Closing Bell: War – Gold – Oil – The ASX – Monday

Via Getty

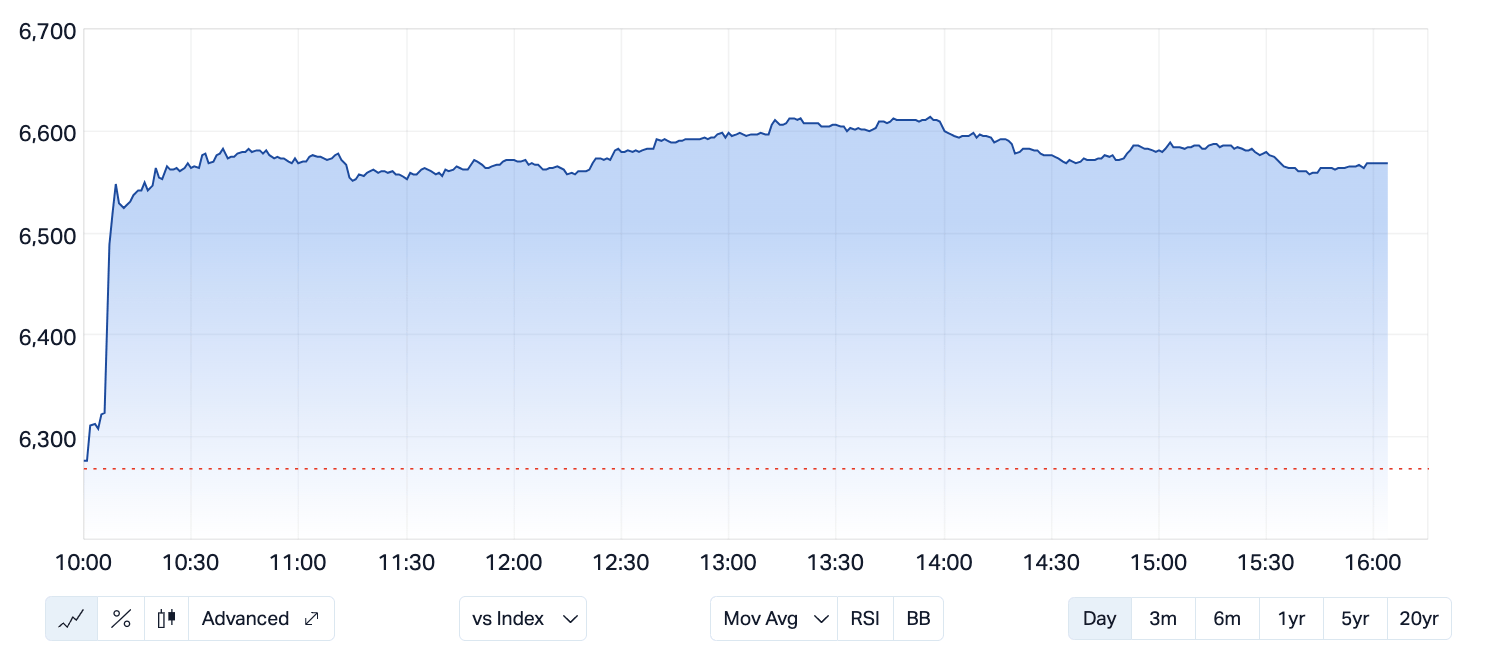

- Benchmark index finishes higher on strong oil prices

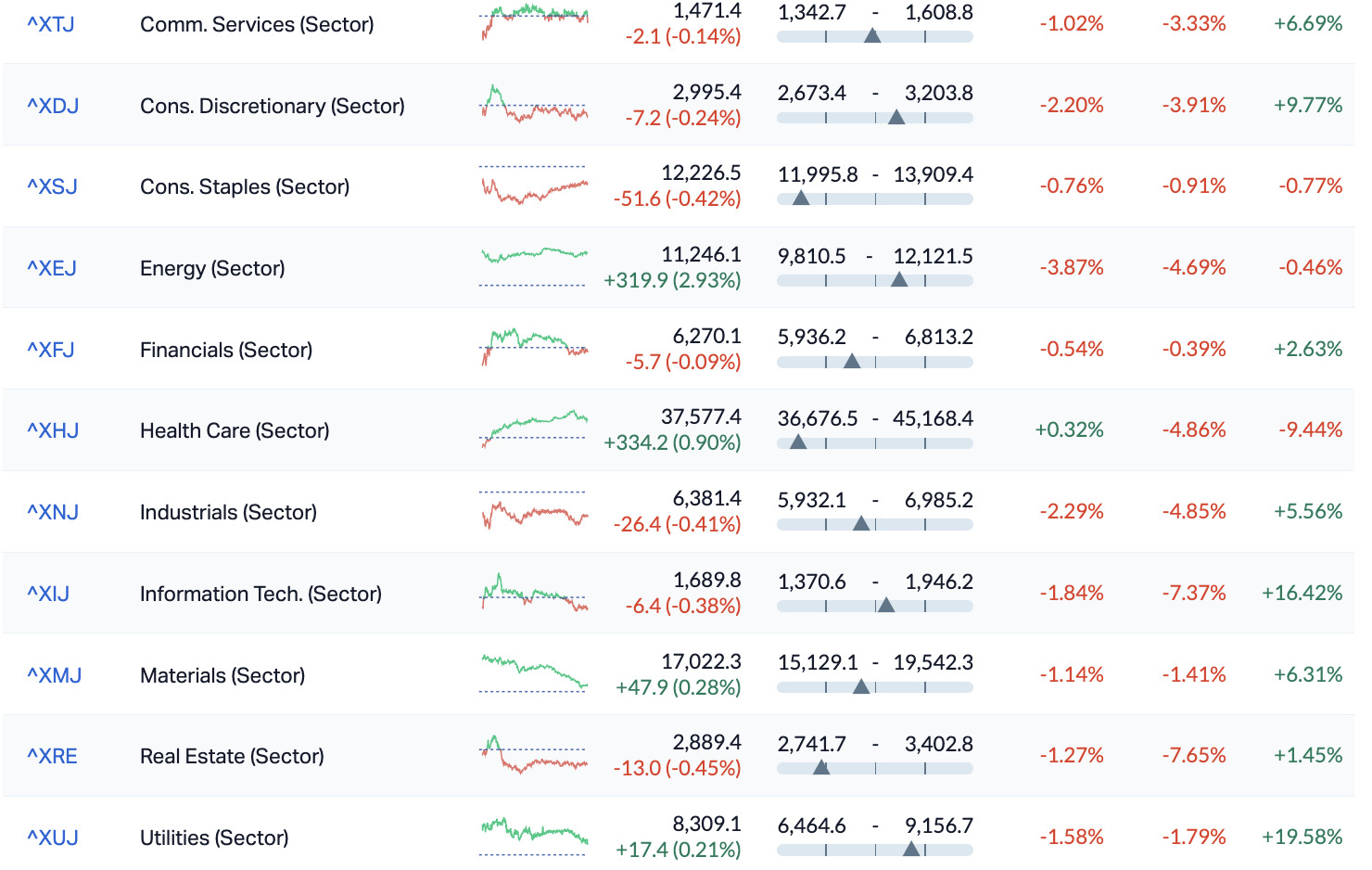

- ASX Sectors led by oil-driven gains for Energy

- Fin Resources banks a banger to be Monday’s small cap legend

The ASX200 found some enthusiasm for living on Monday arvo, supported ably by gold and oil.

The benchmark was up +0.23% at the close.

On the Friday session on Wall Street shrugs off robust US jobs figures to set up a half decent lead for the AM, but then there was some war and the paradigm had one of those shifts.

That said, this is how the Americans ended up last week:

The Dow Jones Industrial Average lost -0.3%. The S&P 500 found +0.5% and The Nasdaq Composite also gained, up +1.6%.

On the volatility front, the Russell 2000 dropped -2.2% and the CBOE Volatility Index eased back -0.4%.

