Confessions of a Day Trader: Australians all – let us rejoice!

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday January 16

Everything up this morning and even RIOs touch $123.40 before retreating a little bit. Their final day range was $2.58.

I of course got stuck into FMG, but being a Monday, first trade and all that, I went for half the size of Friday’s trading.

They had opened at $22.73 and I managed to get a quickie in for first trade of the week and make $250.

When they came back again and with $250 under my belt I took the decision to go a bit harder. This proved my downfall for the day.

They actually fell to $22.04 and I of course had emptied both barrels way before they hit that level. I had to wait till the 4.10pm ruck to get back a bit of dignity.

Finish the day down $100, though it was looking like down $1800 at one point, hence cheese sandwich for lunch with sweaty palms. Hopefully tomorrow we can have steak.

Recap

Bought 2,500 FMG @ 22.41

Sold 2,500 FMG @ 22.51 ($250 profit)

Bought 5,000 FMG @ 22.49

Bought 5,000 FMG @ 22.24

Sold 5,000 FMG @ 22.33 (-$175 loss)

Sold 5,000 FMG @ 22.33 (-$175 loss)

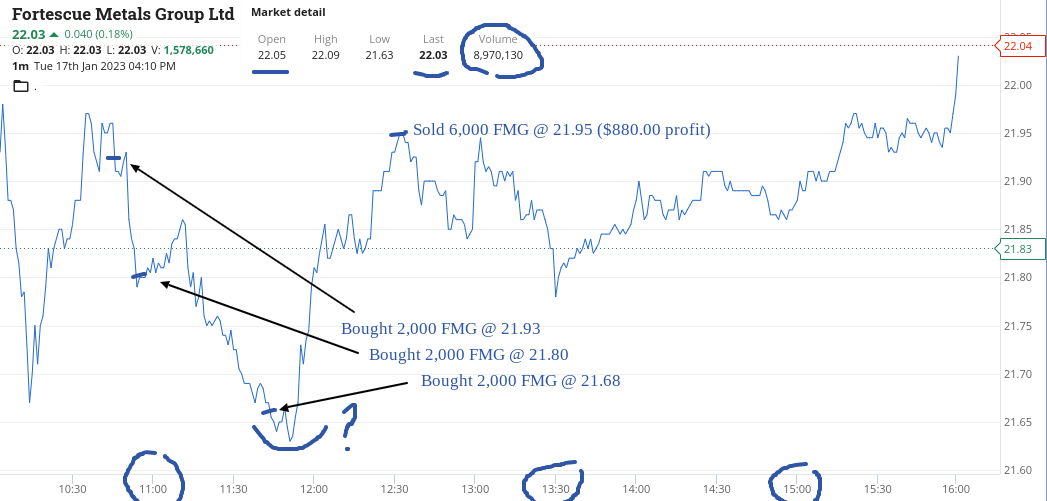

Tuesday January 17

FMG start trading below $22.00, after opening at $22.05. Pick some up at $21.93 and leave a limit order in at $21.80, just in case.

Well Just In Case came in and they went below $21.70, so had to pull the trigger again. They were 90c higher at the close yesterday, so surely they should bounce, I thought to myself.

Eventually, they put on a spurt and shot back up towards the $22.00 level and I’m out at $21.95. Ironically, having opened up at $22.05 and reaching a low of $21.63, they closed at $22.03 and on a volume of 8.9m. A 2c difference on nearly 9m shares is just trading madness at its very best.

