Closing Bell: The ASX 200 rises Part Deux

Via Getty

- ASX closes 5,5% higher than Monday night

- Small cap index finds 1.3%

- AD1 up 40% on zilch

That’ll do pig, that’ll do.

I’m pretty sure everyone gets the above reference to George Miller’s classic outcast movie Mad Babe, a real slow burn Aussie classic about a rogue pig in car investing in a post-pandemic ASX 200 over the long-term, only to die of getting eaten by bored, hungry small cap (up 1.3% today) loving investors who have no patience for waiting some-two-and-a-half years for the benchmark to do something interestingly upward.

The top 200 companies on the local market were ahead about 5.5% since Tuesday morning. Tech is the sector providing the best vector, up about 3.6%.

More reason to recognise the value of a decent holiday: the Hang Seng has gone insane in the membrane on Wednesday, expressing the pent up excitement of watching from the sidelines as the major US indices rocked on up for a second straight session.

In Honkers the Hang Seng is still a good 5.3% higher while the Hang Seng China Enterprises (fairly smashed of late) gained 5.7% and the Hang Seng TECH index soared 7% higher – all revivified after taking a knee opn Tuesday for the Autumn break only to come back to the office to find the tech-heavy Nasdaq back to its electric best, 3.3% higher last night, to go with the 2.6% it collected on Monday.

Stateside, the Dow Jones Industrial Average also jumped 2.8%, while the broader S&P 500 found another 3%.

Around the traps Japanese and Korean indices are only slightly higher while mainland Chinese markets are closed for the Golden Week Lock Up.

Oil prices are doing their pre-OPEC+ meeting greeting: Brent and WTI crude both gaining well over 3% in anticipation of bad news.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.002 | 100% | 4,566,837 | $15,102,574 |

| JAV | Javelin Minerals Ltd | 0.0015 | 50% | 552,527 | $9,454,153 |

| LEL | Lithium Energy | 1.145 | 49% | 3,792,283 | $46,315,500 |

| QXR | Qx Resources Limited | 0.067 | 34% | 57,395,190 | $42,968,116 |

| PRM | Prominence Energy | 0.002 | 33% | 5,122,000 | $3,636,913 |

| SRK | Strike Resources | 0.115 | 31% | 2,572,493 | $23,760,000 |

| FBR | FBR Ltd | 0.056 | 30% | 28,214,445 | $121,900,843 |

| NVU | Nanoveu Limited | 0.013 | 30% | 6,293,496 | $2,332,703 |

| EXL | Elixinol Wellness | 0.032 | 28% | 171,396 | $7,906,639 |

| LIO | Lion Energy Limited | 0.037 | 28% | 1,264,630 | $12,357,196 |

| HMG | Hamelingoldlimited | 0.145 | 26% | 62,365 | $12,650,000 |

| GGE | Grand Gulf Energy | 0.02 | 25% | 9,649,225 | $24,745,771 |

| MGG | Mogul Games Grp Ltd | 0.0025 | 25% | 16,334 | $6,526,882 |

| NWM | Norwest Minerals | 0.041 | 24% | 564,805 | $7,329,544 |

| AD1 | AD1 Holdings Limited | 0.021 | 24% | 438,835 | $11,912,432 |

| BPM | BPM Minerals | 0.135 | 23% | 71,055 | $6,151,444 |

| BUR | Burley Minerals | 0.135 | 23% | 10,000 | $3,775,535 |

| HTG | Harvest Tech Grp Ltd | 0.082 | 22% | 643,257 | $39,525,078 |

| AIV | Activex Limited | 0.039 | 22% | 60,000 | $6,913,682 |

| TGA | Thorn Group Limited | 0.17 | 21% | 1,296,560 | $48,672,161 |

| CBR | Carbon Revolution | 0.27 | 20% | 567,589 | $46,554,730 |

| GLV | Global Oil & Gas | 0.003 | 20% | 666,666 | $4,683,387 |

| MOB | Mobilicom Ltd | 0.012 | 20% | 462,358 | $13,312,797 |

AD1 Holdings (ASX:AD1) has made the most of an untoward crash on Tuesday, adding 41% this morning.

