Confessions of a Day Trader: An Apple a day means time for a BNPL play… or five

Worth getting out of the shower for. Picture: Getty Images/Rob Melnychuk/DigitalVision

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday July 12

The day starts at 10.15am with a purchase of 1000 CHN and ends at 3.12pm with a sale of 2000 BHP. In total, managed to clock up 27 trades and make $1,138 gross over a total of six stocks – all graphs attached.

CHN had an interesting pre market announcement, which gave me a few opportunities as they swung around as the news was being digested. The six stocks traded today were CHN, Z1P, NAB, CBA, APT and BHP and all of them opened up strong, then with Z1P showing the biggest fall after 30 mins.

APT moved around on small volume and CBA did a ‘Bunnings’ for me again today. I didn’t leave my desk the whole day, so I got a good feel for the swings today but not sure what tomorrow is going to bring.

Waiting for Wall Street to have a 2% fall at some point this week, in one hit.

Tuesday July 13

Got a very quick trade on in Z1P at 10.11am. Don’t normally like to do things that early but APT were holding up and these babies were down. So bt 1000 at $8.11 and sold them 2mins later at $8.15 and then had to go out.

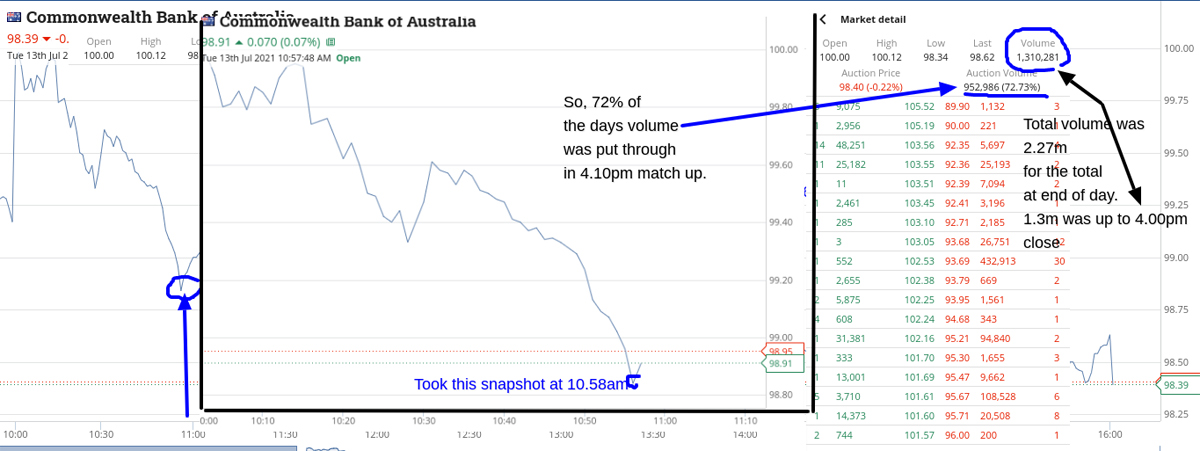

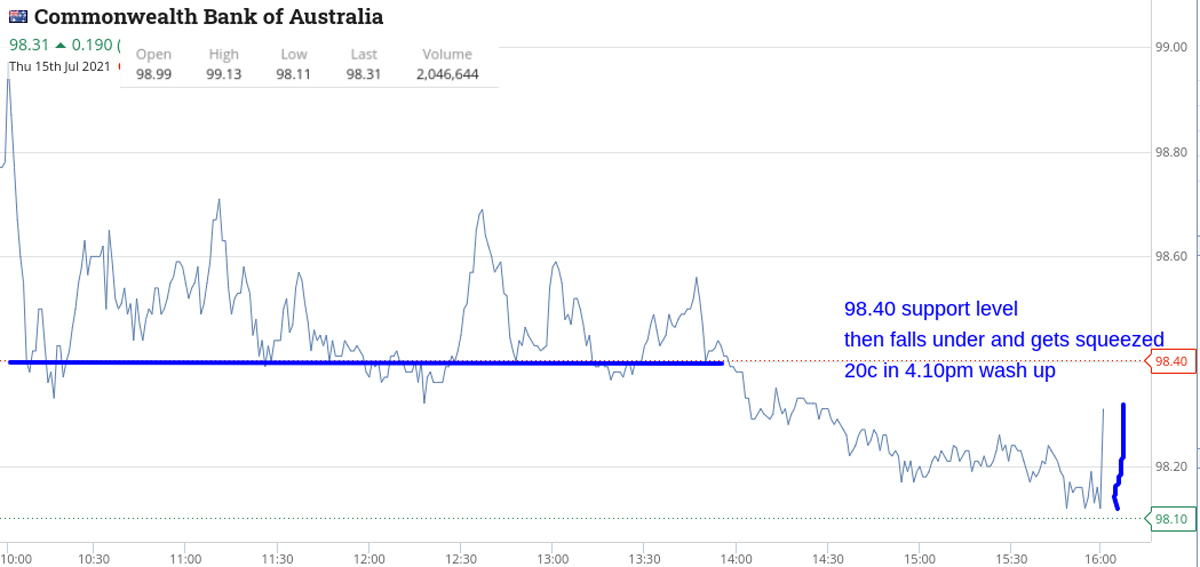

BHP were super strong, so set an alarm to ping me if at $51.00 having seen them up to $51.61, just after opening. At 12.32pm, get a ping to say BHP are at $51.00 and manage to grab 2000 at $50.96 but then shocked to see CBA at below $99.00.

Actually bt 2000 at $98.72 which amazed me and then another 2000 at 98.56 which amazed me even more.

Sold the BHP at $51.14 (+$360), got back in at $50.93 and out at $51.00 but at 3.33pm decide to cut the CBA at $98.62 for a $80 loss gross and $240 net after brokerage.

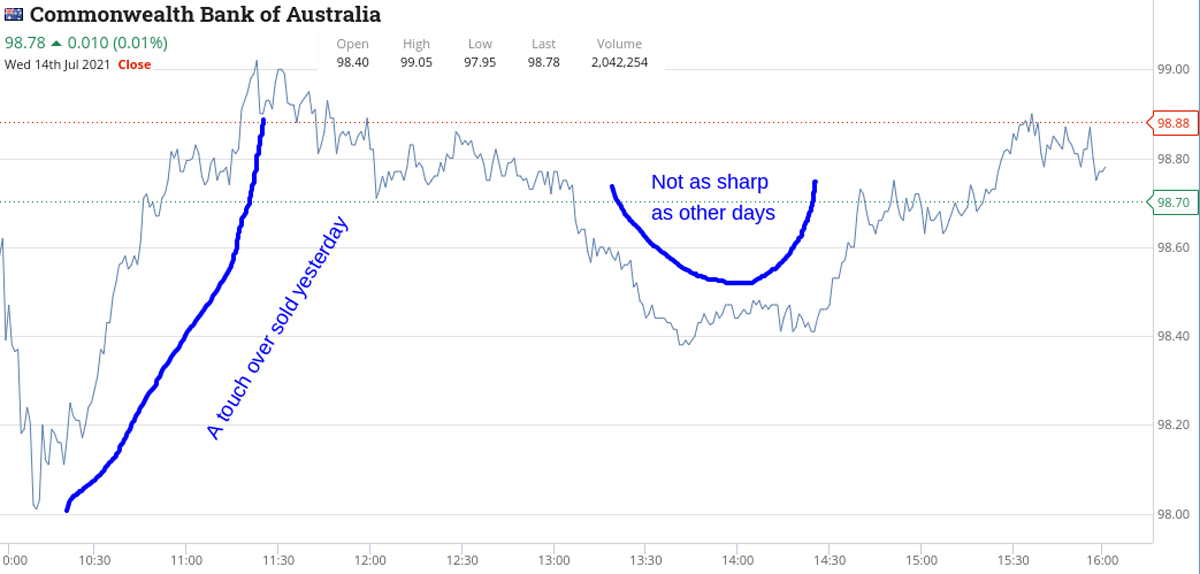

CBA very weird, as seem to have the COVID blues (see two charts). Plus $460 gross for the day and only nine trades compared to yesterday’s 27!

