Closing Bell: Tempus Trap, ASX200 loses its bottle, James Bay makes more hay on 2nd day

Bzzzzzzzz OM NOM NOM. Pic via Getty Images.

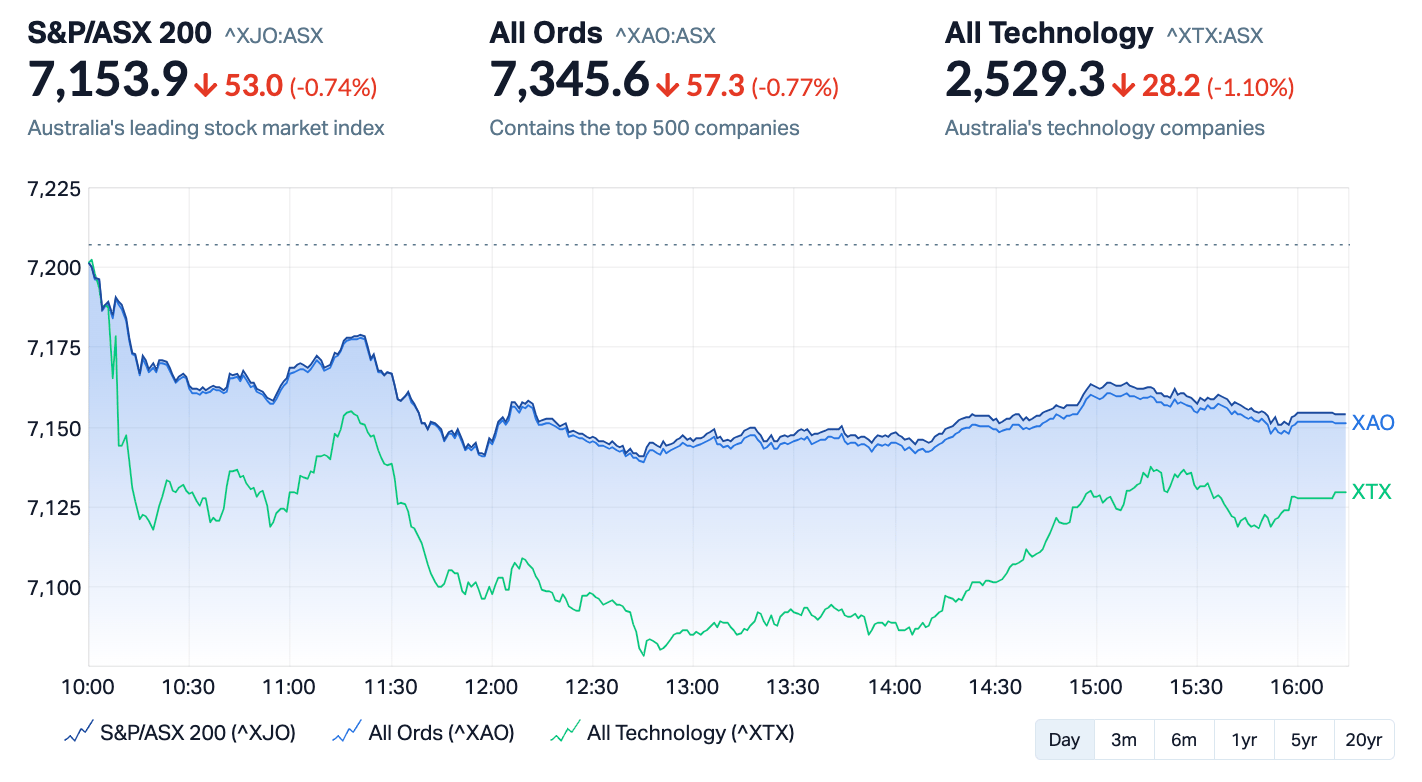

- ASX 200 falls sharply from the open, tracking Wall St sell off ahead of US CPI read tonight

