Closing Bell: There’s been a huge fight on the ASX today, it was cool

Via Getty

- ASX200 rises, then falls, and then rises again like the heaving bosom of a bodice-ripper heroine

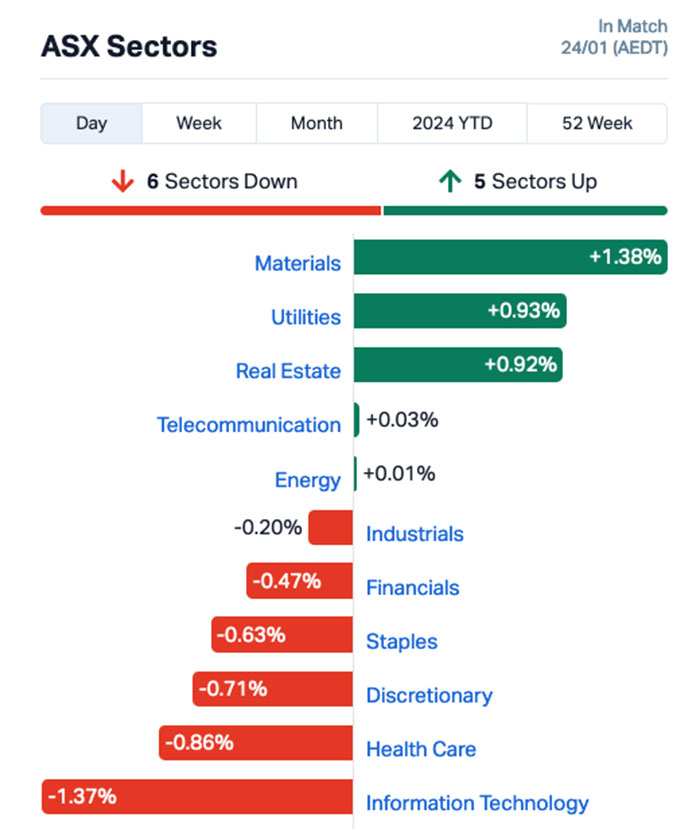

- Most sectors finish in the red, but Materials, Real Estate and Utilities build gains

- Small cap leaders include Harvest Tech, flying high on selling spy tech to God-knows-who

The benchmark XJO index has eked out a hard-won gain for the day, after surging early then admitting it just wasn’t strong enough to defend itself from the onslaught of rumours that someone, somewhere, might have to pay more tax in the back end of this year.

At 4.15pm on 24 Jan, the S&P/ASX200 was ahead 3.6 points or 0.05% to 7,518.5

It’s been an old school Donny Brook on the ASX today. We’re back in the green by about 0.09% at 3.30pm, but they’re not just giving these gains away.

The local IT Sector isn’t playing by the rules after the Nasdaq continued its winning ways on Tuesday in New York.

Tech weighed down the local market, which cut back strong morning gains and edged into the red after lunch.

Punching for the good guys was the Materials sector, which gained over 1.5%, while Energy, Utilities and the REITs (real estate investment trusts) were the only other sectors in the green.

First up, Kogan (ASX:KGN) is laughing all the way to the cost of living crisis, with the stock up over 16% at 2pm after delivering decent beats on both gross profits and revenue for the six months to December.

Kogan also won a fine self-competition on gross margin which soared on the back of more Platform-based sales, up to 63% of gross sales as well as better profitability of in-warehouse inventory sales.

Adjusted EBITDA of $21.5 million in 1H24, representing a 38.3% beat of the consensus $15.5m estimate.

But so far it’s been all about the diggers.

Lithium miner Pilbara Minerals (ASX:PLS) has found a lazy 6% and gold miner Northern Star Resources (ASX:NST) about 5%, both rallied goodly after decent quarterly updates.

Pilbara says December quarter revenue was down by almost half on the previous three months despite a pick up in production.

Northern Star Resources, meanwhile, confirmed it’s on track to hit fiscal 2024 guidance, thanks to an “exceptional” performance at its Kalgoorlie operations.

ASX SECTORS at 4.15pm on WEDNESDAY

Around the ‘hood…

Asian-Pacific equity markets are mixed at around 3.30pm in Sydenham.

Most importantly, I reckon, the Nikkei 225 Index fell 0.3% to around 36,400 while the broader Topix Index dropped 0.6% to 2,526 on Wednesday, sliding for the second straight session a day after the Bank of Japan left its monetary policy unchanged, tho’ Governor Kazuo Ueda’s latest remarks on inflation smacked of a definite hawkish tilt.

