Confessions of a Day Trader: A long flat end to a mildly frothy week

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday August 1

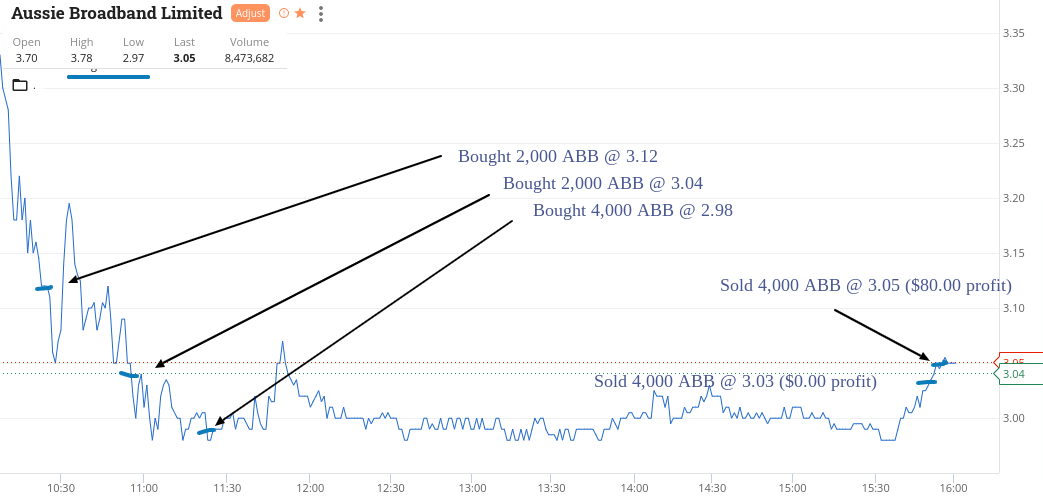

First day of the month and Aussie Broadband comes out of the traps and falls heavily, from $3.78 on a bit of market news.

Had to have a nibble, not too big as I may have to double down. I have to as they head to $3.00 and then I double right down at $2.98 and wait.

What a wait it was. I even got in an afternoon nap ahead of the close. I just kept adjusting my limits down, having split my sells into two lots. Broke even on one and $80 profit on the other one.

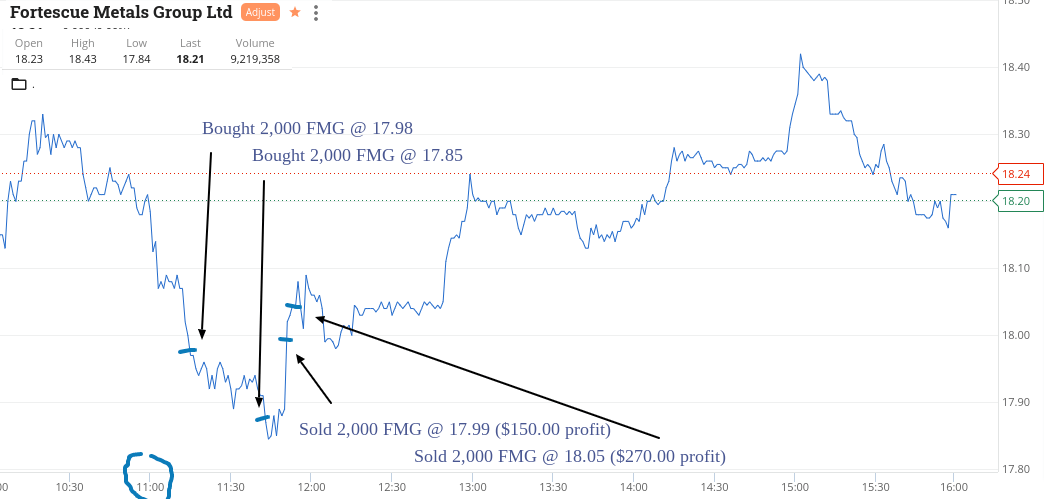

In between all of that, FMG had tumbled below $18.00 so went once at $17.99 and again at $17.85 and again split my sells up into two orders on limits and off they go.

ABB was a classic, news out – find a level – oversold trade. Love it.

Plus $500.

