Closing Bell: The property boom is over, long live the lithium boom!

Pic: Getty

- ASX Emerging Companies (XEC) Index is about 0.3% higher ahead of the close on Friday

- Iron ore maintains US$150, AUD falls back under 75 cents

- Major movers today: RiversGold (ASX:RGL), Latin Resources (ASX:LRS)

The ASX200 looks like closing slightly higher on Friday, while the small cap index is headed for a 0.3% gain.

Lithium stocks are doing their bit on Friday, in the wake of an update from producer Allkem suggesting the June quarter average price for lithium carbonate was looking like topping $US35K per tonne. That’s growth of the high and fast kind.

The materials sector as a whole is anchoring some very volatile trading. The ASX200 has passed in and out of negative territory four times today.

Iron ore futures have taken a small step back – although holding above $US150 a tonne, spot gold is loitering with intent at around $US1940 an ounce, while the Aussie dollar-buck has dipped back under the US75 cents.

Property watch: Watch property

More property huff and puff out today – although now I’ve belittled the flow of data, this time the stuff’s not bluff.

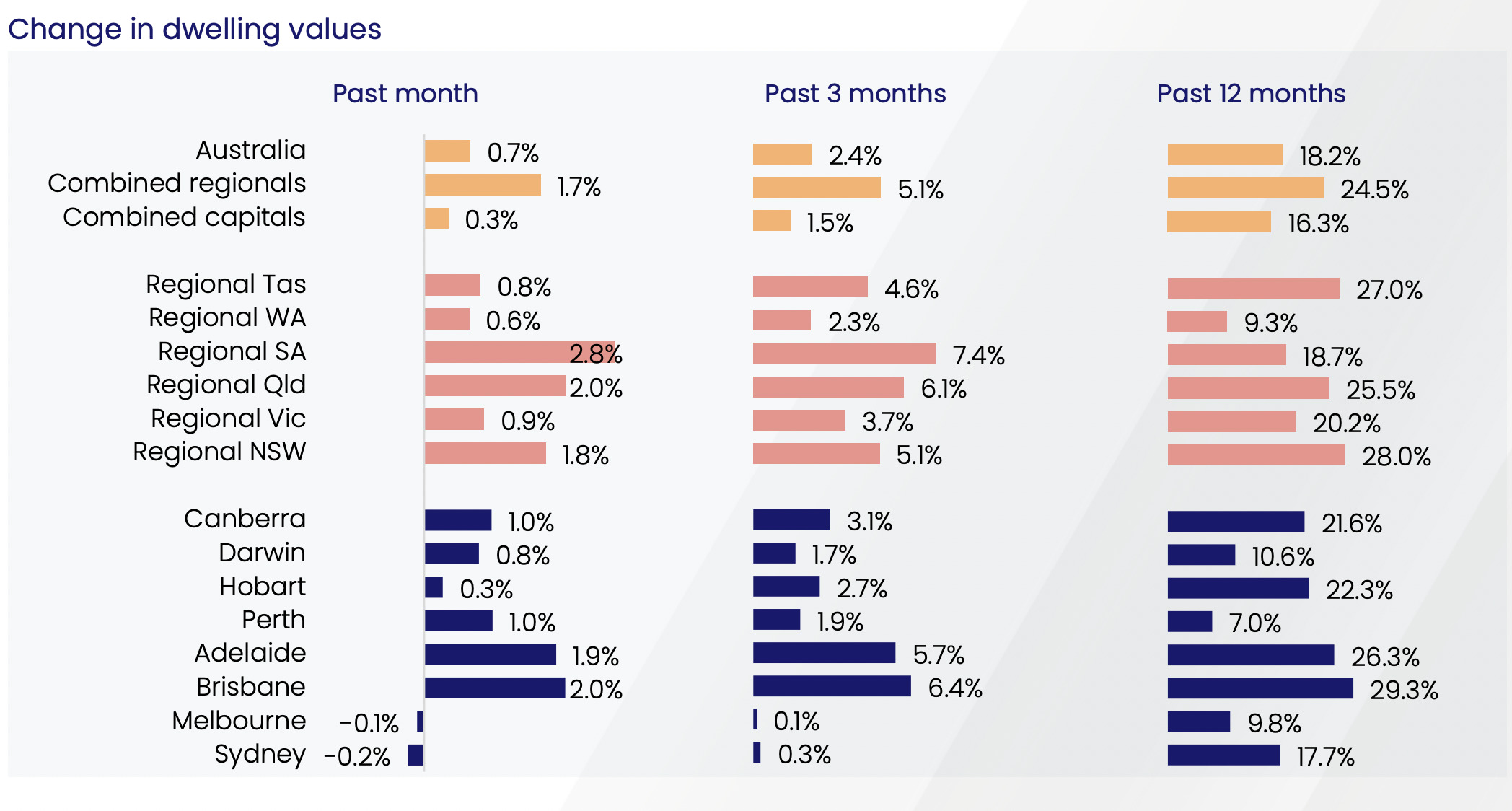

So, a recap: Aussie house prices have jumped over 18% since this time last year, that’s the country’s biggest ever annual increase.