Meantime, exports from Japan rose by 9.8% yoy to a new record peak of JPY 9,648.21 billion in December 2023, beating market forecasts of a 9.1% gain and shifting from a small drop in November.

The latest result also marked the strongest growth in outbound shipments since December 2022, boosted by robust demand from the US and China. For the full year, exports grew by 2.8%.

We’re watching gold…

Gold is also of the ‘let’s steady this ship’ mould on Wednesday, comfy at circa $2,025 an ounce.

The sideways trading range so far this week means we haven’t blown ourselves up, so there’s an upside to sideways.

Traders are basically treading water until key US economic data, including PMI, GDP and PCE inflation figures, point the way.

And in the States…

Gold does have a vulnerability to this stonkingly resilient US economy and no one likes the hawkish Fed signals from various officials of late.

US markets now see a less than 50% chance of a Fed rate cut in March, down significantly from a near two-thirds chance seen a week ago. We’ll find out next week.

The Dow Jones Industrial Average fell off its I’m better than you perch last night, putting it’s record-breaking high back in the to do bucket s as traders ummed and ahhed through a different bucket of corporate earnings.

The blue-chip index lost almost 100 points, or 0.25%, retreating below the 38,000 level it crossed for the first time on Monday.

Next door, the S&P 500 rose by 0.3% to a sprightly new all-time closing high. And our lady of the technology-heavy Nasdaq advanced 0.45%. Because that’s how she rolls now.

In US corporate babble, the 30-stock Dow was clipped from the get go by an 11% fall for 3M on disappointing guidance. Johnson & Johnson fell 1.6% on the same but for reporting earnings.

Homebuilder D.R. Horton dropped more than 9% after also missing consensus and Lockheed Martin gave up 5% following a crap outlook.

Better in planes was last week’s nightmare child, United Airlines, which took off about 5% after dropping desperately needed Q4 strength.

However, UA knows there’s first-quarter loss in the post after the re-grounding of its very ordinary Boeing 737 Max 9s, the model involved in the Alaska Airlines emergency earlier this month. And others.

Finally, Netflix was the latest to report after the bell, topping Wall Street’s revenue expectations. Netflix now has 260.8 million paid subscribers, a new record for the service.

But investors are deliberating how long the gains can persist, especially as the rally this year has centred around technology stocks such as Nvidia, lacking broader participation.

But don’t look to me for justice – this month alone, Nvidia is up 20%. In contrast, the Small Cap Russell 2000 is lower by more than 2%.

US traders are also awaiting two key economic data releases later in the week. The preliminary fourth-quarter gross domestic product figure is due Thursday, followed by the Commerce Department’s closely watched personal consumption expenditures price index for December on Friday.

As I wrote on Monday, like a prophet of profit – the big technology names remain a focus later in the week, with IBM and Tesla slated for Wednesday and Intel expected Thursday.

We’re also watching commodities…

Oil prices are doing well on the stability front, given the startling Middle East signals I’m watching and the consequent crash tackle these might do for supply disruptions. At any time.

The West Texas Intermediate contract and Brent crude are slightly higher.

These fluctuations were influenced by events like Israel proposing a Gaza ceasefire, rejected by Hamas, then some 21 IAF soldiers being killed in one action and then there’s the supply threats posed by increasingly cunning Ukrainian drones and the increasingly ‘what’evs’ attacks (are we the allies?) on Yemen airstrikes.

Cold weather reduced US oil production in North Dakota by 400,000 barrels per day, but Libya restarted production at the Sharara oilfield, adding 300,000 barrels per day.

So. Yeah. Oil prices are actually steady.

The absence of a bottom in nickel prices is expected to result in a bunch of mine closures, BTW, further solidifying Indonesia’s position as a dominant player in the global supply of nickel.

The price decline, more than 40% over the past 12 months, is largely ‘cos of increased nickel supply from Indonesia, coinciding with diminished demand growth.

Bloomberg reckons that Indonesian projects are better equipped to withstand the effects of declining nickel prices due to their flexibility.

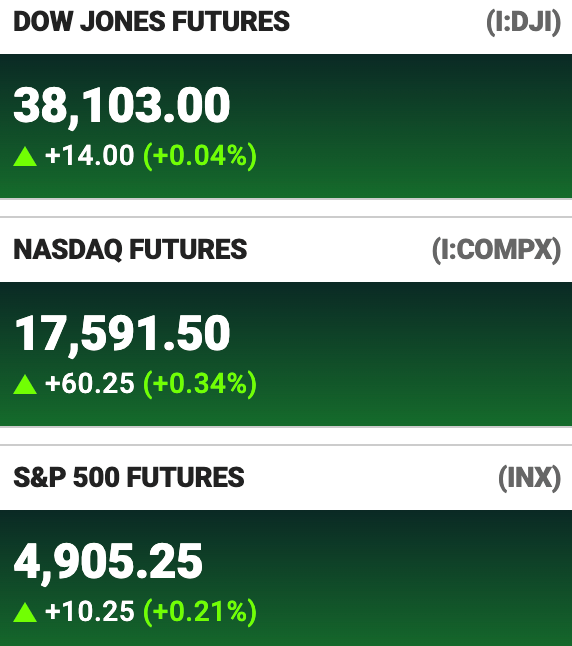

US stock futures were higher by a wee bit at 3pm in Sydney.

