Confessions of a Day Trader: $3000 on ex-divs? That’s irrr-ooon, man!

No, I'm Iron Man. Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday August 7

Had to go slightly off piste for my first crack.

Block were down another 10% or so, so had a nibble in them and then back on the straight and narrow with some RIOs.

Then had a go in Dicker Data, who were down 30c or so.

RIOs came in good on a little sell order and then had to double down on Block and also put them on a limit sell.

They also came good but Dicker Data just got boring so I got out at the same price as got in at.

CBA’s range was about 70c, so they were also a bit boring.

Anyway, up $365. Not too bad for a cold wet Monday.

Recap

Bought 500 SQ2 @ 97.73

Bought 1,000 RIO @ 113.91

Bought 1,500 DDR @ 8.10

Sold 1,000 RIO @ 114.20 ($290 profit)

Bought 500 SQ2 @ 96.96

Sold 1,000 SQ2 @ 97.52 ($175 profit)

Sold 1,500 DDR @ 8.10 ($0 profit)

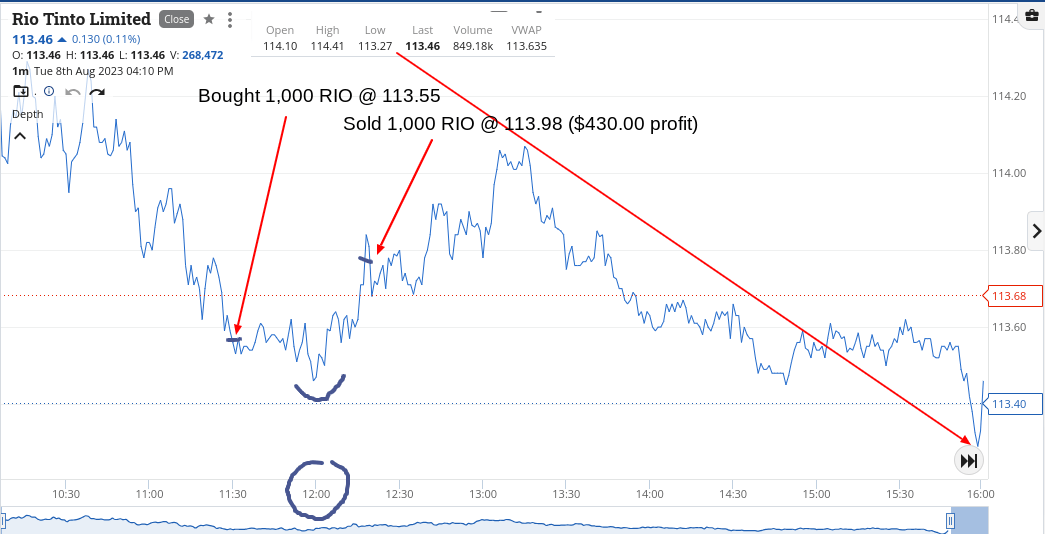

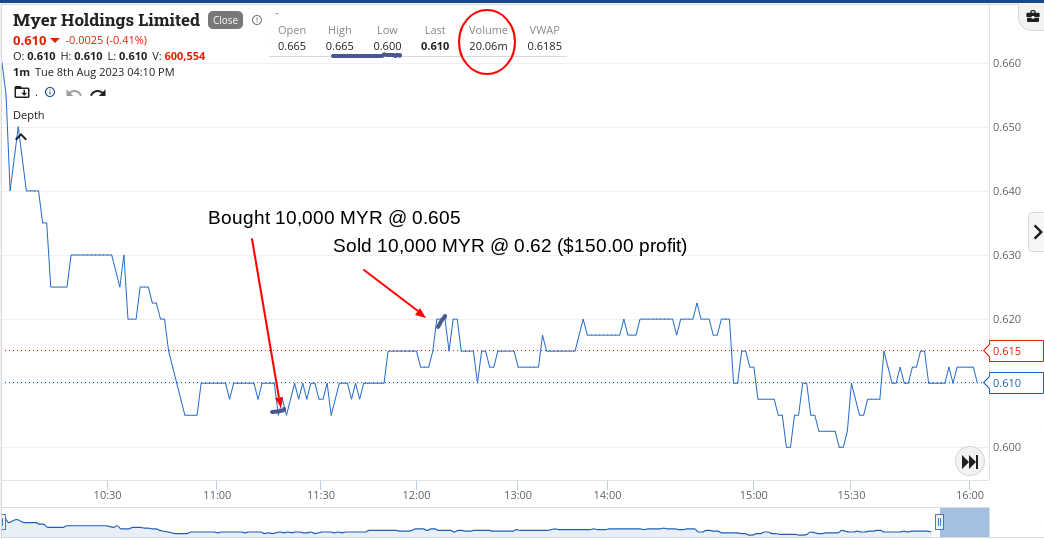

Tuesday August 8

Just had to go shopping for some Myers shares today. Bad profit figures had them marked down by 11% or so.

Had them on a buy limit of 60c but just missed out, so had to pay 1/2c more. Seen as old Solly Lew is into them big time, I was working on the fact that his ego would get them to bounce.

