Closing Bell: Wall Street killed Friday, but the ASX challenges are all Chinese

Via Getty

- Local markets end bad week lower

- Material sector losses dominate

- Small Caps led by Pentanet

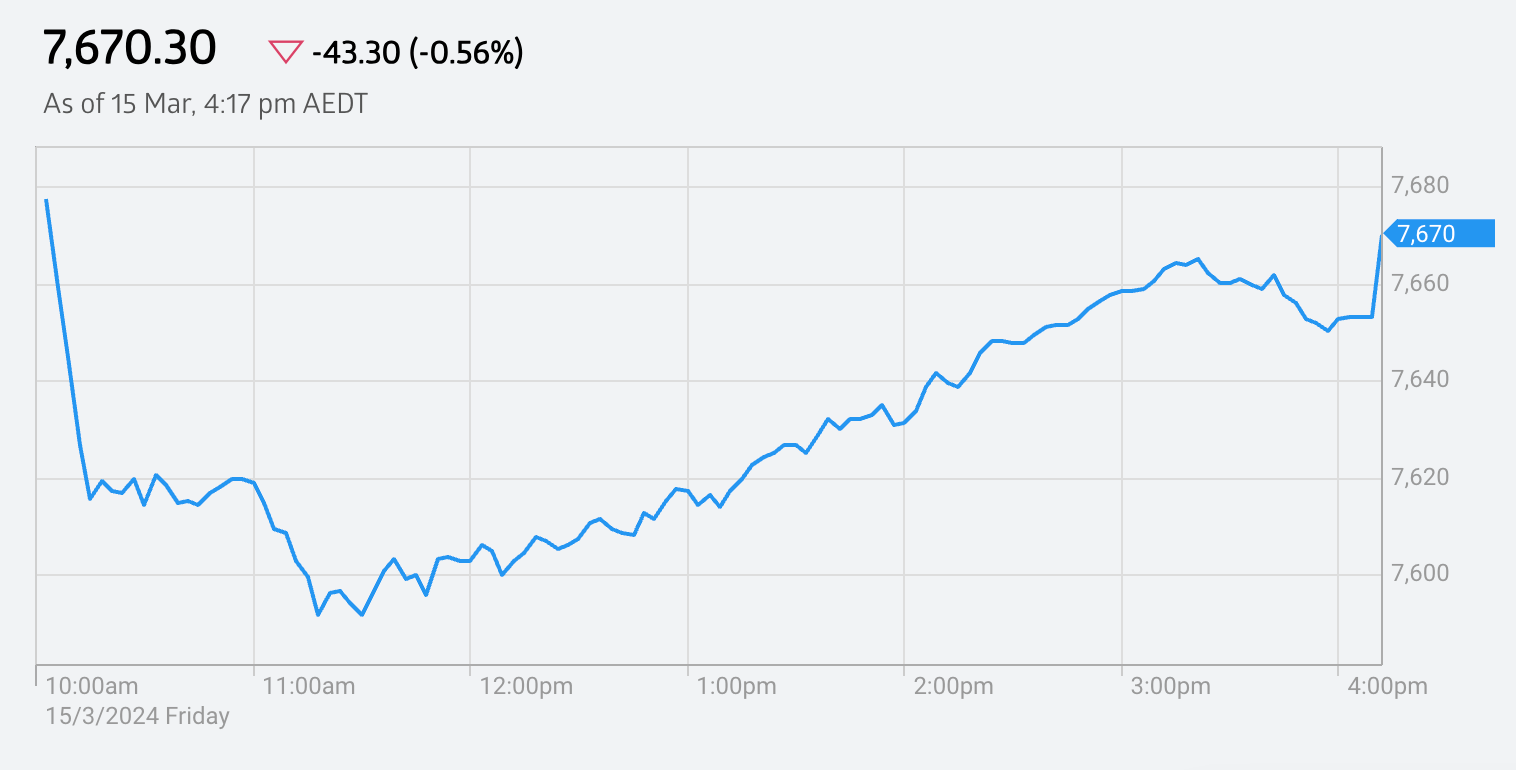

Local markets have ended about half a per cent lower on Friday after some fairly broad based selling.

