Confessions of a Day Trader: A $1000+ Friday! Now that’s the good oil!

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday April 17

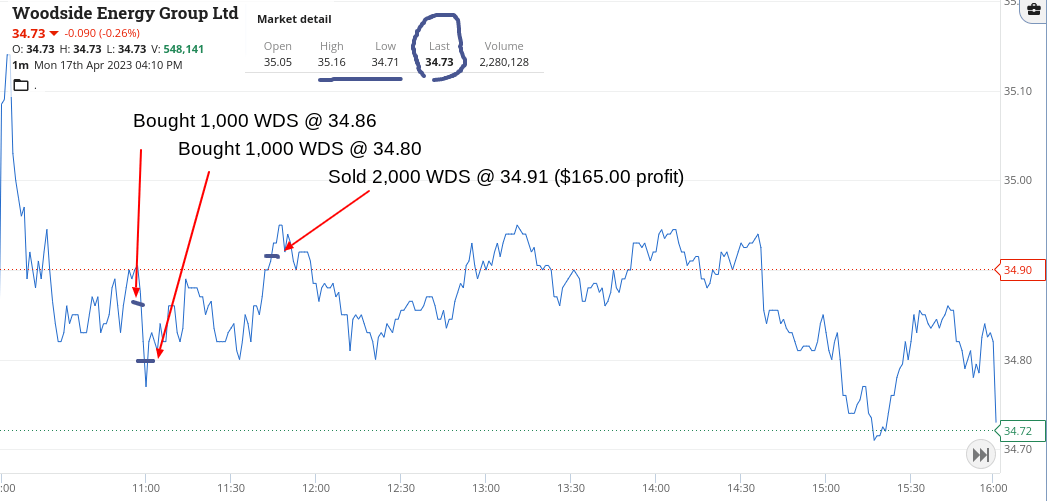

Not much happening in the first hour, as things like CBA race through the $100 barrier and touch $100.48, though WDS give me a bang on 11.00am start.

They opened at $35.05 and touched $35.16 before falling below the $35 mark. Got 1000 at $34.86 and then another 1000 at $34.80, before they rallied 45 mins later.

Had a few cheeky limit orders in CBA at $99.70, BHP at $45.85 and NCM at $28.85. Got hit in CBA, missed BHP completely but NCM I missed by 4 cents.

So in and out of CBA and when you see their chart, you can see that I just had to have another go, having sold them at $98.85 on a limit, they suddenly crash.

Back in at $98.67 and out for a 11c turn at 1 min before the 4.00pm death. Hung onto the WBC for the 4.10pm ruck but didn’t want to for CBA.

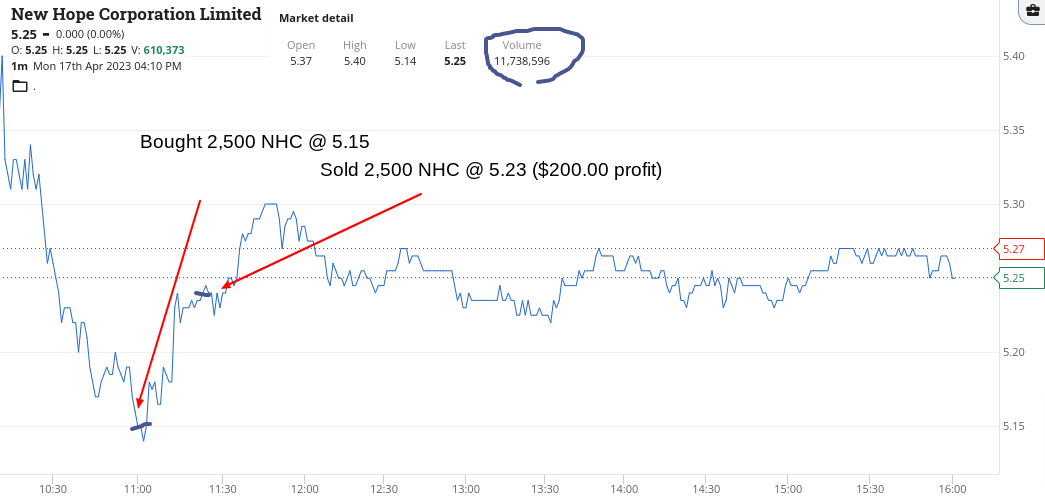

In between all of this fun and games, an old favourite, NHC, popped up as down 11% and they still have a buy back on, so managed a nice turn on them. In fact they gave me my first profit trade of the week.