Then we had RIOs hovering below the $114 level, like yesterday. Chased them from $113.50 till I got set at $113.55 and put them on a limit at just below $114.

The trading God was kind to me today. Up $580 and now we wait for CBA’s results tomorrow, to see how they will set up the market’s mood. Their range was 65c today.

Recap

Bought 10,000 MYR @ 0.605

Bought 1,000 RIO @ 113.55

Sold 10,000 MYR @ 0.62 ($150 profit)

Sold 1,000 RIO @ 113.98 ($430 profit)

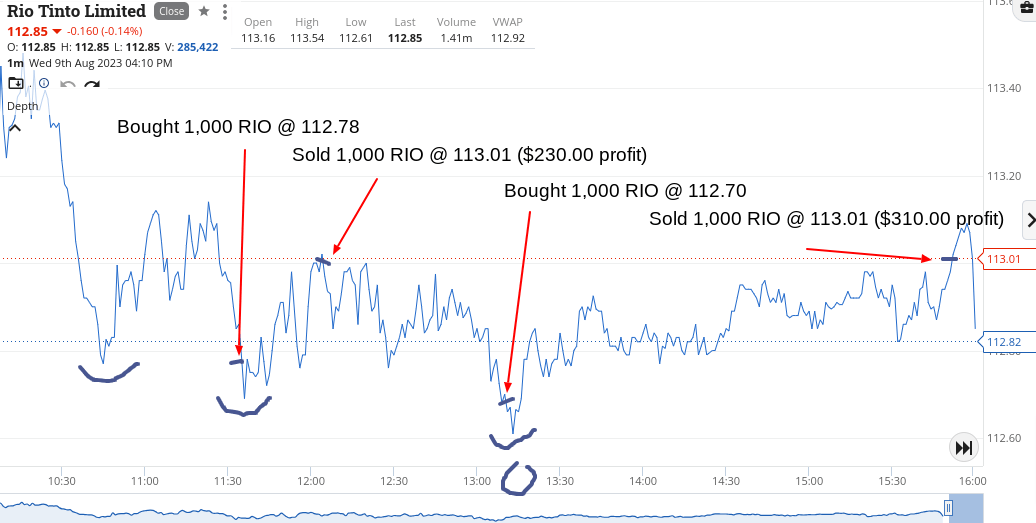

Wednesday August 9

Well. CBA results are out and they shoot out of the traps, up $2.60 at $104.85. Their day’s low was $103.55 and their day’s high was $105.22, with the closing price being $104.85 (+2.6%).

Not much I could do there plus my mind is set on the fact they should be below the $100, so mentally I am biased, which is not good, trading wise.

Having said that, everything is out now, so will wait to see some commentary on them, though it may take them to go ex-div for them to fall.

So whilst all the banks were having their glory in the sun, I was over visiting RIO.

Not once but twice.

In below $113 and out just above $113. This was their level today and they got hit 26c in the 4.10pm session, though I managed to get my exit timing right today.

Phew! Up $540.