The S&P/ASX200 closed lower on Friday, March 15, down 43.30 points or 0.56% to 7,670.3

The XJO index has lost 2.25% over the week and sits 2.33% below its 52-week high

Markets in Sydney – and further afield – took their cues from a wobbly and worried-looking Wall Street overnight, stunned perhaps by some extremely sticky US (PPI) producer prices.

The key inflation report certainly came in hotter-than-hoped-for. It sent US traders back to their books and crystal balls for any insights on when chair J.Powell and buds from the US Federal Reserve might start cutting interest rates.

They won’t find any. The read was nothing but confusion.

Headline prices were high. Core prices seem to have dropped. I’m no economist, but I know madness when I check its prostate.

At home, the losing came bouncing out the gate from the open. By 10.15am local stocks had shed more than 1% and in Stockhead Central the gnashing of teeth forced me to open a window and throw Robert Badman down the stairs.

By lunchtime the ASX200 had shed 1.5%, with the banks being a real drag, even after Thursday’s reprehensible display (admittedly they were overbought).

On Friday, some long-term UBS predictions of a bank share price surrender were vindicated. Not least because that was when UBS analysts put out a note rectracing their worst fears and rerated all of them – sans ANZ – as a sell.

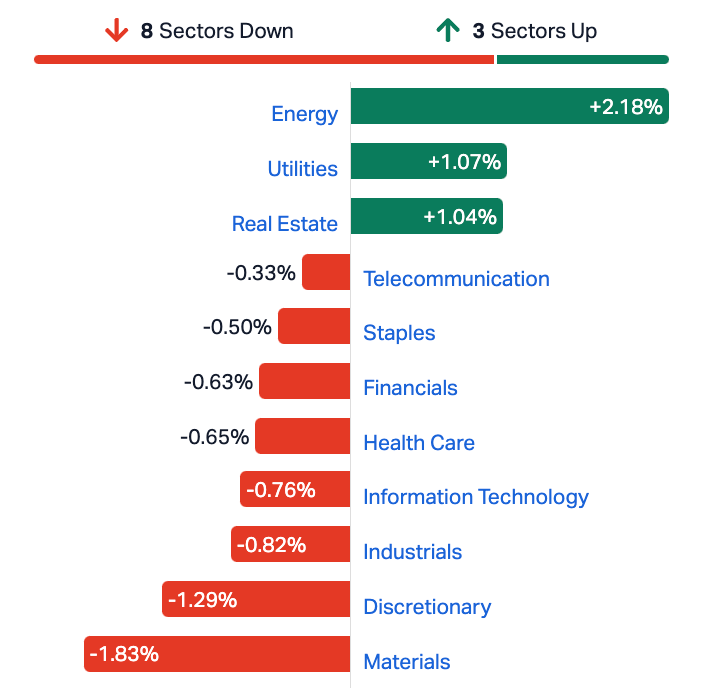

But there was broad based selling today. Pick a corner outside Energy.

China’s a great big proble on Friday.

The iron ore heavies are notably lower, as the spot heads for comfort somewhere under $US100 a tonne.

The Materials sector was worst on field. Rio Tinto (ASX:RIO), BHP (ASX:BHP) and Fortescue (ASX:FMG). All bad.

Lithium prices fell in China and that ended much of the optimism which coalesced around local producers earlier this week.

Core Lithium is still terrible.

We need to talk about China-Kevin

What’s fallen into sharper relief today is the economic mismanagement out of Beijing.

Both China’s major indices have tracked Wall Street lower so far on Friday.

That’s no surprise with the Shanghai Composite and the Shenzhen Component making it four in a row on the back of New York’s response to the uncomfortable US (PPI) producer inflation read.

If only the muddled global outlook on inflation and the US Federal Reserve’s dot-plot for cutting interest rates were the sole algorithm facing Chinese markets.

Alas, no way.

On Friday two sets of data dropped in China, bringing the current mess into stark relief.

First, February’s new home prices show a property market in total freefall (by Chinese standards).

