Confessions of a Day Trader: Black gold. Texas tea. Pack the car, honey, we’re moving to the big smoke!

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday October 2

A bank holiday for me but the markets are open, so volumes will not be too crash hot.

Almost trip over myself when CBA fall below $99. I put in a cheeky bid for some at $98.50, just in case.

As they hover around that $99.00 level, I keep a cheeky limit and just buy them and then wait.

Nothing else on the watch list tickles my fancy, so just end up at the beach, with the occasional glance at the phone.

By not watching them too much, they organically did for me what I wanted them to do. Happy chappie to take a nice profit, without too much effort.

Up $780.

Recap

Bought 1,000 CBA @ 98.99

Sold 1,000 CBA @ 99.77 ($780 profit)

Tuesday October 3

A doughnut day today for me.

Had to wait around for the 2.30pm RBA interest rate decision and it came in as unchanged, so aquick spike in prices, then a pullback, before a rally again.

Have put up a couple of charts, so you can judge for yourselves.

CBA had a $1.35 range today, with a low of $98.50 and a high of $99.85.

I came to the conclusion that whatever I do today would be just pure gambling, as I have no idea what the RBA’s figures will be.

Bond yields went up again overnight, hence the early weakness but the recoveries were just too much for me today.

Recap

Zero!

Wednesday October 4

All the headlines today are about bond yields and the Speaker in USA politics getting sacked, so all doom and gloom.

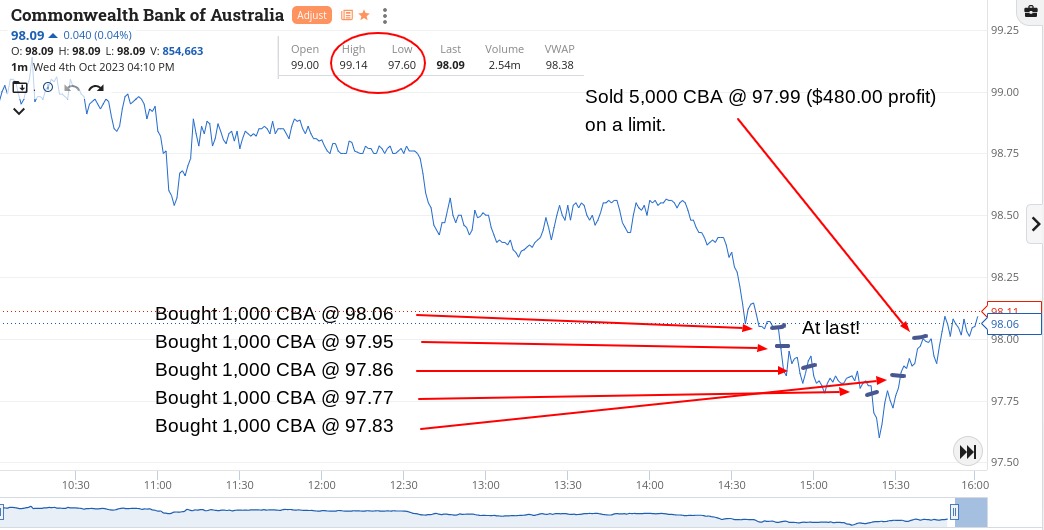

I must admit that I was highly nervous, trading away until CBA finally cracked the $98 level, which as you all know is something I have been waiting weeks for.

So, the timing was just after 3.00pm and even though I had been gingerly trading around in WDS, it wasn’t until now that I got some confidence.

So much so that I basically go all in, as by lifting the size of the trades means that the turns can be smaller but with the same targeted return.

Last trade of the day was basically just some tidying up and the charts tell it all.

This afternoon I became a frustrated CBA watcher who turned into a wild buying maniac when they entered the $97 zone.

Be greedy when others are fearful, as Buffett would say. So I was.

Up $1,440.

Recap

Bought 1,000 RIO @ 112.29

Sold 1,000 RIO @ 112.55 ($260 profit)

Bought 1,000 WDS @ 34.90

Sold 1,000 WDS @ 35.00 ($100 profit)

Bought 1,000 WDS @ 34.87

Sold 1,000 WDS @ 34.90 ($30 profit)

Bought 1,000 CBA @ 98.06

Bought 1,000 CBA @ 97.95

Bought 1,000 CBA @ 97.86

Bought 1,000 CBA @ 97.77

Bought 3,000 WDS @ 34.57

Bought 3,000 BHP @ 43.60

Sold 3,000 WDS @ 34.65 ($240 profit)

Sold 3,000 BHP @ 43.68 ($240 profit)

Bought 1,000 CBA @ 97.83 (to bring my average price down)

Bought 3,000 WDS @ 34.56

Sold 5,000 CBA @ 97.99 ($480 profit)

Sold 3,000 WDS @ 34.59 ($90 profit)

Thursday October 5

Having observed Woodside for the last few weeks and got a feeling on how they trade, I felt obliged to have a go in them at below $34.

Yesterday, they were happily swimming around in the pool of ASX stocks at $34.50, yet today they open below $34 and seduce me in.

It turns out that they just gave me the cold shoulder in the first hour or so, before they fell into the arms of a short seller and then eventually came to their senses and returned back to me and that $34 level.

Their chart will blow you away!

Their range today was $33.62 to $34.42. RIOs also played around with my head, below $112 and it needed a lower limit of $111.50 to save me from losing my trousers today.

Their range was $111.46 to $112.87 on 1.34m shares.

I even managed to get a profitable kiss in from CBA before turning in for the day.

Life’s good.

Up $2,890. Happy days!

Recap

Bought 3,000 WDS @ 33.98

Bought 2,000 FMG @ 20.61

Bought 1,000 RIO @ 111.65

Bought 3,000 WDS @ 33.87

Bought 3,000 WDS @ 33.78

Bought 1,000 RIO @ 111.50

Sold 2,000 RIO @ 111.77 ($390 profit)

Bought 3,000 WDS @ 33.63

Bought 2,000 CBA @ 98.81

Sold 6,000 WDS @ 34.00 ($1,110 profit)

Sold 2,000 FMG @ 20.68 ($140 profit)

Sold 6,000 WDS @ 33.97 ($930 profit)

Sold 2,000 CBA @ 98.97 ($320 profit)

Friday October 6

Everything took off early today, just as I was waiting around for the 11.00am session.

Managed to get stuck into some FMG, NCM and WTC.

So gone a bit off-piste and even though WTC gave me a bit of a hard time early on, they eventually came good.

I had them on a sell limit of $62.90, which would have been hit if I hadn’t adjusted it down.

FMG were lagging behind RIOs so had to wait for them to catch up.

RIO’s range today was $111.94 to $114.24. That’s the kind of day today was.

Anyway, up $560 today and had a cracker of a week, up $5,670 gross or $4,732 net and that includes having one day where I did zero trades!

Still can’t believe RIO’s range today!

Recap

Bought 2,000 FMG @ 20.88

Bought 2,000 NCM @ 24.19

Bought 3,000 WTC @ 62.56

Sold 3,000 WTC @ 62.62 ($180 profit)

Sold 2,000 NCM @ 24.26 ($140 profit)

Sold 2,000 FMG @ 21.00 ($240 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.