Closing Bell: Uranium fever grips ASX, but plunging AUD could delay RBA rate cut

ASX rises as oil, uranium supply issue boosts stocks. Picture via Getty Images

- ASX rises as oil, uranium supply issue boosts stocks

- Aussie dollar slips while gold, real estate gain

- Tesla drags Wall Street down

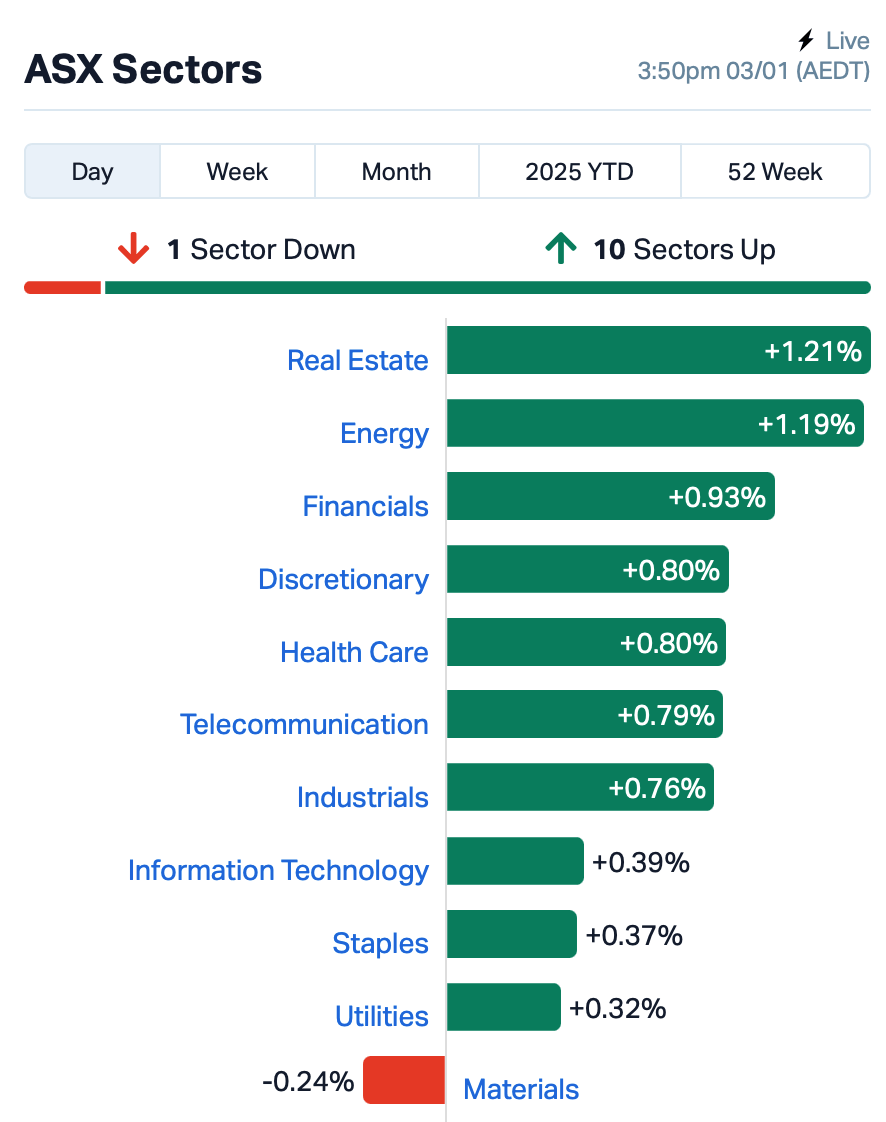

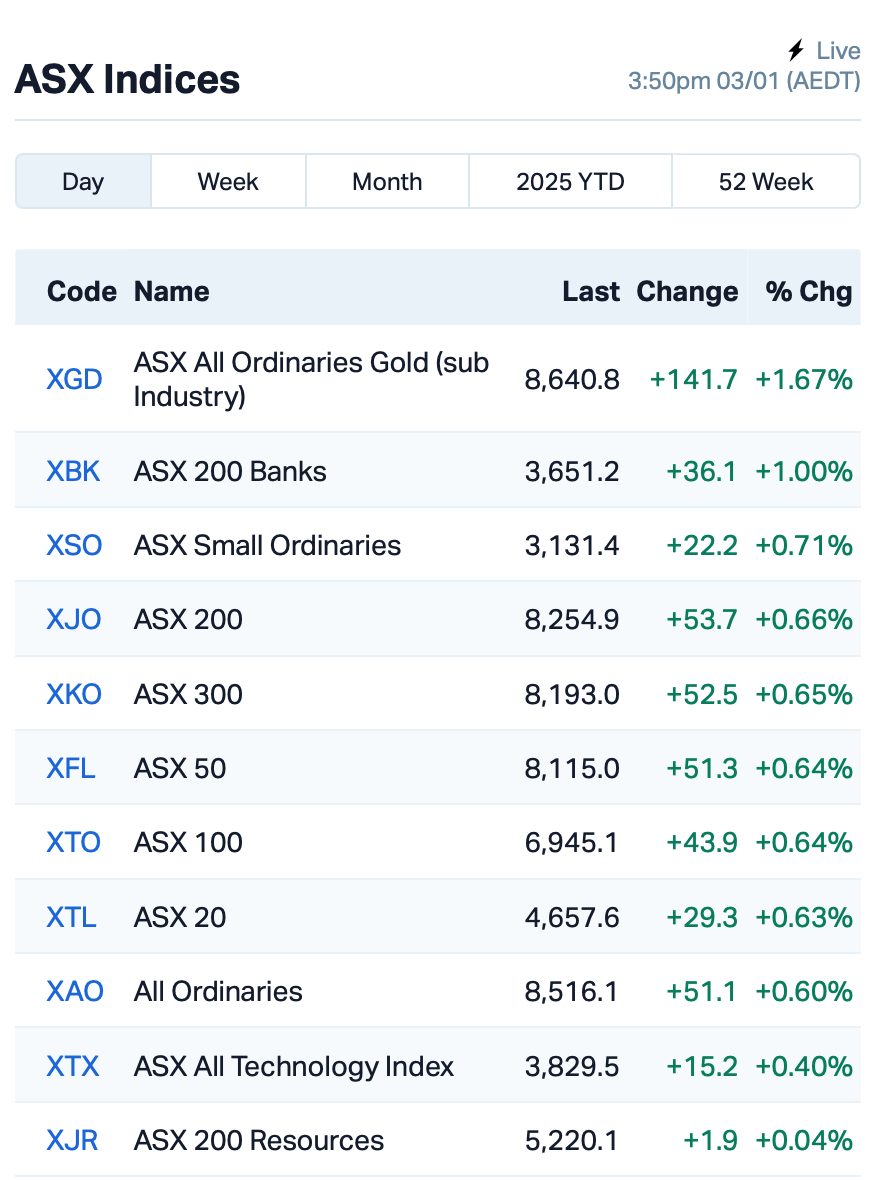

The ASX defied Wall Street’s gloom, roaring higher for a second day in 2025 as soaring oil prices and a hit to global uranium supply turbocharged Aussie energy stocks.

At the close of Friday, the benchmark S&P/ASX 200 was 0.6% higher and up around 1% for the week.

Overnight, Wall Street had its worst session in weeks, with the S&P500, Dow, and Nasdaq all deep in the red.

Tesla dragged the tech sector down, plunging 6% after missing delivery targets; while soft US jobless claims data sent a chill through traders worried about inflation staying stubbornly high.

But back home, Aussie stocks were on a roll.

The real fireworks, however, came from uranium miners, with Paladin Energy (ASX:PDN) and Boss Energy (ASX:BOE) rocketing higher by 5-6% each. Bannerman Energy (ASX:BMN) also surged by 13%.

The rally came after Canada’s Cameco announced a production halt at its Kazakhstan uranium plant.

Cameco said its Inkai project in Kazakhstan has hit a major roadblock, and it had to halt production due to a government approval delay. With Kazakhstan being the world’s largest producer of uranium, investors are rightly spooked.

Now read Resources Top 5: Uranium’s a winner on Kazakh suspension shock

Even gold miners were in on the action following a lift in the gold price as nervous investors sought a safe haven.

Meanwhile, the Aussie dollar crept up to US62.15¢ but remains in a fragile state, weighed down by a sluggish Chinese economy and a US dollar flexing its muscles.