This is how the US S&P 500 Sectors ended the week:

- Consumer Staples -3.1%

- Utilities -2.9%

- Financials -0.5%

- Telecom +3.1%

- Healthcare +0.9%.

- Industrials -0.6%

- IT+2.9%

- Materials -0.7%

- Energy -5.4%

- Consumer Discretionary -0.3%

- Real Estate -1.8%

On Monday local markets swung back into form and while IT did track the nasdaq, it was Aussie gold stocks which really zoomed into focus – up more than 5%, easily topping the sector’s biggest intraday gain since times were happier around mid-July.

ASX All Ordinaries Gold (XGD)

Bullion prices triggered gains across the sector – the biggest names being the easiest bets, including strong performances by gold miners on the market, Northern Star Resources found 6% best since July 20. Newcrest Mining is up 5%, their best day since April.

Local goldies moved higher in tandem with a run on gold futures with oil prices booming and and safe-haven accommodation at a premium while Hamas and Israel trade bombs, hostages and a lot of hate-fury.

Elsewhere in the hood, wee-cap-goldie Riversgold (now leaning toward lithium) still spiked 15%, De Grey Mining (ASX:DEG), Red 5 (ASX:RED) and Evolution Mining (ASX:EVN) grabbed over 7%, Capricorn Metals (ASX:CMM) andRegis Resources (ASX:RRL) collected between 4.5% and 6.5%.

ASX Sectors on Monday

In regional equity markets news, the Shanghai Composite fell 0.5% to around 3,095 while the Shenzhen Component lost 0.4% to 10,070 on Monday, as markets in mainland China return from the week-long Golden Week break and set about playing catch up to the awful run we had across Asian markets last week.

Elsewhere, AM business in Hong Kong was called off due to a roaming typhoon, while South Korean and Japanese markets were shut for national holidays.

The ASX Small Ords (XSO) added +0.35% and the ASX Emerging Co’s (XEC) index ended -0.22% lower.

RIPPED FROM THE HEADLINES

The local Senate committee tasked to scrutinise why Qatar Airways got the big don’t argue from Transport Minister Catherine King for new flights into Australia, has delivered its 10 top recommendations for the Albanese government as part of its review.

Chaired by (Nationals) Senator Bridget McKenzie, the committee, unearthed “clear evidence of the aggressive use of market power by Qantas.”

10 recommendations have emerged – but the urgent one is for the competition watchdog (Australian Competition and Consumer Commission or ACCC) to go and reinstate its oversight of Aussie airlines, starting with a review of further anti-competitive nonsense in the local aviation market.

The federal government meanwhile, plans to “immediately review” the decision.

Other recommendations called for Albo’s people to direct the Australian Competition and Consumer Commission to conduct an inquiry into anti-competitive behaviour in the domestic aviation market.

The committee came into being in August after the hand-wringing over Minister King’s call to bar Qatar Airways from adding 28 additional weekly flights added to their schedule.

Qantas (ASX:QAN) shares were down almost 3.7% near the close.

On a variation of the same theme, China’s done with its biggest big “Golden Week” holiday in many moons and according to the Ministry of Culture and Tourism everything’s OK again because domestic travel has come full circle and the Ministry’s waving about extremely fresh data to prove it.

Tourism numbers have rebounded back to pre-COVID levels, while OS travel has a rather long way to go, according to the official numbers.

Golden Week local tourism revenue was apparently – all up – exactly 753.43 billion yuan (US$103.24 billion). Dunno how they came to that number but it’s up 1.5% on 2019, while total domestic tourist trips wasup by 4.1% from 2019 to 826 million during the latest eight-day holiday. Chinese domestic spend needs a win, and local holiday-making is a good start.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| FIN | FIN Resources Ltd | 0.019 | 73% | 73,403,256 | $6,831,389 |