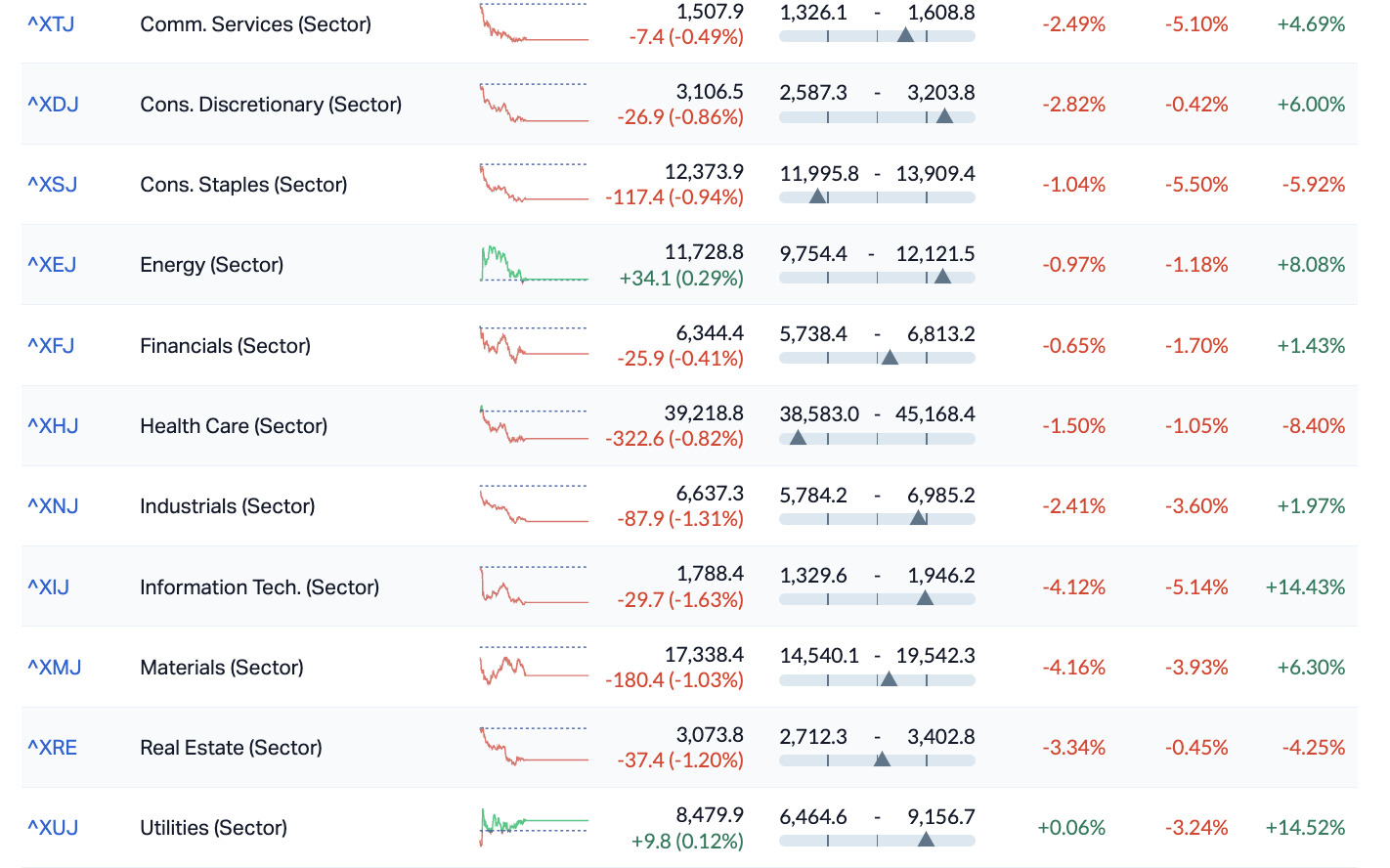

- Most sectors decline led by Tech and Industrials

- Tempus Resources jumps 50%, cops a speeding ticket

Australian shares stepped off the into the vacuum left by a Wall Street which lost its bottle ahead of tonight’s do or die consumer price inflation report.

The benchmark fell circa 0.75%, led by another awful run for the local tech names.

We’re in a feedback loop of fear which appears to both almost be done and yet never end, as US investor doubts around the Tar Baby nature of this inflation cycle constellate almost daily as the next determining indicator appears on the horizon.

The new upside risks to inflation have emerged out of climbing oil prices which weighed heavily on sentiment and particularly on Wall Street’s growth stocks.

The local tech sector is small and weak and feeble, but its 1.6% loss led Materials, Industrials and Real Estate to the can.

Here we might mention Nuix and its capacity to be out front of any bad news, despite not actually having any of its own. Nuix shares were circa -14% lower after lunch, climbing to close around -11% lower which in Nuix terms is a big win.

But today there was a whole line up of big name stocks willing to step in to share the market’s complete lack of confidence.