Up $665, which is $1.00 away from the devil! Phew.

Recap

Bought 1,000 WDS @ 34.86

Bought 1,000 WDS @ 34.80

Bought 2,500 NHC @ 5.15

Sold 2,500 NHC @ 5.23 ($200 profit)

Sold 2,000 WDS @ 34.91 ($165 profit)

Bought 3,000 WBC @ 22.28

Bought 1,000 CBA @ 99.70

Sold 1,000 CBA @ 99.85 ($150 profit)

Bought 1,000 CBA @ 99.677

Sold 1,000 CBA @ 99.78 ($110 profit)

Sold 3,000 WBC @ 22.26 ($60 loss)

Tuesday April 18

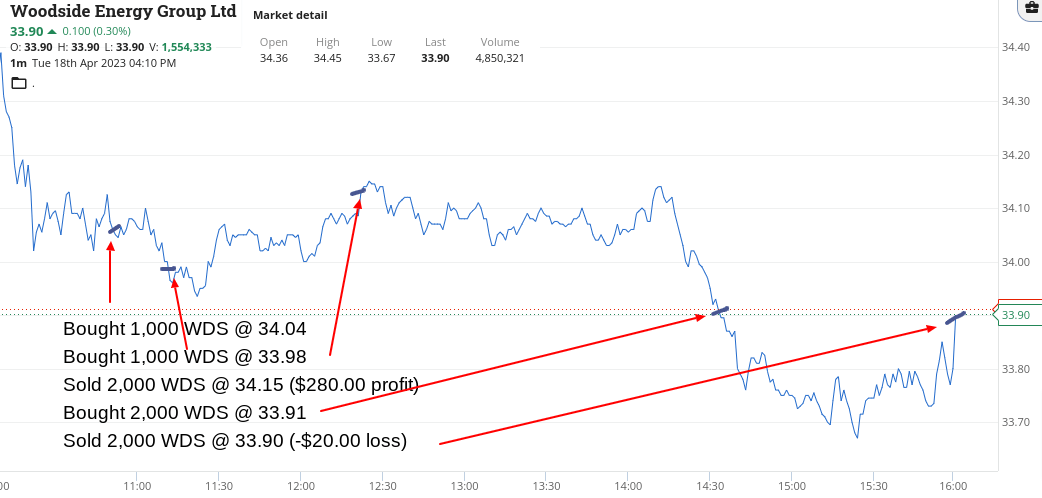

WDS were looking a bit depressed in my watchlist and I thought that at $34.04, they could go either way, so instead of buying 2000, just bought 1,000, thus keeping my powder dry.

Of course they went against me and fell below $34, so in I went again and waited and checked back in every 5 mins or so.

CBA had a fall between the WDS purchases and looked like they had formed a nice bottom having rallied at 11.00am and then falling back again.

Tried another go in WDS and was saved by the 4.10pm session, which left me 20 quid short! Amazing how I got the timing wrong yet again. Must sharpen the old trigger finger on them tomorrow, methinks.

Up $455 and hump day tomorrow!

Recap

Bought 1,000 WDS @ 34.04

Bought 1,000 CBA @ 99.21

Bought 1,000 WDS @ 33.98

Sold 2,000 WDS @ 34.15 ($280 profit)

Sold 1,000 CBA @ 99.40 ($195 profit)

Bought 2,000 WDS @ 33.91

Sold 2,000 WDS @ 33.90 ($20 loss)

