Confessions of a Day Trader: An Italian lover and $4284 in your pocket? In your dreams!

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday January 30

OK. Starting out the week by telling myself to stick to the rules by not getting involved too early in the trading day.

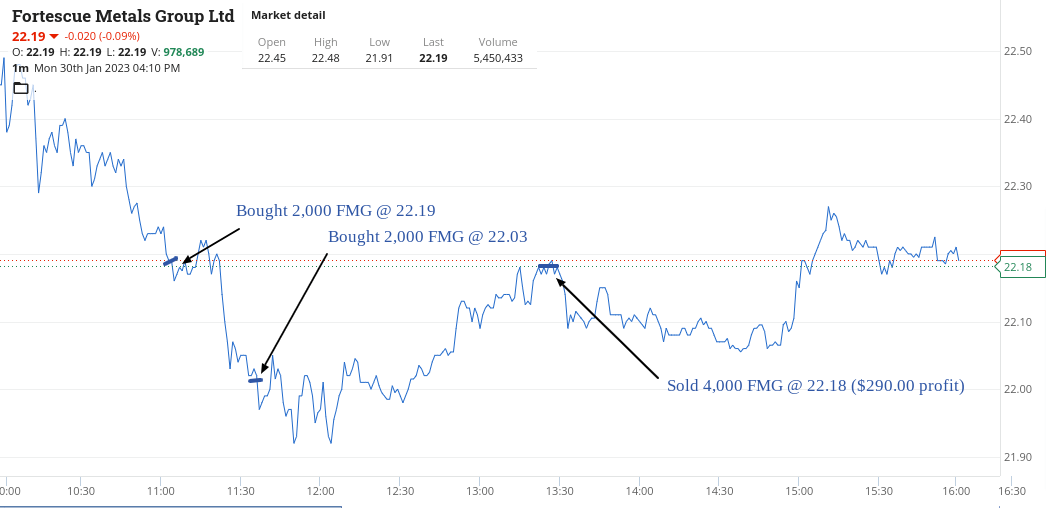

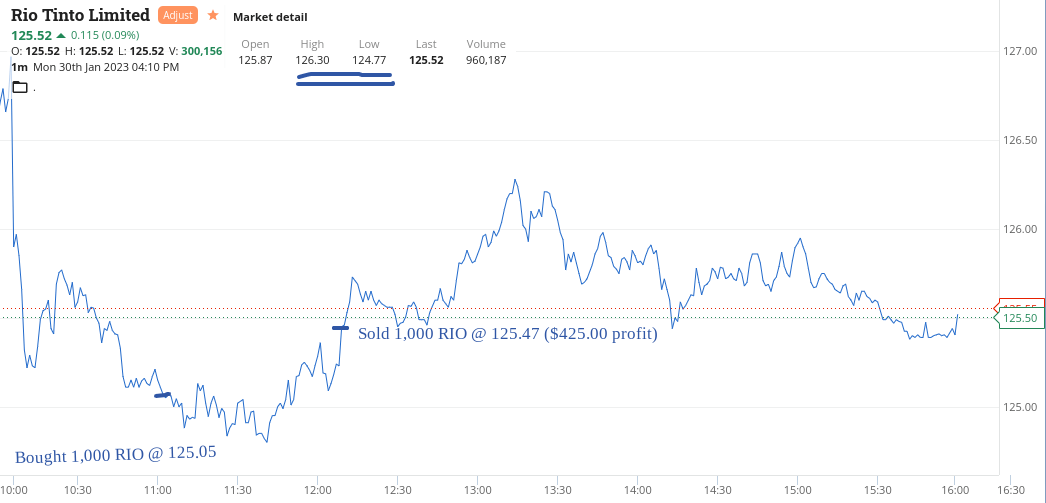

With this in mind I wait around until 11.00am, as that usually is a good time to kick off the trading day. Both RIOs and FMG are fallers from their highs, so line them up in my sights.

RIO hovering just above $125.00, having opened at $125.87, so in I go for 1000 at $125.05. Forty mins later they are $124.77.

