Confessions of a Day Trader: A Big 4 in a trading halt? Take my money…

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday July 18

Markets on Friday night got a bit of a horn on and so today I think I will be struggling to find a trade.

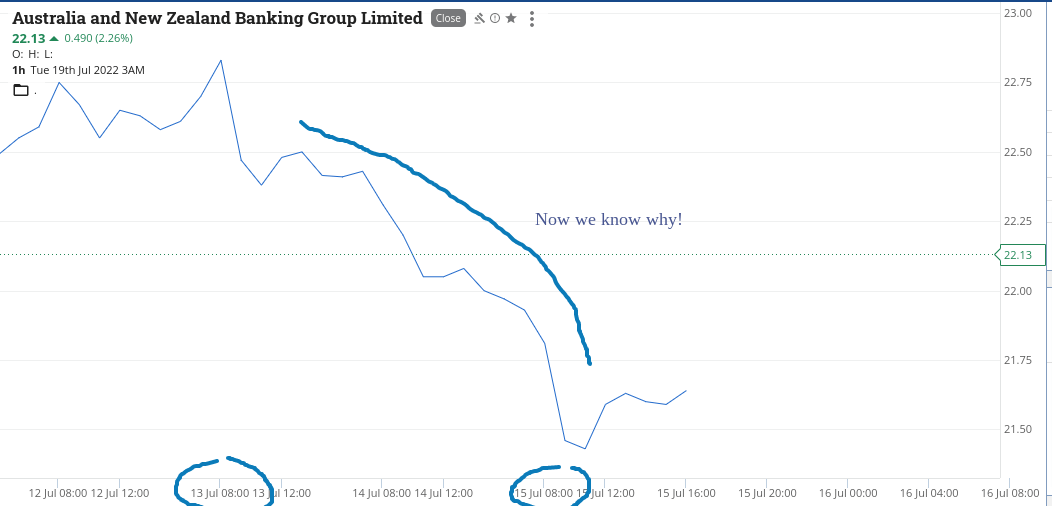

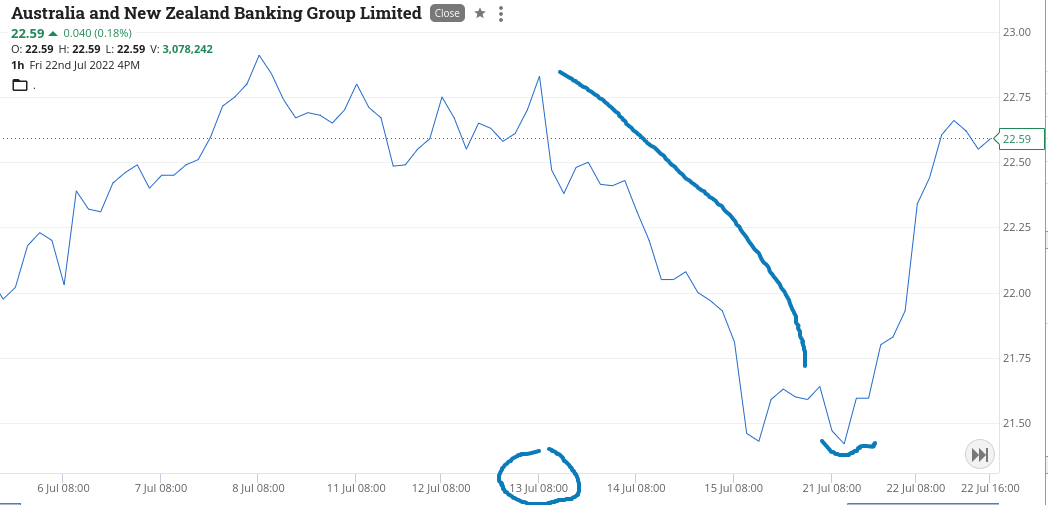

ANZ remain suspended for all of today and this is something of a first for me to experience, since starting this column some three years ago or so.

I don’t recall a major company worth $60bn being suspended this way for a whole trading day. Funnily enough (see chart) I had noticed them not performing that well over the last few trading days and now I know why!