Wednesday April 19

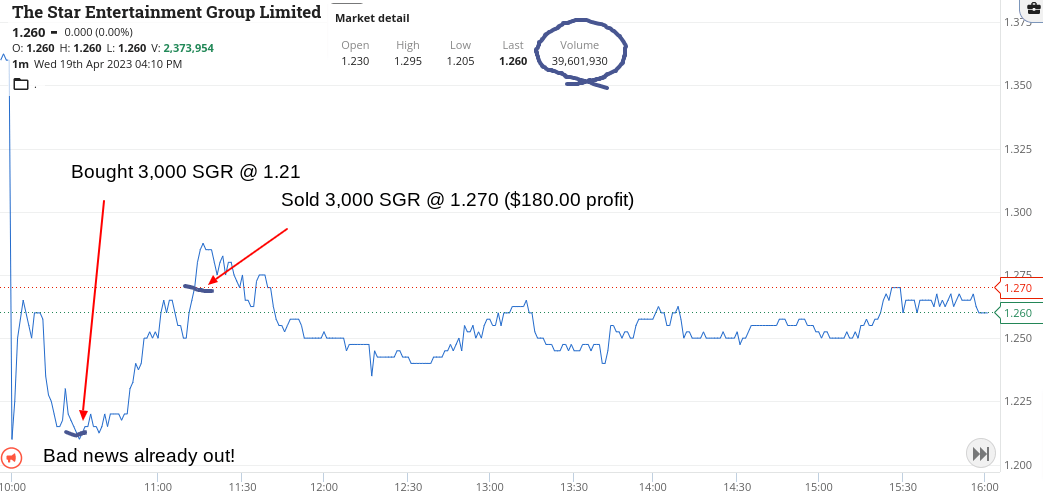

Today, I managed to have a gamble in a gambling stock!

Star City came out with some bad news, pre-market, and got shot on the opening.

The wound left them down 11%, so I came and picked some up and waited for the ambulance to arrive. After a bit of patching up, they recovered 6 cents and we then parted ways, with my wallet up $180 or so.

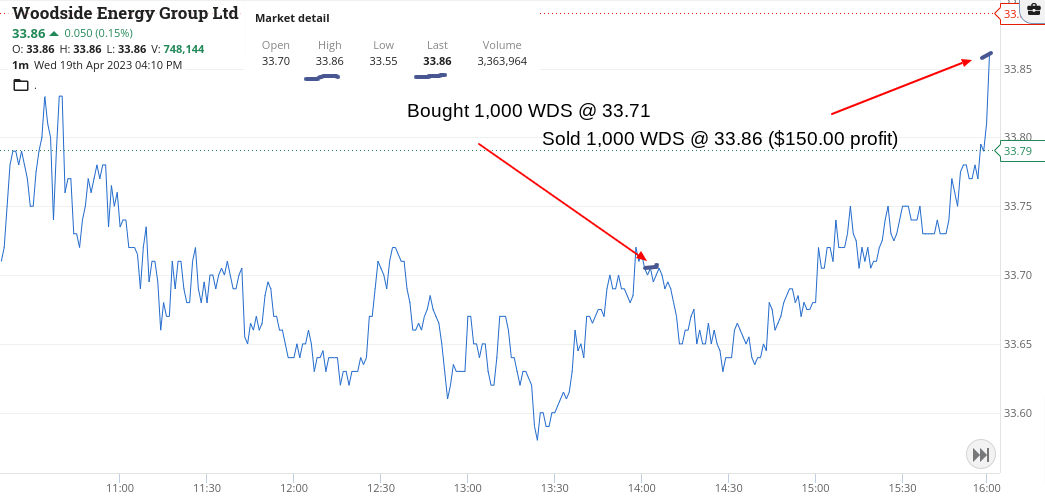

WDS – just had to come back and have another go as they are frustrating me. They finally come good today but again, at the death. They keep making me wait. What’s that? Five days in a row (almost)!

Someone much bigger than me is playing games. Oh well.

Up $330.

Recap

Bought 3,000 SGR @ 1.21

Sold 3,000 SGR @ 1.270 ($180 profit)

Bought 1,000 WDS @ 33.71

Sold 1,000 WDS @ 33.86 ($150 profit)

