Closing Bell: War footing suits ASX as Fed frees a dove

Via Getty

- Benchmark ASX index finishes +1% higher

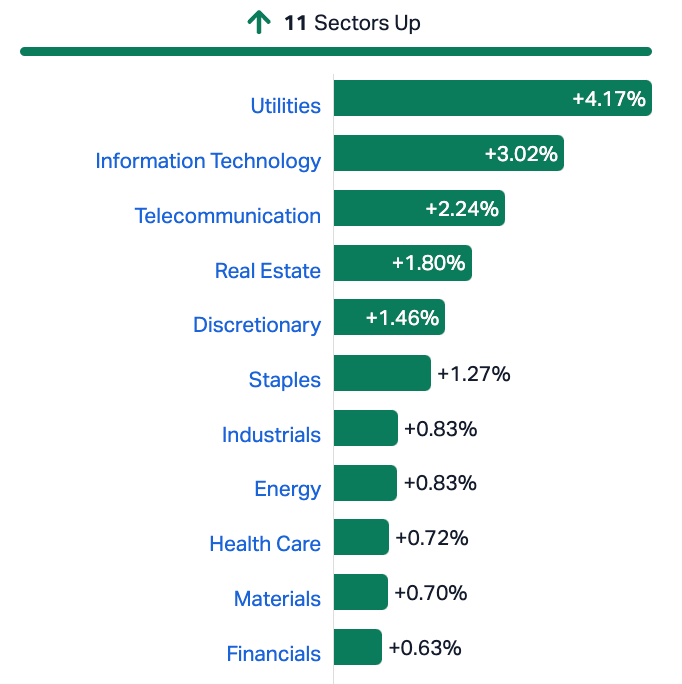

- ASX Sectors led by Utilities (+4.2%) and all ended higher on the day

- Funny bunch of small cap winners including MOB, CZR, NGL

The ASX200 doesn’t seem to mind a bit of war on Tuesday, rising very strongly across the bourse, with all 11 sectors in the green.

The benchmark has closed about 40 points above the 7,000 mark after gaining 1% by match out.

lThe Utilities Sector outperformed all day – jumping almost 4.2% in a stonking run amplified by the ACC’s decision to green light an $18.7bn buyout offer for electricity and gas wholesaler, Origin Energy (ASX:ORG)

Wall Street ended higher on Monday, with Energy the best S&P 500 Sector on field, as both oil and equity investors shrugged off the willies over the blowback of another drawn-out Israel-Hamas conflict.

Growing expectations that the US Fed is near fed-up with all these uninteresting rate rises also lifted Wall Street spirits, with Fed Vice Chair Philip Jefferson dovishly suggesting officials need to balance the risk of over-tightening – his preference was for the board to “proceed carefully.”

. The Dow Jones found+ 0.6% after first dropping more than 150 points at the open. The S&P 500 index gained +0.6% and the Nasdaq Composite index +0.4% – but only after both indices had backtracked some -0.6% and -1.2%, respectively.

Even the Russell 2000 rallied intraday to close more than +0.5%, a sure fire signal that everyone’s on the same confident page.

Hey. With all the money flowing out of Qantas (ASX:QAN), it seems Virgin Australia Holdings (ASX:VAH) chose the right time to announce its first annual profit in more than a decade of trying.

This morning VAH landed a $129m net profit for the full year, quite the impressive about turn on 2022’s $565.5m loss coming on the back of a 124% increase in revenue to almost $5bn.

ASX All Ordinaries Gold (XGD)

We’re tracking gold.

ASX Sectors on Tuesday

Via MarketIndex

In regional equity markets news, Chinese markets are struggling after their extended Golden Holidays. The Shanghai Composite is about 0.4% down and the tech focused Shenzhen Component lost 0.3% on Tuesday afternoon (Beijing time) ignoring signs of a rebound in global equities as investors absorbed and then shrugged off worries around the Israel-Hamas conflict. So, mainland stocks look headed for a second straight session of losses ahead of a big read Chinese inflation and trade data later in the week.

In Hong Kong it was a very different narrative for the Hang Seng which has jumped +1.8% up for the 3rd consecutive straight session.

China’s official data showed a rebound in domestic tourism in the Golden Week break to pre-pandemic levels.

The Nikkei 225 Index jumped 2.2% to above 31,600 while the broader Topix Index climbed 1.9% to 2,307 in post-holiday trade on Tuesday, recouping some losses from last week and tracking gains on Wall Street overnight.

The ASX Small Ords (XSO) added +1.35% and the ASX Emerging Co’s (XEC) index ended ahead for once, up +0.88%.

RIPPED FROM THE HEADLINES

WTI crude futures have eased slightly lingering around $86 per barrel and paring the gains from the previous session. Oil traders appear to be doing the math on the prospects of a contained and likely prolonged Israel-Hamas conflict on the regions oil supply. On Monday, the US oil benchmark surged more than 4% with the Hamas vs Israel debacle – reinstating geopolitical risk in the Middle East as the preeminent determinant of global oil prices.