That run could be done, according to the Bureau of Stats (ABS), which says new home loans fell by 3.7% in February, but is still up 12.6% on this time last year. The total value of home loans eased from it record high of $33.5 billion in January to $32.3 billion in February.

House prices are certainly toppy as they turn the ’22 corner but alongside today’s monthly house values read from CoreLogic, it seems pretty clear both the pace of home lending growth is slowing and national home values are reaching their cyclical peak.

The March numbers out of CoreLogic show the Sydney and Melbourne housing boom could be done. Both cities fell as one for the first time in 18 months, prompting one leading commentator (me) to write about the end of the boom sometime tomorrow.

IbisWorld says the local property market is teetering (my words) on a volatile (their words) price cliff as the telegraphed rate hikes and a bunch of other conditions strike deadly indifference into the sector. The research firm says our house prices will fall by 5.2% this calendar year with hotspots in Sydney’s inner suburbs predicted to fall by as much as 9.2%.

Outlook: Look out

AMP Capital says average national house prices will peak later this year as interest rates rise.

Then we should be back in ‘a cyclical downswing’ with a combo of poor affordability pricing more and more home buyers opting out of the market.

The evidence, according to chief economist Dr Shane Oliver, is rising fixed mortgage rates, which are up more than 75% from their lows last year and are still rising. And this is also convincing from the man:

“The RBA likely to start hiking rates in June likely pushing variable mortgage rates up by nearly 1% by year end; high inflation which will make it even harder to save for a deposit; higher supply in Sydney and Melbourne as a result of vendors seeking to take advantage of high prices and solid construction after two years of zero immigration; and a rotation in consumer spending back towards services as reopening continues which may reduce housing demand.”

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Description | Price | % | Volume |

|---|---|---|---|---|

| YPB | YPB Group Ltd | 0.002 | 100% | 10,277,971 |

| PUR | Pursuit Minerals | 0.029 | 53% | 34,808,585 |

| LRS | Latin Resources Ltd | 0.1425 | 52% | 123,784,673 |

| MM1 | Midasmineralsltd | 0.23 | 39% | 431,582 |

| JAV | Javelin Minerals Ltd | 0.002 | 33% | 1,270,025 |

| RGL | Riversgold | 0.093 | 33% | 73,948,976 |

| MLS | Metals Australia | 0.14 | 27% | 21,812,874 |

| ENT | Enterprise Metals | 0.019 | 27% | 10,511,124 |

| LPI | Lithium Pwr Int Ltd | 0.905 | 27% | 13,689,484 |

| VR8 | Vanadium Resources | 0.1025 | 25% | 29,072,004 |

| GES | Genesis Resources | 0.016 | 23% | 851,716 |

| AJL | AJ Lucas Group | 0.07 | 23% | 24,555,607 |

| MRQ | Mrg Metals Limited | 0.011 | 22% | 37,481,240 |

| RXH | Rewardle Holding Ltd | 0.011 | 22% | 1,011,726 |

| XTC | Xantippe Res Ltd | 0.011 | 22% | 311,534,751 |

| CVV | Caravel Minerals Ltd | 0.345 | 21% | 1,620,422 |

| PIL | Peppermint Inv Ltd | 0.018 | 20% | 13,687,051 |

| RLC | Reedy Lagoon Corp. | 0.036 | 20% | 11,204,227 |

| WCN | White Cliff Min Ltd | 0.03 | 20% | 54,473,983 |

| KEY | KEY Petroleum | 0.003 | 20% | 3,226,521 |

| NZS | New Zealand Coastal | 0.006 | 20% | 8,944,182 |

| ESS | Essential Metals Ltd | 0.575 | 20% | 11,006,576 |

| MHK | Metalhawk. | 0.335 | 20% | 361,031 |

| CZL | Cons Zinc Ltd | 0.037 | 19% | 6,586,061 |

| IRX | Inhalerx Limited | 0.115 | 19% | 941,262 |

Another day, another lithium acquisition, another share price gain.

Lithium explorer White Cliff Minerals (ASX:WCN) will pay $120,000 in cash and shares for the ~250sqkm ‘Abraxis’ lithium project, a proverbial stone’s throw from some big lithium mines in the WA Pilbara.

Abraxis – which WCN says is “prospective for lithium bearing pegmatites but remains significantly underexplored” – bolsters the company’s existing early-stage lithium and REE project portfolio in WA.

A field mapping and sampling program will kick off in the coming weeks, it says. The company is up 60% year to date. The company is trading around 16% higher on Friday.

Upon the same theme, the aptly named RiversGold (ASX:RGL) is up some 80% since spotting another high-grade lithium prospect at its ‘Tambourah’ project near WCN earlier this week.

