Closing Bell: The ASX is spectacularly flat on Monday

Via Getty

- The ASX benchmark has been a bit of a pushover on Monday

- Energy Sector makes sunshine-hay

- Small caps led by LTR Pharma and West Cobar Metals

Local markets have gently and casually ambled their way to a dead heat/tie/draw… whatever on Monday.

Which does make one sometimes wonder why we all got out of bed.

At 4pm on Monday December 11, the S&P/ASX 200 (XJO) index was up 0.4 points, or +0.0056%. That’s flat, as.

It looks rather like the punters are playing it straight to start the week – one which has ahead of us more show-stopping interest rate calls for the monetary policy teams at several of the big global central banks this week.

The calls, which traders reckon are worth waiting on, before deciding where to put the sideline cash – the US Federal Reserve, the European Central Bank (ECB) and the Bank of England (BoE).

At home on Monday, there was little to love as early broad-based gains began to trade with a narrower band almost immediately.

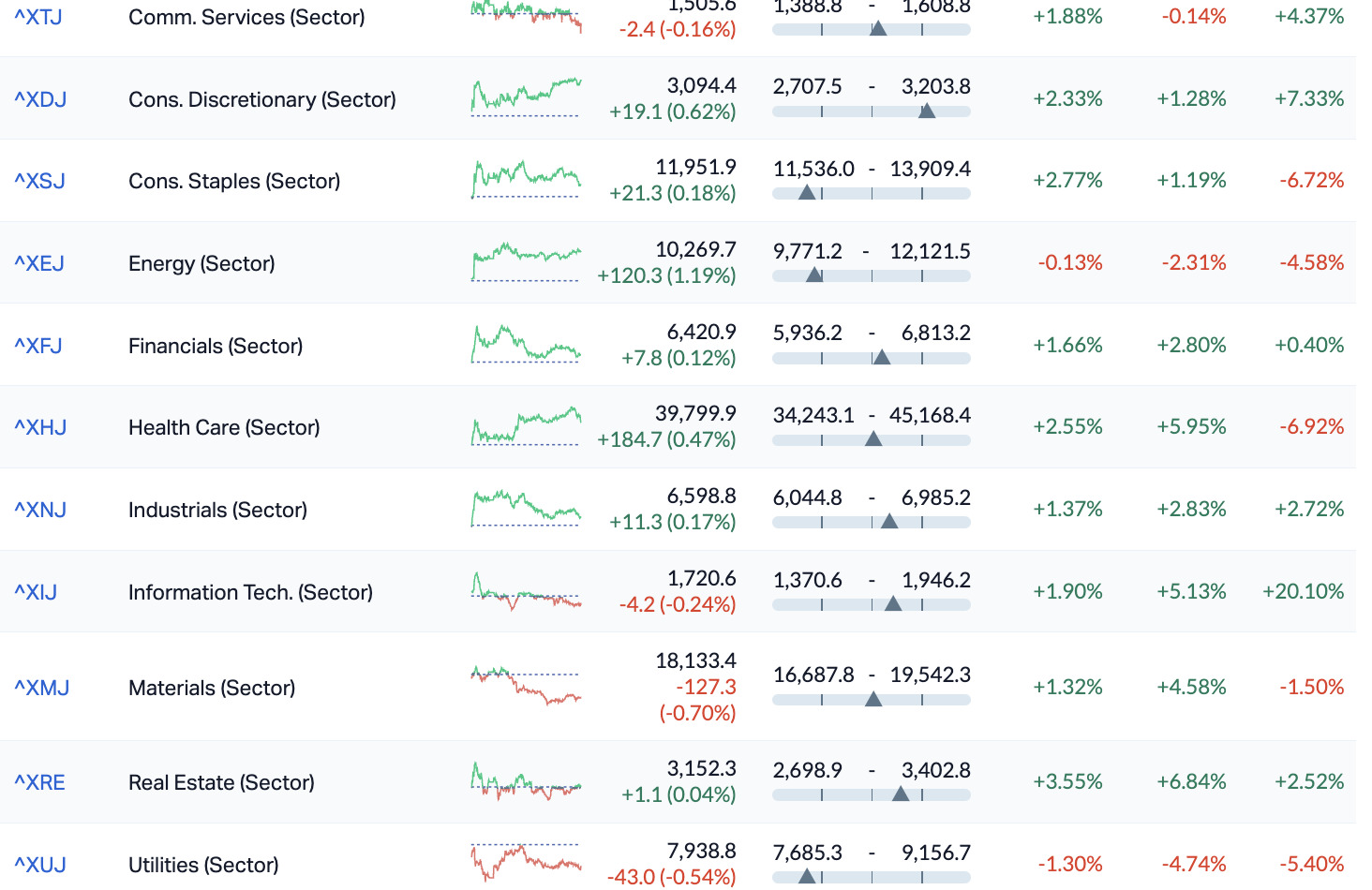

The IT Sector, Utilities and Property stocks have all sounded the retreat.

