Confessions of a Day Trader: Any minute now. Aaany minute now.. Aaaaaany minute now..

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday September 25

Kicked off the day okay, up $260 in an 11.00am special in CBA and then ended the day down $20 after I mixed up my timing.

Being a comedian is all about timing and my timing today was the joke!

Waiting for RIOs to bounce back up above $114 became waiting for them to bounce above $113.

Lordy, lordy, lordy. Not good.

BHP were not as bad and my lower limit double down just got missed, so I wasn’t able to get my average down to a winning level.

Apparently iron ore got the wobbles a bit and a bit of overselling gave them both a 4.10pm kick.

CBA’s high was exactly $100 and its low was 2c above $99, so that about sums up the trading day.

Recap

Bought 1,000 CBA @ 99.14

Sold 1,000 CBA @ 99.40 ($260 profit)

Bought 1,000 RIO @ 113.80

Bought 2,000 BHP @ 44.12

Bought 1,000 RIO @ 112.90

Sold 2,000 RIO @ 113.18 ($340 loss)

Sold 2,000 BHP @ 44.15 ($60 profit)

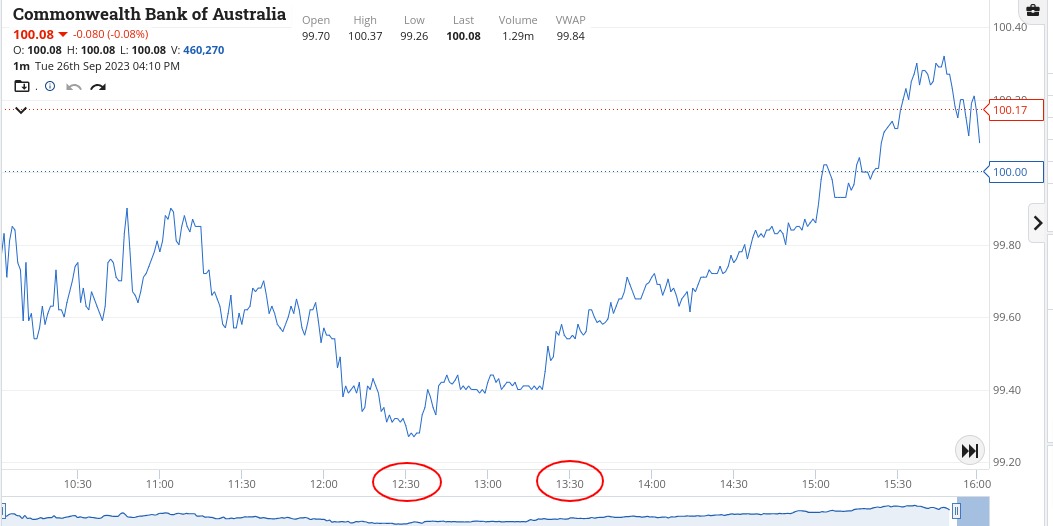

Tuesday September 26

Things open a bit stronger than I think and if I was allowed to go short, now would be the time.

This strength means I have to wait around and even though my finger hovers over the buy button a couple of times, I hold steady.

Takes a bit of discipline but finally at 1.30pm RIOs crack the $111.00 level and I put a limit in to catch some of the stop losses and get hit after a few minutes.

Now I wait and watch.

At $110.82, they are over $2 down from their day’s high. They touch $111.15 and my ego says keep riding them up to $111.50, so I can be a hero, but my gut says no.

After yesterday’s result putting $320 in the bin is worth the take. So out they went and we never looked back!

Can’t believe the strength in CBA. They seem to be holding well between $99 and $100.

Recap

Bought 1,000 RIO @ 110.82

Sold 1,000 RIO @ 111.14 ($320 profit)

Wednesday September 27

Today is another waiting game day, as we have CPI figures out at 11.30am. I send out a text to a few followers saying that whatever today’s outcome inflation wise, the market will end down.

I was right on the money with this prediction and this was my mindset for the day.

Had a quickie in SGR, after their fundraising knocked them down 13% or so. This was pre 11.30am, so just gave me something to do.

Figures come out, market goes up and then falls away and I am left stuck in no man’s land.

Well I thought I was until 2.43pm, when RIOs fell below $111 for the second time and then started to bounce.

I just went on a shopping spree and bought some RIOs, CBA, Woodside and Wisetech. Woodside I have been watching fall over the last few days and you should see them at the close. Boy oh boy.