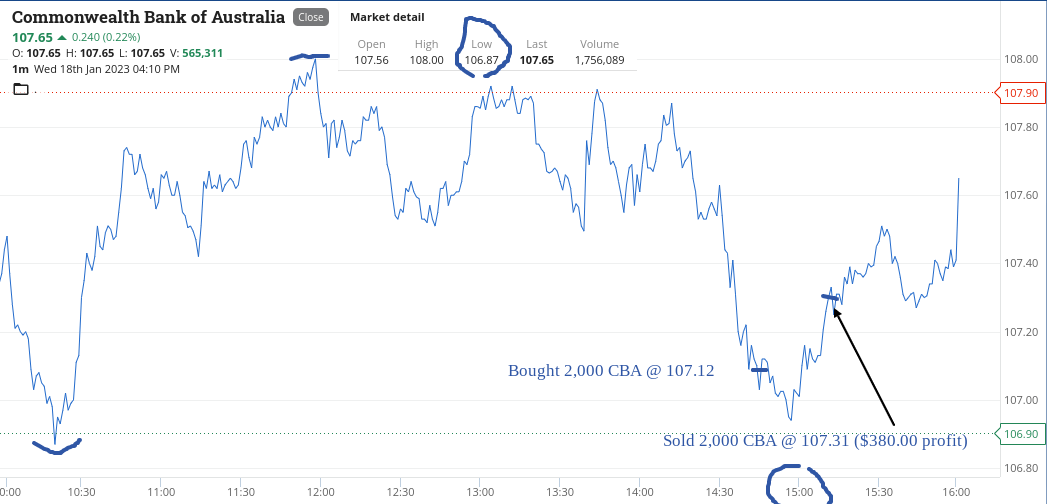

Later on, CBA had a dip and headed towards the $107.00 level and with a nice profit in the bin, they were just too tempting. Total for day plus $1,110, which more than makes up for yesterday’s effort. Steak tonight for dinner, bbq and a nice red. Yippee!

Recap

Bought 2,000 FMG @ 21.93

Bought 2,000 FMG @ 21.80

Bought 2,000 FMG @ 21.68

Sold 6,000 FMG @ 21.95 ($880 profit)

Bought 1,000 CBA @ 107.16

Sold 1,000 CBA @ 107.39 ($230 profit)

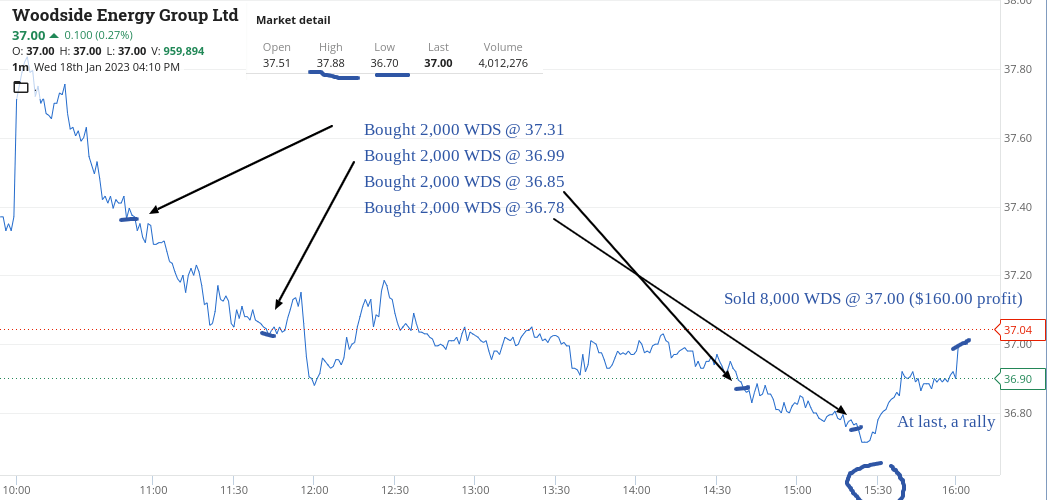

Wednesday January 18

I start my day with WDS and I end my day with WDS. What seemed like a good trade at the time, took all day to come right and avoid taking a loss.

Having seen them open at $37.51 and reach a high of $37.88, I thought getting set in 2000 at $37.31 was a smart move. Er, no.

Over the rest of the day, they fell below $37.00 and kind of hovered around that level before tumbling down to a low of $36.70 and finally rallying at 3.30pm to close at bang on $37.00.