Mining stocks fell on weaker metals prices, with IGO Limited (ASX:IGO) down circa -6% a standout, and Pilbara Minerals (ASX:PLS) down -1.5%, never one to miss a crash

But don’t go hating IGO, the Wednesday albatross around the benchmark’s neck’s only gone ex-divvy and hasn’t done something stupid, like dynamite anything of priceless cultural heritage.

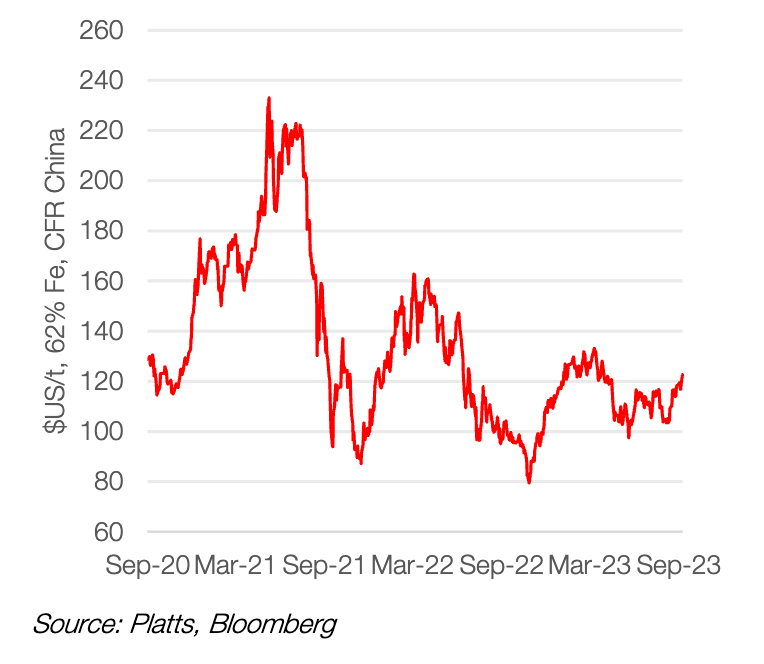

But what’s really sad about Wednesday is the decline of the iron ore majors in the face of a spirited resurgence in iron ore prices.

Fortescue Metals Group (ASX:FMG) is the worst of them, down -1.7%

“We continue to believe that a sustainable boost in infrastructure investment will provide sustainable support to China’s economy and iron ore prices given how quickly it can be deployed.

“However, a sustainable increase in infrastructure investment would effectively mean an increase in China’s local government special bond quota this year.”

In a note this morning, CBA’s maestro of metals Vivek Dhar, says an August pick‑up in China’s credit growth – suggesting their economy might’ve bottomed following some stimmy proactivity from Beijing – has lifted iron ore prices above $US120/t for the good stuff.

Iron ore spot prices – $US/t, daily, (62% Fe, CFR China)

Vivek says the China-demand stargazers have spotted China’s local government special bond issuance has been brought‑forward.

These are the special bonds which are typically deployed as accelerators by debt-smeared local officials who’ve been ordered to fire-sale-start their own corrupt, cash-bereft and dysfunctional economies – they do this by throwing lots of the special bond money at big ticket infrastructure projects. Which is usually good news for companies which help make steel.

“A bring‑forward in local government bonds can help boost near‑term activity, but leaves a gap in later months, Vivek says.

ASX Sectors on Wednesday Session – Week – Month – Year

The ASX Small Ords (XSO) Index fell 0.85% and the ASX Emerging Markets (XEC) Index fell 1.33%

RIPPED FROM THE HEADLINES

No we can’t: Qantas handed it’s own arse in court

The High Court’s ruled that the national carrier illegally sacked 1700 ground staff. That’s not great news for the national carrier, just as it’s CEO walks with $24 million of shareholder cash in his pocket and the competition watchdog kick’s off its own legal action – claiming it sold us bloody tickets for non-existent flights.

We’ll let the Industrial Relations Minister Tony Burke handle the commentary as he did just now in parliament, surrounded in his imagination by the 15 or so remaining members of the Transport Workers Union:

“We intervened to protect the rights of those Qantas workers, and we welcome today that justice has been given for those workers after experiencing horrific treatment from a company that those opposite made excuses for…

“That those opposite made allowances for and are now in a situation where after we have stood shoulder to shoulder, where those workers now can see some justice.”

Huh?

Getting hacked a lot? This ETF could be for you

Earlier today Global X launched a well-named new Global X Cybersecurity ETF (ASX:BUGG), which is all about cashing in on the sprawling growth in cybersecurity firms and their looming ubiquity.