Recap

Bought 2,000 ABB @ 3.12

Bought 2,000 ABB @ 3.04

Bought 4,000 ABB @ 2.98

Bought 2,000 FMG @ 17.98

Bought 2,000 FMG @ 17.85

Sold 2,000 FMG @ 17.99 ($150 profit)

Sold 2,000 FMG @ 18.05 ($270 profit)

Sold 4,000 ABB @ 3.03 ($0 profit)

Sold 4,000 ABB @ 3.05 ($80 profit)

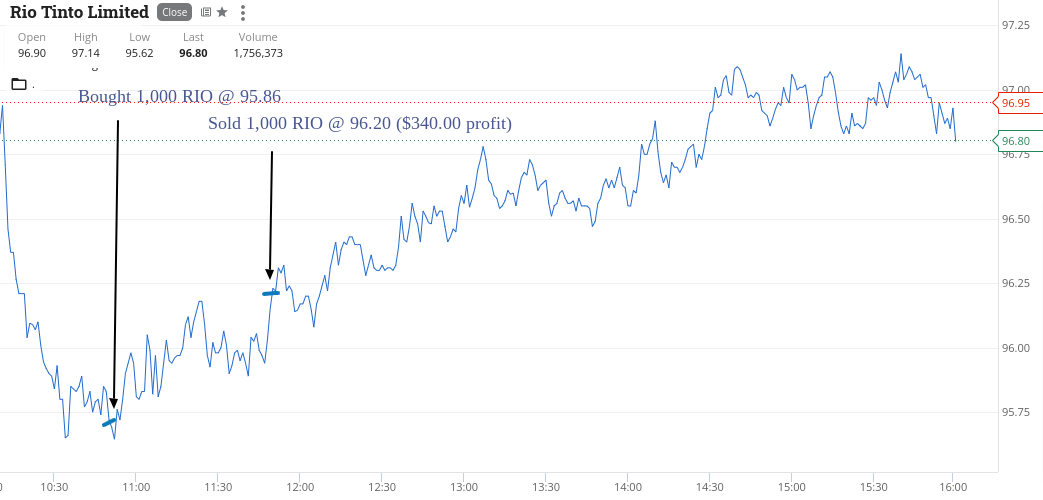

Tuesday August 2

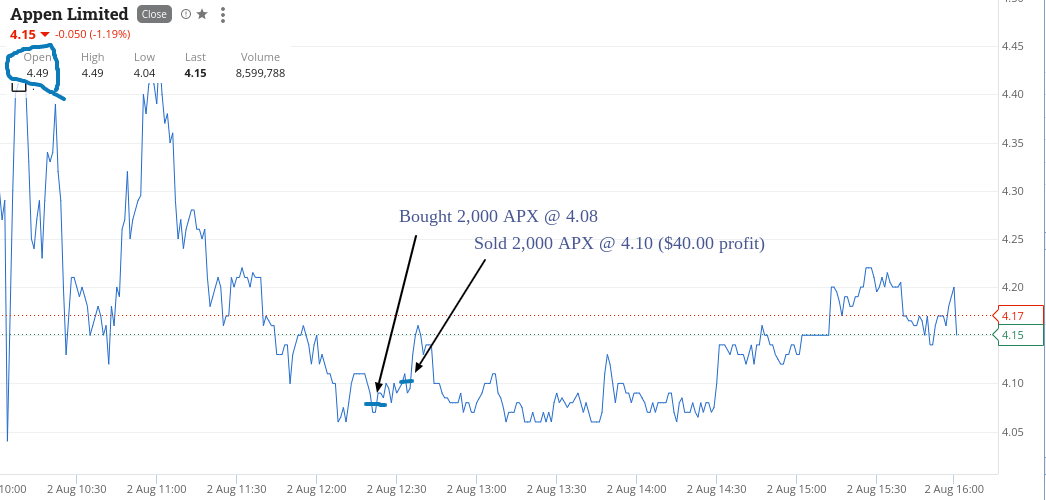

Rate rise day today at 2.30pm, so I was just watching on the sidelines ahead of the news. Well, that was the plan!