Prices fell the most in more than a year of near consecutive falls, double the pace of the previous read.

A good time to perhaps make life easier for lenders? Perhaps a leg up or a little stimmy??

A good time to lean on the (PBoC) People’s Bank of China??

Forget it. The housing data dropped and an hour later the PBoC left its one-year medium-term lending facility rate unchanged at 2.5%. Total disconnect.

In the news on Friday – Iress (ASX:IRE) announced a $164 million deal to sell its pommy mortgage business to private equity giant Bain.

Tabcorp Holdings (ASX:TAH) boss Adam Rytenskild quit after being pinged for bad behaviour.

Pilbara Minerals (ASX:PLS) said it accepted a pre-auction offer for spodumene concentrate – a partly processed form of lithium – with the buyer paying the equivalent of $US1200 a tonne.

Encouragingly for PLS, Emerald and Liontown were the benchmark’s worst of the worst, down 10.06% and 8.06% respectively.

EML Payments (ASX:EML) says it’s agreed to sell its Sentenial payments business for about $54mn.

These local stocks went ex-divvy today:

Ariadne Australia (ASX:ARA) is paying 0.25 cents fully franked

CAR Group Limited (ASX:CAR) is paying 34.5 cents 50 per cent franked

Duratec (ASX:DUR) is paying 1.5 cents fully franked

Kaizen Global Inv (ASX:KGI) is paying 5 cents fully franked

ASX Sectors at 4pm on Friday

Of the 11 ASX sectors On Friday, three were higher, eight were lower.

We’re watching oil…

Oil’s having a great week and possibly hopes the world can keep burning in a heap for a few more months.

Earlier this week it only took a wee Ukrainian drone strike to reach Russian refineries to remind all the world’s gone to hell in a hand basket and that toys can upend global energy markets.

Both Brent and WTI look like logging about 4-5% of gains since this time last week.

There’s lots of war.

A few issues need ironing out there in the Middle East. OPEC+ has committed to extend supply cuts and the Houthis are still lobbing rockets here and there.

Chinese and US demand is punchy again, while the International Energy Agency (EIA) suddenly feels more bullish on global demand for 2024.

The latest EIA read has US crude inventories down by 1.536 million barrels last week, almost diametrically opposed to the expectations of a 1.338 million barrel surplus.

That means one of two tings:

- There’s a potential supply glut out of the States ready to hit the market at any time.

- The International Energy Agency cannot forecast for sh*t.

Around the ‘hood…

Asian-Pacific stock markets mostly fell on Friday.

Asian equity markets fell on Friday,

Investors also awaited updates from Japan’s spring wage negotiations ahead of the Bank of Japan’s policy decision next week. In China, February’s new home prices fell the most in 13 months, while the People’s Bank of China left its one-year medium-term lending facility rate unchanged at 2.5%. Shares in Australia, Japan, South Korea, Hong Kong and China all declined.

Eek. It’s now eight straight months of significant declines in China’s new home prices. They fell by 1.4% year-on-year in February 2024, double the 0.7% (hoho) they fell in January. That’s bad.

Some stimmy would be nice.

But so far the drip feed which passes for stimmy out of Beijing hasn’t done a thing, except prolong uncertainty and exacerbate China’s real estate crisis and half-arsed economic recovery.

