Confessions of a Day Trader: $2200 in a day? That’s gold, that is!

Picture: Getty Images

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday January 15

For some reason, CSL are marked down heavily from the get-go.

So, my trading book started earlier than normal, as I thought with the USA closed tonight, that surely they will bounce.

Of course, being the manic child that they are, they bounced in style. Their range today was $287.70 to $290 (exactly), which just shows you how important big round numbers are.

This trade set me up nicely for the day and especially after last week’s effort!

Uranium stocks were running hot today, so just had to have some Boss Energy (love the name) and hogged in 5,000.

My other trading attempts were a bit ‘ow’s yer father’ though.

Up $830.

Recap

Bought 500 CSL @ 288.04

Sold 500 CSL @ 288.84 ($400 profit)

Bought 2,000 BHP @ 47.24

Bought 5,000 BOE @ 5.40

Bought 2,000 WBT @ 3.49

Sold 5,000 BOE @ 5.51 ($550 profit)

Sold 2,000 BHP @ 47.18 ($120 loss)

Sold 2,000 WBT @ 3.49 ($0 profit)

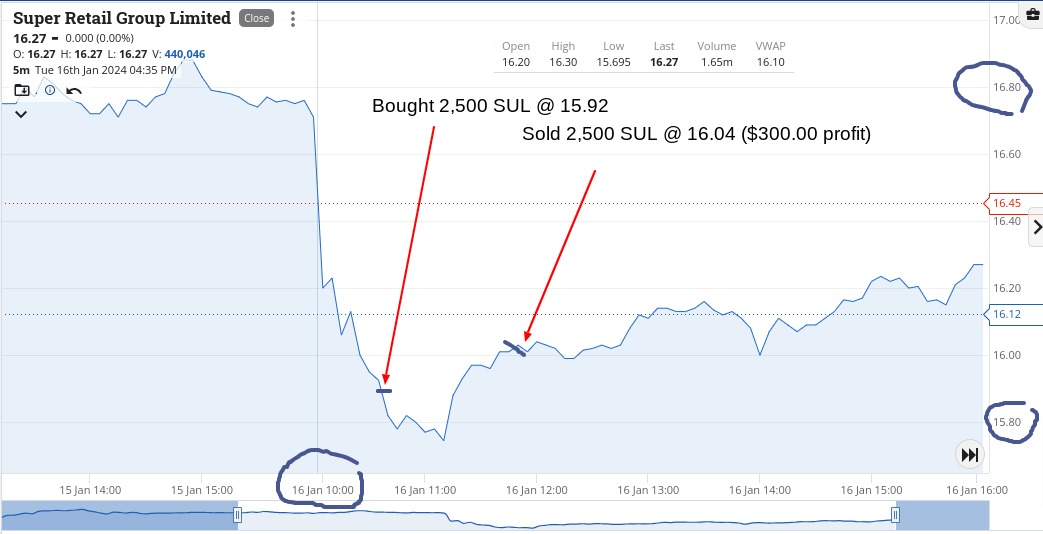

Tuesday January 16

A few profit results came out today and both gave me a hard time until eventually they came good, though with RIOs had to double down. They swung by just over $3 today.

SUL was a lot easier but because RIOs have an international following, it can take time to find its level, whereas SUL was more like ‘bang’ and there you go.

Got into a bit more of a swing in things but my P/L was swinging around all day, so there was a bit of volatility in the air.

Even the manic child got a look in twice today on the buy side, even if the brokerage is on the high side!

Up $910 today, which needed a bit of patience to achieve.

Recap

Bought 2,500 SUL @ 15.92

Bought 1,000 CBA @ 113.38

Bought 1,000 RIO @ 127.11

Bought 2,000 WTC @ 71.60

Sold 2,500 SUL @ 16.04 ($300 profit)

Bought 5,000 BOE @ 5.45

Sold 2,000 WTC @ 71.71 ($220 profit)

Sold 5,000 BOE @ 5.50 ($250 profit)

Bought 500 CSL @ 285.45

Bought 1,000 RIO @ 126.01

Bought 1,000 CBA @ 113.00

Bought 500 CSL @ 285.35

Sold 1,000 CSL @ 285.72 ($320 profit)

Sold 2,000 RIO @ 126.66 ($200 profit)

Sold 2,000 CBA @ 113.00 ($380 loss)

Wednesday January 17

Today started out not too bad.

Going along and minding my own business, with some great trading in RRL and then cutting CBA, so I could relax and then BANG!

I was checking my phone and the CBA I cut at $112.29 were now trading at $111.84.

This triggered me off, in what I can only describe, like a mistress on a shopping spree, after you have told her that you can’t leave your wife and then forgot to cancel your secret David Jones credit card.

The buying was fast and vicious and then stunned silence as we all waited to see who was right and who was wrong.

The results speak for themselves.

Instead of bringing home the bacon with a two position trade of plus $680, it turned into the whole pig, with plus $2,200.

Don’t understand the fall. See charts for the whole jackanory.

Recap

Bought 20,000 RRL @ 2.06

Bought 1,000 CBA @ 112.41

Bought 20,000 RRL @ 2.03

Sold 40,000 RRL @ 2.07 ($1000 profit)

Sold 1,000 CBA @ 112.29 ($120 loss)

Bought 1,000 CBA @ 111.84

Bought 2,000 WTC @ 71.73

Bought 2,000 RIO @ 126.54

Bought 2,000 BHP @ 46.39

Bought 4,000 WDS @ 30.57

Sold 4,000 WDS @ 30.62 ($200 profit)

Sold 2,000 RIO @ 126.62 ($160 profit)

Sold 2,000 BHP @ 46.45 ($120 profit)

Sold 2,000 WTC @ 71.97 ($470 profit)

Sold 1,000 CBA @ 112.21 ($370 profit)

Thursday January 18

A bit of a quieter day today. BHP came out with some results and opened lower.

Went early on them and had to wait.

Not sure about the interest rate outlook and also these Bitcoin ETFs seem to be soaking up a lot of interest and distraction at the moment.

Momentum to me seems to be downward.

If you look at CSL, they had a range of $285 to $282.15 and closed just above their low at $282.81

Keeping my powder dry today and tomorrow, having locked in some good gains.

Up $190.

Recap

Bought 1,000 BHP @ 45.86

Sold 1,000 BHP @ 46.05 ($190 profit)

Friday January 19

Things in the USA are going a bit mad and what with it being a Friday and all of that, I’m only hanging around till midday and going on a long lunch.

Everything comes out of the traps and goes up, though RRL have a bit of a relapse.

I like trading them as you can gear up a bit more than normal, size-wise, so you only need a 1c turn to make it worth your while.

See their chart, as it looks like I wasn’t the only one going on a long lunch. As for CSL, over A$300m worth went through in the day and CBA traded over 4m.

Now just have to wait till Monday morning to see how things fared overnight.

Anyway, up $500 today and $4630 gross or $3,898 net. Sure makes up for last week. Bottoms up!

Recap

Bought 25,000 RRL @ 2.06

Sold 25,000 RRL @ 2.07 ($250 profit)

Bought 25,000 RRL @ 2.06

Sold 25,000 RRL @ 2.07 ($250 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.