Confessions of a Day Trader: Always believe in… gold!

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

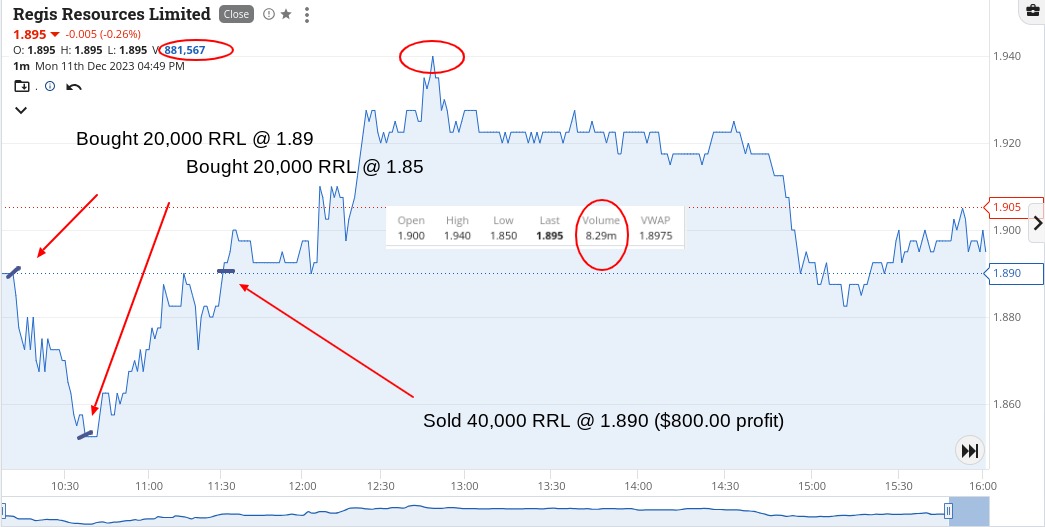

Monday December 11

Someone put up a pre-market announcement from Regis Resources on my X feed. It said that they had unwound their gold hedge book and that they are now a totally unhedged producer of gold.

I thought this very bullish news for all of the gold bugs out there and being a Monday, with all of the week ahead of me, I decided to throw a bit of caution to the wind.

It worked out OK but had to double down before the market joined in with my excitement. In fact RRL opened at $1.90, had a high of $1.94 and a low of $1.85 on just over 8m.

Then with all the others, it was just a matter of picking an entry spot, after they had broken down through a solid number. $107 in CBA’s case and $129 in Rio’s case.

A cracker of a start to the week, up $1,865.

Recap

Bought 20,000 RRL @ 1.89

Bought 20,000 RRL @ 1.85

Bought 2,000 CBA @ 106.94

Bought 2,000 BHP @ 47.65

Sold 2,000 CBA @ 107.13 ($380 profit)

Sold 40,000 RRL @ 1.890 ($800 profit)

Sold 2,000 BHP @ 47.72 ($140 profit)

Bought 2,000 CBA @ 106.80

Bought 1,000 RIO @ 128.98

Bought 1,000 RIO @ 128.79

Sold 2,000 CBA @ 106.92 ($250 profit)

Sold 2,000 RIO @ 129.03 ($295 profit)

Tuesday December 12

Had some lower limits in RIOs and CBA, just in case they broke downwards, which they never did.

Luckily for me, I did some more reading on RRL and decided that some overseas buying will have to come in today, after their news yesterday.

Was happy to up my size, if I had to, and not being shy on this one, as to me everything is lining up for them.

I didn’t have to double down and was happy with my 3c turn.

Could have been more but cautious after the way they traded towards their close yesterday.

One stock. One shot and bingo. Plus $1,500 and seriously thinking I should take the rest of the week off as the rest of the market is very strong.

Recap

Bought 50,000 RRL @ 1.88

Sold 50,000 RRL @ 1.91 ($1,500 profit)

Wednesday December 13

I really can’t find anything that fits my trading style today. What makes a few retirees happy makes me become frustrated.

WBT popped up as a 4% faller and without any news, so maybe a margin call sell off?

Anyway, don’t really care, so pick up a couple of thousand and stick them on what I thought at the time was a bit of an outrageous limit.

Then blow me down they got there. Up $220, on a day when RIOs nudge $130.95 and CBA $108.39.

Amazing.