“If it keeps falling from here, say 20 per cent since the start of 2024, it could have an impact on the RBA’s decision,” said AMP chief economist Shane Oliver.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.002 | 100% | 9,895,922 | $28,933,812 |

| 1TT | Thrive Tribe Tech | 0.003 | 50% | 21,552,268 | $4,063,446 |

| EEL | Enrg Elements Ltd | 0.002 | 50% | 10,000,000 | $3,253,779 |

| MTB | Mount Burgess Mining | 0.006 | 50% | 650,082 | $1,358,150 |

| RMI | Resource Mining Corp | 0.006 | 50% | 125,304 | $2,609,391 |

| H2G | Greenhy2 Limited | 0.004 | 33% | 201,964 | $1,794,553 |

| 1AE | Auroraenergymetals | 0.063 | 31% | 176,983 | $8,595,059 |

| FFF | Forbidden Foods | 0.009 | 29% | 1,136,776 | $4,005,564 |

| FNR | Far Northern Res | 0.140 | 27% | 15,500 | $3,989,241 |

| CDT | Castle Minerals | 0.003 | 25% | 1,950,000 | $3,793,628 |

| MOM | Moab Minerals Ltd | 0.003 | 25% | 1,591 | $3,133,999 |

| ETM | Energy Transition | 0.046 | 24% | 9,956,139 | $52,122,221 |

| ASO | Aston Minerals Ltd | 0.011 | 22% | 2,033,226 | $11,655,578 |

| AER | Aeeris Ltd | 0.075 | 21% | 10,000 | $4,535,229 |

| NES | Nelson Resources. | 0.003 | 20% | 12,000,000 | $5,429,819 |

| VEN | Vintage Energy | 0.006 | 20% | 2,330,299 | $8,347,656 |

| PGD | Peregrine Gold | 0.155 | 19% | 196,272 | $8,824,195 |

| MGL | Magontec Limited | 0.220 | 19% | 20,000 | $14,734,097 |

| EBR | EBR Systems | 1.290 | 17% | 1,045,722 | $408,018,820 |

| SRN | Surefire Rescs NL | 0.004 | 17% | 87,505 | $7,248,923 |

| BDG | Black Dragon Gold | 0.072 | 16% | 1,857,472 | $18,716,729 |

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DTI | DTI Group Ltd | 0.008 | -38% | 196,843 | $5,831,168 |

| ASR | Asra Minerals Ltd | 0.003 | -25% | 430,127 | $9,250,520 |

| EAT | Entertainment | 0.003 | -25% | 768,347 | $5,235,144 |

| ENT | Enterprise Metals | 0.003 | -25% | 67,520 | $4,713,269 |

| M2R | Miramar | 0.003 | -25% | 423,261 | $1,587,293 |

| MKL | Mighty Kingdom Ltd | 0.006 | -25% | 4,626,427 | $1,728,507 |

| MRD | Mount Ridley Mines | 0.003 | -25% | 105,674 | $3,113,956 |

| PAB | Patrys Limited | 0.003 | -25% | 1,716,573 | $8,229,789 |

| BGE | Bridgesaaslimited | 0.040 | -20% | 348,008 | $9,992,960 |

| LSA | Lachlan Star Ltd | 0.057 | -19% | 8,724 | $17,680,124 |

| FDR | Finder | 0.032 | -18% | 715,179 | $11,087,244 |

| ADD | Adavale Resource Ltd | 0.003 | -17% | 17,235,666 | $4,622,496 |

| IXU | Ixup Limited | 0.010 | -17% | 237,578 | $24,191,831 |

| TMK | TMK Energy Limited | 0.003 | -17% | 4,425,698 | $27,976,695 |

| VML | Vital Metals Limited | 0.003 | -17% | 2,997,791 | $17,685,201 |

| A11 | Atlantic Lithium | 0.290 | -15% | 89,085 | $235,670,086 |

| ADN | Andromeda Metals Ltd | 0.006 | -14% | 503,395 | $24,001,094 |

| DTR | Dateline Resources | 0.003 | -14% | 1,969,174 | $8,806,912 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 856,016 | $36,598,998 |

| VRC | Volt Resources Ltd | 0.003 | -14% | 53,746 | $14,746,338 |

| ROG | Red Sky Energy. | 0.010 | -14% | 68,790,514 | $59,644,499 |

| FME | Future Metals NL | 0.013 | -13% | 49,128 | $8,625,607 |

Red Sky Energy (ASX:ROG) dropped despite securing a 35% stake in Block 6/24 offshore Angola, located in the Kwanza Basin. The block spans nearly 5,000km² and has been well explored with extensive 2D and 3D seismic data. After reviewing the data, Red Sky sees strong potential for oil, with previous drilling uncovering the Cegonha oil field and a potential commercial discovery. The company has signed a Risk Service Contract with ANPG, ACREP, and Sonangol E&P, marking its first move into Angola.

IN CASE YOU MISSED IT

Weebit Nano (ASX:WBT) has kicked off 2025 with a bang, licensing its ReRAM technology to Tier 1 semiconductor giant onsemi for integration into its Treo platform. Through the deal, WBT will earn manufacturing licence fees, non-recurring engineering fees and royalties.

At Stockhead, we tell it like it is. While Weebit Nano is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.