Confessions of a Day Trader: Buy Now, Pray Later?

Pic: d3sign / Moment via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday March 1

Both APT and Z1P are trending up but luckily for me FMG go ex div, so I pick up 2000 at 22.72, down from 24.20 close on Friday. Thought it would be a quick trade and up A$300 after about 20 mins, but hold on to a limit sell at 22.99.

Never happened and annoyingly had to double down at 1.48pm, by buying another 2000 at 22.52. This gave me an average price now of 22.62. Adjust limit to now selling 4000 at 22.72 which got taken out at 3.15pm.

So all up one trade for A$400 profit and took longer than I thought it would. Total volume was 13m, which is about 4 times normal.

+2000 FMG at 22.72; +2000 at 22.52; Sell 4000 at 22.72; Profit A$400 (took all day of watching)

Tuesday March 2

Have to have the car serviced and have a long lunch organised for a friend’s birthday, so away from the big screens today and have patchy reception as the lunch is in a downstairs restaurant.

Every time I do check in everything is red on my watch list and something doesn’t feel right. As I’ve learnt the hard way, alcohol and trading is like oil and water. They don’t mix well.

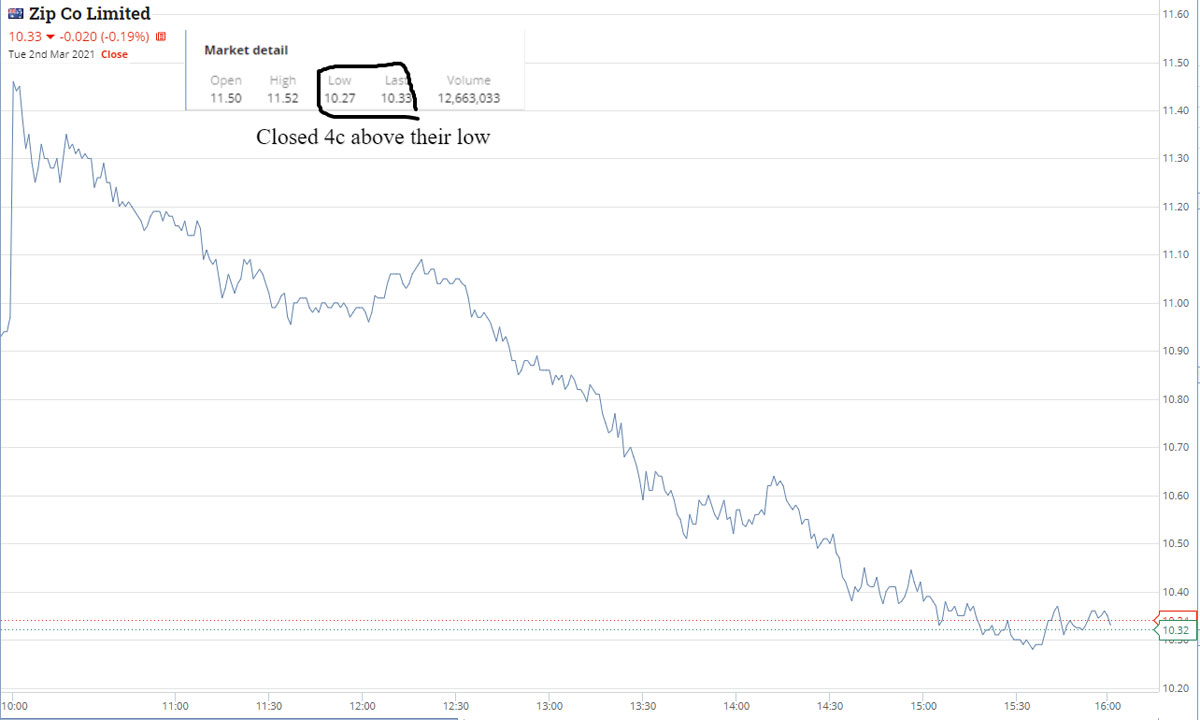

FMG closed on their low and Z1P were just 4c of theirs.

Wednesday March 3

Lots of coffee consumed before the opening bell. Very interested in FMG and Z1P on their opening levels today. Both open up and fall. Manage to buy 1000 FMG at 21.82 at 10.11am and sell them at 21.99 three mins later.

Now at 10.49am, they are trading at 22.58! And Z1P touch a low of 10.04 at 10.37am and have a limit order in at 9.85, just in case they break down past the psychological 10.00 barrier.

APT are at 120.74 and waiting to see if they break below 119.00. Have a limit order in at 118.50, which gets hit whilst I am out and when I check via the app my positions I sell them immediately at 119.51 as they move around so fast. All up plus A$312.

Z1P never falls below 10.00, with 10.04 being the day’s low.

+1000 FMG at 21.82; -1000 FMG at 21.99; Profit A$170 (left a bit on the table)

+200 APT at 118.50; -200 APT at 119.51; Profit A$202 (still moving up and down very fast)

Thursday March 4

Tech stocks down overnight and bond yields ticking up again. Sit watching from the opening and feels like a nothing day. Everything is red on my watch list except CBA.