| BUY | Bounty Oil & Gas NL | 0.008 | 33% | 7,531,660 | $8,223,006 |

| SFG | Seafarms Group Ltd | 0.006 | 33% | 1,407,973 | $21,764,696 |

| VN8 | Vonex Limited. | 0.024 | 33% | 1,186,090 | $6,512,915 |

| PCK | Painchek Ltd | 0.063 | 31% | 6,812,732 | $67,503,490 |

| EXL | Elixinol Wellness | 0.008 | 23% | 218,798 | $4,103,735 |

| SER | Strategic Energy | 0.016 | 23% | 12,868,069 | $6,315,597 |

| WMG | Western Mines | 0.34 | 21% | 521,281 | $17,514,793 |

| KRR | King River Resources | 0.012 | 20% | 17,141,165 | $15,535,249 |

| RIM | Rimfire Pacific | 0.006 | 20% | 94,466 | $10,526,224 |

| CAI | Calidus Resources | 0.16 | 19% | 1,047,106 | $82,063,781 |

| ADD | Adavale Resource Ltd | 0.013 | 18% | 109,175 | $8,034,062 |

| FGR | First Graphene Ltd | 0.105 | 17% | 1,122,140 | $53,118,475 |

| MOB | Mobilicom Ltd | 0.007 | 17% | 927,402 | $7,960,060 |

| MOH | Moho Resources | 0.007 | 17% | 283,000 | $1,632,213 |

| PKO | Peako Limited | 0.007 | 17% | 953,351 | $2,824,389 |

| RGL | Riversgold | 0.014 | 17% | 1,679,195 | $11,415,137 |

| NGY | Nuenergy Gas Ltd | 0.029 | 16% | 201,690 | $37,023,887 |

| AWJ | Auric Mining | 0.044 | 16% | 93,969 | $4,972,664 |

| AUZ | Australian Mines Ltd | 0.015 | 15% | 1,711,016 | $8,994,929 |

| AX8 | Accelerate Resources | 0.03 | 15% | 17,412,991 | $9,895,646 |

| AIS | Aeris Resources Ltd | 0.19 | 15% | 2,452,190 | $114,006,023 |

| BRN | Brainchip Ltd | 0.1725 | 15% | 18,830,393 | $266,258,722 |

| ADG | Adelong Gold Limited | 0.008 | 14% | 3,238,102 | $4,174,256 |

| GGE | Grand Gulf Energy | 0.008 | 14% | 6,178,576 | $13,067,502 |

Rob ‘Swimming with Sharks’ Badman reports the young lithium bull shark that is Fin Resources (ASX:FIN) is carving a bloody swathe through ASX waters this morning after its maiden fieldwork program identified abundant spodumene crystals within a broad pegmatite outcrop at Cancet West in James Bay, Canada.

Big nearology feels there, just 45km west of Winsome Resources’ (ASX:WR1) Cancet lithium deposit and 100km west of Patriot Battery Metals’ (ASX:PMT) 109.2Mt at 1.42% Li2O world-class Corvette deposit.

Then there’s the explorer’s 98km2 Ross project, close to Critical Elements Lithium’s (TSXV:CRE) Graab prospect and Nemaska Lithium’s 36.6Mt at 1.3% Li2O Whabouchi deposit – about 65km and 100km to the southwest respectively. Fieldwork has now begun at Ross targeting nine priority areas.

But regarding Cancet West, the company reports at least five pegmatite bodies have been identified outcropping across the western and eastern blocks of the area, with roughly total strike lengths of each outcrop ranging from 200-400m.

“These pegmatite bodies may extend for significant distances, along strike and below surface,” notes the company’s ASX release this morning.

Up to 30cm long green spodumene crystals, trace lepidolite, coarse muscovite, tourmaline, blue-green beryl, coarse red garnets and megacrystic feldspars were mapped within one of the pegmatite outcrops.

Fin Director, Jason Bontempo,:

“Following this initial spodumene discovery, the company is optimistic that additional lithium mineralisation will be discovered at Cancet West through further field work, detailed sampling and drilling.

“We are now looking forward to the field work beginning at our second high priority project area shortly at Ross.”

Read more on FIN’s latest discovery, here.

FIN share price

King River Resources (ASX:KRR) secured itself a speeding ticket from the ASX, up 40% in the AM, up 20% in the arvo.

