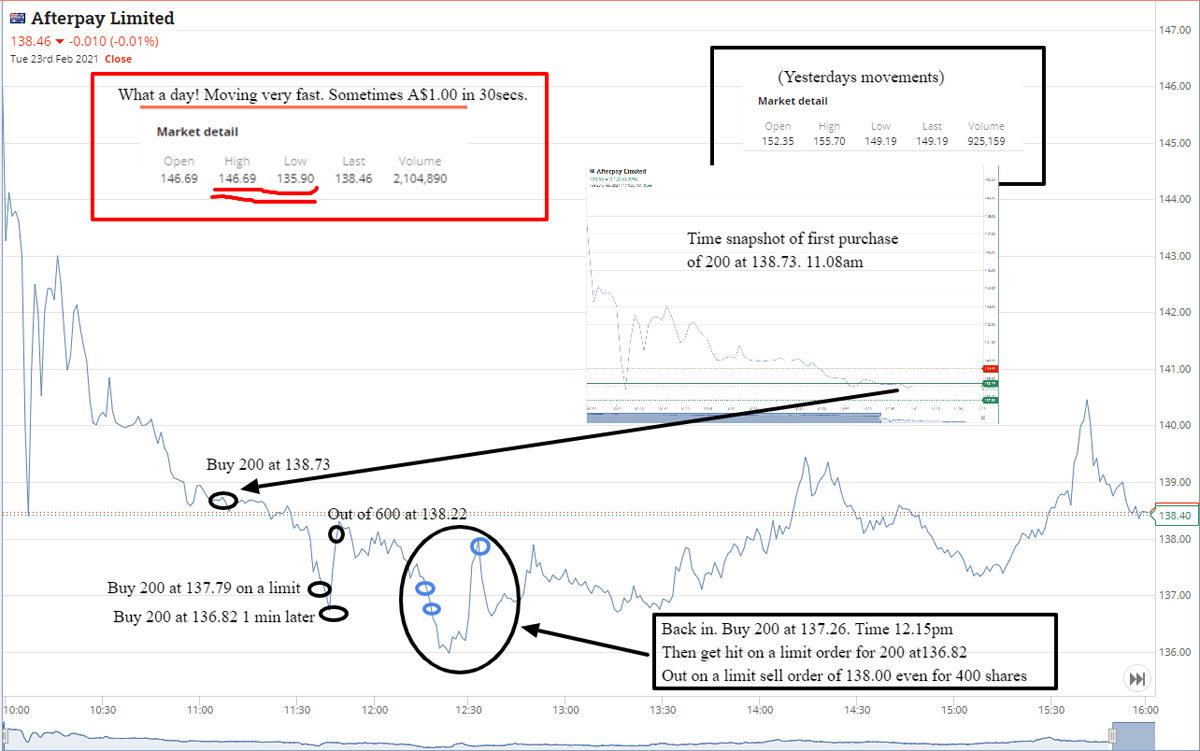

Tuesday 23rd Feb

It’s all about APT today. Moving around very fast. Falling and bouncing. Bouncing and falling. It’s like being on a scary ride at Disneyland.

From my first purchase of 200 to my next two purchases, I am down yesterday’s profit. Then bang, out for a A$264 profit.

Tell myself, that’s it, leave alone, but can’t help myself. Back in for 200 at 137.26. Time 12.15pm. Get hit with another 200 on a limit of 136.82, which I had immediately put on after this back in buy. They fall and then bounce and have them on to sell at 138.00 on a limit, which gets hit.

Overall, up A$648 (another day ending in an 8 and just A$10 below yesterday’s profit). Expecting more volatility ahead of Thursdays half-year results. Bring it on!

+200 APT at 138.73; +200 at 137.79; +200 at 136.82; +200 at 137.26; +200 at 136.82; -600 APT at 138.22; -400 at 138.00; Profit A$648 (Sweaty palm trading and lots of limit adjusting! Plus bt 200 twice at 136.22 at different times.)