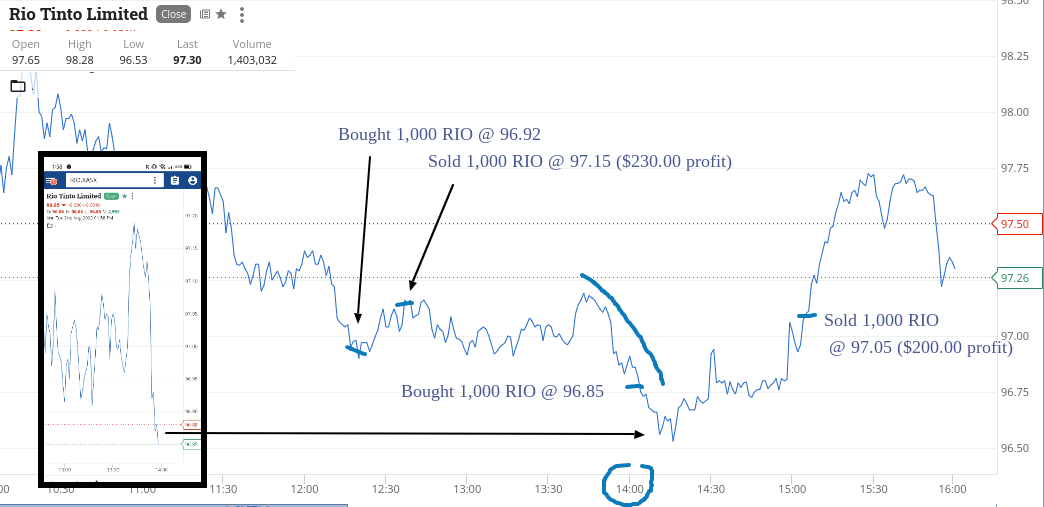

Then along come RIO, just before 12.20pm, crack down below the $97.00 level. I work on the fact that the banks are a bit more interest rate sensitive than the iron ore plays.

Buy 1000 at $96.92 and they quickly recover above $97.00 and out they go on a limit at $97.15.

Appen or APX are the day’s big faller so nibbled some around the same time. After closing out the RIO trade, close APX out for a quick $40 profit, as was meant to be doing nothing till 2.30pm.

Then RIOs do it again and at just before 2.00pm, they fall below $97 again. They fall further as do BHP, so instead of doubling down on RIO, I buy 2000 BHP at $38.28. Both stocks rally after 2.30pm and RIO go out again on a limit and BHP just get sold into their rally.

RIOs then catch fire and rocket $97.70 before coming back at the close. Be interesting to see what they do tomorrow. Up $620 on a day when interest rates rise 0.5%. Gotta be happy with that.

Recap

Bought 2,000 APX @ 4.08

Bought 1,000 RIO @ 96.92

Sold 1,000 RIO @ 97.15 ($230 profit)

Sold 2,000 APX @ 4.10 ($40 profit)

Bought 1,000 RIO @ 96.85

Bought 1,000 BHP @ 38.27

Sold 1,000 BHP @ 38.42 ($150 profit)

Sold 1,000 RIO @ 97.05 ($200 profit)

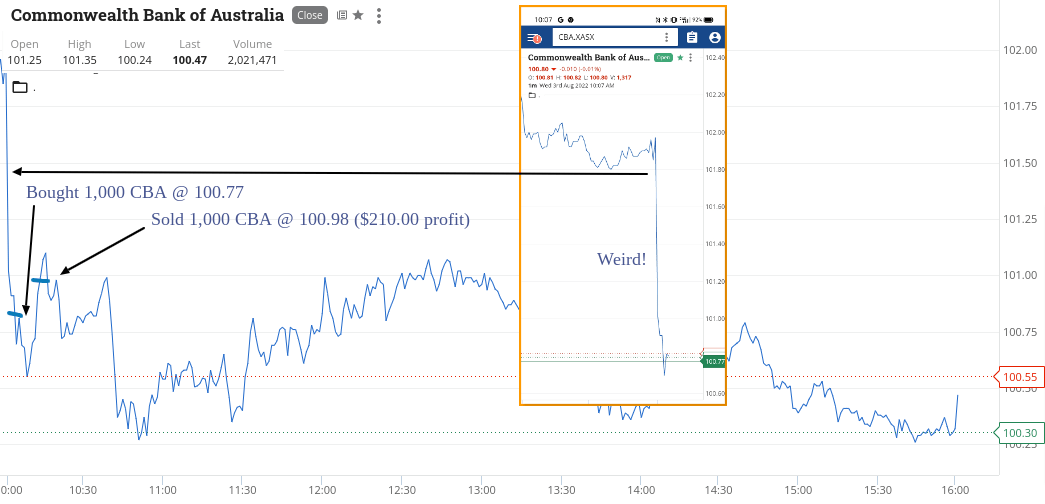

Wednesday August 3

Went very early into CBA, as they were marked down by too much. Was showing them opening over a coffee with a mate and he asked me ‘why are they doing that?’

I couldn’t really explain why, so we had a go and were out (on a limit) by the time we had finished our cappuccinos. Was happy to pay.

Then RIOs were again down and now below the $96 level, let alone the $97 level. Picked up at $95.86 and after watching them for a bit, left them on a limit.

