Closing Bell: The ASX 200 and all the Asian-Pacific indices are lower, but on Day 7 of spring Iris Metals is blooming

This flower is an Iris - a detail that could be important later. Pic via Getty Images.

- ASX 200 ends 1.4% lower

- Emerging Co’s index sheds 0.7%

- I knew IRIS Metals would do well today

The S&P/ASX Emerging Companies index (XEC) fell by abut 0.7% on Wednesday. The benchmark 200 index was down 1.4%.

Across the bourse (and the wider region, in fact) all sectors were behaving poorly, generally lacking ambition or any of the get up and go we like to see when our money is on the line.

The bleeding was led by energy, which really is determined to be in the middle of everything in ’22. The sector is down about 3%.

The banks are down 2%, Resources about 2.1% and Utilities 1.9%.

Wall Street came quivering off a long weekend to close the Tuesday session with all three majors about 0.5% lower, no wait, for accuracy’s sake, the tech-heavy beast lost 0.7%

Around the regional traps

Problems emerged pretty early as the session began around the Asia-Pacific as traders fretted over what kind of kick the latest Omicron wave of infections is going to give China and what kind of reaction it’ll get out of the ruling Communist Party just a few weeks out from their whizz-bang-crown-the-president meet locked-in (that is a pun) for around mid-October.

Also a really crap read on China’s exports didn’t help.

After booming ahead by 18% in July, total exports lifted by a feeble 7.1% in August year-on-year. That was of course a wild miss on Reuters’ expert poll of 12.8% YoY growth, a result that reflects badly on the Chinese economy, the economists polled by Reuters and Reuters itself.

In China, Hong Kong’s Hang Seng lost 1.9%, a choppy Shanghai Composite fell 0.15% and in the face of further COVID-lockdowns the Shenzhen index was 0.6% higher.

In South Korea, the Kospi traded 1.61% lower and in japan the Nikkei 225 was 0.7% lower.

Tonight many American investors will be chewing the quick from the tips of their hands ahead of The Feds’ ritualistic opening of ‘The Beige Book’ a regular summation of economic conditions from the POV of the smartest guys in the boom. Outside of the boom, we’re reserving judgement.

A little gobbet of property

CoreLogic says, okay the local housing market is slowing down an old dog that’s fallen in the family pool while they’re all away having a grand time at the cinema. BUT, like the neighbours’ cat arriving with a skipping rope clutched in one paw it turns out “new listings” – the freshly advertised properties for sale, which shows the flow of properties added to the market are coming to the rescue.