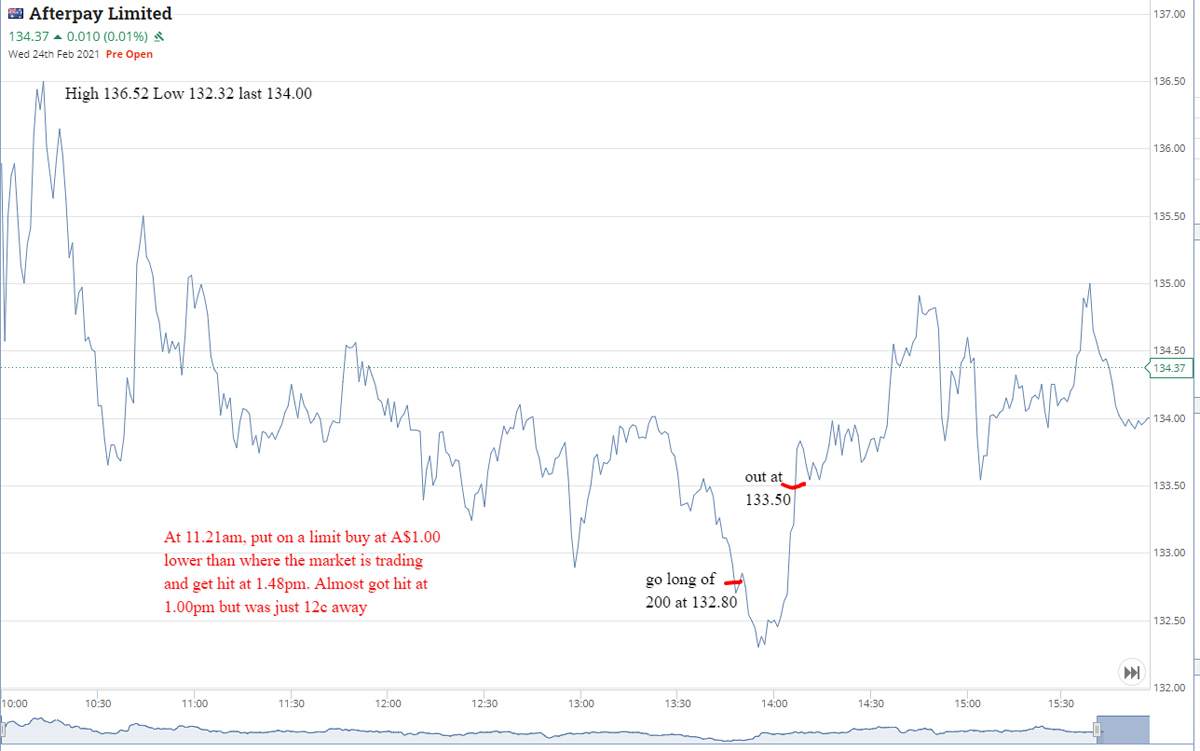

Wednesday February 24

Have to go late in the morning so I leave a limit in APT at A$1.00 below where it was trading at 11.21am and get filled in with 200 at 132.80. Time 1.48pm.

I put them straight on to sell at 133.50, which goes through at 2.12pm and now will sit back for Thursday’s results from Z1P and APT. Up A$140 for the day.

+200 APT at 132.80; -200 APT at 133.50; Profit A$140

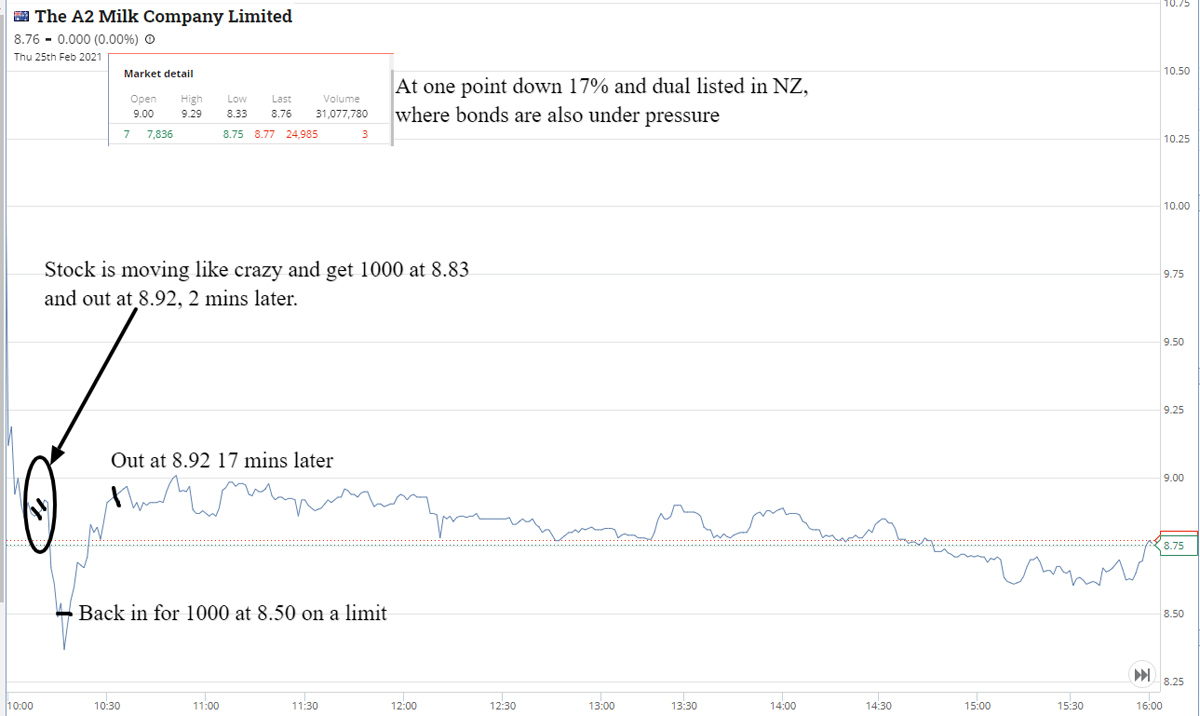

Thursday February 25

Mmmm great. APT are in a trading halt after results and a capital raising, so nothing happening today.

