Confessions of a Day Trader: All at sea? Time to set sail for home… and 2022

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday December 20

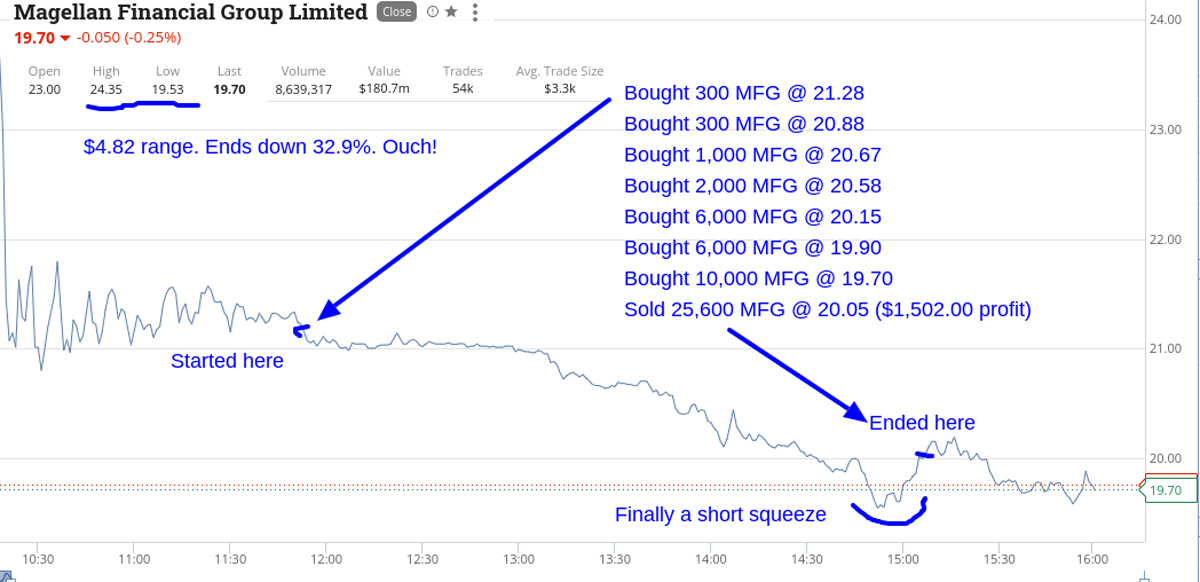

What starts out as a few nibbles, just to get set and get my eye in, turns out to become the dealings of a madman.

Buying 300 (only) MFG compounds to 25,600 as I chase them down to find a bottom and a short squeeze. The squeeze finally comes around after the very last purchase of 10,000 at $19.70. They fell to $19.53 before bouncing.

So, when a stock falls 30% or more and the news is out and digested, then two more days of this would mean the shares would almost disappear. At some point a shorter must cover and create a short squeeze. Like waiting for the right wave, you have to be in the ocean to ride it.

I was well and truly in the ocean with MFG, compared to CIM, which behaved itself in the paddling pool. Cut the Z1P after closing out MFG.

A big day that started out small, leaves me drained but up $1,712 gross.

Recap:

Bought 300 MFG @ 21.28

Bought 500 CIM @ 15.59

Bought 2,000 Z1P @ 4.17

Bought 300 MFG @ 20.88

Bought 1,000 MFG @ 20.67

Bought 2,000 MFG @ 20.58

Bought 6,000 MFG @ 20.15

Bought 6,000 MFG @ 19.90

Sold 500 CIM @ 16.17 ($290.00 profit)

Bought 10,000 MFG @ 19.70

Sold 25,600 MFG @ 20.05 ($1,502.00 profit)

Sold 2,000 Z1P @ 4.14 (-$70.00 loss)

Tuesday December 21

A very slow day today, with most of my watchlist up. Managed one trade in 2500 FMG, after they had a bit of a sell-down. Left a bit on the table, but don’t really care as a profit is a profit. Plus $175 and relaxed.

Bought 2,500 FMG @ 19.56

Sold 2,500 FMG @ 19.63 ($175 profit)

Wednesday December 22

Got a bit more aggressive today as a few fallers looked overdone and I thought not worth tiptoeing around – just go for it.

RIOs were marked up overnight and touched $101.70 as a high. Bought 2000 at $98.91 and sold them 20c higher.

CHC got marked down over an acquisition and had a range of $21.62 and $19.70. Took me three goes to find their bottom, but got there in the end.

First purchase was at $20.15 and last was at $19.86. Both gave me a bit of pain before the gain!

Ended the day up $930 but don’t think will be so aggressive tomorrow or Friday, as I can see maybe a few tears because of lower volumes and interest.

Recap:

Bought 2,000 RIO @ 98.81

Sold 2,000 RIO @ 99.01 ($400 profit)

Bought 2,000 CHC @ 20.15

Bought 2,000 CHC @ 20.03

Bought 4,000 CHC @ 19.86

Sold 8,000 CHC @ 20.04 ($530 profit)

Thursday December 23

Everything is getting slower and the daily swings are getting smaller.

Could only find one trade today in FMG, who were trying to nudge $20.00 yesterday so picked up 2500 at $19.20 and watched them fall below $19.00 and then slowly climb back up to become a profitable trade.

Got the feeling that you could make money today, whether going long or short.

Plus $300 and tomorrow the markets shut at 2.00pm.

Recap:

Bought 2,500 FMG @ 19.20

Sold 2,500 FMG @ 19.32 ($300.00 profit)

Friday December 24

Looked, searched and gave up today.

Volumes low and movements were not too large. The biggest faller out of the top 200 was RWC, who at $6.15 were down 2.38% on 500,000 shares.

CBA for example opened at $100.58 and closed at $100.63 on 888,000 shares and APT opened at $86.55 and last trade was $86.65. Their range was $1.04 but only on 321,000 shares mind you.

So happy to pull up stumps and head for the beach.

Plus $3117 gross and $2711 net. Another short week next week, though we may have a bit of year-end touching up.

Let’s see.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.