RGL now has two prospects on the go; the existing ‘Ragdoll’ and newly identified ‘Bengal’ prospect.

“Our field crew will be assessing the Bengal prospect this week and will continue to work through the prospective 26km long mineralised corridor,” is the word from CEO Julian Ford.

And rounding us out, Latin Resources (ASX:LRS) is up 51% on the sniff of spodumene.

The lithium explorer’s largest shareholder, Jose Luis Manzano, has exercised ~100m in options worth just over $1.2m.

Well done to Manzano, who now has a 13.4% interest in LRS. Just as the LRS market cap nears $200m and the stock is up well over 310% year-to-date.

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| EVE | EVE Health Group Ltd | 0.0015 | -25% | 502,876 |

| NTL | New Talisman Gold | 0.0015 | -25% | 1,385,075 |

| UUL | Ultima Utd Ltd | 0.2 | -22% | 600 |

| ICN | Icon Energy Limited | 0.015 | -21% | 3,712,608 |

| LKY | Locksleyresources | 0.135 | -18% | 197,875 |

| 9SP | 9 Spokes Int Limited | 0.005 | -17% | 4,188,332 |

| GGX | Gas2Grid Limited | 0.0025 | -17% | 2,304,333 |

| SIH | Sihayo Gold Limited | 0.005 | -17% | 400,200 |

| TYX | Tyranna Res Ltd | 0.005 | -17% | 319,853 |

| VPR | Volt Power Group | 0.0025 | -17% | 650,393 |

| SPA | Spacetalk Ltd | 0.115 | -15% | 102,577 |

| MBK | Metal Bank Ltd | 0.006 | -14% | 7,335,116 |

| IPB | IPB Petroleum Ltd | 0.02 | -13% | 695,823 |

| CLT | Cellnet Group | 0.035 | -13% | 1,466,195 |

| HHR | Hartshead Resources | 0.021 | -13% | 348,406 |

| ZGL | Zicom Group Limited | 0.075 | -12% | 8,300 |

| OXX | Octanex Ltd | 0.024 | -11% | 1,000 |

| AHN | Athena Resources | 0.008 | -11% | 2,373,831 |

| ESH | Esports Mogul Ltd | 0.004 | -11% | 2,085,113 |

| KFE | Kogi Iron Ltd | 0.008 | -11% | 1,611,884 |

| KP2 | Kore Potash PLC | 0.025 | -11% | 10,070,728 |

| AIS | Aeris Resources Ltd | 0.1475 | -11% | 8,031,331 |

| ELS | Elsight Ltd | 0.425 | -11% | 301,392 |

| W2V | Way2Vatltd | 0.052 | -10% | 167,699 |

| E33 | East 33 Limited. | 0.09 | -10% | 54,368 |

The waste water treatment company De.mem (ASX:DEM) is tracking almost 5% lower after it finalised its acquisition of Stevco Seals & Pumps Victoria.

De.mem’s snapped up three businesses since 2019 as part of its value-add strategy including De.Mem-Capic in Western Australia, De.mem Pump-tech in Tasmania and De.mem-Geutec GmbH in Germany.

The company aid all three businesses had achieved significant growth since their acquisition despite the challenging business environment caused by the Covid-19 pandemic.

ANNOUNCEMENTS YOU MAY HAVE MISSED

On April Fool’s Day it’s been a brave time to finalise acquisitions. Construction giant Adbri (ASX:ABC) has announced finalisation of its $57 million acquisition of Zanow’s’ Concrete & Quarries.

Zanows operates a sand and gravel quarry, a hard rock quarry and two concrete plants in South East Queensland. It also has approval for an additional concrete plant in western Brisbane.

Chemicals supplier DGL Group (ASX:DGL), has finalised its purchase of RLA Polymers NZ, which provides construction adhesives for a range of industries.

As part of the deal, DGL today issued 363,924 fully paid ordinary shares to the vendors of RLA for $2.93 as part consideration. The shares are subject to a 12-month escrow and a further tasty cash payment of $3.45 million has been made to seal the deal.

Telco Swoop Holdings (ASX:SWP) has completed the acquisition of Dark Fibre Network and customers of Sydney-based provider Luminet. The $8 million purchase price comprises $6.4 million in cash and $1.6 million in Swoop shares.

TRADING HALTS

Sovereign Metals (ASX:SVM) – trading halt, pending an announcement regarding an updated Mineral Resource Estimate at Kasiya

LawFinance Limited (ASX: LAW) – trading halt, pending capital raising

Payright Limited (ASX: PYR) – trading halt, pending capital raising

RPM Automotive Group Limited (ASX: RPM) – trading halt, pending an announcement in relation to two acquisitions.

Domain Holdings Australia Limited (ASX: DHG) – trading halt, pending capital raising

Ozgrowth Limited (ASX:OZG) – trading halt, pending capital raising

Berkeley Energia Limited (ASX:BKY) – trading halt, pending an announcement regarding the settlement of litigation

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.