A cruisy $550 day today, though going so early in CBA was against the rules, so quite a rare event.

Recap

Bought 1,000 CBA @ 100.77

Sold 1,000 CBA @ 100.98 ($210 profit)

Bought 1,000 RIO @ 95.86

Sold 1,000 RIO @ 96.20 ($340 profit)

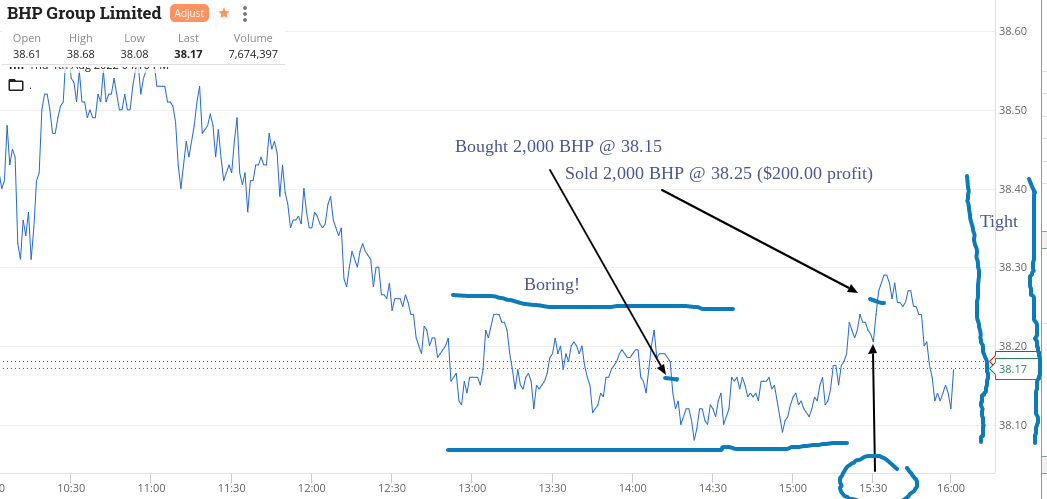

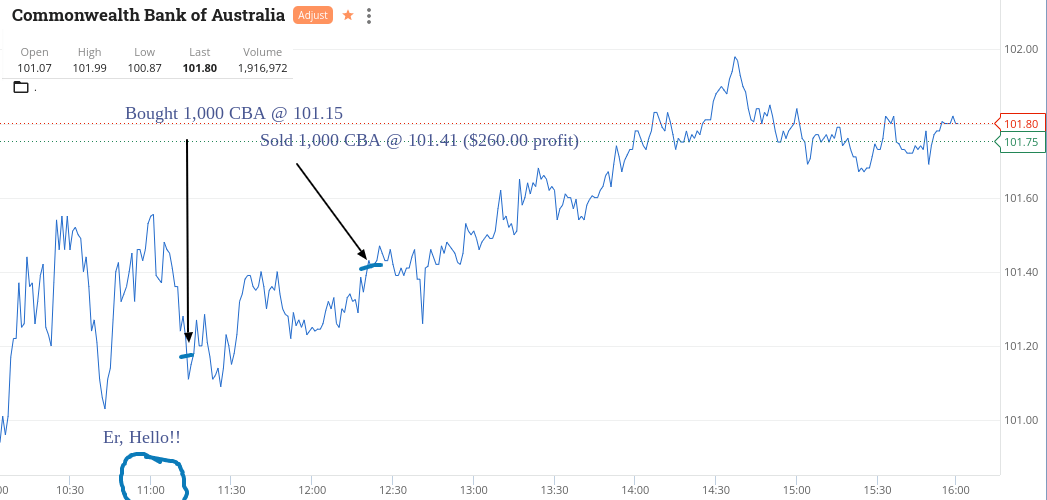

Thursday August 4

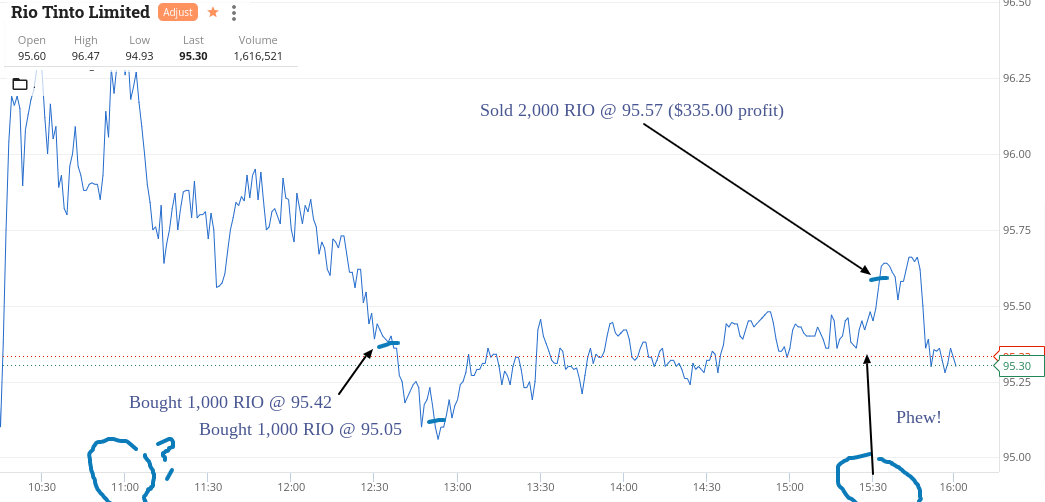

It feels like today, you could be long or short and still make money. CBA are still behaving strangely, though RIO are even worse. The range on RIO:

Open 95.60 High 96.47 Low 94.93 Last 95.30 Volume 1.6m

CBA:

Open 101.07 High 101.99 Low 100.87 Last 101.80 Volume 1.9m

And then there was BHP. Smaller range but much bigger volume:

Open 38.61 High 38.68 Low 38.08 last 38.17 Volume 7.6m

So BHP’s range never got out of $38.00 and slightly had to change tactics today, moving away from key price levels (101.00, 38.00, 94.00 etc) and a bit more on gut feel.

