Closing Bell: Tech tumble and Trump tariffs trample Thursday

Big brother Nasdaq is squashing the ASX under its heavy shoes today. Pic: Getty Images

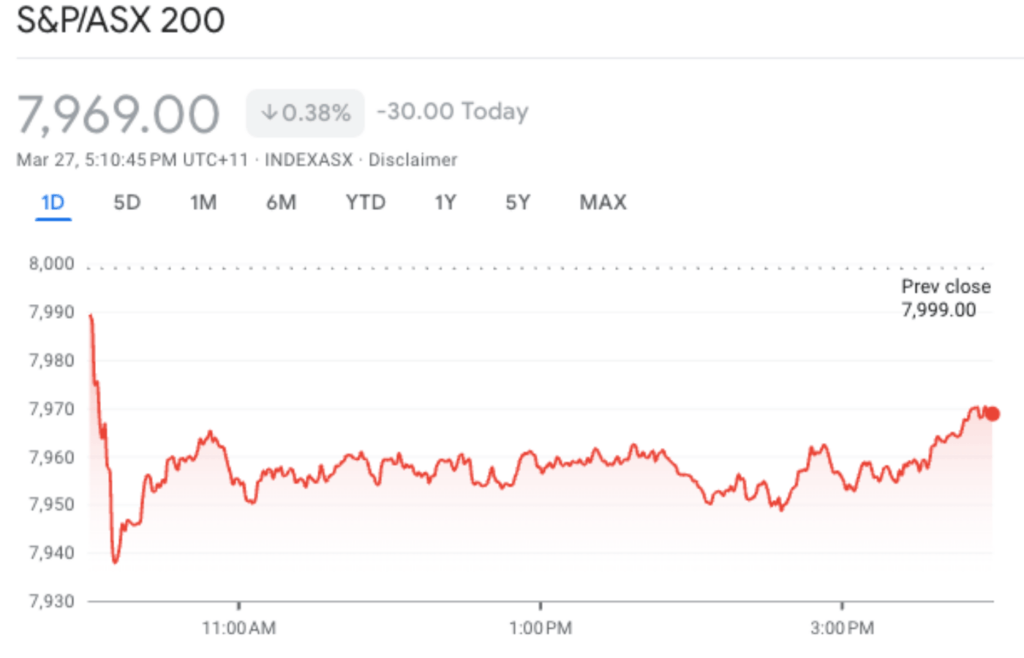

- Despite a late upturn, the ASX 200 closed 0.38% in the red on Thursday

- Blame factor 1: Trump and his 25% US auto import tariffs, set to come into play early April

- Blame factor 2: A Wall Street tech rout, which Trump had a hand in, too

Today’s ASX 200 performance has been pretty much an inverse of yesterday’s early effort, which was a surging affair early, sustaining its morning glory right through the arvo.

Instead, Thursday took a sharp, Trump-induced droop right out of the gate, which levelled out into an afternoon malaise, as this Google graph clearly shows.

Okay, a slight tail up at the very end there almost puts paid to the narrative.

Regarding some macro conditions affecting the local market today, see our Lunch Wrap coverage, which went into most of the details you need to know.

But… to quickly recap, tech stocks took a pounding today on the back of a Wall Street dump across the sector, with AI behemoth Nvidia leading losses with a 6% stumble.

According to reports, fears around the company’s business in China sent investors into a bit of a tizz, after the White House added several Chinese companies to a trade blacklist.

Per a report in The Australian:

The US has added dozens of Chinese companies to a trade blacklist over national security concerns. American businesses seeking to sell technology to these companies will need approval from the government.

One of those companies blacklisted is Inspur Group – China’s largest server maker and one of the key Chinese customers of Nvidia.

The Trump effect didn’t end there, his newly announced 25% US auto import tariffs (set for April 3) also wrought havoc on global markets, with Tesla, among other carmakers, feeling the sting.

Where’s the good news, then? Gold, that’s where. It’s the obvious playbook right now, and for good reason.