Recap

Bought 2,000 WBT @ 3.56

Sold 2,000 WBT @ 3.67 ($220 profit)

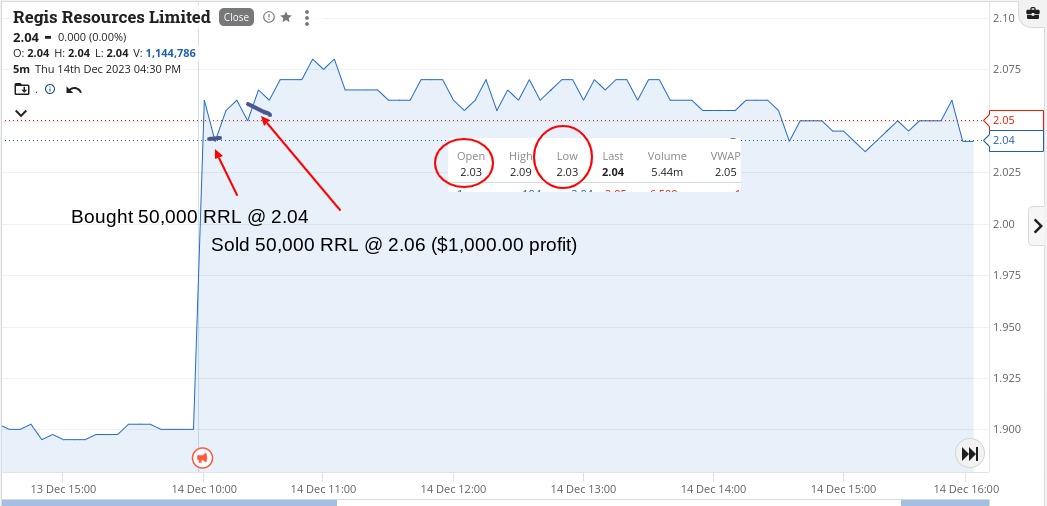

Thursday December 14

Bullish news on interest rates from America means the market only has one way to go. Up!

So, I’m thinking that I’m not going to be doing anything today, when I notice that RRL are looking 10c plus pre open.

Head over to them and they have bullish drill results. So, I’m in just after the opening, just for old time sake. I can feel a bit of a dip and then a bit of a firming.

Then CBA are above $109 and RIOs are above $131, so it’s that kind of market.

Go long CBA, coming into 11.00am, as they just fall below $109. I put them on a sell limit ($109.20) and then adjust it down when it starts to get there and then fall away again. I chase them don and close them out.

Then later, they do it again and I set myself up and get set below $108.80 and again put them on a limit, just in case they pop, when/if reaching the $109.00 level.

Automatically get taken out when they do pop and then I’m off to the beach. I’m in love with RRL and can’t believe RIOs went above $132 today. They are almost acting like AfterPay used to. My My.

Plus $1,860. Yay!

Recap

Bought 50,000 RRL @ 2.04

Sold 50,000 RRL @ 2.06 ($1,000 profit)

Bought 2,000 CBA @ 108.94

Sold 2,000 CBA @ 109.08 ($280 profit)

Bought 2,000 CBA @ 108.76

Sold 2,000 CBA @ 109.05 ($580 profit)