If it wasn’t for a quick trade in CBA, I really would have been spinning my wheels.

Up $540 after being down $1,600 at one point and boy, it was a long day.

Recap

Bought 2,000 WDS @ 37.31

Bought 2,000 WDS @ 36.99

Bought 2,000 WDS @ 36.85

Bought 2,000 CBA @ 107.12

Sold 2,000 CBA @ 107.31 ($380 profit)

Bought 2,000 WDS @ 36.78

Sold 8,000 WDS @ 37.00 ($160 profit)

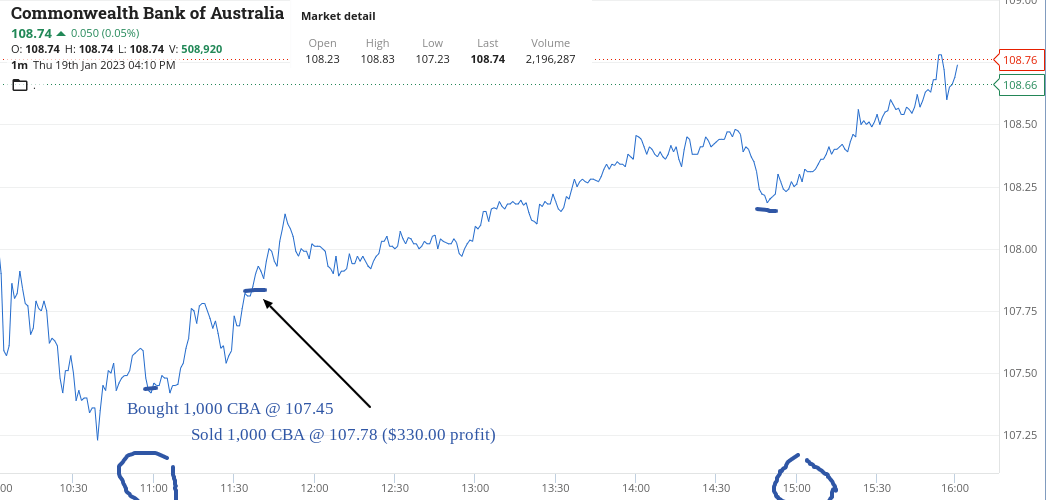

Thursday January 19

Well.

Australian equities seem to be decoupling from the rest of the world at the moment.

RIOs touched $126.35 after having a low of $122.51. CBA came in with an 11.00am special at $107.45 and then touched a high of $108.83.

FMG reached $22.60 and this market looks so strong. Not sure if it’s a bit of a suckers’ rally.

Up $330 and cautiously looking forward to tomorrow. If it’s up again, I think I’m in trouble.

Recap

Bought 1,000 CBA @ 107.45

Sold 1,000 CBA @ 107.78 ($330 profit)

Friday January 20

Managed to get a couple of trades in at around that 11.00am time frame. Noticed that WDS seems to have had a bit of a run. Did them in half the normal size as convinced that will maybe have to double down below $37.00.

Ummed and ahhed about buying another thousand just before they took off. I had the original thousand on a sell limit of $37.35 but as they went on a rally really quickly, I adjusted it down.

Should have kept it though. CBA looked like they were about to break out above $109.00 and trigger off some stop losses, which they did for a quick 12c turn.

Nothing else to see or do with the Friday weekend coming up, so did nothing else.

Up $220 today and $2,300 gross or $1,870 net as WDS and FMG took a bit of wind out of my sails. Australia Day coming up next week and then after all said and done, back to normal.

Everything has been a bit of a tear and I noticed 10yr bonds rallied 22 basis points yesterday. It’s all happening here folks!!!!

Recap

Bought 1,000 WDS @ 37.08

Sold 1,000 WDS @ 37.18 ($100 profit)

Bought 1,000 CBA @ 108.94

Sold 1,000 CBA @ 109.06 ($120 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.