ASX Sectors on Monday

Around the bourse…

It’s transformational-merger-time for local Heathcare Sector leader Sigma Healthcare (ASX:SIG), which says it’s got a green light love-in with Chemist Warehouse – almost certainly dragging the retail pharmacy onto the bourse to create what SIG says would be a near $9bn vertical health giant, capable of pulling in some $3bn in revenue in just Year One of operations.

Sigma owns health retail brands like Amcal and PharmaSave.

The money flows would be largely toward Chemist Warehouse’ key stakeholders who secure 85.75% of the merged company – the founders – Jack Gance and Mario Verrocchi (or specifically, their families), enjoying a 49% stake worth circa $2bn a piece.

The families would also receive a $700 million cash payment up front.

In other random – but exciting – company news veggie maker Costa Group Holdings (ASX:CGC) warned investors of a likely dip in earnings for the FY with lower prices and bad weather not quite baked in.

They are a little bit now – CGC is down almost -3% at the time of writing.

“With the knowledge of actual trading since August 2023 including the finalisation of both the northern and southern citrus crops and Costa’s current outlook for the remainder of CY23, Costa now expects the full year EBITDA-S result to be below CY22,” the company told the ASX on Monday.

CGC told shareholders a few months ago that earnings were headed up, not down.

Costa is down -4%.

Elsewhere, on the big cap list of cyclical stock sufferers on Monday – IDP Education (ASX:IEL) (-.3.7%), Infratil (ASX:IFT) (- 2.5%) and the overbought goldie Northern Star Resources (ASX:NST) leading the bleeding.

And naturally we’re watching oil…

Meantime, after crude oil futures surged 2.5% on Friday, the ASX Energy Sector (XEJ) index was gifted a way back from the Doghouse it’s been in this last quarter, and it’s been trying to play catch up from the pretty calamitous market ructions still shaking old school energy stocks.

All that is except for Santos.

Napoleon’s large cap ASX vanguard putting the spinse back into local energy names were led by Allkem (ASX:AKE) (up +3.5%), Mercury NZ (ASX:MCY) (up +2.4%), Woodside Energy Group (ASX:WDS) (up +1.5 per cent) as well as Meridian (ASX:MEZ) (up 1.6%) led the large-cap stocks as crude oil futures rose slightly after surging 2.5 per cent on Friday.

West Texas Intermediate (WTI) has nudged US$71.7 per barrel on Monday, up for a second straight session, despite signs of a structural weakening in market fundamentals – mainly there’s a glut which we ain’t calling a glut.

That’s weighing on market sentiment… but not mine. I reckon cheaper petrol prices could work for Chrissy this Christmas.

The US government has sought up to 3 million barrels for strategic reserves for delivery in March 2024. Still, oil prices have come off a seven-week losing streak, the longest since 2018, amid signs of increasing global supplies and weakening demand.

Despite OPEC+’s pledge to cut 2.2 million barrels per day in the first quarter of 2024, traders remain skeptical it would have a significant impact on the market as production in non-OPEC countries continued to grow.

Naturally we’re watching gold…

And spot prices are back taking a look around the US$2,000 an ounce mark on Monday, down circa -0.4% at US$1,996.

Not an all out tragedy, but the precious metal is a little less precious now it’s back around its lowest levels in more than two weeks.

Cheap as China…

Over the weekend, China’s consumer prices (CPI) fell 0.5% year on year (during November), easily double the 0.2% drop of October, and absolutely whaling on the consensus -0.1% forecast.

It was three years to the month since a decline of that size and pace was last felt. That was China’s CPI read of November 2020, a historic pandemic-induced shocker in its own right. This time it was the bottom falling out of food prices – down the most in over two years due to collapsing pork prices.

China is the world’s only nation with a strategic pork reserve.

Oh. And China’s producer prices (PPI) also fell by a monstrous -3.0%. A 15th straight monthly decline.

Traders are also looking ahead to US inflation data, which could further seal the deal on interest rate trading.

In the States…

The three major US indices closed higher on Friday and were ahead for a sixth straight week following the Goldilocksier-than-expected US jobs data, which balanced the view that the Fed could start cutting rates by March 2024.