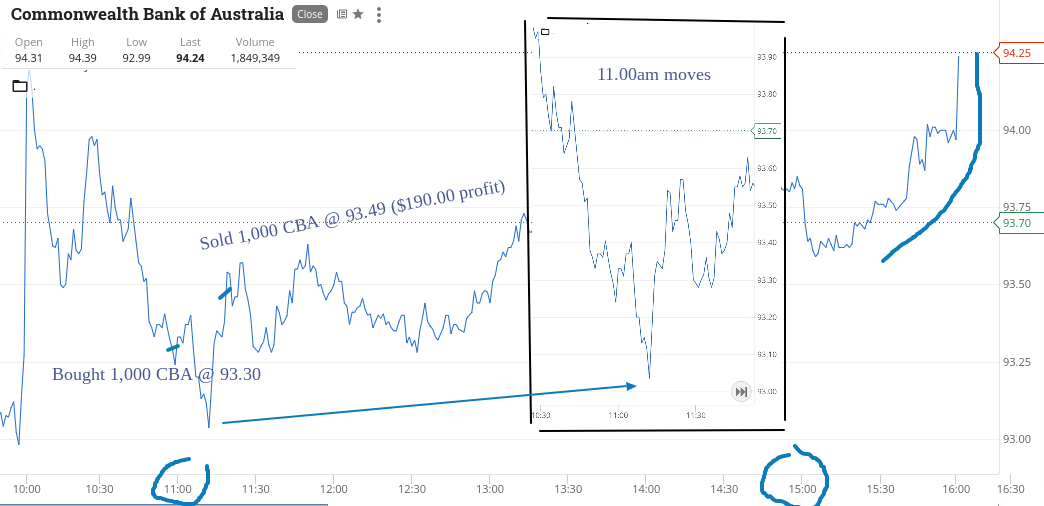

Had a curious local in the cafe today asking about trading and we were looking and talking, so I got a bit distracted and went a bit early on CBA, as when watching I thought they could go lower but had to show them how it all works.

More rain today and rest of the week, so start off with $190 gross to buy an umbrella with. Hopefully ANZ back on tomorrow and a trade to be made.

Recap

Bought 1,000 CBA @ 93.30

Sold 1,000 CBA @ 93.49 ($190 profit)

Tuesday July 19

ANZ are not back on today, so that’s that. Have to look around elsewhere.

