Closing Bell: Utility players burst off bench to keep ASX from falling too far behind

After the team's long lunch, Darren (at left) had drawn the short straw on positions. Pic via Getty Images

- It was a tale of two halves for the ASX today, and neither were great

- Caution abounds ahead of two major market-moving events this week, including RBA and Trump decisions

- Utilities stock Origin Energy was a big-cap MVP today, although there were strong efforts from small-cap ressies

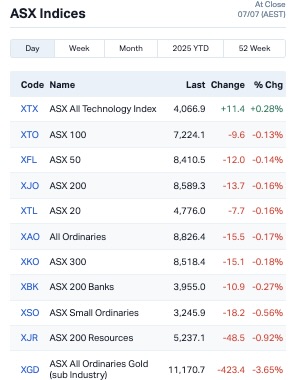

The ASX managed to claw back a bit of respect in the dying minutes but it was a Monday loss, closing down 0.16% at the final whistle.

We won’t say this was always on the cards, as it was a murky gauge this morn with Wall Street traders taking July 4 off for fireworks, hot dogs, blind patriotism and such and such.

While that followed all-time highs for the S&P 500 and Nasdaq Composite, today’s performance does continue the fizzling-out ASX pattern from late Friday and mirrors a Euro stocks downturn plus a 0.5 per cent fall in S&P 500 futures.

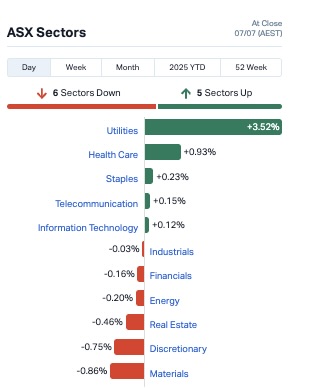

Here’s a glimpse at what happened on the ASX today, courtesy of Market Index.

While materials/resources stocks took a hit as a whole, utilities stocks kept up their effort to bolster the bourse all day with little else to commend from the sectors more broadly, although healthcare gets a “satisfactory” stamp.

Big gun Origin Energy (ASX:ORG) ($19.84 billion market cap) played a major part there, closing almost 7% higher. There was a Reuters report on the weekend about UK’s Octopus Energy’s plans for a $US13.7bn divestment and stake sale of Kraken, its technology arm. Origin owns a stake in Octopus and uses the Kraken tech platform, so this could be behind the spike that’s helping prop up the ASX from further losses this afternoon.

As reported by The Australian, Origin increased its stake in Octopus to 23% in December 2023, spending £280m ($530m) for a 3% top-up.

Major factors at play this week

RBA rate cuts

If the four big banks are anything to go by, and we guess they are, there’s a goodly amount of consensus that the Reserve Bank of Australia will pull out the shears and trim off another 25 basis points from its cash rate tomorrow. This would bring the cash rate down to 3.6%, give some relief to mortgage holders and maybe give the local economy a pick-me-up. That’s the theory, anyway.

As reported by business journalist Valerina Changarathil in The Australian: on Friday, Westpac chief economist Luci Ellis, a former RBA official, noted there is nothing in the next five weeks that makes it worth RBA governor Michele Bullock waiting until August to cut the official cash rate. Inflation is in the target range, with downwards momentum now evident, she said.

“Likewise, another monthly labour force release and the last-ever retail sales number will not change the current view on the economy.”

Tariffs decision deadline

The 90-day pause on reciprocal tariffs announced by US President Donald Trump in April is set to expire this Wednesday, July 9. Traders will be nervous. Once they’ve taken a hit of Berocca and are back at their desks, we might know a bit more about how our American counterparts are feeling heading into the next day or so.

Expecting the unexpected from the Prez has become the norm, so we’ll see.

As Phoebe Shields noted at lunch today…

Hotly anticipated deals with India and the EU appear to have fallen through at the last minute, leaving the door open for some big market upsets when the new tariffs finally come into effect.

On Friday, Trump added more fuel to that fire, stating tariffs could range up to 70% compared to the 10% to 50% threatened in April.

That said, investors aren’t running for the hills as they were on Liberation Day.

“The markets are discounting a return to tariff levels of 35%, 40% or higher, and anticipating an across-the-board level of 10% or so,” Boston-based Twinfocus’ chief investment officer John Pantekidis told Reuters.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VN8 | Vonex Limited | 0.035 | 94% | 2,220,557 | $13,546,863 |