Same for FMG, though at 11.00am they weren’t really hovering around a round figure. Pay $22.19 after they opened at $22.45 and they also followed RIO’s line of trading but this time I doubled down at $22.03. They fell twice to $21.91 before recovering above $22.00.

Results below!

Recap

Bought 1,000 RIO @ 125.05

Bought 2,000 FMG @ 22.19

Bought 2,000 FMG @ 22.03

Sold 1,000 RIO @ 125.47 ($425 profit)

Sold 4,000 FMG @ 22.18 ($290 profit)

Up $715 and CBA finally broke out above $110.

Tuesday January 31

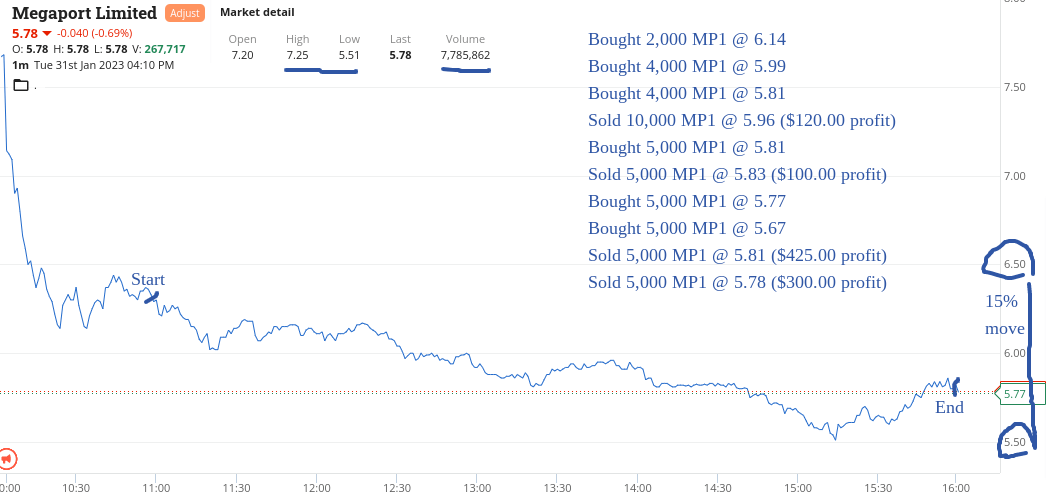

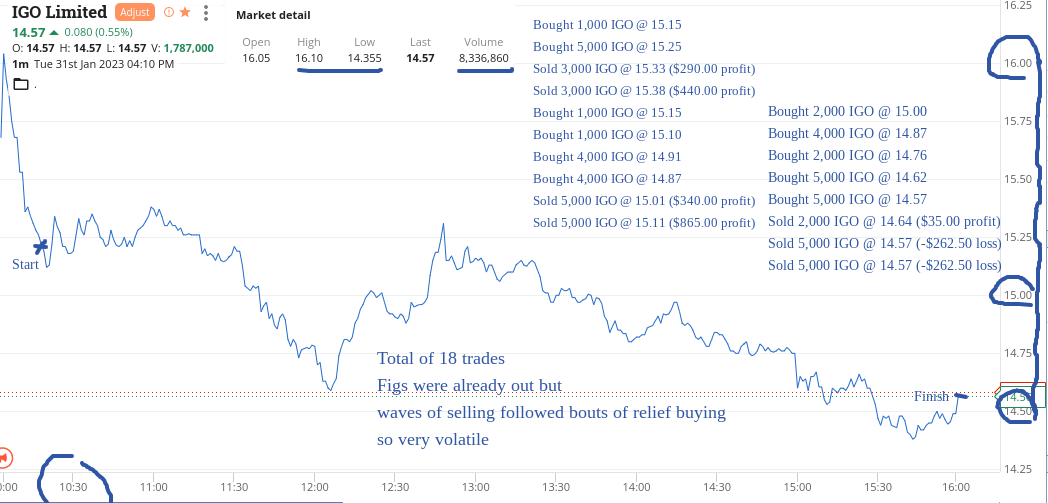

Had a mad day today, so forgive me if I don’t say very much, as I need to lie down on the floor to regain some energy.

Couldn’t do much with my usual partners in crime, so had to search around for other stocks to kill and eat.