Up $795 today, though RIOs were a bit of a nail-biter until the 3.30pm bounce, which came good and also for BHP.

Recap

Bought 1,000 CBA @ 101.15

Sold 1,000 CBA @ 101.41 ($260.00 profit)

Bought 1,000 RIO @ 95.42

Bought 1,000 RIO @ 95.05

Bought 2,000 BHP @ 38.15

Sold 2,000 BHP @ 38.25 ($200.00 profit)

Sold 2,000 RIO @ 95.57 ($335.00 profit)

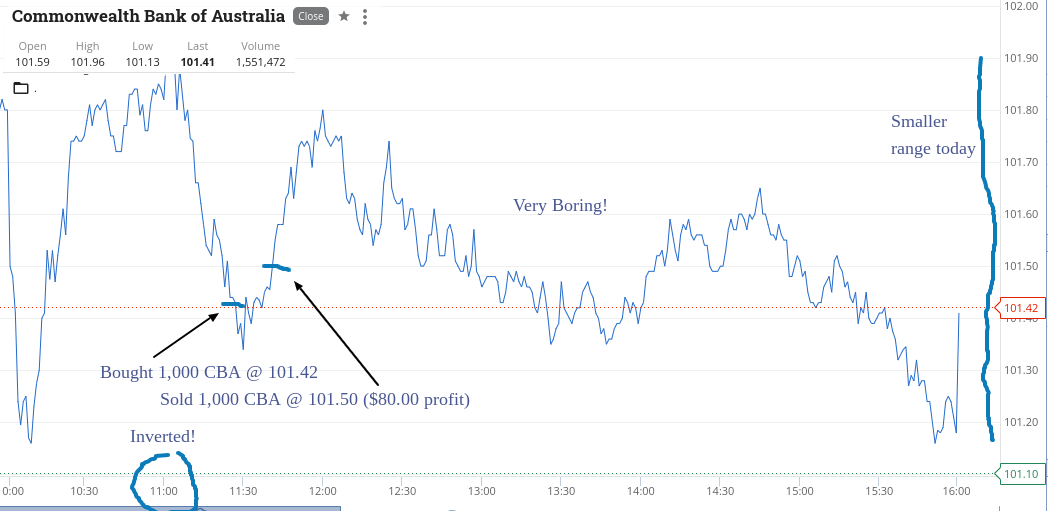

Friday August 5

A very boring day today. All the big major fallers outside of my watch list had low volumes, so no fishing there.

My actual watch list didn’t really throw up any biters either. CBA seems to now invert at 11.00am, so had to wait till around 11.30am before having a go. Short and sharp, as I just don’t know where they are heading.

Up $80 today and $2545 gross or $2121 net. Glad the week is over. US job figures out tonight, which may give some direction and hopefully some more volatility than today.

Recap

Bought 1,000 CBA @ 101.42

Sold 1,000 CBA @ 101.50 ($80 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.