Data from November showed that nearly 200,000 jobs were added to the US economy, firmly above market expectations of a 180,000 net gain. Additionally, the unemployment rate unexpectedly retreated and wage growth persisted at an elevated rate, while the labor force also increased.

Whatevs. It’s all about what happens this week with The Fed.

Futures tied to the 3 major US indices are almost at universal parity ahead of the Thursday open in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NZS | New Zealand Coastal | 0.002 | 100% | 1,070,997 | $1,667,010 |

| LTP | LTR Pharma Ltd | 0.38 | 90% | 9,684,040 | $14,081,098 |

| ADS | Adslot Ltd | 0.003 | 50% | 189,995 | $6,448,991 |

| AVM | Advance Metals Ltd | 0.003 | 50% | 1,000,000 | $1,585,265 |

| CT1 | Constellation Tech | 0.003 | 50% | 50,000 | $2,942,401 |

| IVX | Invion Ltd | 0.006 | 50% | 2,962,231 | $25,686,529 |

| WC1 | West Cobar Metals | 0.075 | 39% | 5,174,805 | $6,257,538 |

| AVW | Avira Resources Ltd | 0.002 | 33% | 200,000 | $3,200,685 |

| GGE | Grand Gulf Energy | 0.0105 | 31% | 34,897,028 | $16,761,976 |

| ILA | Island Pharma | 0.085 | 29% | 63,061 | $5,363,719 |

| NTM | NT Minerals Limited | 0.009 | 29% | 522,766 | $6,019,320 |

| CXU | Cauldron Energy Ltd | 0.019 | 27% | 10,544,692 | $16,982,452 |

| NPM | Newpeak Metals | 0.019 | 27% | 91,513 | $1,499,276 |

| EDE | Eden Inv Ltd | 0.0025 | 25% | 2,500,592 | $7,334,027 |

| TMX | Terrain Minerals | 0.005 | 25% | 150,000 | $5,413,711 |

| YOJ | Yojee Limited | 0.005 | 25% | 5,786,554 | $5,223,941 |

| PGH | Pact Group Hldgs Ltd | 0.84 | 23% | 11,138,735 | $235,838,686 |

| ADRDA | Adherium Ltd | 0.033 | 22% | 5 | $8,998,935 |

| HXG | Hexagon Energy | 0.012 | 20% | 337,966 | $5,129,159 |

| BLU | Blue Energy Limited | 0.025 | 19% | 19,071,794 | $38,870,446 |

| TBNDA | Tamboran | 0.16 | 19% | 462,188 | $231,750,797 |

| MGA | Metals Grove Mining | 0.088 | 17% | 916,654 | $2,790,038 |

| MZZ | Matador Mining Ltd | 0.048 | 17% | 9,348,031 | $16,165,043 |

| NC1 | Nico Resources | 0.345 | 17% | 73,424 | $31,417,670 |

| BCK | Brockman Mining Ltd | 0.028 | 17% | 89,781 | $222,725,571 |

Leading the Small Caps winners list – and waaaay out ahead of the rest of the market – was debutante LTR Pharma (ASX:LTP), which made a stunning entrance on the ASX this morning to be up 70% in the space of a couple of hours, and closed out the day by cracking the ton, up 100%.

LTR Pharma’s immediate success can be pinned on the fact that it’s done what a lot of microcap pharmaceutical companies don’t do – and that’s come to the ASX with a developed, patent-protected product that makes immediate sense the moment it’s explained.

The company makes a product called Spontan, which looks like a nasal decongestant spray, but acts on an entirely different part of the male anatomy as a rapid, on-demand fix for erectile dysfunction.

The company is in the process of commercialising Spontan, it’s got a successful Phase I human proof of concept study under its belt – which indicates a 6x faster effect compared to oral administration of tablets like Viagra – and the company says it’s got a clear pathway to market, progressing to bioequivalence study with expedited regulatory filings in the US and Australia within 1-2 years.

The next two on the ladder are slightly curious – West Cobar Metals (ASX:WC1) and Cauldron Energy (ASX:CXU) have both banked better-than +30% gains, despite neither having any recent news that might explain why they’re moving that way today.

For what it’s worth, West Cobar did get a speeding ticket from the ASX, to which it responded with (words to the effect of) “nothing to see here… we’re also mystified” – but Cauldron seems to just be puddling along, well out in front of the rest of the small cappers with a big grin on its face.

The next best performer with actual news was Pact Group (ASX:PGH), which went sailing through +22.5% today because it’s the target of an off-market takeover that got very juicy this morning.