IGO came out pre market with results and so did MP1 (Megaport) and I sort of got involved and just like having an Italian lover, every time I walked away, I had to come back for more.

And I ain’t 21 anymore, hence the lie down!

I had to split up some sales as I was forced to double down a few times before they came good and I could close the door smiling.

IGO’s range was $16.10 to $14.35 and MP1’s was $7.21 to $5.51.

So, stand back. Here’s today’s recap. Up $2730 on 30 trades!

Recap

Bought 1,000 IGO @ 15.15

Bought 5,000 IGO @ 15.25

Sold 3,000 IGO @ 15.33 ($290 profit)

Sold 3,000 IGO @ 15.38 ($440 profit)

Bought 1,000 IGO @ 15.15

Bought 2,000 MP1 @ 6.14

Bought 1,000 IGO @ 15.10

Bought 4,000 IGO @ 14.91

Bought 4,000 IGO @ 14.87

Sold 5,000 IGO @ 15.01 ($340 profit)

Sold 5,000 IGO @ 15.11 ($865 profit)

Bought 4,000 MP1 @ 5.99

Bought 4,000 MP1 @ 5.81

Bought 2,000 IGO @ 15.00

Sold 10,000 MP1 @ 5.96 ($120 profit)

Bought 4,000 IGO @ 14.87

Bought 5,000 MP1 @ 5.81

Sold 6,000 IGO @ 14.97 ($340 profit)

Sold 5,000 MP1 @ 5.83 ($100 profit)

Bought 2,000 IGO @ 14.76

Bought 5,000 MP1 @ 5.77

Bought 5,000 MP1 @ 5.67

Bought 5,000 IGO @ 14.62

Bought 5,000 IGO @ 14.57

Sold 2,000 IGO @ 14.64 ($35 profit)

Sold 5,000 MP1 @ 5.81 ($425 profit)

Sold 5,000 MP1 @ 5.78 ($300 profit)

Sold 5,000 IGO @ 14.57 (-$262.50 loss)

Sold 5,000 IGO @ 14.57 (-$262.50 loss)