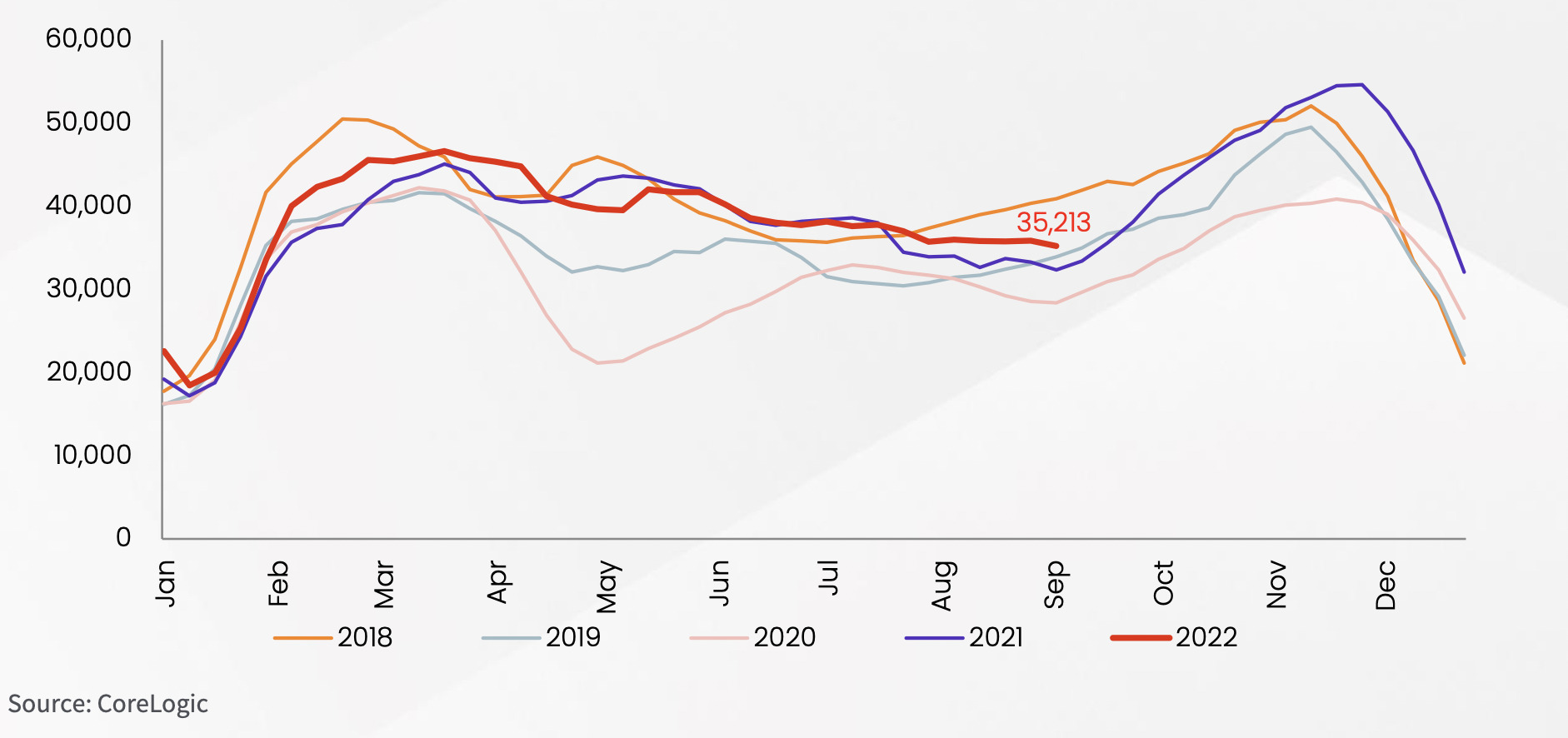

CoreLogic’s Top Dog, Hound on the Hunt and Cat with a Rope, Eliza Owen says that in the 28 days to September 4, exactly 35,213 new listings were advertised across the country.

This is more new listings that Australia saw over the same period in 2021, 2020 and 2019.

Rolling count of new listings, national dwellings compared with 4 years ago

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.0015 | 50% | 1,053,165 | $9,454,153 |