Recap

Bought 1,000 RIO @ 112.78

Sold 1,000 RIO @ 113.01 ($230 profit)

Bought 1,000 RIO @ 112.70

Sold 1,000 RIO @ 113.01 ($310 profit)

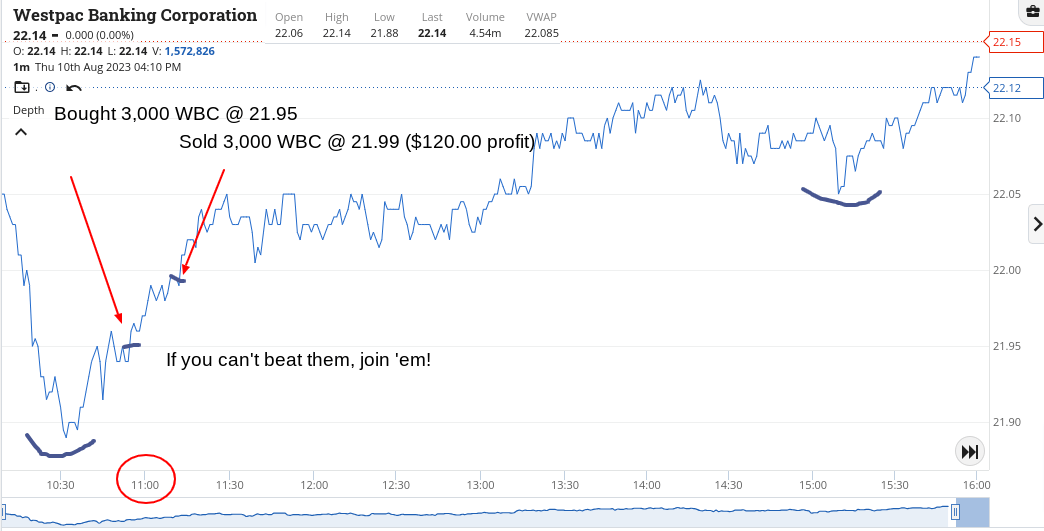

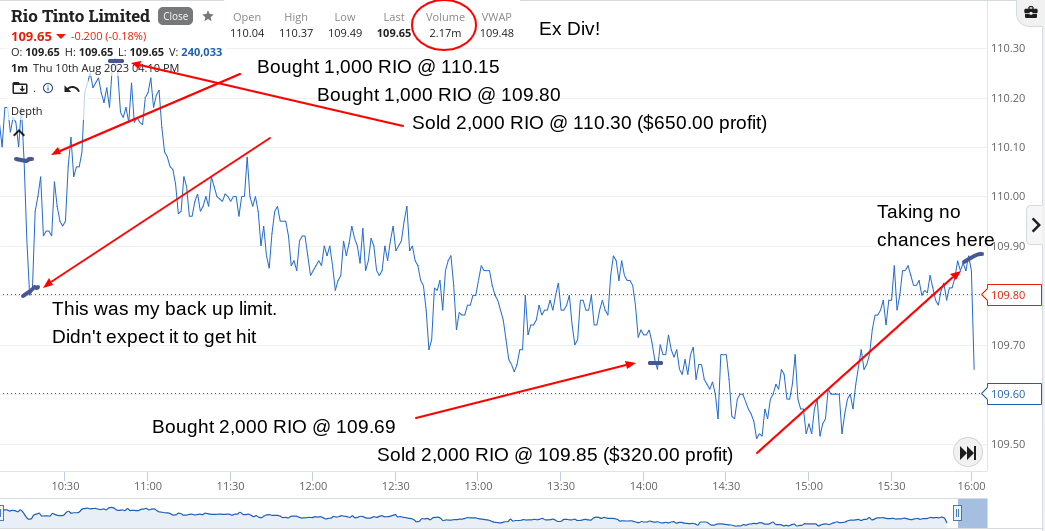

Thursday August 10

Today we went RIOs and banks, but RIOs mainly because theywent ex dividend today, so they were marked down $3.20 by the end of the day.

Working on the fact that even though RIOs have gone ex div, they are the same company but now a few dollars cheaper, I went in and was happy to go big. Bigger than usual, as even though I may get the timing wrong, the underlying current should follow through.