Finally Bitcoin has lost 15% of its BTC’ness over the past couple of weeks, with some investors capitalising on the recent launch of bitcoin exchange-traded funds (ETFs) to realise profits and exit their positions in the volatile cryptocurrency.

Overnight, the price fell below $39,000 for the first time since early December, before showing a partial recovery during afternoon trading, while ETH is down -4.25% and the rest of the market’s all over the place as well.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| YPB | YPB Group Ltd | 0.002 | 100% | 3,040,000 | $790,461 |

| RMX | Red Mount Min Ltd | 0.003 | 50% | 1,772,288 | $5,347,152 |

| TMR | Tempus Resources Ltd | 0.007 | 40% | 7,425,892 | $3,451,450 |

| NPR | Newmark Property | 1.325 | 37% | 2,801,075 | $176,198,848 |

| TFL | Tasfoods Ltd | 0.03 | 36% | 27,892 | $9,616,101 |

| FG1 | Flynngold | 0.071 | 34% | 4,169,335 | $7,723,385 |

| EDE | Eden Inv Ltd | 0.002 | 33% | 16,053,907 | $5,517,407 |

| SRN | Surefire Rescs NL | 0.012 | 33% | 31,501,138 | $17,668,420 |

| HTG | Harvest Tech Grp Ltd | 0.017 | 31% | 707,748 | $9,177,523 |

| HT8 | Harris Technology Gl | 0.013 | 30% | 408,251 | $2,991,355 |

| IPB | IPB Petroleum Ltd | 0.014 | 27% | 3,972,874 | $6,216,347 |

| CPO | Culpeominerals | 0.048 | 26% | 4,222,129 | $5,160,048 |

| AL8 | Alderan Resource Ltd | 0.005 | 25% | 13,296,334 | $4,427,445 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 237,530 | $12,000,000 |

| NAE | New Age Exploration | 0.005 | 25% | 1,481,689 | $7,175,596 |

| AUZ | Australian Mines Ltd | 0.011 | 22% | 40,414,524 | $8,505,444 |

| HXG | Hexagon Energy | 0.012 | 20% | 2,020,540 | $5,129,159 |

| IBG | Ironbark Zinc Ltd | 0.006 | 20% | 1,233,333 | $7,969,363 |

| SIT | Site Group Int Ltd | 0.003 | 20% | 5,035,914 | $6,506,226 |

| XRG | Xreality Group Ltd | 0.031 | 19% | 93,592 | $13,884,822 |

| TG1 | Techgen Metals Ltd | 0.056 | 19% | 298,111 | $4,517,550 |

| APX | Appen Limited | 0.335 | 18% | 8,908,062 | $62,483,933 |

| DEL | Delorean Corporation | 0.035 | 17% | 196,122 | $6,471,627 |

| KFM | Kingfisher Mining | 0.14 | 17% | 86,983 | $6,445,800 |

| CDT | Castle Minerals | 0.007 | 17% | 140,562 | $7,346,958 |

Newmark Property REIT was charging hard at the top of the Small Caps ladder Wednesday, up more than 38% on news that it has entered into a Bid Implementation Deed that will see BWP Management lock in an off-market, 100% takeover, as part of a proposed all-scrip merger between the pair.

It’s an almost-impossible-to-turn-down transaction, with BWP happy to cough up 0.40 BWP units per NPR security, to meet an implied value of $1.39 per NPR security – which is a thunderous 43.1% premium to its closing price yesterday at $0.97 a pop.

Meanwhile, Surefire Resources (ASX:SRN) hit a home run in the lab, with the company claiming a breakthrough pre-treatment and leach process that has allowed it to extract 91% of vanadium and 88% of titanium directly from Victory Bore magnetite concentrate.

It’s big news for Surefire, and stems from the company’s strategy of teaming up with METS Engineering in May last year, specifically to look into developing a better method of extraction, specifically for vanadium – as it appears that the ”unexpected extraction” of titanium during the process is a surprise bonus for the team.