PainChek (ASX:PCK) was up 40% this morning, but is now down 25%. Just like that.

Also odd, but true – the full-service mini-telecommunications service provider known in wee ASX circles as Vonex (ASX:VN8) is up 33% this afternoon. I don’t know why. Could be cost cutting, could be a random gamble. VN8 does its thing on the cloud and provides the full gamut of traditional telecommunications products such as mobile and internet.

In its Annual Report dropped to great silence late last week, Vonex says its been a rough transition of customers from one place top another (that’s almost done) and as it winds down said migration of customers from recent acquisitions, it has ‘closed one call centre in the Philippines, integrating the workload to the remaining Philippines call centre.’

“This along with other staff streamlining has reduced cost and headcount overall, again positioning the business for a year of improving fundamentals.”

Through 2SG the group’s wholesale division customers, such as internet service providers, can access the core Vonex PBX, call termination services, hardware, mobile and internet at wholesale rates via a white label model. Vonex also delivers custom built software solutions to wholesale customers to facilitate projects of scale.

Know you know more, but not everything.

Telco’s enjoying Monday Part#2:

Mobilicom (ASX:MOB) came out the gate strongly, up circa 20% this morning but the surge lacked urge.,

Gregor surmises it might be because the company has requested an extension prior to an upcoming voluntary delisting to allow shareholders to complete converting their shares into American Depositary Shares.

“But it could also be related to its core business as an end-to-end provider of cybersecurity and robust solutions for drones and robotics, given the current geopolitical issues its country is facing.”

Quickly, the late mover is Cleanspace (ASX:CSX), which designs, makes, and flogs “premium respiratory protection equipment for industrial and healthcare markets”

Here’s an upbeat unaudited Q1 2024 update late on Monday:

• Sales $4.0m (+52% v PCP, +18% v Q4 FY23)

• Cash at Bank at September 30: $11.6m (30 June 2023: $12.2m)

Key Bullies:

• Industrial sales +69% v PCP, while Healthcare sales remain low post pandemic (5% of total sales)

• Europe sales growth +81% v PCP (France and UK drove growth). Europe 61% of total company sales

• APAC sales growth + 33% v PCP (Australia +47% v PCP)

• North America sales growth +7% v PCP

• 53% of sales were from respiratory units

• The company does not expect to need to raise capital to fund current operations

Graham McLean, CEO:

“Q1 sales were driven by the focus on our 6 priority countries, the ongoing rollout of upgraded models Ultra and Pro and improved sales execution with our distribution partners including new distributors in those markets.”