The recap tells it all, as do the charts. As for the banks, well I just had to have a go. There looked like a bit of a switch out of CBA and into the others. Closed the last RIO trade out just before the 4.00pm ruck as happy to walk away with what I had.

The price of RIOs and CBA are getting closer together and we haven’t seen that for a long, long time.

Plus $1,220.

Recap

Bought 1,000 RIO @ 110.15

Bought 1,000 RIO @ 109.80

Sold 2,000 RIO @ 110.30 ($650 profit)

Bought 3,000 WBC @ 21.95

Bought 1,000 CBA @ 103.22

Sold 3,000 WBC @ 21.99 ($120 profit)

Sold 1,000 CBA @ 103.35 ($130 profit)

Bought 2,000 RIO @ 109.69

Sold 2,000 RIO @ 109.85 ($320 profit)

Friday August 11

Had to go three times today, not once but twice. and in both times had to wait till the last hour or trading for them to come good.

Have a go at RIOs will you? Having gone ex div the other day and then today they open and fall a dollar lower than yesterday.

They put on a dollar in their last hour of trading, which was amazing to watch. They even fell below $108 at one stage and then managed to close plus 13c from their opening trade till their last.

Today, I just stayed as a believer, as BHP was up and these guys getting marked down so much ex div, seemed to be an obvious trade. A bit nerve-racking but obvious outcome.

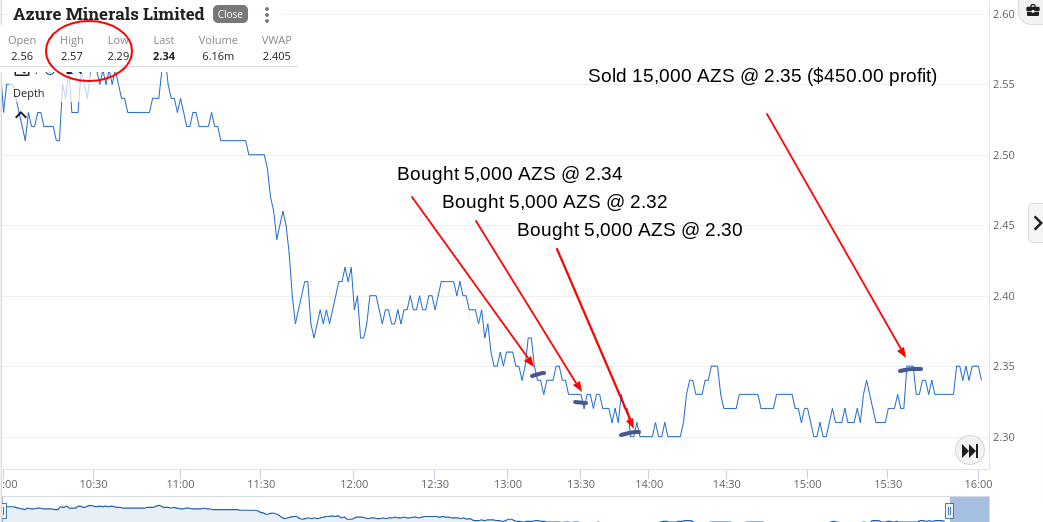

Then we had AZS, who presented at Diggers and Dealers and promptly fell 30c or so. Again, had to go three times and when the hit $2.35 and fell back, I put them on a limit at that level and waited and watched as eventually they hit it again.

Not a bad old day. Up $1,090 and definitely need a beer after the close and then a lie down. Took me to plus $3,795 gross ($3,194 net) for the week, thanks mainly to RIOs going ex div and then next week we have CBA doing the same. Should be fun!

Recap

Bought 1,000 RIO @ 108.79

Bought 1,000 RIO @ 108.19

Bought 1,000 RIO @ 108.03

Bought 5,000 AZS @ 2.34

Bought 5,000 AZS @ 2.32

Bought 5,000 AZS @ 2.30

Sold 15,000 AZS @ 2.35 ($450.00 profit)

Sold 3,000 RIO @ 108.55 ($640.00 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.