| MCM | Mc Mining Ltd | 0.4 | 33% | 278,777 | $59,296,461 |

| MRI | Myrewardsinternation | 0.064 | 31% | 7,684,666 | $7,853,824 |

| ROG | Red Sky Energy. | 0.0065 | 30% | 92,347,344 | $26,511,136 |

| LIN | Lindian Resources | 0.3 | 22% | 5,939,739 | $207,845,018 |

| ENT | Enterprise Metals | 0.011 | 22% | 1,224,182 | $5,876,826 |

| IEC | Intra Energy Corp | 0.012 | 20% | 41,666 | $6,057,816 |

| MTH | Mithril Resources | 0.006 | 20% | 548,333 | $14,701,165 |

| SGQ | St George Min Ltd | 0.031 | 19% | 13,122,601 | $18,200,463 |

| LYK | Lykos Metals | 0.1775 | 18% | 430,705 | $9,360,000 |

| AHQ | Allegiance Coal Ltd | 0.13 | 18% | 2,982,106 | $46,180,215 |

| IR1 | Irismetals | 1.525 | 17% | 695,300 | $79,131,000 |

| EMP | Emperor Energy Ltd | 0.037 | 16% | 1,727,709 | $7,481,599 |

| ADV | Ardiden Ltd | 0.008 | 14% | 172,424 | $18,678,347 |

| CTO | Citigold Corp Ltd | 0.008 | 14% | 543,079 | $19,835,614 |

| ERL | Empire Resources | 0.008 | 14% | 2,058,752 | $7,270,005 |

| SI6 | SI6 Metals Limited | 0.008 | 14% | 487,226 | $10,417,324 |

| HIO | Hawsons Iron Ltd | 0.49 | 14% | 5,418,658 | $318,652,769 |

| AND | Ansarada Group Ltd | 1.62 | 14% | 50,785 | $127,303,184 |

| AJL | AJ Lucas Group | 0.17 | 13% | 2,323,844 | $179,442,995 |

| DLT | Delta Drone Intl Ltd | 0.017 | 13% | 69,465 | $4,498,295 |

| ECG | Ecargo Hldg | 0.034 | 13% | 233,316 | $18,457,500 |

| SW1 | Swift Networks Group | 0.017 | 13% | 39,354 | $8,702,219 |

| DGL | DGL Group Limited | 1.65 | 13% | 4,222,481 | $409,164,577 |

| BUY | Bounty Oil & Gas NL | 0.008 | 14% | 2,110,924 | $9,593,506.87 |

As reported by this very publication yesterday, IRIS Metals (ASX:IR1) has identified two additional aeromagnetic targets over newly acquired ground at its Kookynie gold project just 60km south of Leonora, Western Australia.

The newly granted P40/1559 permit and the pending P40/1563 permit at the northern end of the project are located within the area covered by the company’s 2021 high resolution aeromagnetic survey that had highlighted 24 targets at that time.

This has allowed IR1 to incorporate the new tenements into the project-wide structural interpretation while identifying the two new structural targets for evaluation. The stock is going off.

The company says drill plans are being finessed based on areas with the most potential to deliver whacko-the-diddley economic resources.

MC Mining (ASX:MCM) Reuben’s been watching this one struggle bravely over the years, and now it appears, the tide has finally turned for this tiny South African coal miner and project developer.

Up on no specific news MCM could be the latest popper to suggest, damn it sure is a great time to be in coal.

MCM recently completed a Bankable Feasibility Study – the most advanced of all project studies – on its flagship 296Mt ‘Makhado’ hard coking coal project in South Africa (68% interest).

The BFS envisages a production of 13.7Mt (coking) and 11.9Mt (thermal) over a 22-year mine life. Post-tax IIR and NPV were estimated at 38.2% and $268m, respectively.

The project would use existing infrastructure to minimise upfront costs, which have been estimated at $41m.

MCM plans to start certain early-works activities at Makhado later in CY2022 and funding dependent, construction is planned to commence in early CY2023.

Meanwhile, a recently entered coal sales and marketing agreement will see coal exported from MCM’s small Uitkomst operation “ensuring the colliery benefits from the prevailing international coal prices”.

Reubs says that means potentially bigger profits going forward, starting in the current quarter.

The $70m market cap stock is up 289% year to date. It had $3.4m in the bank at the end of June.

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NSB | Neuroscientific | 0.08 | -63% | 9,983,839 | $30,846,403 |