A2M are down 15%, so grab 1000 at 8.83 and out at 8.92 just 2 mins later. Then back in on a limit buy at 8.50 and out at 8.92 17 mins later. Crazy moving shares!

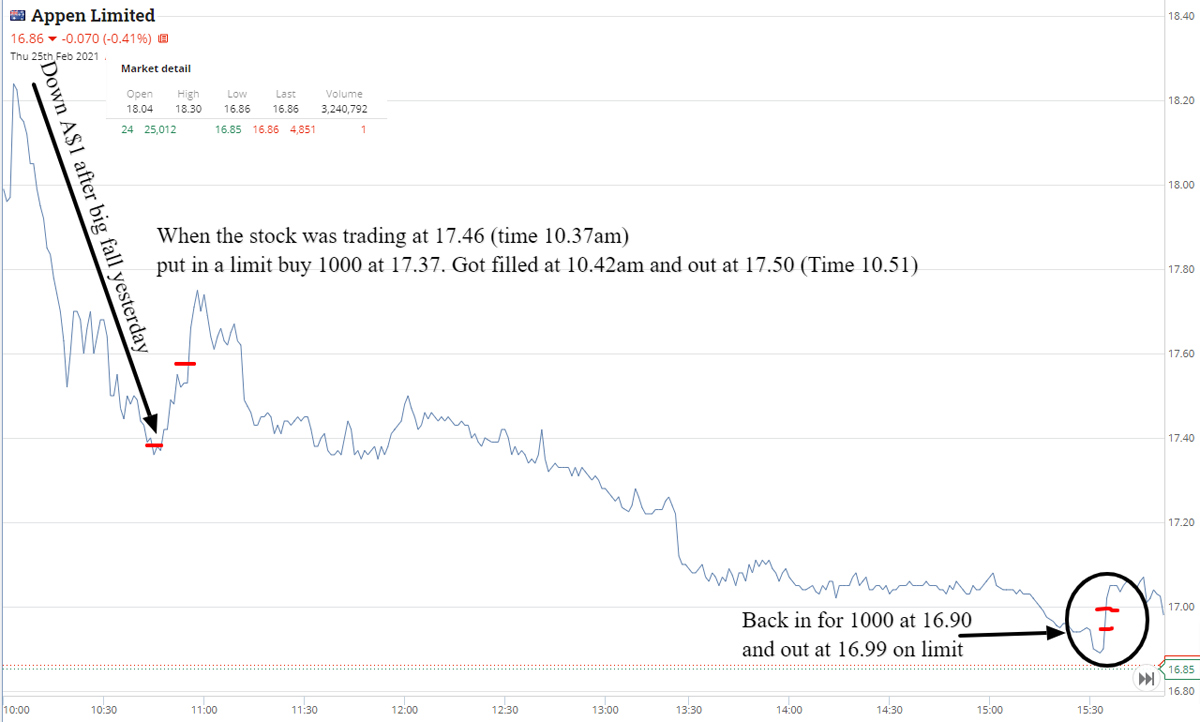

Another big faller yesterday was APX and today marked down A$1.00 more after opening. Buy 1000 at 17.37 and sell them at 17.50. Towards the end of the day they are trading at 16.90 and get a quick in and out at 16.99.

Z1P were also getting smashed but leaving alone till APT come back on! Up A$730 for the day.

+1000 A2M at 8.83; +1000 at 8.50; -1000 at 8.92; -1000 at 8.92; Profit A$510 (crazy movements)

+1000 APX at 17.37; +1000 at 16.90; -1000 at 17.50; -1000 at 16.99; Profit A$220 (big faller yesterday)

Friday February 26

And they are back. APT get smashed and move around like a crazy man. Buy 200 at 118.99. They were 151.00 on Monday. Out at 120.10 on the 11.00am bounce and now step back.

Z1P are also down and I have a limit order in to buy 2000 at 9.81, which I miss by 7 cents.

NXL are down a huge 26% and I buy a 1000 at 6.57. Time 11.13am. Double down at 6.22. Time 12.41. Have to cut them at 6.25, 10 mins before the close at a loss of A$280.

So end day down A$58, but up A$2118 gross for the week, which saw APT fall over A$30.

+200 APT at 118.99; -200 APT at 120.10; Profit A$222 (very hairy stuff)

+1000 NXL at 6.57; +1000 NXL at 6.22; -2000 NXL at 6.25; Loss A$280 (will have another look on Monday)

Gross profit for week: A$2118

Brokerage: A$223

Net Profit: A$1895

Most satisfying: A2M

Least satisfying: NXL

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.