Confessions of a Day Trader: APT and CBA – now that’s what I call a proper double shot

Pic: Rommel Gonzalez / EyeEm / EyeEm via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday December 6

So we had a bit of a meltdown in tech stocks on Friday night NY time and today APT did cross over with CBA, which tells us a market story and sets up the trading day and possibly the trading week.

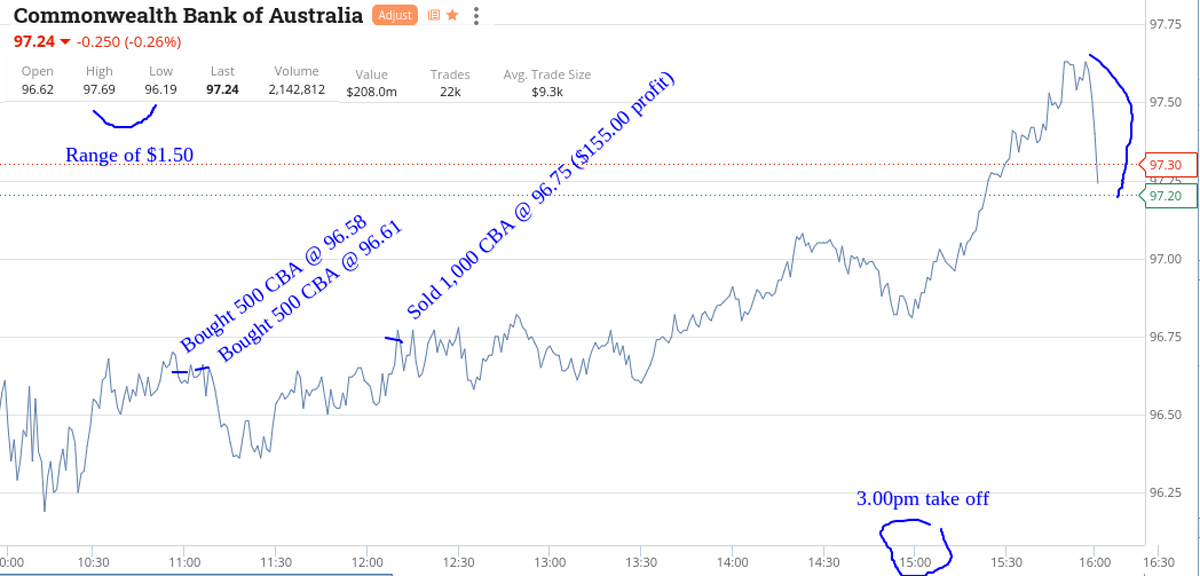

So have to hang around for 11.00am to buy some APT and some CBA but only in 500 shares each as thinking I may need to really keep my powder dry.

They bounce nicely but CBA hardly moves so after booking the APT profit, double up on CBA as now have a bit of confidence back.

TPG then arrive on the radar and appears over-sold to me as the news on David Teoh’s sell down is already in the market. Buy 1000 and sell 1000 for an 8c turn and just keep watching CBA, who put in a quick spurt at some point and then fall back just as fast.

Tried to have a go at Z1P but got the timing wrong so just cut them with enough profit to cover the brokerage, which is $10. So APT and Z1P take a lot of the brunt from Friday night’s NY sell-down and CBA just motors along nicely.

Plus $465 for the day and left the afternoon trading session well alone.

I was long gone before the closing bell so I could not have a moment of weakness and lose the day’s profits.

Recap:

Bought 500 APT @ 93.80

Bought 500 CBA @ 96.58

Sold 500 APT @ 94.26 ($230 profit and an 11.00am special!)

Bought 500 CBA @ 96.61

Bought 1,000 TPG @ 5.79

Sold 1,000 TPG @ 5.87 ($80.00 profit)

Sold 1,000 CBA @ 96.75 ($155.00 profit)

Bought 1,000 Z1P @ 4.43

Bought 1,000 Z1P @ 4.36

Sold 2,000 Z1P @ 4.40 ($10.00 profit)

Tuesday December 7

Everything kicks off the day in green with not one red showing on my watchlist. APT manage to take off at 10.30am and every time I had a look at Z1P, they edged up higher than any limit buys I had set for them.