Analysts still have to wrangle with the worst case scenarios and there’s a lot of them. However, front of mind would be short-term implications of the conflict smoking US efforts to broker any kind of status quo between sworn enemies Saudi Arabia and Israel. And then there’s the likely strangulation of Iranian supply – if and when the US with Israel’s aid, figures out exactly what kind of involvement Tehran had in the attacks.

Probably won’t be long:

NAB’s business confidence index hit 1 in September which doesn’t sound great, but represents some steadying for the 3rd straight month, while still sitting well below average,. The take out being that maybe businesses are less concerned about the outlook than was the case previously.

Meanwhile, for the geeks: business conditions eased (11 vs 14 in August), amid moderation in sales (16 vs 19), profitability (8 vs 14), and employment (8 vs 10). Conditions fell in mining, transport & utilities, and construction.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TAL | Talius Group Limited | 0.011 | 57% | 16,397,326 | $16,002,975 |

| MAUCA | Magnetic Resources | 0.4 | 48% | 75 | $5,513,093 |

| MOB | Mobilicom Ltd | 0.01 | 43% | 6,367,665 | $9,286,737 |

| DCL | Domacom Limited | 0.022 | 38% | 491,340 | $6,968,028 |

| AUK | Aumake Limited | 0.004 | 33% | 82,500 | $4,461,778 |

| PVS | Pivotal Systems | 0.004 | 33% | 170,407 | $2,305,138 |

| ROO | Roots Sustainable | 0.0065 | 30% | 11,268,473 | $761,195 |

| NGL | Nightingale Intel | 0.065 | 30% | 199,253 | $5,106,451 |

| CZR | CZR Resources Ltd | 0.175 | 30% | 478,190 | $31,824,177 |

| KRR | King River Resources | 0.015 | 25% | 4,020,054 | $18,642,299 |

| PR1 | Pureresourceslimited | 0.2 | 25% | 544,998 | $4,104,001 |

| HFY | Hubify Ltd | 0.02 | 25% | 810,046 | $7,938,181 |

| M4M | Macro Metals Limited | 0.005 | 25% | 415,022 | $7,948,311 |

| FAL | Falconmetalsltd | 0.16 | 23% | 204,663 | $23,010,000 |

| AEV | Avenira Limited | 0.011 | 22% | 3,812,862 | $15,570,065 |

| YBR | Yellow Brick Road | 0.06 | 20% | 7,498,140 | $16,319,073 |

| SFG | Seafarms Group Ltd | 0.006 | 20% | 5,000 | $24,182,996 |

| BNR | Bulletin Res Ltd | 0.11 | 20% | 2,818,270 | $27,010,381 |

| NNL | Nordicnickellimited | 0.185 | 19% | 20,000 | $9,061,301 |

| 4DS | 4Ds Memory Limited | 0.13 | 18% | 10,034,320 | $192,086,758 |

| ALV | Alvomin | 0.165 | 18% | 20,817 | $10,709,456 |

| BRN | Brainchip Ltd | 0.2 | 18% | 32,411,634 | $301,759,885 |

| A11 | Atlantic Lithium | 0.47 | 18% | 1,409,468 | $244,896,664 |

| GCM | Green Critical Min | 0.007 | 17% | 2,559,503 | $6,819,510 |

| HCD | Hydrocarbon Dynamic | 0.007 | 17% | 211,988 | $3,897,995 |

Hang about – and that’s exactly what Mobilicom (ASX:MOB), not long for this bourse is doing on Tuesday – and has jumped circa 40% to boot.

MOB says it’s received ‘a number of inquiries from shareholders in Australia requesting additional time to complete the conversion process of ordinary shares into American Depositary Shares (ADSs)’ – that’s because last month MOB broke the news it’l be removed from the official list of ASX shares and make its forever home on the Nasdaq.

“In an effort to accommodate its shareholders, the Company has decided to extend the proposed Delisting date to 19 October 2023 to allow current shareholders the ability and time to be able to transfer their fully paid ordinary shares to ADSs if they wish to do so,” MOB says.

That’s all. Up 43%.

Nightingale Intelligent Systems (ASX:NGL), might not be the Shane Warne of ASX small cap security drone technology, but the San Pablo Police Department, in sunny California thinks they could be.

NGL says it’s finalised an expanded contract with the San Pablo Police Department (SPPD), which invested in 2 x additional AI-powered Blackbird Robotic Aerial Security (RAS) systems, bringing their total to five.

Chillingly for the good people of San Pablo, the systems will ‘further improve citywide drone coverage and enhance SPPD’s pioneering Drone as a First Responder(DFR) program.’