First trade is at 11.03am, when notice that IGO is down because of a fall in the nickel price. Buy 1000 at 6.66, which used to be my ‘lucky’ price in Z1P. The devil bit me on this one as had to buy another 2000 at 6.53 and was down over A$600 at one point. Cut them on the close for a A$160 loss.

In between had to use the same technique for my other two trades. Buy 1000 and then double down by buy 2000 but that is all, as nothing is recovering strong enough and not a day to chase. Got my timing wrong on the opening of all three positions, more out of boredom, after sitting on my hands for an hour.

See graphs, as had to wait with limit orders almost to the death. Very frustrating as walk away up A$70 for the day, which doesn’t reflect my stress levels.

+1000 NXL at 5.32; +2000 NXL at 5.14; -3000 NXL at 5.24; Profit A$120 (average in cost came down to 5.20)

+1000 IGO at 6.66; +2000 IGO at 6.53; -3000 IGO at 6.52; Loss A$160 (was down A$600 at one point)

+1000 FMG at 22.30; +2000 FMG at 22.02; -3000 FMG at 22.15; Profit A$110 ( got the timing of first purchase wrong on all three trades)

Friday March 5

Within 15 mins of the opening, my entire watch list is again showing red, including CBA. For two days I have been trying to buy Z1P at below 10.00 and today at 10.18am they are trading at 9.70, down 4%. Plan to wait till 11.00 to see if they bounce after margin calls have been made.

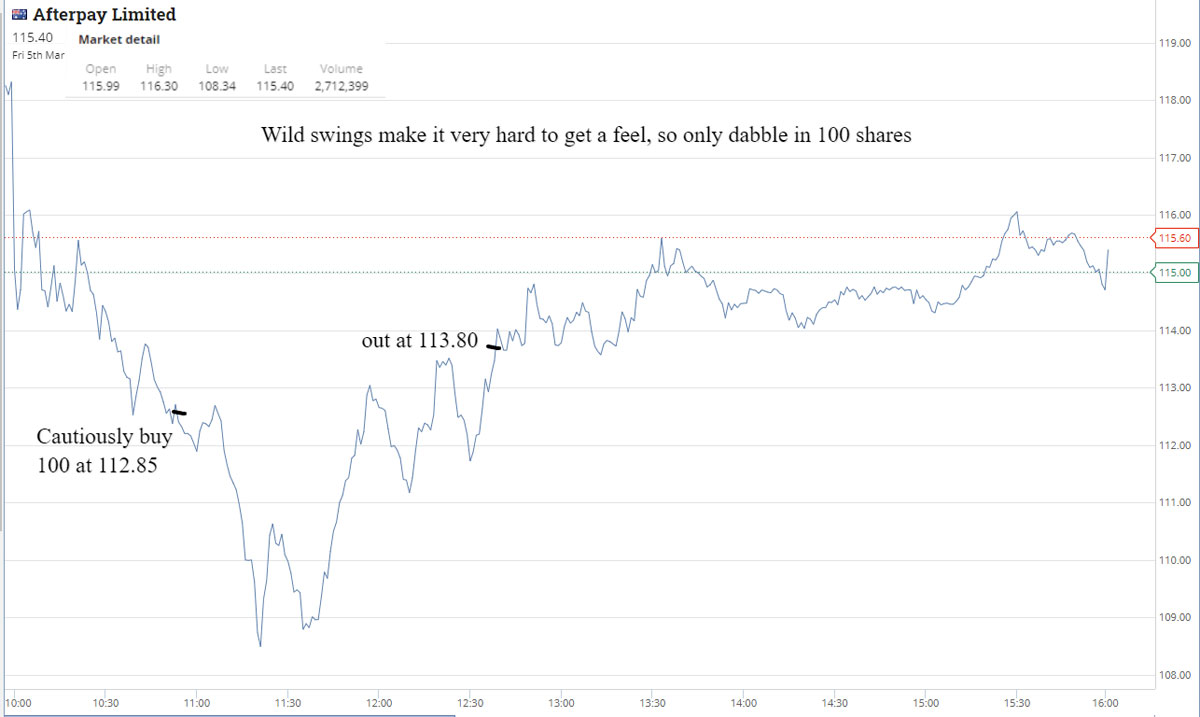

Tea, biscuits, wait. Can’t help myself, as I have to have a go but decide to do so in very small parcels. At 10.48am, I buy 500 (only) Z1P at 9.54 and at 10.50am I buy 100 (only) APT for 112.85. At this point, their range is 116.30 to 110.66 and I get out of them for a A$95 profit.

Time 12.48pm and their range at this point is 116.30 to 108.34. Four hours later I sell the Z1P for a A$50 (10c a share) profit.

So, overall up A$145 for the day and at the close only two stocks on my watchlist are not showing red.

+500 Z1P at 9.54; -500 Z1P at 9.64; Profit A$50 (slowly wait for over 4 hrs to make $50)

+100 APT at 112.85; -100 APT at 113.80; Profit A$95

Gross profit for week: A$917

Brokerage for the week: A$134

Net Profit: A$783

Most satisfying: APT on Wed

Least satisfying: IGO

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.