Booked first profit in Wisetech, then RIOs and CBA and finally Woodside. All on a limit and though not big profits, locked in a total of plus $510.

CBA still hasn’t really cracked that $100 level yet!

Recap

Bought 3,000 SGR @ 0.625

Sold 3,000 SGR @ 0.655 ($90 profit)

Bought 1,000 RIO @ 110.72

Bought 1,000 CBA @ 100.24

Bought 1,000 WDS @ 35.37

Bought 1,000 WTC @ 65.62

Sold 1,000 WTC @ 65.71 ($90 profit)

Sold 1,000 RIO @ 110.86 ($140 profit)

Sold 1,000 CBA @ 100.35 ($110 profit)

Sold 1,000 WDS @ 35.45 ($80 profit)

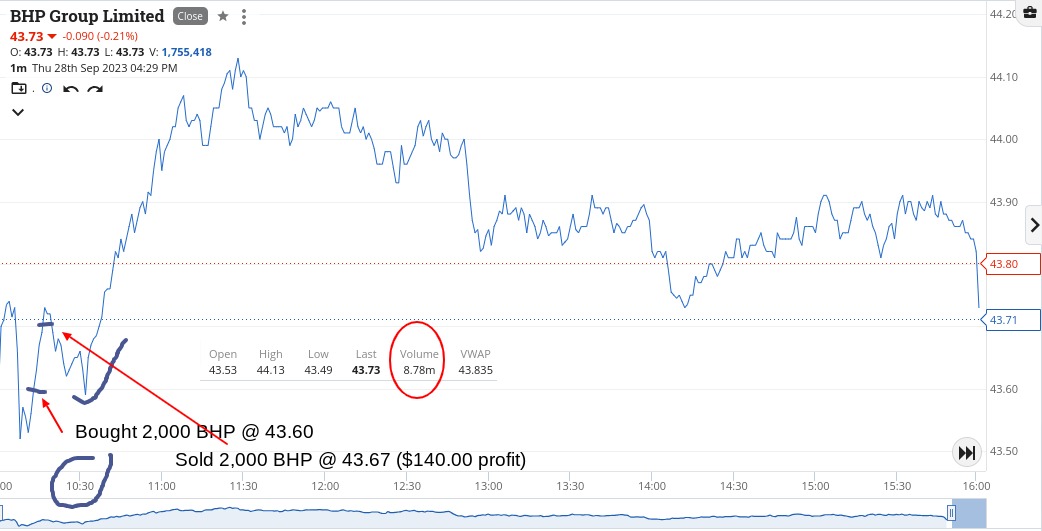

Thursday September 28

Hanging around in the changing rooms, stuck on the bench, when all of a sudden RIOs go on a run. BHP a bit slow to catch them up, so game on.

As soon as I was happy with the profit, in I went into FMG and stuck them on a limit.

Then Brickworks fell 11% on their results and fell below $23 and they also went out on a limit, as did FMG.

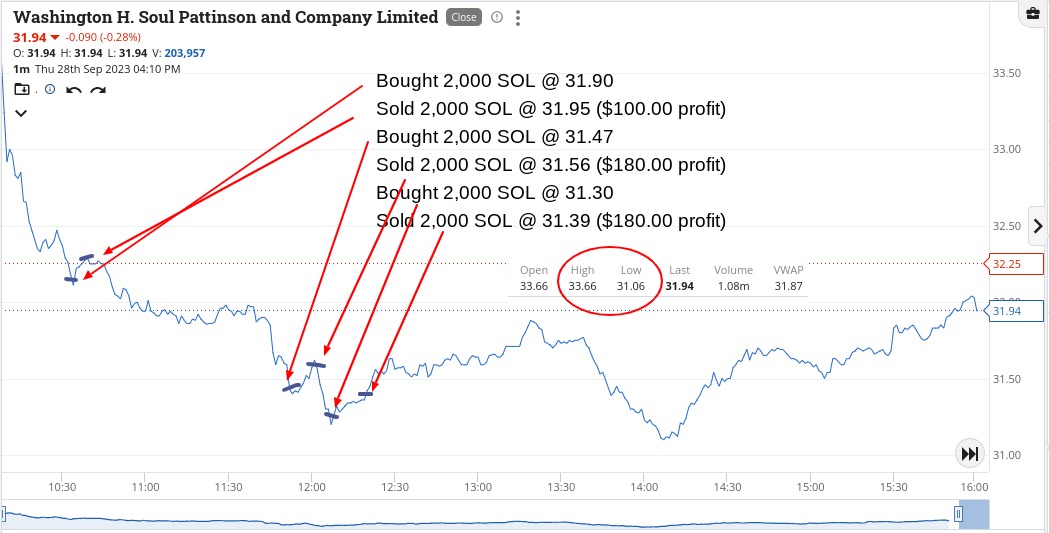

Soul Pats came on the radar, also after their results. Not once, but three times.