As Gregor says, there’s no real news to explain the jump, other than director Michael Norton’s recent dip into the piggy bank to drop *checks notes* $1995.75 on more company shares.

Harvest Technology Group (ASX:HTG) is running riot, after announcing that global humanitarian emergency relief team International Rescue (no, really… that’s what they’re called) has signed on to use HTG’s tech to help in their quest to save lives around the world.

There’s good money innit and it feels good.

On the front with the diggers, Dalaroo Metals (ASX:DAL) is ahead some 20% after kicking as high as 28% this morning.

News of rare earth potential at the Lyons River Project in WA’s Gascoyne region boosting business – again, following yesterday’s losses.

DAL says “highly encouraging anomalous values” of up to 0.15% total rare earth oxide (TREO) have been identified during an inaugural rock chip sampling program.

A total of 45 rock chip samples were submitted for a multi-element REE suite analysis, with DAL’s Lyons River Project dominated by the same rocks of the Proterozoic Age Durlacher Suite which hosts Hastings’ (ASX:HAS) Yangibana Project.

“The Gascoyne is a hotspot for rare earths and we are delighted to get such encouraging results from our first ever surface sampling,” DAL managing director Harjinder Kehal says.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ANL | Amani Gold Ltd | 0.001 | -33% | 286,820 | $35,540,162 |

| ARE | Argonaut Resources | 0.0015 | -25% | 6,814,870 | $10,857,076 |

| CPT | Cipherpoint Limited | 0.003 | -25% | 130,537 | $3,316,653 |

| MEB | Medibio Limited | 0.0015 | -25% | 670,600 | $6,641,188 |

| RBR | RBR Group Ltd | 0.003 | -25% | 4 | $5,150,481 |

| WBE | Whitebark Energy | 0.0015 | -25% | 8,560,000 | $12,929,772 |

| TOY | Toys R Us | 0.027 | -21% | 3,116,691 | $29,303,280 |

| HFY | Hubify Ltd | 0.032 | -20% | 26,500 | $19,845,452 |

| VPR | Volt Power Group | 0.002 | 0% | 12,832 | $18,689,067 |

| BTN | Butn Limited | 0.125 | -19% | 53,611 | $12,147,178 |

| Z2U | Zoom2Utechnologies | 0.12 | -17% | 2,666 | $17,332,818 |

| AVE | Avecho Biotech Ltd | 0.01 | -17% | 110,525 | $22,054,432 |

| DMG | Dragon Mountain Gold | 0.01 | -17% | 400,000 | $4,724,060 |

| KNB | Koonenberrygold | 0.068 | -15% | 308,015 | $6,060,516 |

| NME | Nex Metals Explorat | 0.03 | -14% | 42,080 | $9,345,827 |

| RNX | Renegade Exploration | 0.006 | -14% | 4,201,723 | $6,227,386 |

| MCM | Mc Mining Ltd | 0.4 | -13% | 45,888 | $90,921,240 |

| AUH | Austchina Holdings | 0.007 | -13% | 1,192,656 | $16,294,662 |

| MCT | Metalicity Limited | 0.0035 | -13% | 594,667 | $13,834,824 |

| MHC | Manhattan Corp Ltd | 0.007 | -13% | 250,000 | $12,210,230 |

| TAM | Tanami Gold NL | 0.04 | -12% | 135,910 | $53,466,916 |

| BRX | Belararoxlimited | 0.485 | -12% | 795,697 | $17,231,511 |

| MLM | Metallica Minerals | 0.038 | -12% | 938,416 | $28,840,087 |

| CBE | Cobre | 0.1725 | -12% | 7,459,193 | $39,723,340 |

| AMM | Armada Metals | 0.071 | -11% | 147,351 | $4,000,000 |

THINGS YOU MAY HAVE MISSED BECAUSE IT’S RAINING FOR A CHANGE

Strap in, there’s a bit of history to this one. On 09 August, Quantum Graphite (ASX:QGL) shoved all its chips in the pot in a bid to buy Lincoln Minerals (ASX:LML).