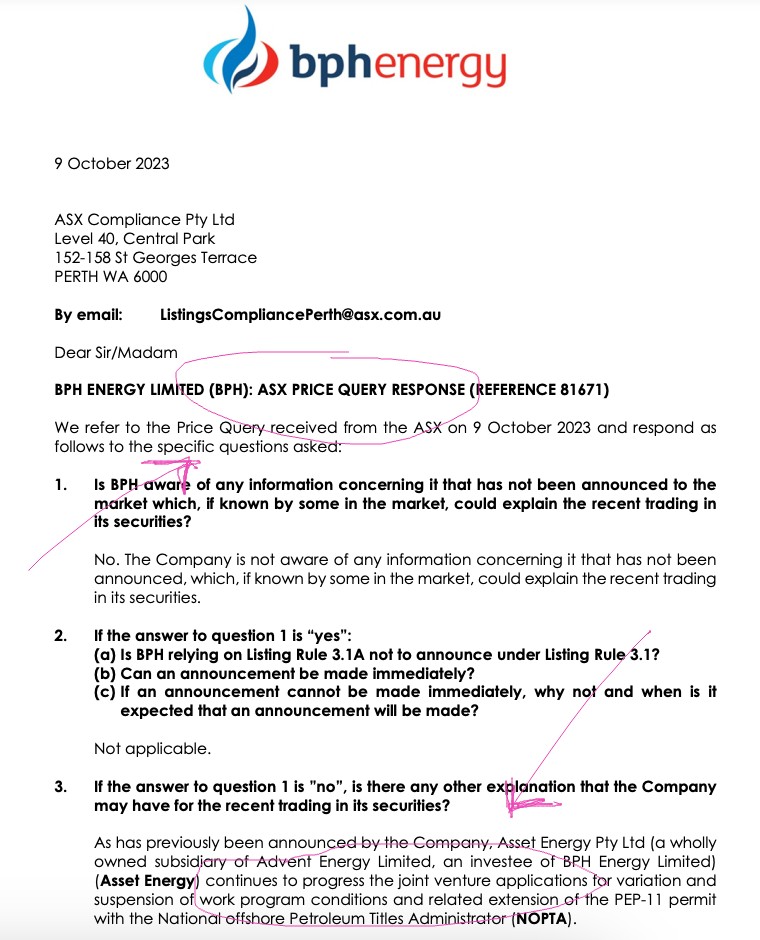

Aaand finally – BPH Energy is doing well enough to get in trouble for it:

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.008 | -33% | 364,358 | $3,468,964 |

| MCM | Mc Mining Ltd | 0.09 | -33% | 15,905 | $53,954,802 |

| KP2 | Kore Potash PLC | 0.008 | -27% | 89,334 | $7,345,837 |

| RDN | Raiden Resources Ltd | 0.0205 | -27% | 150,864,699 | $65,404,225 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | 170,014 | $4,267,580 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 1,925,938 | $31,285,147 |

| MXC | Mgc Pharmaceuticals | 0.0015 | -25% | 1,125,527 | $8,855,936 |

| SIH | Sihayo Gold Limited | 0.0015 | -25% | 675,000 | $24,408,512 |

| YPB | YPB Group Ltd | 0.003 | -25% | 20,600 | $2,973,846 |

| DTR | Dateline Resources | 0.01 | -23% | 2,961,594 | $11,510,757 |

| NET | Netlinkz Limited | 0.007 | -22% | 1,240,051 | $32,044,755 |

| TAL | Talius Group Limited | 0.007 | -22% | 263,850 | $20,575,254 |

| VMT | Vmoto Limited | 0.175 | -20% | 2,272,694 | $63,852,864 |

| CHK | Cohiba Min Ltd | 0.002 | -20% | 3,020,380 | $5,533,110 |

| ERL | Empire Resources | 0.004 | -20% | 150,000 | $5,564,675 |

| IEC | Intra Energy Corp | 0.004 | -20% | 13,499,898 | $8,303,908 |

| LNU | Linius Tech Limited | 0.002 | -20% | 1,456,100 | $10,574,477 |

| M4M | Macro Metals Limited | 0.004 | -20% | 1,165,531 | $9,935,389 |

| PUA | Peak Minerals Ltd | 0.004 | -20% | 5,324,008 | $5,206,883 |

| BLY | Boart Longyear | 1.195 | -20% | 347 | $440,921,417 |

| IR1 | Irismetals | 1.6 | -20% | 2,718,876 | $241,649,644 |

| ERW | Errawarra Resources | 0.105 | -19% | 645,654 | $9,035,520 |

| GNM | Great Northern | 0.022 | -19% | 51,842 | $4,174,985 |

| 1ST | 1St Group Ltd | 0.009 | -18% | 2,065 | $15,586,903 |

| GML | Gateway Mining | 0.025 | -17% | 43,000 | $7,990,006 |

TRADING HALTS

Tombador Iron (ASX:TI1) -Pending release of an announcement regarding the operations of the Tombador Iron Project

Arovella Therapeutics (ASX:ALA) – Pending an announcement regarding a proposed in-license agreement

SenSen Networks (ASX:SNS) – to allow the Company to finalise the terms of a proposed equity capital raising

NT Minerals (ASX:NTM) – Pending an announcement regarding a capital raising

Ragnar Metals (ASX:RAG) – Pending a material release regarding a project acquisition in Sweden

Visioneering Technologies (ASX:VTI) – For the purpose of considering, planning and executing a capital raising and analysing data for an announcement to the market on the top-line interim 1-year results of the PROTECT clinical trial

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.