Then CBA below $100 came and went and finally WTC looked like an easy one, which of course came back to bite me on the arse.

Wasn’t expecting to be so busy today, but them are the markets!

Up $1,030. Phew.

Recap

Bought 2,000 BHP @ 43.60

Sold 2,000 BHP @ 43.67 ($140 profit)

Bought 2,000 FMG @ 20.59

Bought 2,000 BKW @ 22.86

Sold 2,000 BKW @ 22.99 ($260 profit)

Sold 2,000 FMG @ 20.70 ($220 profit)

Bought 2,000 SOL @ 31.90

Sold 2,000 SOL @ 31.95 ($100 profit)

Bought 2,000 SOL @ 31.47

Sold 2,000 SOL @ 31.56 ($180 profit)

Bought 2,000 SOL @ 31.30

Sold 2,000 SOL @ 31.39 ($180 profit)

Bought 1,000 CBA @ 99.87

Sold 1,000 CBA @ 99.99 ($120 profit)

Bought 1,000 WTC @ 65.24

Bought 1,000 WTC @ 65.01

Bought 1,000 WTC @ 64.86

Sold 3,000 WTC @ 64.98 ($170 loss)

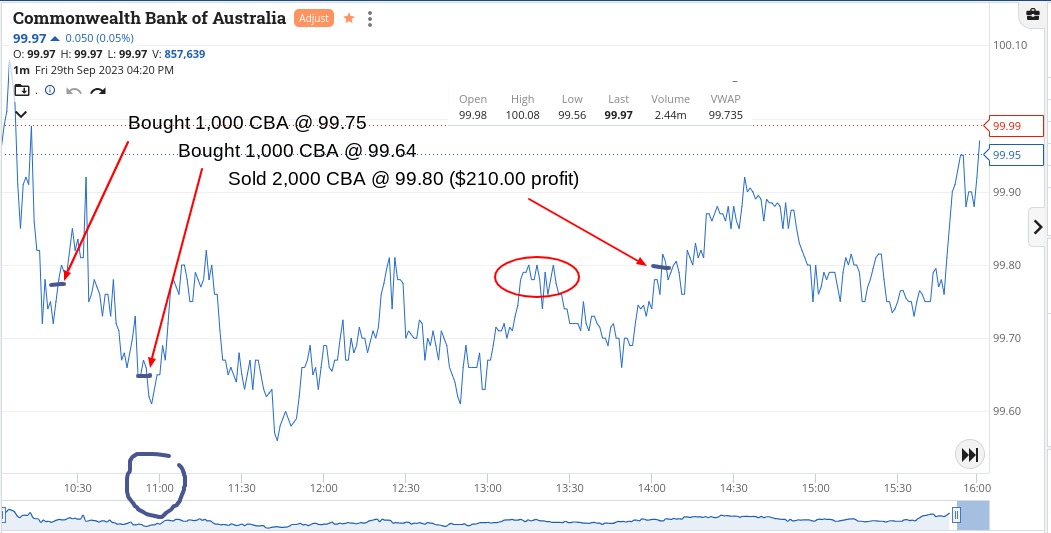

Friday September 29

Well it’s the Friday ahead of a bank holiday and today will be a slow day. I plan to be out of everything before noon.

Well that was the plan, as I get stuck into CBA. Such a good plan that I have to double down, which I really didn’t want to do.

I have the first 1000 on a limit of $99.99 to sell and that then becomes a long shot. After I double down, the limit gets adjusted to 2000 at $99.89.

After watching them get to $99.80 three times, I reluctantly join them and adjust my limit down.

Of course when they do eventually go through me and my limit, they touch $99.89 without any trouble.

Sums up my day and my week actually. Up $2,050 gross which comes in at $1,493 so got a bit roasted all round.

See some of you on Monday, maybe. CBA’s range today was 52c, RIO’s was $1.13 and BHP’s came in at 62c, so Monday won’t be much better… unless Wall St cracks it.

Recap

Bought 1,000 CBA @ 99.75

Bought 1,000 CBA @ 99.64

Sold 2,000 CBA @ 99.80 ($210 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.