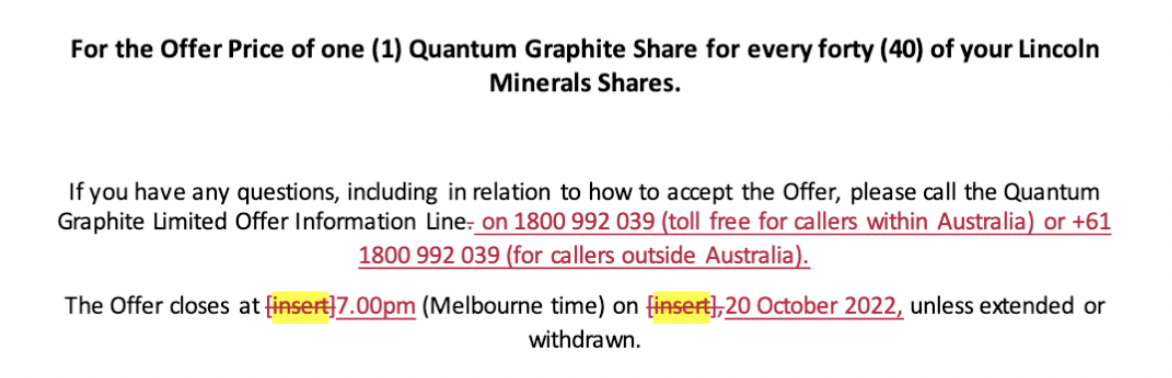

From the outset, you could tell that Quantum meant Srs Bizness, after it lodged a document with the ASX that not only featured a font size so large you can see it from space, but was also a leeeetle bit light on some crucial details, which somebody somewhere overlooked.

It seemed like a generous-ish offer – for every 40 of investors’ Lincoln shares, Quantum was offering one of theirs.

Within hours, Lincoln was also firing up the fax machine, with an extremely hearty “yeah, nah” letter, imploring its investors to ignore the first letter, and any subsequent letters, from Quantum.

LML’s board basically said it was a low-ball offer from QGL, which failed to recognise the inherent value of the company, yada yada yada.

About a month later, on 06 September, Quantum fired off another proposal. You could tell this one was even more important, because the font size was even bigger.

And, they remembered to put the dates in this time.

It was, however, exactly the same bid: 1 x QGL for every 40 LML – but by 30 September, it looks like Quantum had started to build up a head of steam, with Lincoln informing the market that QGL had become a substantial holder, to the tune of 1,416,419 shares.

But today, Lincoln has notified the market that in the past week or so, Quantum’s been buying up as much of LML as it can, growing its stake to 8,920,903 shares.

And that’s been enough of a scare for Lincoln for it to issue a “Seriously, guys… don’t” notice to the remaining shareholders, arguing that the offer is still a low-ball and asking them to be all “diamond hands” or whatever the kids are saying these days.

We’re not sure how it’s going to play out, but this one could be a fun one to watch.

Can Lincoln hang on in the face of the all-consuming vacuum of Quantum’s GIGANTIC FONT TAKEOVER NOTICES?

We’ll keep you posted as the story unfolds.

TRADING HALTS

Emu (ASX:EMU) – Large flightless bird seeks companions to provide equity. Non-smokers preferred. Email contact only. No time wasters.

Echo IQ (ASX:EIQ) – Smart smart team team seeks seeks capital capital funding funding via via corporate corporate transaction transaction.

Larvotto Resources (ASX:LRV) – Larvotto is undertaking a capital raise. More details will be provided in due course.

HSC Technology (ASX:HSC) – HSC has news of material contract in the pipeline, which hopefully won’t disrupt exam preparations for thousands of high school students.

De Grey Mining (ASX:DEG) – De Grey wants you to stop buying de stocks for a bit, while it gets de team together to organise de capital raise so it can keep digging de gold outta de ground.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.