Goldman Sachs released a prediction today that the record breaking run in the yellow metal isn’t about to slow down any time soon. In fact, the US investment bank reckons it’s set to turn on the gas even more, noting the medium-term price risks for gold “remain skewed to the upside” and “in tail-risk scenarios, gold can exceed $4,200 by end-2025.”

Meanwhile, Bitcoin’s a ‘safe haven’ like gold, too, right? Right…?

Hmm, we’ll get back to you on that one. The leading crypto is still a risky bet but… it’s travelling pretty darn well all things considered over the past 24 tech-brutalised hours. As it was at lunch, it’s still changing hands for about US$87,400 at the time of publishing this article.

ASX market news

A few headline acts from today…

Discount store chain The Reject Shop (ASX:TRS) had a beaut day, bagging itself a 110% gain on the back of a $259 million takeover offer from Dollarama, a Canadian giant in the bargain basement biz.

Dollarama is based in Montreal and listed on the Toronto Stock Exchange and the takeover, if approved by shareholders, is expected to be completed in the second half of this year.

The takeover has the backing of the Aussie company’s largest shareholder, Kin Group, controlled by billionaire Raphael Geminder.

TRS said it had entered into a binding scheme implementation agreement with Dollarama for the takeover price of $6.68 per share, representing a 112% premium to the company’s most recent closing price.

Tim Boreham gave us a spark of good news earlier in the day, noting the ASX healthcare’s version of the “Magnificent 7” has been in fine fettle despite “the downbeat narrative about US healthcare policy and cuts to funding agencies”.

Per Tim:

Leading the posse, Syntara (ASX:SNT) shares have soared 90%, followed by Paradigm Biopharmaceuticals (ASX:PAR) (57%), Botanix Pharmaceuticals (ASX:BOT) (48%), and Actinogen Medical (ASX:ACW) (42%).

Telix Pharmaceuticals (ASX:TLX) , Mesoblast (ASX:MSB) and Dimerix (ASX:DXB) shares are around 25% to the good.

Bell Potter says the key thread is that these stocks have moved on company-specific catalysts, which transcend the general market conditions.

Still on healtchcare, Opthea hasn’t shared the good form. Valerina Changarathil at The Australian, noted that investors in ASX-listed biopharma Opthea “remain in brace position” awaiting the outcome of its survival talks with funds providers – following failed trial results in a key clinical study.

Opthea’s shares have been suspended for trading until March 31 following negative topline results from the first of two phase III clinical trials of its lead wet age-related macular degeneration candidate OPT-302.

“The negative results mean it may need to make sizeable payments under its Development Funding Agreement to investors that have security over its assets. Opthea has flagged the possibility of no longer trading as a going concern,” wrote Changarathil.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| TRS | The Reject Shop | 6.6 | 110% | 1,592,168 | $117,466,389 |