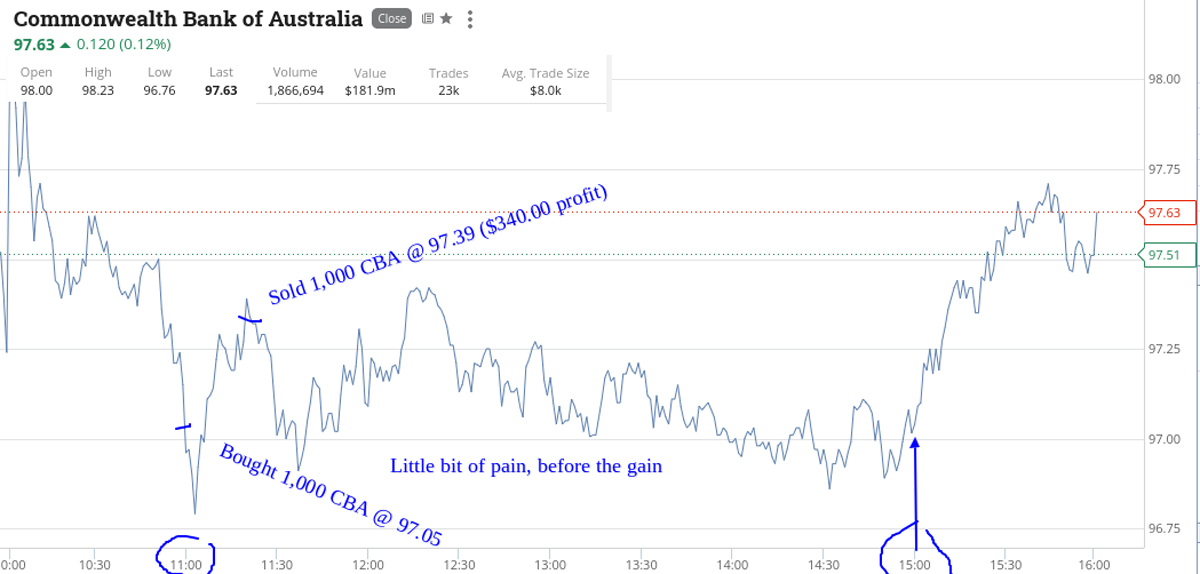

The only horse I jump on today is CBA at 11.00am and this gives me a little bit of pain before a gain. Classic move today and a nice 34c turn makes my day. Everything else was a bit hard to read and expecting the same tomorrow. Plus $340 and :).

Recap:

Bought 1,000 CBA @ 97.05

Sold 1,000 CBA @ 97.39 ($340.00 profit)

Wednesday December 8

Everything up overnight, with some indices up over 3% in Europe and the NASDAQ put in a 2.9% gain, so today will test my trading style, as finding a bottom or trying to will be a challenge. Let’s see.

Decide to go early as things like FMG and Z1P both look like they could go higher and APT’s share price crosses back over above CBA’s. Went a bit early on CBA but only in 750 shares and managed to double down at near their day’s low at 11.00am (knew I should have waited, but got a bit carried away with the action).

Later got another go in CBA at below my last sale, so that was good. Up $795 which was only because I got out of my comfort zone a bit and went with the flow. Again, anything could happen tonight.

Recap:

Bought 1,000 FMG @ 17.80

Sold 1,000 FMG @ 17.95 ($150.00 profit)

Bought 2,000 Z1P @ 5.00

Bought 750 CBA @ 97.56

Sold 2,000 Z1P @ 5.10 ($200.00 profit)

Bought 750 CBA @ 97.10

Sold 1,500 CBA @ 97.50 ($255.00 profit)

Bought 1,000 CBA @ 97.30

Sold 1,000 CBA @ 97.48 ($180.00 profit)

Thursday December 9

A mixed reaction from overseas so today will be different. Have a few things on today and my whole watchlist opens up mixed. Z1P were marked down, even though APT were travelling OK.

Bt 2000 as a toe in the water. They were the second biggest faller (in the top 200) and the biggest faller was MFG. I read that a fund manager who gets divorced underperforms the market and from memory their shares are down 15% or so.

Pick up 1000 and they literally take off. Make $280 and more a fluke than skill but suppose it’s still a knack that occasionally kicks in. See graph.

However, my knack became knackered with Z1P and I cut them with 20 seconds to go.

Finish plus $140 having given 50% back on Z1P. Lacking a real direction at the moment. Kinda of lukewarm direction.

Recap:

Bought 2,000 Z1P @ 5.13

Bought 1,000 MFG @ 28.72

Sold 1,000 MFG @ 29.00 ($280.00 profit)

Bought 2,000 Z1P @ 5.10

Sold 4,000 Z1P @ 5.08 (-$140.00 loss)

Friday December 10

NASDAQ gets a bit of a whack overnight so expecting the usual suspects to be marked down and CBA to cross over APT share price again.

Watching these two stocks is my lazy way to gauge market sentiment.

CBA close at $97.90 and APT close at $95.89 (down 4.37%) and I have included a chart so you can see their movements today. It is most unusual.

Avoided both of those today but got in two 11.00am specials. One in MFG and another in FMG (same three letters) and both recovered very quickly and both with a classic setup.

Finish Friday up $410 and plus $2150 ($1889 net) for the week which was better than I expected and I enjoyed watching CBA and APT share prices keep crossing over themselves.

Recap:

Bought 1,000 MFG @ 28.35

Bought 1,000 FMG @ 17.87

Sold 1,000 FMG @ 18.05 ($180.00 profit)

Sold 1,000 MFG @ 28.58 ($230.00 profit)

Addendum: Just so you all know, I now run my own cafe and day trade at the same time. So, for those who came and said hi yesterday, I’d like to thank the five guys from Sydney who brought lattes with hazelnut and caramel and managed to park their car and jetski in the wrong direction.

Also thanks to Riccardo from Liverpool, who was heading to Rick Stein’s for lunch. Anyone who wants a coffee and a chat, Eleanor Rigby Coffee Emporium @wanderlust wine bar, 30 Donald Street, Nelson Bay NSW. www.beatlescoffee.com

(PS don’t come at 11.00am as I may be putting trades on!)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.