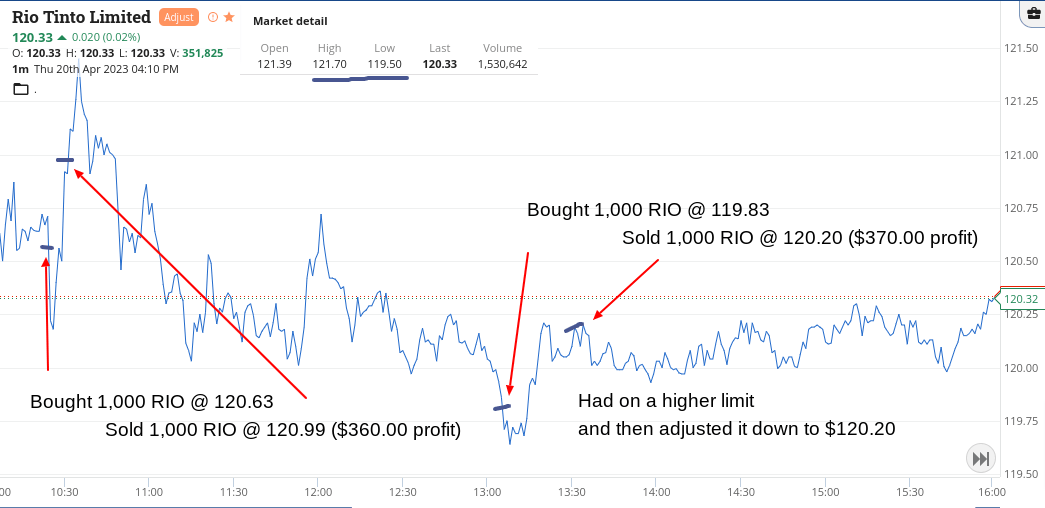

Thursday April 20

Had a real couple of quick ones in CBA and RIO.

CBA looked like breaking out, so took some and waited for some stop loss triggers to go off. They reached $100.25 before coming back.

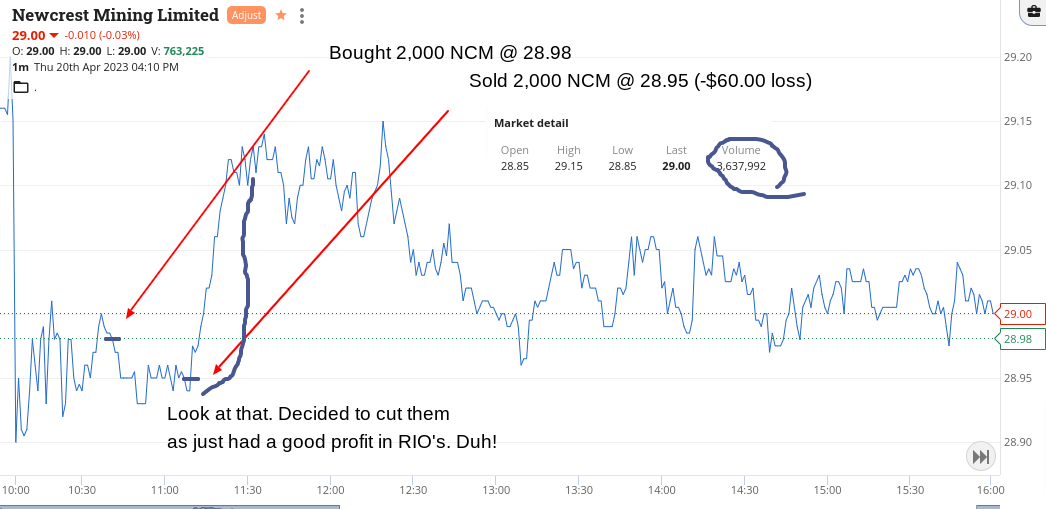

RIOs had some good news but still got marked down below $121, having been $124 yesterday. Decided to cut the NCM and then they took off. I was just happy to have no positions and not have to watch them. Boy did they take off.

RIO went below $120 and I had a limit buy in which got hit to my surprise. Put them on at $120.35 and they reached $120.20 before coming back, so adjusted down to that level and waited before they went back through it.

Up $910, thanks to my RIOs. Funny old market in them but I’ll just go with the flow!

Recap

Bought 1,000 CBA @ 100.00

Sold 1,000 CBA @ 100.24 ($240 profit)

Bought 1,000 RIO @ 120.63

Bought 2,000 NCM @ 28.98

Sold 1,000 RIO @ 120.99 ($360 profit)

Sold 2,000 NCM @ 28.95 ($60 loss)

Bought 1,000 RIO @ 119.83

Sold 1,000 RIO @ 120.20 ($370 profit)