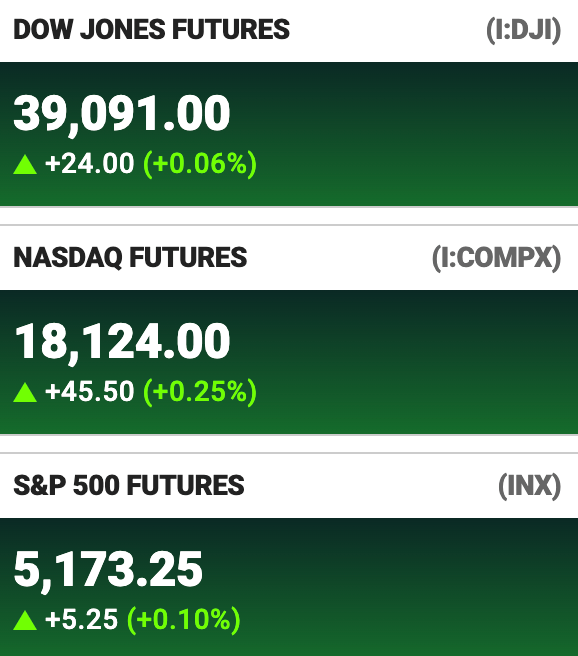

US stock futures rose on Friday in Sydney:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| 5GG | Pentanet | 0.086 | 72% | 110,962,595 | $18,686,361 |

| MRD | Mount Ridley Mines | 0.002 | 33% | 869,755 | $11,677,324 |

| SFG | Seafarms Group Ltd | 0.004 | 33% | 1,103,824 | $14,509,798 |

| ASP | Aspermont Limited | 0.012 | 33% | 1,970,189 | $22,100,712 |

| TSL | Titanium Sands Ltd | 0.009 | 29% | 580,690 | $13,956,112 |

| KAL | Kalgoorlie Gold Mining | 0.025 | 25% | 10,750,845 | $3,170,014 |

| LVE | Love Group Global | 0.125 | 25% | 80,000 | $4,053,417 |

| ASR | Asra Minerals Ltd | 0.005 | 25% | 305,201 | $6,655,983 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 3,039,074 | $12,000,000 |

| ECT | Env Clean Tech Ltd | 0.005 | 25% | 215,130 | $11,457,242 |

| PRX | Prodigy Gold NL | 0.005 | 25% | 119,115 | $7,004,431 |

| TMK | TMK Energy Limited | 0.005 | 25% | 120,162 | $24,490,317 |

| NME | Nex Metals Exploration | 0.021 | 24% | 1,563 | $5,993,053 |

| IMI | Infinity Mining | 0.075 | 23% | 50,550 | $7,243,957 |

| TTT | Titomic Limited | 0.04 | 21% | 2,351,472 | $30,120,476 |

| XAM | Xanadu Mines Ltd | 0.052 | 21% | 9,625,847 | $73,788,258 |

| KAM | K2 Asset Mgmt Hldgs | 0.06 | 20% | 2,416 | $12,054,260 |

| MHC | Manhattan Corp Ltd | 0.003 | 20% | 820,000 | $7,342,449 |

| MSG | MCS Services Limited | 0.006 | 20% | 735,250 | $990,498 |

| NRX | Noronex Limited | 0.012 | 20% | 5,170,511 | $3,783,018 |

| TLM | Talisman Mining | 0.215 | 19% | 309,004 | $33,897,663 |

| FNX | Finexia Financial Group | 0.225 | 18% | 7,674 | $9,358,013 |

| ASV | Asset Vision Company | 0.013 | 18% | 223,707 | $7,984,202 |

| LYN | Lycaon Resources | 0.17 | 17% | 17,198 | $6,388,156 |

| NRZ | Neurizer Ltd | 0.0035 | 17% | 1,239,175 | $4,504,232 |

Pentanet (ASX:5GG) says its will extend the GeForce NOW Alliance Partner Agreement with US AI darling Nvidia to include New Zealand, with more territories to come.

“Pentanet has fostered a deeply engaged cloud gaming community in Australia with GeForce NOW Powered by CloudGG. Its commitment to delivering GeForce RTX 3080-level performance that elevates experiences for gamers nationwide and underscores the company’s dedication to pushes the boundaries of gaming and internet connectivity,” NVIDIA GeForce NOW vice president Phil Eisler says.

Shares in Kalgoorlie Gold Mining (ASX:KAL) posted solid gains on Friday, thanks to thick and shallow gold intercepts at the Kirgella Gift and Providence prospects within the Pinjin project, around 140 km east of Kalgoorlie-Boulder.

Intercepts include: 32 m at 1.29 g/t Au from 3 m depth (containing 4 m at 3.29 g/t Au from 16 m); 35 m at 1.15 g/t Au from 11 m depth (containing 4 m at 2.91 g/t Au from 16 m); and 45 m at 2.36 g/t Au from 51 m depth (containing 33 m at 3.10 g/t Au from 51 m).