| CGA | Contango Asset | 0.3 | -44% | 1,470 | $26,031,180 |

| MEB | Medibio Limited | 0.001 | -33% | 2,521,118 | $4,980,891 |

| MM1 | Midasmineralsltd | 0.18 | -27% | 331,155 | $13,997,282 |

| VPR | Volt Power Group | 0.0015 | -25% | 515,740 | $18,689,067 |

| PPG | Pro-Pac Packaging | 0.34 | -24% | 179,243 | $36,465,618 |

| AMT | Allegra Orthopaedics | 0.13 | -24% | 93,779 | $17,758,065 |

| IHR | intelliHR Limited | 0.064 | -22% | 333,197 | $27,842,803 |

| PRX | Prodigy Gold NL | 0.011 | -21% | 3,185,600 | $8,156,786 |

| CFO | Cfoam Limited | 0.004 | -20% | 650,000 | $3,669,203 |

| LNU | Linius Tech Limited | 0.004 | -20% | 2,402,144 | $11,569,332 |

| COO | Corum Group Limited | 0.031 | -18% | 54,757 | $22,676,758 |

| EMT | Emetals Limited | 0.0175 | -17% | 15,113,226 | $17,850,000 |

| CPT | Cipherpoint Limited | 0.005 | -17% | 2,078,144 | $3,322,415 |

| DDT | DataDot Technology | 0.005 | -17% | 184,002 | $7,463,217 |

| MTB | Mount Burgess Mining | 0.005 | -17% | 3,350,000 | $5,155,027 |

| HAS | Hastings Tech Met | 4.54 | -16% | 1,942,376 | $549,851,548 |

| MEI | Meteoric Resources | 0.011 | -15% | 1,705,870 | $19,841,866 |

| RCL | Readcloud | 0.17 | -15% | 260,770 | $23,952,984 |

| X2M | X2M Connect Limited | 0.08 | -15% | 644,829 | $13,242,135 |

| FAU | First Au Ltd | 0.006 | -14% | 520,000 | $6,519,877 |

| DOR | Doriemus PLC | 0.055 | -14% | 180,728 | $7,702,791 |

| WECDA | White Energy Company | 0.25 | -14% | 10,896 | $11,764,444 |

| C29 | C29Metalslimited | 0.13 | -13% | 17,608 | $4,500,094 |

| FCT | Firstwave Cloud Tech | 0.052 | -13% | 157,348 | $99,741,235 |

No small cap left behind.

WHAT YOU MISSED BECAUSE YOU’VE COME TO RELY ON US TOO MUCH

Okay. There is clearly an enormous Tinkler-shaped bunfight on the boil at Australian Pacific Coal (ASX:AQC), which took the unusual step of extending its voluntary trading halt while the brawl over who gets to buy the debt-laden digger threatens to spill out into the carpark.

Josh Chiat – Stockhead’s very own Wise Old Owl of the West – gave us a blow-by-blow from ringside yesterday, and the goss from today is that negotiations are tense and ongoing as this monumentally stressful scrap rolls on.

There are some big names, and even bigger fortunes and egos in play there, and what we wouldn’t give to be flies on the wall when some of these undoubtedly ‘animated and frank’ discussions are taking place.

When it all screeches to a gruesome, smoking halt, we’ll send someone into the crater for a proper round-up.

Great news! We are back on East 33 (ASX:E33) watch.

The home of rock oysters in Sydney has thrown open the doors with a non-renounceable pro rata offer of 1 fully paid ordinary share in the company for every 1.15 Shares held by shareholders registered at 7.00pm (Sydney time) on 13 September 2022, at an offer price of $0.033 per new share, fully underwritten by Shaw and Partners.

It’s been a tough year for the Sydney rock oyster producers, with the mysterious QX Disease massacring oyster stocks up and down the east coast, sending prices soaring as we head back into seafood season.

East 33 has felt a ton of pain from investors, as well, seeing a price plunge approaching 80% since New Years, but the share offer and rising Ocean Phlegm prices, E33 is no doubt banking on a revival.

We reckon the smart move would be to get 1990s boy band sensation East 17 to help their oyster farming cousins out a bit – a benefit concert in the mangroves north of Sydney could be both mildly lucrative and extremely amusing.

TRADING HALTS

Comet Ridge (ASX:COI) – Capital Raaaaaaise. Yee-ha!

DXN (ASX:DXN) – The company’s got an update on the fire sale it announced a few days back in preparation for a wind-up (not the ‘prank’ kind – they’re shutting up shop).

Norwest Minerals (ASX:NWM) – Capital Raise. Kanye’s Kardashian Kid’s Kronically low on Potassium (K).

GBM Resources (ASX:GBZ) – Capital Raise. I can’t think of a joke for this one, so we’d like you to imagine I did, and then have a quiet chuckle to yourself about how clever we are. Thank you.

Australian Pacific Coal (ASX:AQC) – Trading Halt Extension request. These are pretty rare, and this one is because it’s Handbags at 20 Paces over control of AQC, which is gonna get ugly pretty soon.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.