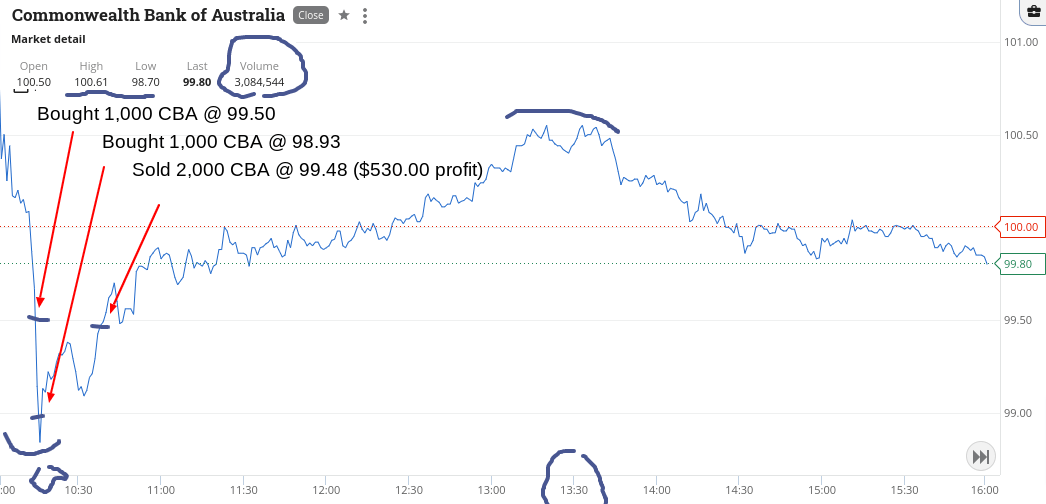

Friday April 21

CBA started misbehaving today and I got dragged into their mood swings, got roughed up a bit but came out on top in the end. All washed up, they started the day at $100.50 and 15 mins later they hit their low of $98.70.

By lunchtime they hit their day’s high of $100.61.

So, had to strap myself in and stay a believer as they crashed almost $1.00 lower than my first go, which meant that they were about $2.00 lower than their opening and it’s just 15 mins in.

Come out up $530.

Picked myself up off the floor and dusted myself down and said that’s it for the day… or so I thought.

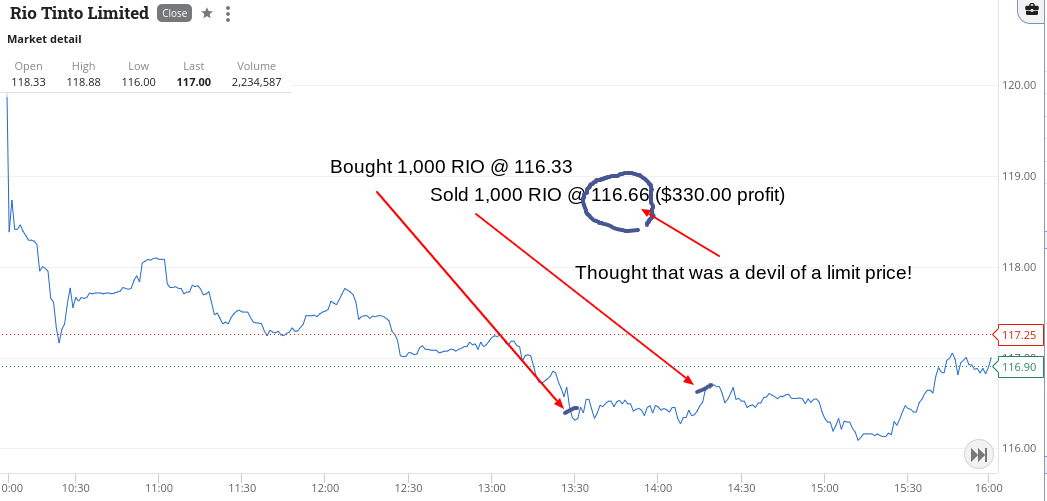

Having lunch at home and thought I would have a sneak peak and blow me down. RIOs are trading with a $116 in the front. Just had to put my sandwich down and press a few buttons. Kept munching away and watched as, of course, they were going against me.

BHP below $45 and took the opportunity to gear myself up below that level. Stuck them on a limit 10c or so higher and waited. RIOs came up trumps first and then had to wait on BHP, who finally cracked the $45 level and kept going and through my limit. You beauty!

Finished today up a magnificent $1,080, $3340 gross for the week or $2829 net. Another shorter week next week with ANZAC Day on Tuesday. (Lest we forget.)

Recap

Bought 1,000 CBA @ 99.50

Bought 1,000 CBA @ 98.93

Sold 2,000 CBA @ 99.48 ($530 profit)

Bought 1,000 RIO @ 116.33

Bought 2,000 BHP @ 44.94

Sold 1,000 RIO @ 116.66 ($330 profit)

Sold 2,000 BHP @ 45.05 ($220 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.