Confessions of a Day Trader: Psst! Wanna buy a falling knife?

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: $10 (previously $40 on alternative platform)

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday November 16

All settled in and watching the opening first half hour to find some day trends and then I notice things aren’t updating on graphs. Then the headline comes out that the ASX has suspended all trading, due to a technical hitch. So added the ASX to my watch list because Tabcorp (ASX:TAH) fell 4% after they had an outage, so curious to see how the ASX opens on the ASX!

You would think that they would have a backup system. Now a bit lost, as not sure if coming back on, so all of this throws me a bit. Let’s see what happens tomorrow.

Tuesday November 17

Wall street closes on a record high with news that another vaccine has achieved better results than Pfizer’s – a 94% success rate. Gold off a bit. Europe all up around 1% to 1.5%. And after yesterday’s outage, I’m feeling a bit tentative, in case it happens again.

Frustratingly looking at FMG, which has a low of 16.69, 3c away from my ‘lucky level’ of 16.66 and bounce. They keep finding a higher level and bounce.

Buy 1000 Z1P (ASX:Z1P) at 5.91 at 11.22am and notice APT (ASX:APT) falling. Buy 100 APT at 96.76, which is down $6.48 from their high. Decide to sell Z1P at 5.93 as APT is still falling. Make $20. They promptly jump to 5.96 as APT keep falling!

Getting frustrated now. It’s 2.57pm. Buy another 100 APT at 96.13 at 3.21pm. Buy another 100 at 95.67 at 3.31pm for an average long price of 96.187. Then buy 200 at 95.57 to now make me now long of 500 at an average of 95.90. It’s 3.40pm. Surely they have to bounce soon?

Buy 500 at 95.51 and they start to bounce to 95.60. Average long price is 95.705. Then the bounce starts to fade away and forced to sell the whole 1,000 at 95.50 with just 10 seconds to the close.

Loss is a frustrating $205 and minus $195 for the day. FMG closes at bang on 17.00. Well and truly chased the wrong stock today. ASX shares closed down 1.48%!

+1000 Z1P at 5.91; -1000 Z1P at 5.93; Profit $20

+100 APT at 96.76; +100 APT at 96.13; +100 APT at 95.67; +200 APT at 95.47; +500 APT at 95.51

(Long 1,000 average 95.705)

-1000 APT at 95.50; Loss $205

Total Loss $195

Wednesday, November 18

Everything is lower overnight. Broke a golden rule yesterday and carried over a long of 1,000 Northern Star Resources (ASX:NST) at 14.49. I know, I know but sometimes you need to break a rule. I was sort of out of step yesterday and having seen gold starting to firm and NST not, I was peeved off enough to know they would be higher the next day. Sold them at 14.59 today on a limit order.

Also, determined to make some money out of the ASX for Monday’s debacle. See them under 80.00, so buy 100 at 79.94 at 10.44am. Out of stubbornness, put them on to sell $100 higher and at 11.43am, they go through 80.94, heading towards 81.00. I get my vengeance!

Having missed a few tricks in FMG yesterday, they open below $17.00 and watch them bouncing around 16.925 and finally buy some at that level at 11.36am. Put on a limit to sell at 16.99 and get taken out at 11.47am for a $65 profit.

A2M are down from a high of 15.05 and are heading towards 14.00. Buy 1000 at 14.09 and put in another 1,000 to buy at 13.99. Time is 1.13pm. At 2.29pm I get filled and now long 2000 A2M at an average of 14.04. Put on another limit buy of 1000 at 13.91 a bit later, after they bounced off that level. Eventually sold the 2000 at 14.09 for a $100 profit.

Z1P had a fall below 5.90, so bought 1,000 at 5.87 and sold them at 5.91, in between the ASX vengeance trades. Just after lunch I buy 100 APT at 93.95 and wait for their bounce above 94 and sell at 94.31 at 1.41pm.

FMG back down to below 17.00 and at 1.38pm I buy 1000 at 16.88 and wait and watch. They become very boring, so buy another 1,000 at 16.86. Eventually sell them at 16.89 an hour later at 3.25pm.

That’s me done for the day. Some good stock moves today and also some very boring stock movements.

+1000 NST at 14.49; -1000 NST at 14.59; Profit $100 (broke a golden rule)

+1000 Z1P at 5.87; -1000 Z1P at 5.91; Profit $40

+100 ASX at 79.94; -100 ASX at 80.94; Profit $100 (vengeance trade)

+100 APT at 93.95; -100 APT at 94.31; Profit $36

+1000 FMG at 16.925; -1000 FMG at 16.99; Profit $65

+1000 FMG at 16.88; +1000 FMG at 16.86; -2000 FMG at 16.89; Profit $40 (bored)

+1000 A2M at 14.09; +1000 A2M at 13.99; -2000 A2M at 14.09; Profit $100 (was down $130 at one point)

Total Profit $481

Thursday, November 19

Overnight, the Dow closed down over 1% though at one point it was up exactly 6.66 points, which must be a signal to Trump. Go for a coffee and a swim and get back just after 10.00am. Have a few things to do later but spend about 50 mins just watching.

Just before 11.00am is a good picking time and if you take A2M, anyone holding them on margin have until 11.00am today to put more margin up – if they can’t, they get sold out before that deadline. See today’s chart for a classic move. Make $70 out of them before 11.00am.