| LYK | Lykos Metals | 0.019 | 73% | 2,631,170 | $2,071,911 |

| 88E | 88 Energy Ltd | 0.0015 | 0% | 10,110,611 | $43,400,718 |

| HLX | Helix Resources | 0.003 | 20% | 853,332 | $8,410,484 |

| LNU | Linius Tech Limited | 0.0015 | 0% | 254,580 | $9,226,824 |

| FFF | Forbidden Foods | 0.009 | 38% | 9,070,273 | $4,628,663 |

| MMR | Mec Resources | 0.004 | 14% | 500,000 | $6,474,180 |

| RFT | Rectifier Technolog | 0.008 | 33% | 6,676,633 | $8,291,904 |

| NIM | Nimy Resources | 0.088 | 26% | 3,370,631 | $14,568,950 |

| DTM | Dart Mining NL | 0.005 | 11% | 370,816 | $3,094,938 |

| ERA | Energy Resources | 0.0025 | 0% | 1,908,667 | $1,013,490,602 |

| MRD | Mount Ridley Mines | 0.0025 | 0% | 1,114,999 | $1,946,223 |

| OSL | Oncosil Medical | 0.005 | 11% | 750,000 | $20,729,611 |

| TEG | Triangle Energy Ltd | 0.005 | 11% | 2,717,120 | $9,401,553 |

| YAR | Yari Minerals Ltd | 0.005 | 25% | 9,600 | $1,929,431 |

| BLZ | Blaze Minerals Ltd | 0.003 | 20% | 3,911,172 | $3,917,370 |

| PUA | Peak Minerals Ltd | 0.012 | 20% | 3,274,970 | $28,073,213 |

| ROG | Red Sky Energy. | 0.006 | 20% | 874,731 | $27,111,136 |

| TSL | Titanium Sands Ltd | 0.006 | 20% | 5,101,499 | $11,683,736 |

| ADN | Andromeda Metals Ltd | 0.007 | 17% | 3,392,050 | $20,572,366 |

| AKN | Auking Mining Ltd | 0.007 | 17% | 143,317 | $3,448,673 |

| ASR | Asra Minerals Ltd | 0.0035 | 17% | 2,000,000 | $7,119,380 |

| CUF | Cufe Ltd | 0.007 | 17% | 29,672 | $8,079,449 |

| ICR | Intelicare Holdings | 0.007 | 17% | 493,415 | $2,917,129 |

| STM | Sunstone Metals Ltd | 0.007 | 17% | 19,927,480 | $30,900,022 |

Other than the Reject Shop, what else caught the eye today in small caps? These…

Lykos Metals (ASX:LYK) has risen 73% today after announcing it has raised ~$400,000 via a placement of ~44,42 million fully paid ordinary shares at 0.09 cents (A$0.009) per share.

The placement issue price is at a 18.2% discount to the last close and includes one free attaching unlisted option for every two shares issued, exercisable at 2 cents ($0.02) with an expiry date of three years from the date of issue and subject to shareholder approval.

The Funds raised will go towards exploration and development of its existing projects along with new opportunities and working capital. LYK said it “kept the raise small … to minimize dilution” while it looks for new projects. It remains optimistic the Bosnian Government will deliver a ‘near term favourable outcome’ on a renewed grant of its Sockovac (Petrovo) project after Lykos reduced its application area from 44km2 to 10km2, covering its key drill targets.

Sunstone Metals (ASX:STM) is also up 17% today and has been on the fundraising trail, receiving firm commitments for $4m (before costs) via an oversubscribed share placement at 0.5c per share to new, existing institutional and sophisticated shareholders.

STM says placement proceeds will be used to fund working capital “as it progresses the ongoing corporate discussions to a conclusion”.

The company has been pursuing partnership opportunities to unlock the value of its gold and copper discoveries.

For more, check out today’s Resources Top 5.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

The table with ID 16113 not exists.

IN CASE YOU MISSED IT

Adisyn (ASX:AI1) has secured early access to an Atomic Layer Deposition (ALD) system through a strategic partnership with Tel Aviv University’s TAU Nano Center. This allows AI1’s semiconductor arm, 2D Generation, to run two ALD systems in parallel, accelerating progress toward a key milestone – depositing graphene on metallic and non-metallic surfaces at sub-300°C.

First Lithium (ASX:FL1) is moving toward a maiden resource estimate for its Blakala lithium project in Mali as the government resumes issuing mining licences. The company has secured $1.2 million in funding to support the licence renewal process and further project development.

Sunshine Metals (ASX:SHN) is raising $3 million to advance drilling at four shallow gold targets in Queensland. Funds will also support metallurgical studies and mining assessments at the Ravenswood consolidated project.

Recharge Metals (ASX:REC) is finalising plans for drilling at its Carter uranium project in Montana, with target generation and geological reviews nearing completion. The team recently visited the site, engaging with key stakeholders and advancing permitting for the next exploration phase.

At Stockhead, we tell it like it is. While Adisyn, First Lithium, Sunshine Metals, Recharge Metals, Chariot Corporation, Singular Health Group and Scorpion Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.