| BMM | Bayan Mining and Minerals | 0.063 | 80% | 32,805,320 | $3,603,439 |

| BPM | BPM Minerals | 0.045 | 55% | 15,364,703 | $2,531,709 |

| GTR | Gti Energy Ltd | 0.0045 | 50% | 13,615,308 | $8,996,849 |

| IPB | IPB Petroleum Ltd | 0.009 | 50% | 2,112,051 | $4,238,418 |

| KPO | Kalina Power Limited | 0.009 | 50% | 7,043,612 | $17,597,974 |

| CYQ | Cycliq Group Ltd | 0.003 | 50% | 172,933 | $921,033 |

| EEL | Enrg Elements Ltd | 0.0015 | 50% | 546,851 | $3,253,779 |

| PAB | Patrys Limited | 0.0015 | 50% | 2,150,000 | $2,365,810 |

| EVR | Ev Resources Ltd | 0.013 | 30% | 48,546,961 | $19,858,367 |

| 4DS | 4Ds Memory Limited | 0.033 | 27% | 15,615,069 | $53,583,367 |

| FRB | Firebird Metals | 0.097 | 26% | 1,710,829 | $10,961,828 |

| MMR | Mec Resources | 0.005 | 25% | 8,400,000 | $7,399,063 |

| PLG | Pearlgullironlimited | 0.01 | 25% | 610,716 | $1,636,334 |

| SRZ | Stellar Resources | 0.02 | 25% | 19,379,782 | $33,276,009 |

| ZMM | Zimi Ltd | 0.01 | 25% | 595,632 | $3,420,351 |

| SCP | Scalare Partners | 0.13 | 24% | 11,447 | $4,392,677 |

| SWP | Swoop Holdings Ltd | 0.13 | 24% | 283,853 | $22,520,255 |

| RRR | Revolverresources | 0.038 | 23% | 194,474 | $8,564,502 |

| C29 | C29Metalslimited | 0.017 | 21% | 4,287,125 | $2,438,635 |

| ZEU | Zeus Resources Ltd | 0.017 | 21% | 22,276,413 | $9,001,113 |

| ATX | Amplia Therapeutics | 0.355 | 20% | 22,417,949 | $114,446,037 |

| 1AI | Algorae Pharma | 0.006 | 20% | 309,697 | $8,436,974 |

| QXR | Qx Resources Limited | 0.003 | 20% | 6,644,685 | $3,275,822 |

| RCM | Rapid Critical | 0.003 | 20% | 111,311 | $3,539,445 |

Making news…

Bayan Mining and Minerals (ASX:BMM) burst up 80% today after it filed staking claims for 72 lode claims covering 6km2 in the Mojave Desert of California in a bid to form the Desert Star rare earth project.

It’s a Tier 1 area for rare earth mineralisation, just 4.5km from the globally significant Mountain Pass REE Mine, and 4.7km from Dateline Resources’ (ASX:DTR) Colosseum project.

BMM has started a desktop review, while field recon and rock chip sampling will start shortly to identify early-stage targets.

BPM Minerals (ASX:BPM) is preparing to kick off drilling at its newly acquired Forelands gold project in the Yilgarn Craton–Albany Fraser Orogen margin of WA.

The project comprises of ~630km2 of prospective ground with historical RC, diamond and AC drilling confirming presence of high-grade gold mineralisation across multiple prospects.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| C7A | Clara Resources | 0.003 | -25% | 1,011,827 | $2,353,084 |

| EDE | Eden Innovations | 0.0015 | -25% | 22,000 | $8,219,762 |

| FAU | First Au Ltd | 0.003 | -25% | 6,532,822 | $8,305,165 |

| AGY | Argosy Minerals Ltd | 0.026 | -24% | 19,499,638 | $49,501,312 |

| PV1 | Provaris Energy Ltd | 0.014 | -22% | 1,123,604 | $12,564,023 |

| AQC | Auspaccoal Ltd | 0.04 | -22% | 27,068 | $35,723,847 |

| 1AD | Adalta Limited | 0.002 | -20% | 2,700,000 | $2,678,291 |

| GGE | Grand Gulf Energy | 0.002 | -20% | 750,000 | $7,051,062 |

| MEL | Metgasco Ltd | 0.002 | -20% | 1,097 | $4,581,467 |

| TMX | Terrain Minerals | 0.002 | -20% | 81,780 | $6,329,536 |

| HE8 | Helios Energy Ltd | 0.018 | -18% | 1,572,173 | $70,630,530 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 2,024,333 | $11,104,423 |

| BPP | Babylon Pump & Power | 0.005 | -17% | 3 | $20,261,346 |

| GMN | Gold Mountain Ltd | 0.0025 | -17% | 7,724,232 | $16,859,278 |

| MRD | Mount Ridley Mines | 0.0025 | -17% | 751,500 | $2,335,467 |

| NES | Nelson Resources. | 0.0025 | -17% | 31,999 | $6,515,783 |

| NFL | Norfolkmetalslimited | 0.14 | -15% | 111,195 | $8,586,754 |

| MDR | Medadvisor Limited | 0.047 | -15% | 6,964,794 | $34,363,178 |

| AKN | Auking Mining Ltd | 0.006 | -14% | 2,943,588 | $4,023,451 |

| AYT | Austin Metals Ltd | 0.003 | -14% | 104,766 | $5,544,670 |

| LCL | LCL Resources Ltd | 0.006 | -14% | 95,362 | $8,394,800 |

| OVT | Ovanti Limited | 0.006 | -14% | 3,900,487 | $29,850,265 |

| SNS | Sensen Networks Ltd | 0.03 | -14% | 10,000 | $27,756,312 |

| SPX | Spenda Limited | 0.006 | -14% | 1,789,660 | $32,306,508 |

| AHK | Ark Mines Limited | 0.155 | -14% | 7,950 | $11,908,926 |

Making news…

Argosy Minerals (ASX:AGY) was down 24% after completing an oversubscribed share placement, raising $2m at 2.5 cents per share.

AGY will use the funding for an ongoing engineering and optimisation study for the 12,000-tonne-per-annum Rincon lithium project in Argentina and strategic plans for the Tonopah lithium project in the US.

IN CASE YOU MISSED IT

Rock chip sampling by Golden Mile Resources (ASX:G88) at the Aurora prospect has returned up to 29.3g/t, marking the highest gold grades achieved at the project to date.

LinQ Minerals (ASX:LNQ) has selected a drilling contractor to start its key phase 1 program at the Gilmore gold and copper project.

TRADING HALTS

Manuka Resources (ASX:MKR) – cap raise

Chariot Corporation (ASX:CC9) – acquisition

Kincora Copper (ASX:KCC) – trading halt

Island Pharmaceuticals (ASX:ILA) – trading halt

Almonty Industries (ASX:AII) – JORC technical report filing

Pantera Lithium (ASX:PFE) – trading halt

Viridis Mining and Minerals (ASX:VMM) – trading halt

Native Mineral Resources (ASX:NMR) – trading halt

Lifestyle Communities (ASX:LIC) – trading halt

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.