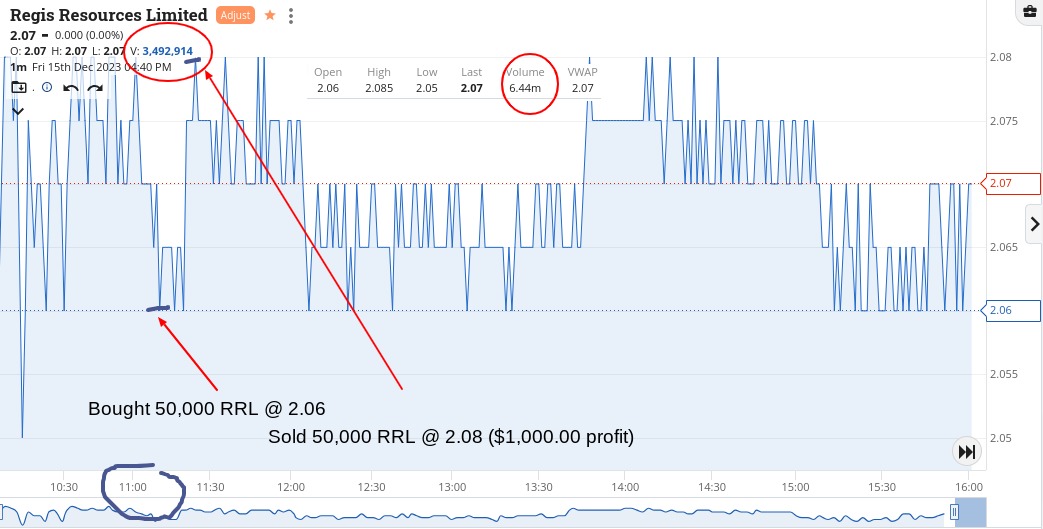

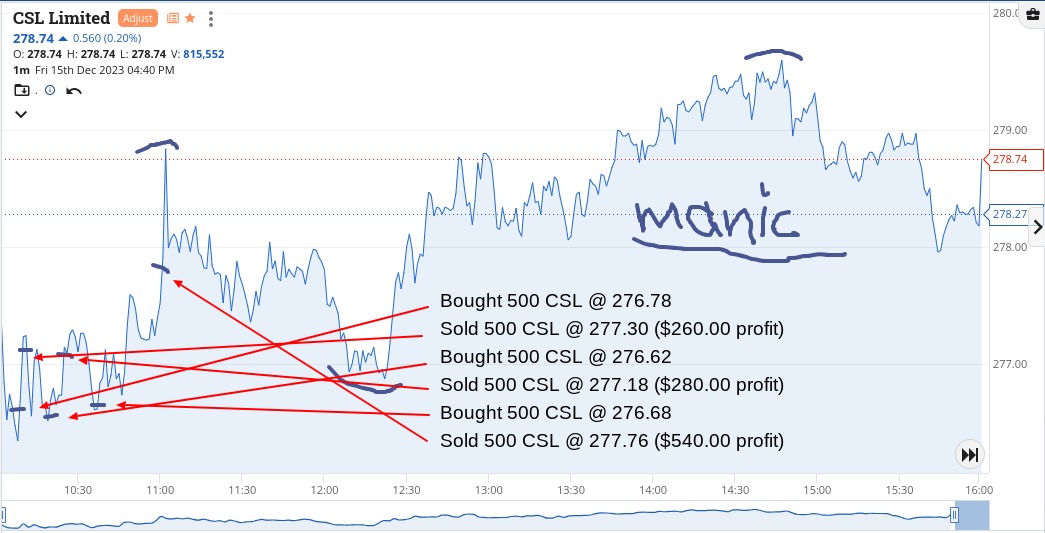

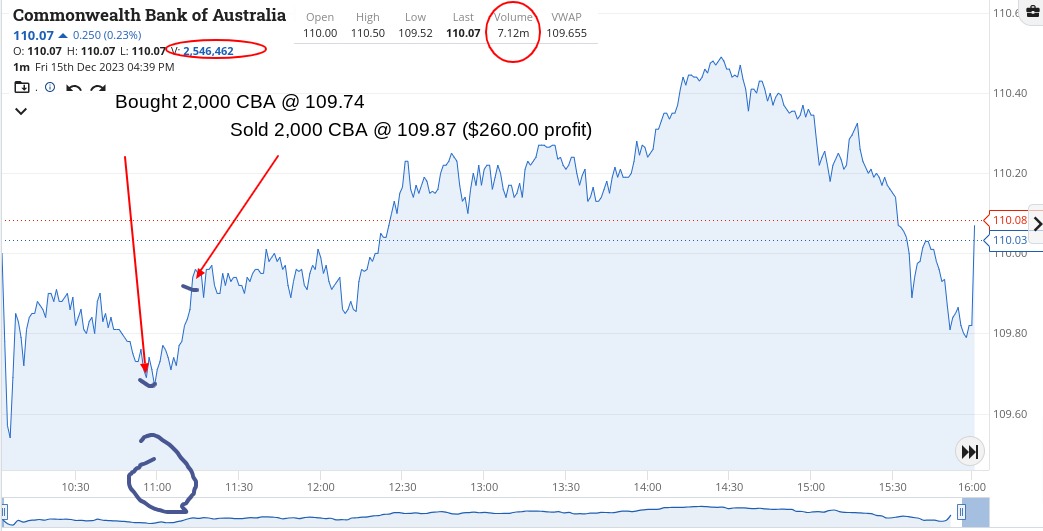

Friday December 15

Very bullish signals coming out of USA overnight means that we are in for a cracker of a market, so get stuck in early to BHP early as it comes out of the first opening batch of stocks.

Everything I did today was with the conviction that everything will only get stronger as the day goes on.

Took a bit longer than I thought and I managed a few dips on the way. CSL is still my manic child as it ranged from $276.33 to $279.69 and gave me three good goes today.

As ever, RRL was the stock that couldn’t stop giving and even BHP cracked the $49 barrier and then RIOs managed to crack the $134 barrier and touch $134.04!

Been a big week for me and I must say it was unexpected. Mainly thanks to RRL and their re rating.

Plus $2,560 today, which brought the total for the week to $8,005 gross and $7,152 net, so Santa is definitely back on with oysters, prawns and French champagne all ordered. Happy days.

Recap

Bought 2,000 BHP @ 48.78

Bought 500 CSL @ 276.78

Bought 2,000 CBA @ 109.74

Sold 500 CSL @ 277.30 ($260 profit)

Bought 500 CSL @ 276.62

Sold 2,000 CBA @ 109.87 ($260 profit)

Bought 50,000 RRL @ 2.06

Sold 500 CSL @ 277.18 ($280 profit)

Sold 2,000 BHP @ 48.89 ($220 profit)

Sold 50,000 RRL @ 2.08 ($1,000 profit)

Bought 500 CSL @ 276.68

Sold 500 CSL @ 277.76 ($540 profit)

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.