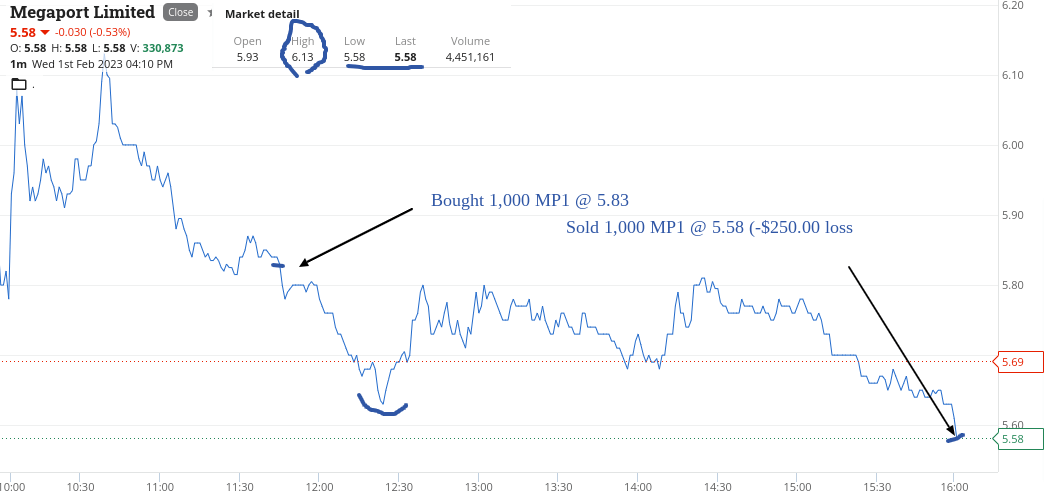

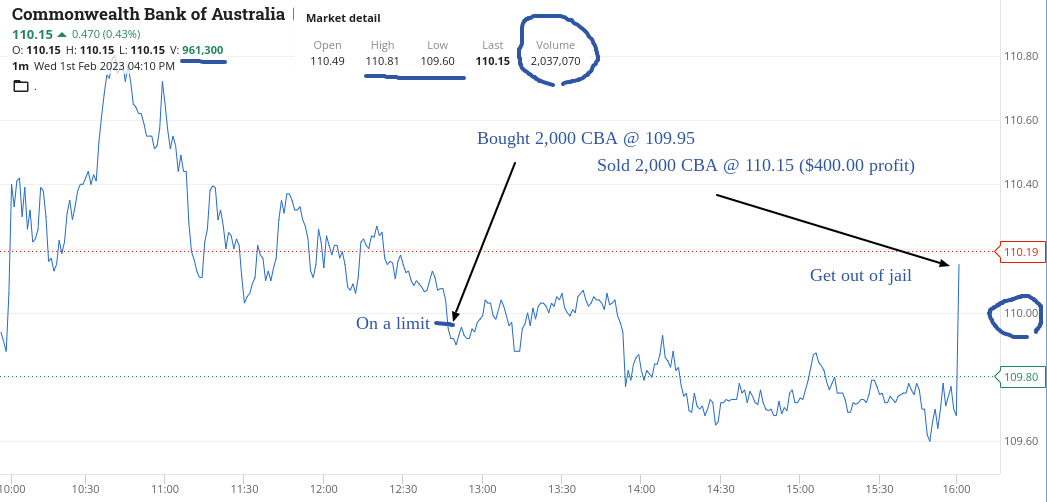

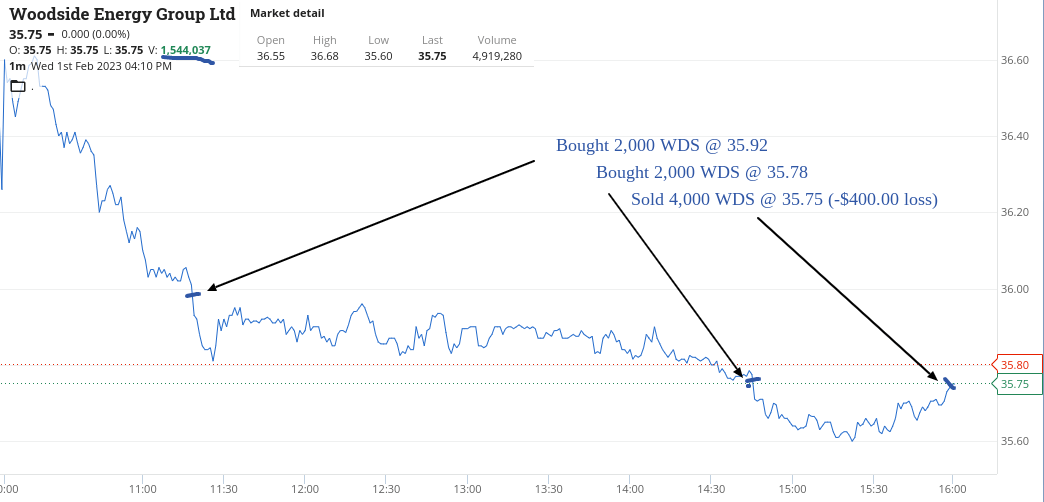

Wednesday Feb 1

Much more subdued today. So much so, that I managed to lose $250 as I was too lazy to lift my fingers after yesterday’s effort.

So today was pretty much a write-off day for me, though I did play the CBA game below $110 and came away with something.

Unfortunately, not enough to cover the other two, WDS and MP1, who lost me money. Hopefully tomorrow, I will have more get up and go.

Recap

Bought 2,000 WDS @ 35.92

Bought 1,000 MP1 @ 5.83

Bought 2,000 CBA @ 109.95

Bought 2,000 WDS @ 35.78

Sold 2,000 CBA @ 110.15 ($400 profit)

Sold 4,000 WDS @ 35.75 ($400 loss)

Sold 1,000 MP1 @ 5.58 ($250 loss)