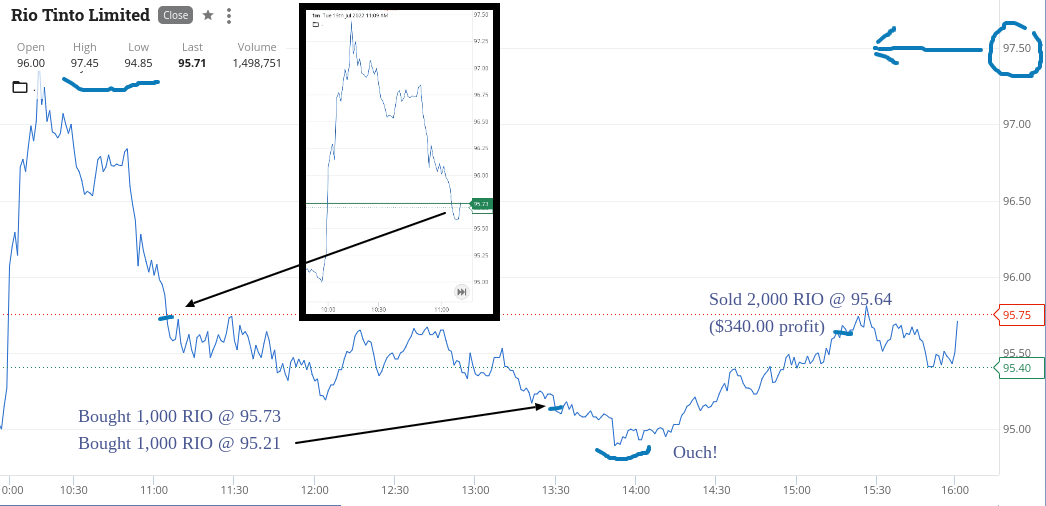

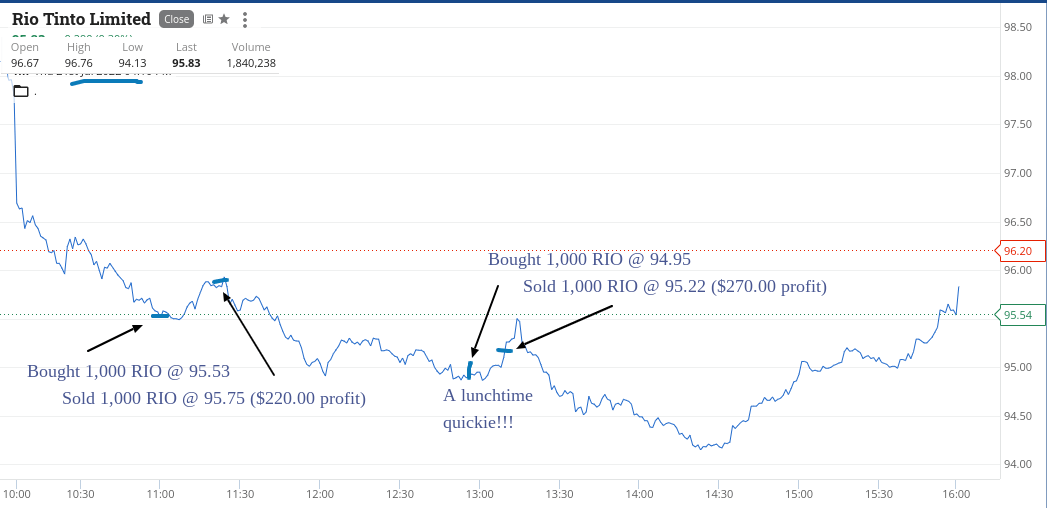

RIO pop up as a potential, having fallen from $97.50 and down $1.70 lower or so.

Pick up 1,000 and they just go lower. Have a second go at $95.21 and watch them head towards trading with a 94 on the front. See chart.

Plus $340 and RIOs was the one with the biggest day range today on my watchlist.

Now, maybe ANZ will be back tomorrow!

Recap

Bought 1,000 RIO @ 95.73

Bought 1,000 RIO @ 95.21

Sold 2,000 RIO @ 95.64 ($340 profit)

Wednesday July 20

Still no ANZ today, which I don’t fully understand or really care to understand, though my waters tell me there will be a trade when they come back on and the longer they take, the better the trade will be (or should be).

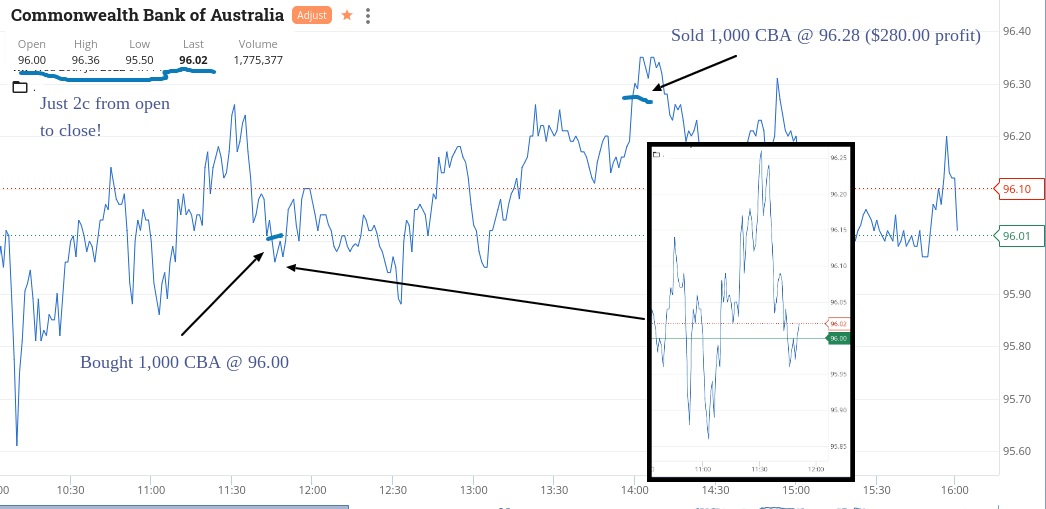

CBA come through but a bit later than usual in getting set, like 45 mins. At the end of the day, they opened at $96 and last trade (4.10pm) was $96.02, so only 2c difference. Amazing.