Wednesday July 14

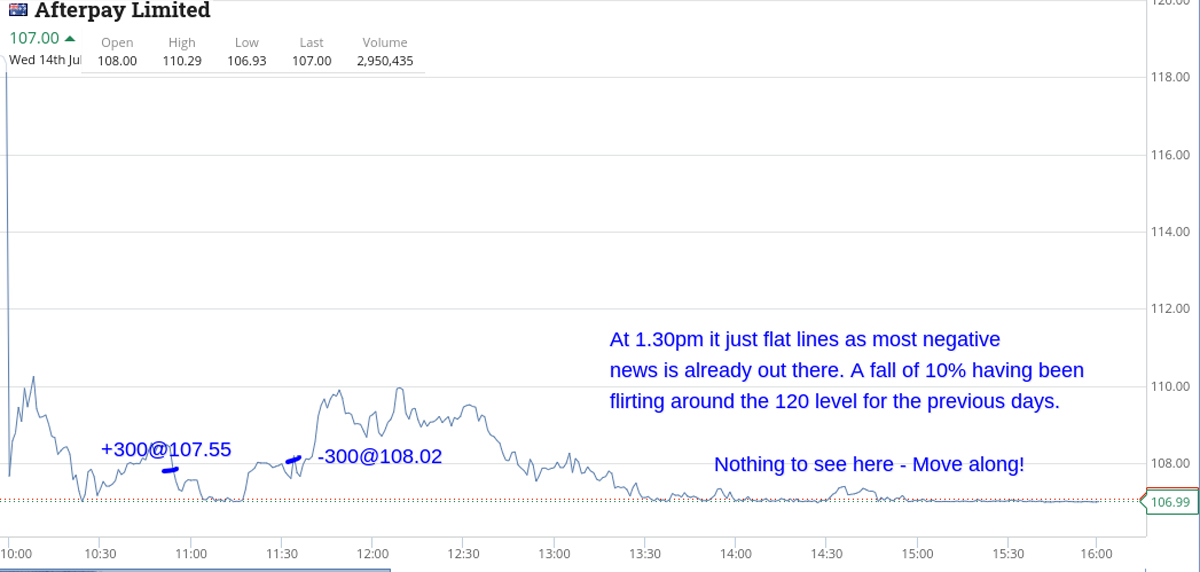

News that PayPal are going big into BNPL knocks APT down 7% and also Z1P down 7% on the opening.

No 2% fall from Wall St yet but interest rates on bonds are rising, so will see.

CBA very quickly dip below $98.00, 10mins in and now at $98.20, after 25mins in. Just watching and waiting. At 10.42am APT are at $108.00 and Z1P are $7.50. Still waiting to see if they can fall anymore as expecting them to.

Buy 300 APT at $107.55 and sell them at $108.02 for a $141 profit and then get an invite to lunch. Come back and decide to have a go at SZL and Z1P (down to $7.33!) as expecting them to get a touch up off their lows before the close, which happens, but you had to be quick.

All up plus $280 as besides the BNPL sector there wasn’t enough volatility after the opening movements, CBA or BHP.