Bennamon Industries is the entity behind the bid, and today it announced that it really wants to buy Pact holus bolus – as indicated by Bennamon upping its per share offer from $0.68 cash per Pact share to $0.84 cash.

That’s a chunky 21% push in price, and quite a sizeable step up from Pact’s previous closing price – whether it’s going to be enough to entice the required number of shareholders over the line remains to be seen.

And a couple of short bursts to round out the list: MetalsGrove Mining (ASX:MGA) is up on news that the company has entered into a strategic agreement to acquire six new lithium claims in Zimbabwe, while Grand Gulf Energy (ASX:GGE) rose sharply on news that the Jesse-1A well has unexpectedly flowed significant helium to surface at concentrations consistent with the previous downhole sample of 1% helium.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| SCL | Schrole Group Ltd | 0.15 | -42% | 10,151 | $9,348,312 |

| JAVDF | Javelin Minerals Ltd | 0.002 | -33% | 644,990 | $2,836,246 |

| WEL | Winchester Energy | 0.002 | -33% | 4,378,319 | $3,061,266 |

| WEC | White Energy Company | 0.04 | -31% | 265,628 | $3,967,559 |

| RNO | Rhinomed Ltd | 0.028 | -30% | 1,542,479 | $11,428,788 |

| AOA | Ausmon Resorces | 0.003 | -25% | 250,000 | $4,027,997 |

| FAU | First Au Ltd | 0.003 | -25% | 1,841,812 | $6,647,973 |

| M4M | Macro Metals Limited | 0.003 | -25% | 15,000,000 | $9,868,311 |

| SIS | Simble Solutions | 0.003 | -25% | 350,000 | $2,411,803 |

| M2M | Mt Malcolm Mines NL | 0.025 | -22% | 569,725 | $3,274,992 |

| PTX | Prescient Ltd | 0.072 | -20% | 6,211,836 | $72,478,781 |

| LNU | Linius Tech Limited | 0.002 | -20% | 14,350,000 | $11,305,727 |

| RVS | Revasum | 0.14 | -18% | 177,155 | $20,165,313 |

| G50 | Gold50Limited | 0.125 | -17% | 67,303 | $16,393,500 |

| BXN | Bioxyne Ltd | 0.01 | -17% | 2,000,000 | $22,819,745 |

| CNJ | Conico Ltd | 0.005 | -17% | 468,518 | $9,420,570 |

| RDS | Redstone Resources | 0.005 | -17% | 14,691 | $5,528,271 |

| SKN | Skin Elements Ltd | 0.005 | -17% | 3,477,007 | $3,536,917 |

| YAR | Yari Minerals Ltd | 0.01 | -17% | 4,224,014 | $5,788,294 |

| TGM | Theta Gold Mines Ltd | 0.105 | -16% | 14,695 | $88,259,376 |

| FRX | Flexiroam Limited | 0.021 | -16% | 62,939 | $16,515,180 |

| AI1 | Adisyn Ltd | 0.022 | -15% | 125,249 | $4,154,472 |

| LRS | Latin Resources Ltd | 0.2125 | -15% | 27,824,566 | $693,201,550 |

| ADX | ADX Energy Ltd | 0.098 | -15% | 2,101,110 | $47,389,866 |

| IMR | Imricor Med Systems | 0.47 | -15% | 111,018 | $92,904,974 |

TRADING HALTS

Rimfire Pacific Mining (ASX:RIM) – pending an announcement by the Company to the market regarding a capital raising.

Elixir Energy (ASX:EXR) – pending an announcement by the Company with respect to a capital raising.

Technology Metals Australia (ASX: TMT) – pending an announcement to the market in relation to a merger with Australian Vanadium.

Australian Vanadium (ASX: AVL) – See above.

Investigator Resources (ASX: IVR) – pending an announcement by the Company to the market regarding a capital raising.

Sunstone Metals (ASX: STM) – pending an announcement by the Company to the market regarding a capital raising.

PharmAust (ASX:PAA) – pending an announcement by the Company to the market regarding a capital raising.

Infinity Mining (ASX: IMI) – pending an announcement by the Company to the market regarding a capital raising.

Compumedics (ASX:CMP) – pending an announcement about correspondence received from a China-based distributor regarding additional MEG orders.

Talisman Mining (ASX: TLM) – pending an announcement in relation to exploration results at

the Company’s Lachlan Copper-Gold Project in NSW.

Sacgasco (ASX:SGC) – pending an announcement to the market in relation to an update by the Company regarding the divestment of its Filipino operations.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.