Plus $280 and will shut up about ANZ, until they come back on.

Recap

Bought 1,000 CBA @ 96.00

Sold 1,000 CBA @ 96.28 ($280 profit)

Thursday July 21

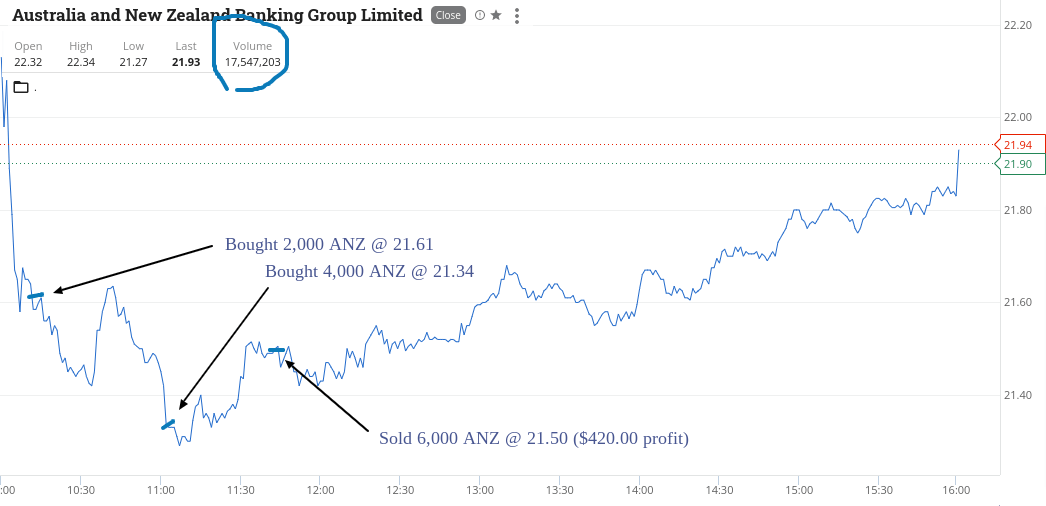

Hey hey hey, ANZ finally decide to turn up this morning and start trading. At last! However they open up before falling as expected.

They actually open at $22.32 and I get set at $21.61 or almost 70c lower. Then I have to double down, as surely they have found a bottom at $21.34. But no, they have to hit $21.27 before they recover.

Volume in them was 17.5m and they close 39c below their opening price.

RIOs had just a wild ride, with a day range of $2.63 on a volume of 1.8m, though CBA was a little bit quieter with a range of $2.23 on 2.66m. Amazing.

Finally, the waiting for ANZ brings in a nice $420 and RIO allowed me to have two goes to bring a smile to my face.

Finish the day with a happy ending! Plus $1100!

Recap

Bought 2,000 ANZ @ 21.61

Bought 4,000 ANZ @ 21.34

Bought 1,000 RIO @ 95.53

Bought 1,000 CBA @ 95.92

Sold 1,000 CBA @ 96.11 ($190 profit)

Sold 1,000 RIO @ 95.75 ($220 profit)

Sold 6,000 ANZ @ 21.50 ($420 profit)

Bought 1,000 RIO @ 94.95

Sold 1,000 RIO @ 95.22 ($270 profit)

Friday July 22

After yesterday’s heroic effort, today turns out to be a ‘doughnut’ day, as everything on my watchlist seems to have a rally and not look back.

CBA manages to have a range of $1.48 on a bigger than usual volume of 4.5m and peaks around 1.30pm and their chart just about sums up the day.

End the week plus $1910 gross or $1649 net and happiest trade was the ANZ trade, after they came back on from their trading halt. A bit of a wait but worth it.

Next week we have some inflation figures coming out, so hopefully I get a bit more volatility than today.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.