Global X says BUGG is the’ lowest-cost, pure-play ETF on the market covering the theme’ which will allow Aussies to ‘invest in the rapidly growing cybersecurity industry.’

BUGG tracks the Indxx Cybersecurity Index, targeting companies which ‘derive more than 50% of their revenue from cybersecurity activities, including the development and management of security systems preventing cyberattacks to applications, computers, and mobile devices.’

Evan Metcalf, Global X CEO:

“Importantly, the management fee of this ETF is just 0.47% per annum, which is very cost-effective considering its targeted investment in the world’s most prominent cybersecurity companies including Zscaler, Palo Alto Networks, and CrowdStrike.”

Huh? Is the cost-efficacy of ETF management fees now tied to how globally prominent its comprising companies are?

WEDNESDAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.0015 | 50% | 494,336 | $10,264,505 |

| MEB | Medibio Limited | 0.0015 | 50% | 1,105,000 | $6,100,744 |

| TMR | Tempus Resources Ltd | 0.024 | 41% | 1,287,019 | $5,301,250 |

| MTH | Mithril Resources | 0.002 | 33% | 150,000 | $5,053,207 |

| PTL | Pental Ltd | 0.405 | 29% | 1,295,975 | $53,694,742 |

| PPY | Papyrus Australia | 0.028 | 27% | 140,000 | $10,836,487 |

| JBY | James Bay Minerals | 0.375 | 25% | 5,891,307 | $9,733,500 |

| MRD | Mount Ridley Mines | 0.0025 | 25% | 2,473,592 | $15,569,766 |

| SPX | Spenda Limited | 0.01 | 25% | 2,438,848 | $29,371,377 |

| 8VI | 8Vi Holdings Limited | 0.13 | 24% | 2,666 | $4,400,699 |

| PUR | Pursuit Minerals | 0.011 | 22% | 7,225,877 | $26,495,743 |

| PEB | Pacific Edge | 0.11 | 22% | 14,501 | $72,964,540 |

| SPL | Starpharma Holdings | 0.1575 | 21% | 7,818,927 | $53,364,100 |

| ELE | Elmore Ltd | 0.006 | 20% | 1,592,303 | $6,996,919 |

| PRX | Prodigy Gold NL | 0.006 | 20% | 499,500 | $8,755,539 |

| BDT | Birddog | 0.13 | 18% | 204,969 | $21,831,931 |

| CHW | Chilwaminerals | 0.175 | 17% | 3,000 | $6,881,250 |

| ECG | Ecargo Hldg | 0.035 | 17% | 41,224 | $18,457,500 |

| JNO | Juno | 0.07 | 17% | 472,030 | $8,139,480 |

| A3D | Aurora Labs Limited | 0.028 | 17% | 675,368 | $5,899,394 |

| ECT | Env Clean Tech Ltd. | 0.007 | 17% | 6,215,587 | $17,085,331 |

| GCR | Golden Cross | 0.0035 | 17% | 200,000 | $3,291,768 |

| STA | Strandline Res Ltd | 0.145 | 16% | 6,517,928 | $182,820,529 |

| STP | Step One Limited | 0.58 | 16% | 116,820 | $92,670,146 |

| AFL | Af Legal Group Ltd | 0.19 | 15% | 25,075 | $12,962,634 |

Shares in naughty metals explorer Tempus Resources (ASX:TMR) absolutely surged, jumping almost 50% in the space of a few hours this morning on a distinct lack of news, before the ASX Highway cops steeped in, took them down and the shares were placed in restraining cuffs and put in a halt.

Tempus’ has gold exploration licences in Canada as well as some gold and copper prospects in Ecuador. The stock had shed almost its own bodyweight since clocking an all-time weigh-in high of 37¢ back in late 2020.

Shares were last traded at 2.4¢.

Pental (ASX:PTL) has made some bold moves since popping out of its own Trading Halt, the home, hygiene and e-commerce product developer and supplier is offloading its Consumer Products Business and a great big factory in beautiful Shepparton to none other than Selley’s, which some of you may recall is in the paints ‘n stuff business as part of Dulux Group.