“Nightingale’s state-of-the-art RAS system, which seamlessly integrates with the SPPD’s operational framework, will be deployed in Q4 2023 and Q1 2024,” the company said this arvo.

As part of the expansion, SPPD will start hosting other US law enforcement ‘to showcase their DFR program and the dynamic partnership with Nightingale,’ which NGS goers on to say highlights the company’s ‘commitment to advancing public safety and elevating situational awareness for law enforcement officers during critical incidents.’

Here’s the kicker and why the share price is topping out on Tuesday: as part of the expansion with SPPD, Nightingale obtained Tactical Beyond Visual Line of Sight (TBVLOS) approval for its Blackbird drones from the US Federal Aviation Administration.

The FAA hold the keys to the US drone kingdom.

CZR Resources (ASX:CZR) jumped early and stayed high on news the Definitive Feasibility Study (DFS) at the Robe Mesa iron ore project in the Pilbara looks “set to generate exceptional financial returns”.

The main talking points of the announcement include increased ore reserves at the project, from 8.2Mt in the pre-feasibility study (PFS), to 33.4Mt and production rates have increased from 2Mtpa in the PFS to 3.5-5Mtpa in the DFS.

“Outstanding metallurgical testwork results have also confirmed the high quality of Robe Mesa iron ore and the ability to substitute Robe Mesa for well-known products, such as Rio Tinto’s Robe River Fines and FMG Super Special Fines and Blended Fines,” the company says.

Elsewhere, we got Pure Resources (ASX:PR1) up on news it’s staked 13.5km2 of exploration claims in the Crystal Mountain Pegmatite District, Colorado, and Atlantic Lithium (ASX:A11) is higher on word Ghana’s first lithium mine has been boosted by government acquiescence in diverting two transmission lines that run right across A11’s planned mining area.

“The diversion of the transmission lines that traverse the proposed project site forms an important part of the mine plan and the company’s preparations towards shovel readiness at Ewoyaa,” A11 CEO Keith Muller said.

And DomaCom (ASX:DCL) has started a capital raise of up to $6 million via convertible notes, the company saying the cash infusion ‘fortifies the company’s financial position enabling further expansion.’

That’s also it. Up 38% to 0.022 cents.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| VTI | Vision Tech Inc | 0.25 | -38% | 45,704 | $12,686,888 |

| FAU | First Au Ltd | 0.002 | -33% | 1,396,660 | $4,355,980 |

| AXP | AXP Energy Ltd | 0.0015 | -25% | 106,265 | $11,649,361 |

| BP8 | Bph Global Ltd | 0.0015 | -25% | 2,200,000 | $2,669,460 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 510,784 | $31,285,147 |

| MTH | Mithril Resources | 0.0015 | -25% | 591,864 | $6,737,609 |

| MXC | Mgc Pharmaceuticals | 0.0015 | -25% | 500,500 | $8,855,936 |

| LVT | Livetiles Limited | 0.007 | -22% | 9,281,632 | $10,593,996 |

| AHK | Ark Mines Limited | 0.185 | -18% | 42,381 | $10,157,571 |

| ANO | Advance Zinctek Ltd | 0.89 | -17% | 93,319 | $67,114,098 |

| ACW | Actinogen Medical | 0.02 | -17% | 2,894,551 | $53,191,442 |

| HCT | Holista CollTech Ltd | 0.01 | -17% | 687,494 | $3,345,601 |

| EXT | Excite Technology | 0.006 | -14% | 50,000 | $8,464,692 |

| G50 | Gold50Limited | 0.12 | -14% | 4,165 | $14,980,100 |

| PHL | Propell Holdings Ltd | 0.012 | -14% | 1,913,141 | $1,684,977 |

| AL8 | Alderan Resource Ltd | 0.013 | -13% | 4,952,336 | $9,250,420 |

| BLU | Blue Energy Limited | 0.013 | -13% | 1,092,651 | $27,764,604 |

| DTC | Damstra Holdings | 0.1 | -13% | 250 | $29,656,441 |

| DC2 | Dctwo | 0.02 | -13% | 10,000 | $3,006,470 |

| NOX | Noxopharm Limited | 0.096 | -13% | 1,126,602 | $32,146,175 |

| ADG | Adelong Gold Limited | 0.007 | -13% | 573,981 | $4,770,578 |

| BUY | Bounty Oil & Gas NL | 0.007 | -13% | 140,006 | $10,964,008 |

| ETR | Entyr Limited | 0.007 | -13% | 4,634,054 | $15,864,831 |

| EXL | Elixinol Wellness | 0.007 | -13% | 1,198,287 | $5,050,751 |

| HNR | Hannans Ltd | 0.007 | -13% | 73,127 | $21,796,838 |

TRADING HALTS

Emu (ASX:EMU) – Pending the release of an announcement advising details relating to a proposed capital raise

Nuheara (ASX:NUH) – Pending the release of an announcement by the Company regarding a material equity raising

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.