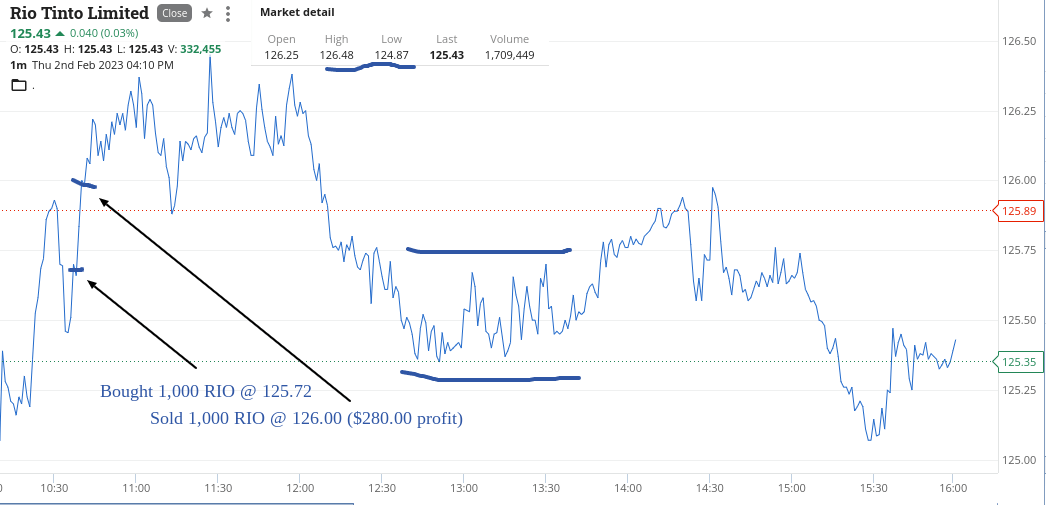

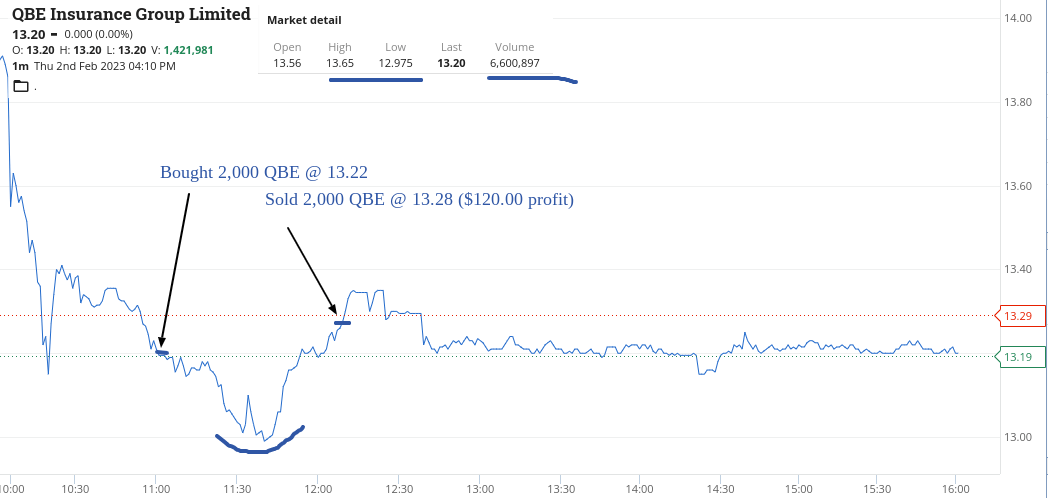

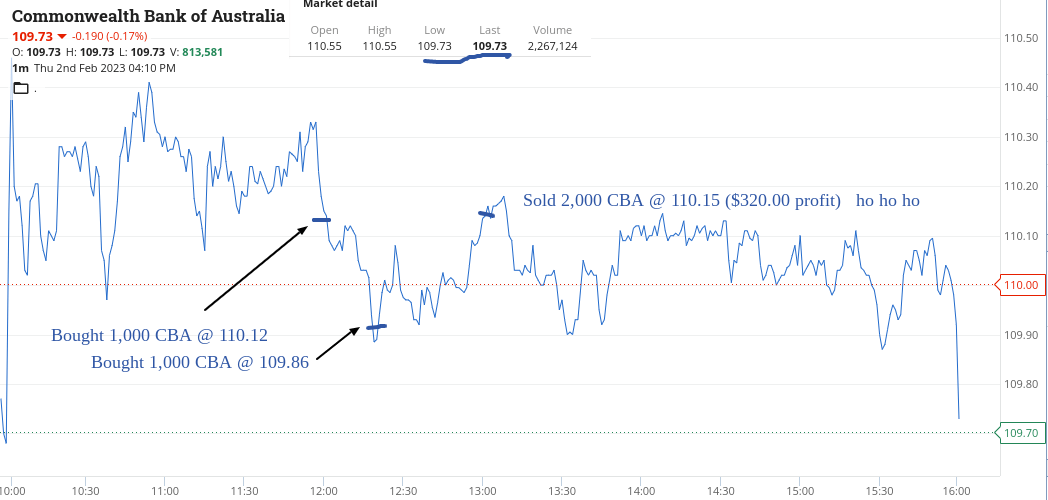

Thursday Feb 2

Get off to a good start in RIOs and happy to make back yesterday’s loss. Cut and shut, in at $125.72 and out at $126, so happy to feed the ducks on the way up.

QBE have a bit of a fall and give me a 6c turn and then finally, we had our beloved CBA at below $110.00. What an ideal present, averaging down at $109.86 on a limit order.

They have a nice pop and out they go, ho ho ho, I sing to myself. Obviously I’m a lot happier today than yesterday.

Up $720 and tomorrow is Friday and then the weekend in which to play up. No screens required.

Recap

Bought 1,000 RIO @ 125.72

Sold 1,000 RIO @ 126.00 ($280 profit)

Bought 2,000 QBE @ 13.22

Bought 1,000 CBA @ 110.12