The gold hits are being compared with mineralisation hosted within larger, broader zones of anomalism at the Rebecca gold project 21 km to the south (of the KAL prospects), which is owned by Ramelius Resources (ASX:RMS).

This all comes amid a comprehensive appraisal of gold mineralisation completed at Kirgella Gift and Providence following successful drilling late 2023.

Black Rock Mining (ASX:BKT) has secured a $53.4 million loan approval from The Industrial Development Corporation. BKT says it will proceed to finalise full form facility agreements and determine the ultimate structure of the Mahenge project’s debt package.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 989,006 | $11,649,361 |

| TKL | Traka Resources | 0.001 | -50% | 200,000 | $3,501,317 |

| MOM | Moab Minerals Ltd | 0.005 | -29% | 61,875 | $4,983,744 |

| 1MC | Morella Corporation | 0.003 | -25% | 146,527 | $24,715,198 |

| PPY | Papyrus Australia | 0.015 | -25% | 210,000 | $9,853,852 |

| OPL | Opyl Limited | 0.022 | -21% | 3,898 | $4,735,610 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 17,655,905 | $15,846,485 |

| CZN | Corazon Ltd | 0.008 | -20% | 118,707 | $6,155,979 |

| ROG | Red Sky Energy | 0.004 | -20% | 1,601,205 | $27,111,136 |

| SYR | Syrah Resources | 0.55 | -20% | 15,723,666 | $466,041,723 |

| AS1 | Asara Resources Ltd | 0.009 | -18% | 918,339 | $8,720,040 |

| TEM | Tempest Minerals | 0.009 | -18% | 1,561,337 | $5,710,369 |

| AXN | Alliance Nickel Ltd | 0.033 | -18% | 190,198 | $29,033,585 |

| CLU | Cluey Ltd | 0.066 | -18% | 24,820 | $16,129,085 |

| ADD | Adavale Resource Ltd | 0.005 | -17% | 2,911,880 | $6,067,033 |

| FTC | Fintech Chain Ltd | 0.02 | -17% | 38,363 | $15,618,470 |

| IXU | Ixup Limited | 0.02 | -17% | 871,900 | $26,100,854 |

| BMG | BMG Resources Ltd | 0.011 | -15% | 6,670,096 | $8,239,363 |

| SHP | South Harz Potash | 0.022 | -15% | 430,739 | $20,945,079 |

| BC8 | Black Cat Syndicate | 0.2 | -15% | 1,689,310 | $72,257,018 |

| MRL | Mayur Resources Ltd | 0.2 | -15% | 418,306 | $78,983,781 |

| WIN | Widgie Nickel | 0.052 | -15% | 552,704 | $18,174,648 |

| EPM | Eclipse Metals | 0.006 | -14% | 18,000 | $14,525,380 |

| NTM | NT Minerals Limited | 0.006 | -14% | 6,917,425 | $6,019,320 |

| TSO | Tesoro Gold Ltd | 0.03 | -14% | 596,034 | $43,035,325 |

ICYMI – PM Edition

Aspiring gold miner Magnetic Resources (ASX:MAU) has raised $12 million via an oversubscribed placement to take its Lady Julie project to the next phase of development, with deeper drilling and ongoing feasibility work on the company’s near-term agenda.

Venture Minerals (ASX:VMS) has committed to an extensive 300-hole Stage 2 drilling program at its impressive Jupiter REE prospect which could culminate in delivery of a maiden resource estimate.

Northern Territory-focused explorer Litchfield Minerals (ASX:LMS) listed on the ASX earlier today following an oversubscribed $5 million IPO.

And Felix Gold (ASX:FXG) remains on the hunt for near-surface gold and antimony mineralisation at its flagship Treasure Creek tenure in Alaska’s prolific Fairbanks mining district.

At Stockhead, we tell it like it is. While Felix Gold, Litchfield Minerals, Magnetic Resources and Venture Minerals are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.