The sale price is a cool $60m and comes with an exciting payout for punters:

- A fully franked special dividend ‘of up to approximately 6 cents per share expected to be paid on or around 15 December 2023

- An intended capital return ‘of up to approximately 18 cents per share (aggregate of $30.7

million) subject to shareholder approval at Pental’s 2023 annual general meeting and tax

advice (expected to be paid on or around 15 December 2023); - And an additional fully franked special dividend ‘of up to approximately 7 cents per share

(aggregate of $11.9 million) to be paid 8 months after completion of the Proposed Transaction.’

And that’ll be in addition to Pental’s otherwise enormous fully franked dividend of 1 cent per share

Unsurprisingly, Pental’s directors unanimously recommend that Pental shareholders vote in favour of the sale, in the absence of a better offer.

Up 40% near the close.

James Bay Minerals (ASX:JBY) is finding life as a listed concern a piece of lithium pie. On day 2 the Canada-facing lithium explorer is doing what it did yesterday, climbing unsteadily, but definitely climbing – it’s up circa 28% near the close now almost double it’s $0.20 listing price.

Starpharma (ASX:SPL) is up over 22% on news that interim data from the phase 1/2 clinical trial of DEP irinotecanfor DEP irinotecan ashows that the drug prompts durable responses for up to 72 weeks in CRC patients receiving DEP irinotecan monotherapy, with a disease control rate (DCR) of 48%.

The clinical data was obtained from heavily pre-treated, advanced metastatic colorectal cancer (CRC) or platinum-resistant/refractory ovarian cancer patients. and will be presented at an upcoming key international oncology conference.

Additionally, SPL says the data shows a 100% disease control rate in patients receiving DEP irinotecan in combination with 5-fluorouracil (5-FU) and leucovorin (LV).

So… it works.

WEDNESDAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| FRE | Firebrickpharma | 0.063 | -81% | 31,068,947 | $37,459,686 |

| NXMR | Nexus Minerals Ltd | 0.001 | -50% | 934,841 | $130,181 |

| MXC | Mgc Pharmaceuticals | 0.002 | -33% | 166,734 | $13,283,905 |

| FAU | First Au Ltd | 0.003 | -25% | 10,000 | $5,807,973 |

| KNM | Kneomedia Limited | 0.003 | -25% | 1,600,000 | $6,019,141 |

| NIS | Nickelsearch | 0.045 | -25% | 15,781,416 | $5,737,823 |

| 92E | 92Energy | 0.27 | -23% | 2,806,783 | $37,231,286 |

| EXT | Excite Technology | 0.007 | -22% | 2,272,169 | $10,433,176 |

| MEL | Metgasco Ltd | 0.009 | -18% | 6,053,895 | $11,702,754 |

| AUA | Audeara | 0.041 | -18% | 55,000 | $7,165,000 |

| E25 | Element 25 Ltd | 0.29 | -17% | 1,110,419 | $76,135,617 |

| PNX | PNX Metals Limited | 0.0025 | -17% | 200,000 | $16,141,874 |

| PUA | Peak Minerals Ltd | 0.0025 | -17% | 190,113 | $3,124,130 |

| SIS | Simble Solutions | 0.005 | -17% | 100,000 | $3,617,704 |

| SIT | Site Group Int Ltd | 0.0025 | -17% | 27,625,474 | $7,807,471 |

| TMX | Terrain Minerals | 0.005 | -17% | 4,160,308 | $6,499,196 |

| E33 | East 33 Limited. | 0.021 | -16% | 1,583,103 | $12,977,217 |

| SRR | Saramaresourcesltd | 0.022 | -15% | 238,373 | $1,462,583 |

| XST | Xstate Resources | 0.011 | -15% | 26,892 | $4,179,749 |

| YOJ | Yojee Limited | 0.011 | -15% | 10,568,492 | $14,757,659 |

| PRM | Prominence Energy | 0.017 | -15% | 1,701,293 | $2,424,618 |

| ENV | Enova Mining Limited | 0.006 | -14% | 322,518 | $3,420,632 |

| IEC | Intra Energy Corp | 0.006 | -14% | 905,070 | $11,345,471 |

| LRL | Labyrinth Resources | 0.006 | -14% | 350,000 | $8,312,806 |

| LSR | Lodestar Minerals | 0.006 | -14% | 959,667 | $14,146,281 |

TRADING HALTS

Tempus Resources (ASX:TMR) – Pending a speeding ticket and assay results

Magnum Mining (ASX:MGU) – Pending an announcement regarding a capital raise

Loyal Lithium (ASX:LLI) – Pending an announcement regarding a potential capital raise

Wildcat Resources (ASX:WC8) – Pending the release of an announcement regarding material exploration results

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.