The process is, as you’d expect, commercial in confidence – so, the specifics aren’t going to be made public just yet – and Surefire says it is subject to a Provisional Patent protection and remains solely the company’s IP.

Market minnow Eden Innovations (ASX:EDE) banked a 33.3% jump on the heels of a positive quarterly, which talked up “interest from a large multi-national company” in the company’s patented, core pyrolysis tech to make hydrogen and carbon nanotubes from natural gas without all that pesky CO2 as a by-product.

Eden reports that revenue for December quarter for its EdenCrete product is up 8% on PCP, however sales of its OptiBlend have fallen dramatically, down -93% – with a caveat that there are some significant sales negotiations underway in India at the moment.

And online retailer Harris Technology (ASX:HT8) has dropped its quarterly with the news that it has generated sales revenue of $4.9m through the December quarter, with thanks to an “increased contribution from the Household and Seasonal categories in line with the busy retail season through Black Friday, Christmas and Boxing Day”.

That was enough to drive a net operating cash inflow of $235,000 for the quarter, marking the second consecutive quarter and just pipping the previous three-month result of $226,000.

Later in the day, Harvest Technology Group (ASX:HTG) spiked on news that its received both second and third orders for its Nodestream technology from its significant Five-Eyes defence customer, in the total amount of approximately $380,000 – which has reportedly been paid up-front, and in cash.

And Flynn Gold (ASX:FG1) enjoyed a late surge after lunch, after the results from an Extraordinary General Meeting were published, days out from the extended deadline of the company’s in-progress share purchase plan.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.001 | -50% | 14,977,218 | $9,833,237 |

| DXN | DXN Limited | 0.001 | -33% | 1,000,000 | $3,230,010 |

| JAV | Javelin Minerals Ltd | 0.001 | -33% | 600,000 | $2,450,593 |

| NAN | Nanosonics Limited | 2.915 | -33% | 7,885,293 | $1,323,364,334 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | 1,200,600 | $15,569,766 |

| VAL | Valor Resources Ltd | 0.003 | -25% | 1,825,245 | $16,693,339 |

| ESR | Estrella Res Ltd | 0.0045 | -25% | 111,602 | $10,556,231 |

| HTA | Hutchison | 0.031 | -21% | 211,779 | $529,327,835 |

| IRX | Inhalerx Limited | 0.02 | -20% | 4,615 | $4,744,174 |

| 88E | 88 Energy Ltd | 0.004 | -20% | 10,982,471 | $123,627,103 |

| INP | Incentiapay Ltd | 0.004 | -20% | 99,141 | $6,388,573 |

| PRX | Prodigy Gold NL | 0.004 | -20% | 275,550 | $8,755,539 |

| WBE | Whitebark Energy | 0.015 | -17% | 550,300 | $2,947,358 |

| WEL | Winchester Energy | 0.0025 | -17% | 901,167 | $3,061,266 |

| AKN | Auking Mining Ltd | 0.035 | -15% | 431,140 | $9,444,502 |

| X2M | X2M Connect Limited | 0.035 | -15% | 57,998 | $8,615,259 |

| CCO | The Calmer Co Int | 0.006 | -14% | 778,861 | $6,002,466 |

| MOM | Moab Minerals Ltd | 0.006 | -14% | 445,958 | $4,983,744 |

| RAS | Ragusa Minerals Ltd | 0.03 | -14% | 437,162 | $4,990,958 |

| 1TT | Thrive Tribe Tech | 0.013 | -13% | 16,239 | $4,449,323 |

| CRR | Critical Resources | 0.013 | -13% | 6,184,807 | $26,667,754 |

| COD | Coda Minerals Ltd | 0.1 | -13% | 214,778 | $16,372,708 |

| BUY | Bounty Oil & Gas NL | 0.007 | -13% | 204,991 | $11,988,008 |

| BXN | Bioxyne Ltd | 0.014 | -13% | 796,422 | $30,426,326 |

| ME1 | Melodiol Glb Health | 0.001 | -50% | 14,977,218 | $9,833,237 |

TRADING HALTS

Merchant House (ASX:MHI) – pending an announcement to the market in relation to a material asset sale from the Company’s subsidiary, Footwear Industries of Tennessee.

Cassius Mining (ASX:CMD) – pending an announcement by the Company in relation to a capital raising.

Papyrus Australia (ASX:PPY) – pending an announcement to be made to the market regarding a Share Sale & Purchase Agreement.

Matador Mining (ASX:MZZ) – “Out of an abundance of caution related to the remediation of a government clerical error relating to the status of a few of Matador’s tenements in Newfoundland.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.