Sold 2,000 QBE @ 13.28 ($120 profit)

Bought 1,000 CBA @ 109.86

Sold 2,000 CBA @ 110.15 ($320 profit)

Friday Feb 3

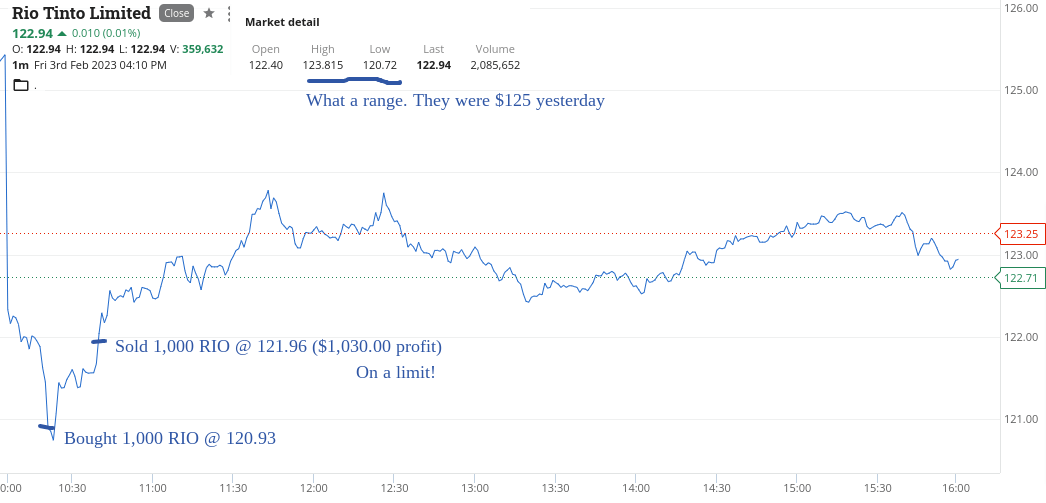

Today was a good day. A day trader’s dream, one of them ones where you wake up breathing hard and hoping you didn’t call the wrong name out.

One trade and make over a grand and just like my dream, all over in a few minutes. In at 10.20am and out at 10.40am. Mind you, I did leave a bit on the table as they touched $123.80 an hour later but such is life. Don’t care. Long gone!

Up $4945 gross and $4284 net for the week, after manic Tuesday. And CBA’s range today, I hear you ask. $109.80 to $111.43.

Have a good weekend!

Recap

Bought 1,000 RIO @ 120.93

Sold 1,000 RIO @ 121.96 ($1,030 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.