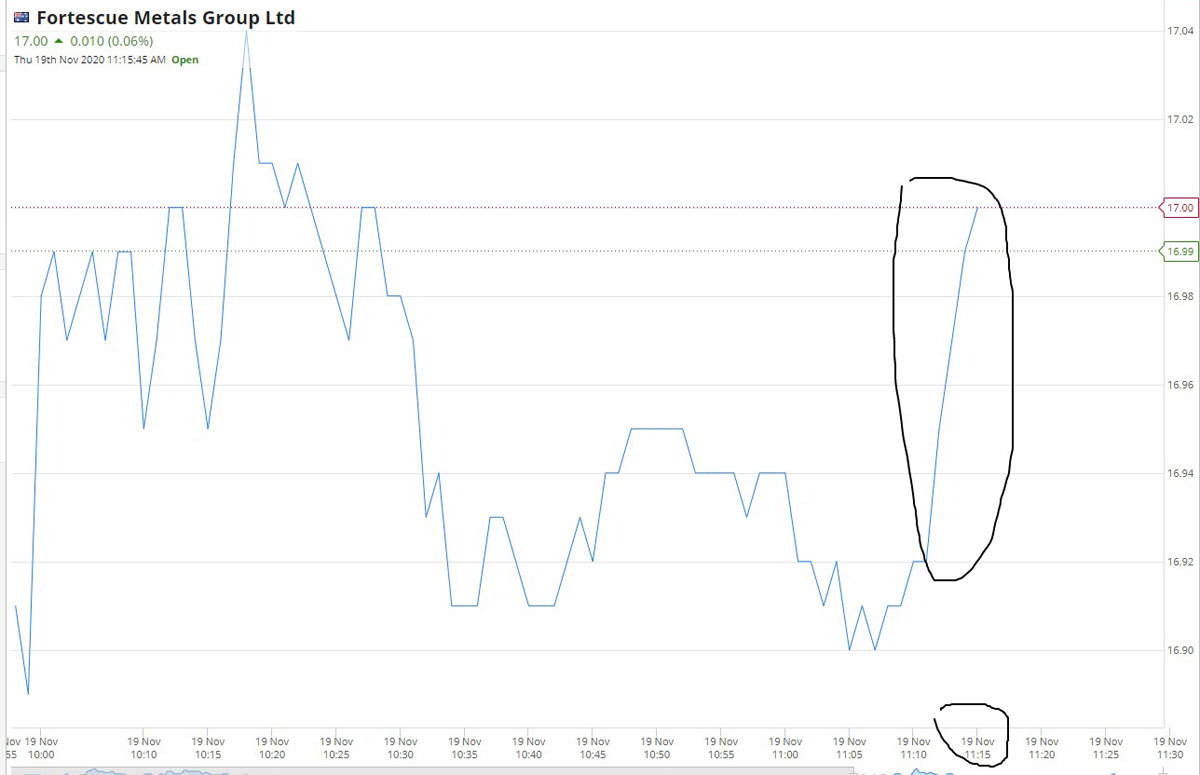

Buy 1000 FMG at 16.93 and put them in to sell at 16.99. Too big a queue of sellers at 17.00, so prefer to get a cent lower than all the others. FMG jump to 17.00 bang in one go, so I’m out for a $60 profit. Again, see graph.

Buy and sell 1,000 Z1P after holding and getting bored. Later Z1P and APT go up after not too bad unemployment figures but I have to go out and happy with morning’s $150 profit. It’s 11.20!

+1000 A2M at 13.66; -1000 A2M at 13.73; Profit $70 (classic margin call trade)

+1000 FMG at 16.93; -1000 FMG at 16.99; Profit $60 (see graph)

+1000 Z1P at 5.83; -1000 Z1P at 5.85; Profit $20 (bounced 6 times off 5.83, bored and have to go out)

Friday, November 20

TGIF! Mkts down mainly 0.8% overnight and thinking it’s going to be a quiet one today. FMG open at their high of 17.12 and slowly move down towards the 17.00 level.

A2M finding support at 13.70 and buy 1000 at that level at 11.33am. Get taken out at 13.75 at 11.51am for a $50 profit. They promptly keep moving up and keep going to 14.00. Amazing!

Finally buy 1000 FMG at 16.99 and put on a sell at 17.04. Buy 1000 NST at 14.00, which could be a suicide trade and go either way. Their high has been 14.18. At 1.52pm they get taken out at 14.04 for a $40 profit. Always a bit nervous on a Friday and ahead of book squaring ahead of the weekend.

Still waiting on FMG, stuck in a range of 16.99 – 17.01. Fingers crossed it goes my way but feels like it may not! Compared to the daily movements of the last four days you have to see the graph to believe it. Just 39 mins to go and last trade 16.99. Decided to cancel sell order and cut position at 16.99 as 30 mins to go and rather walk away for the day. Plus $90 for the day.

+1000 A2M at 13.70; -1000 A2M at 13.75; Profit $50

+1000 NST at 14.00; -1000 NST at 14.04; Profit $40

+1000 FMG at 16.99; -1000 FMG 16.99; Break even. As can go either way and not prepared to to keep wondering.

Best trade: ASX +$100 for mucking me around on Monday

Worst trade: APT -$205 after waiting for the bounce that never came!

Profit for week: +$526

Less Brokerage: -$175

Running net tally: +$1,129.60

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.