Thursday July 15

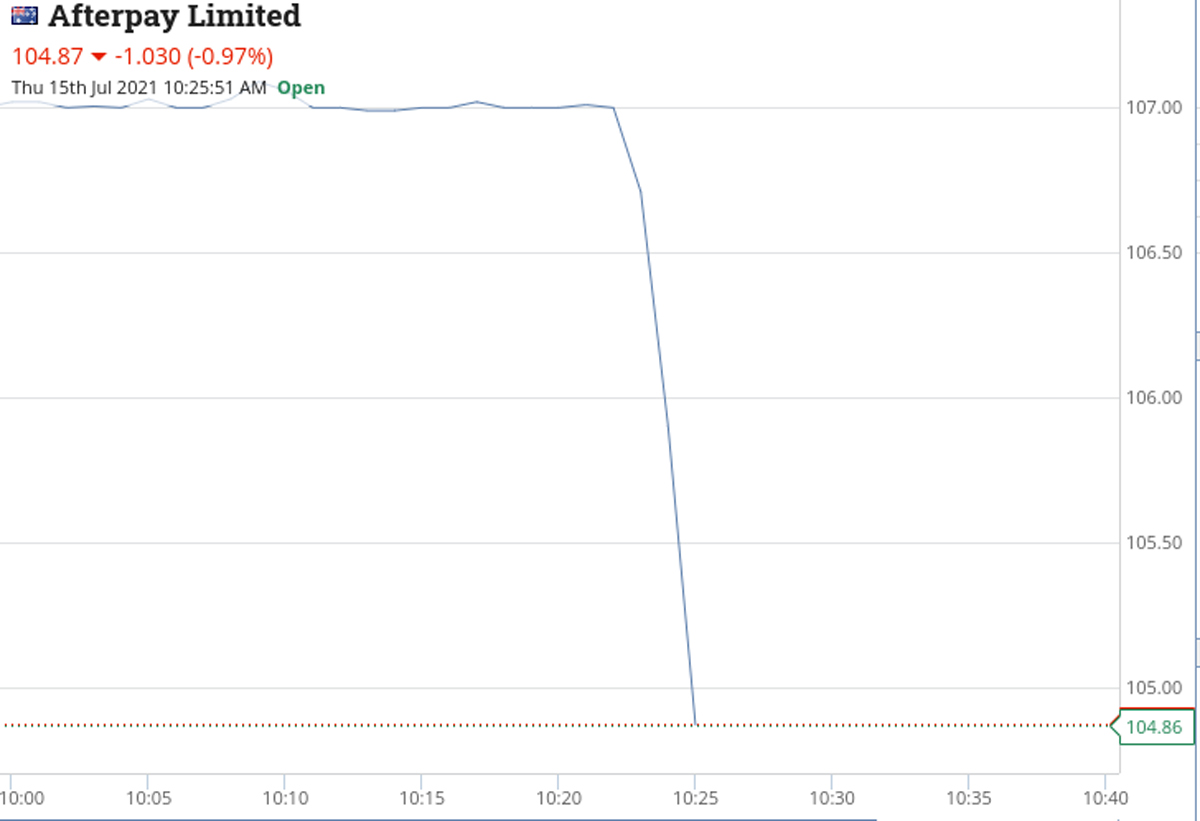

Can’t wait for APT and Z1P to open and today they don’t disappoint.

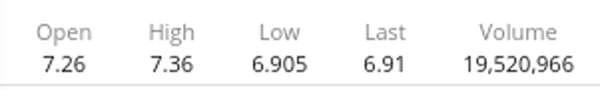

As they rotate the openings of stocks, Z1P actually opens 8mins after APT. In that 8 mins APT turns over 242,000 and it showing +5c at $107.05 and Z1P turnover 1m shares in its first minute.

This is exciting stuff and it gets even more exciting as just before 10.30am, APT does this:

I am sitting here in my dressing gown and am blown away at how fast they fall. As quick as my little fingers can I buy [email protected].

Time 10.27am. Then buy [email protected].

Time 10.30am. Then buy [email protected] on a limit at 10.34am. Buy 2000 Z1P at $6.99.

Time is 10.36am and I put them on a limit sell at $7.05 and APT I just watch. APT have done this to me before, so I am quite relaxed that by 11.00am, they should bounce.

Close the computer lid and go and have a shower, as watching not helping. In the shower I decide that if they are still down, that I am going in boots and all, as this is a margin call fall.

Come out and lift the computer lid and they are trading at 105.00. My Z1P position had been taken out on a limit, so up $120 there and with APT I manage to sell all 900 at $104.98, locking in a $999 profit.

So up $1,119 before 11.00am and walk away for the day. Check my phone too many times and get very tempted by BHP and CBA but remain very strict so as not to push my luck. Let’s see what Friday brings.

Friday July 16

Pick up 1000 CBA just before 10.30am at $97.62 and sell them 12c higher for $120 profit. Can’t find any more inspiration from anything else today.

Z1P hit a low of $6.71 just after the open and then sort of went on a steady climb to close at $7.10 and APT did the same, hitting their low at the same time – $101.40 but were a bit more dramatic in they days movements, closing at $103.21.

My 2% fall on Wall St prediction never happened this week, though the 7% fall in APT on Thursday certainly made up for it.

So up $120 today and overall over the week plus $3,117 gross and $2,552 net of brokerage.

Best trade of the week was APT on Thursday and worst was CBA today. Maybe next week will give me a 2% or so fall on Wall St.

Let’s see, as fully prepared.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.