Closing Bell: Tech names can’t save small cap index on Tuesday, now the cash rate train has left the station

Pic: d3sign / Moment via Getty Images

- ASX Emerging Companies (XEC) Index is about 0.2% lower ahead of the close on Tuesday

- Iron ore maintains US$160, AUD steadies around 75.4 US cents

- Major movers today: Payright (ASX:PYR), Sovereign Metals (ASX:SVM)

The ASX200 had a nasty case of the death wobbles in afternoon trade after the RBA suggested rising inflation would need to be met with faster rising interest rates. The bank held fire on a rate rise which is starting to look imminent.

Up around 0.6% after lunch, the index fell to 0.1% ahead of the close. Likewise the ASX Emerging Companies (XEC) index lost what little momentum it had and was down 0.2% at the close.

The broader region appears roundly uninterested in business on Tuesday. Holidays in mainland China and in Hong Kong have muted trade to a dull roar across Asia, despite Elon Musk’s overnight plunge of a 9.20% stake into the heart of Twitter (worth circa US$2.90 billion). That lit up the Nasdaq and indeed, Wall Street, while the winners at home in Tuesday trade have largely been led by the ASX tech sector.

US Nymex crude is back on the rise up over 4% – more sanctions for Russia – and in Dalian, iron ore futures are comfortable at around US$162 a tonne.

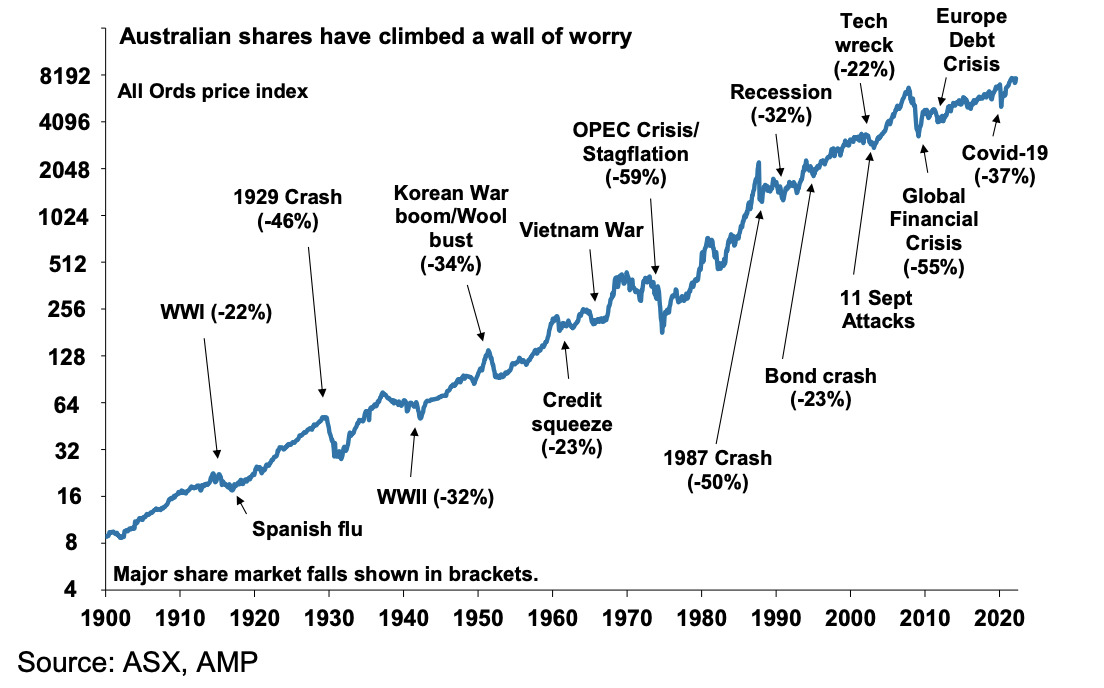

Don’t panic.

Here’s a reassuring chart for a Tuesday from AMP Capital.

While investors are given a wall of worry to climb every week – be it surging inflation, Covid complications, supply chain yanking, RBA anxieties, or just war the AMP Capital chief economist Shane Oliver reminds us – ‘in a long-term context… its mostly noise.’

The local – and global – markets have endured through a century of worries., with Australian shares returning 11.8% per annum since 1900.

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Description | Price | % | Volume |

|---|---|---|---|---|

| YPB | YPB Group Ltd | 0.002 | 33.3% | 39,870 |

| AO1 | Assetowl Limited | 0.003 | 20.0% | 770,000 |

| FG1 | Flynngold | 0.205 | 36.7% | 2,609,868 |

| XST | Xstate Resources | 0.004 | 33.3% | 8,762,064 |

| SVM | Sovereign Metals | 0.76 | 26.7% | 6,087,221 |

| SER | Strategic Energy | 0.034 | 25.9% | 1,591,466 |

| AFW | Applyflow Limited | 0.0025 | 0.0% | 188,933 |

| AMD | Arrow Minerals | 0.005 | 11.1% | 15,641,302 |

| BAT | Battery Minerals Ltd | 0.01 | 25.0% | 5,731,206 |

| GGX | Gas2Grid Limited | 0.0025 | 25.0% | 995,017 |

| OEX | Oilex Ltd | 0.005 | 25.0% | 65,385,798 |

| ATU | Atrum Coal Ltd | 0.016 | 23.1% | 6,934,957 |

| MTM | Mtmongerresources | 0.22 | 22.2% | 1,749,888 |

| ADY | Admiralty Resources. | 0.018 | 20.0% | 499,092 |

| AEI | Aeris Environmental | 0.09 | 20.0% | 931,587 |

| PYR | Payright Limited | 0.18 | 20.0% | 241,742 |

| NCR | Nucoal Resources Ltd | 0.012 | 20.0% | 2,496,521 |

| PCL | Pancontinental Energ | 0.006 | 20.0% | 4,895,189 |

| XAM | Xanadu Mines Ltd | 0.037 | 19.4% | 8,399,609 |

| BDX | Bcaldiagnostics | 0.125 | 19.0% | 90,000 |

| DRX | Diatreme Resources | 0.025 | 19.0% | 18,346,380 |

| SW1 | Swift Networks Group | 0.019 | 18.8% | 39,367 |

| HHI | Health House Int Ltd | 0.033 | 17.9% | 131,514 |

| EMU | EMU NL | 0.021 | 16.7% | 2,487,097 |

| TRU | Truscreen | 0.07 | 16.7% | 615,072 |

BNPL player Payright (ASX:PYR) provides a BNPL service for merchant clients to offer customers, with a focus on bigger-ticket items.

The company announced a $125 million warehouse funding facility with senior lender Goldman Sachs and mezzanine arranger iPartners, which it said will reduce cost of funding by 5.5% and add an additional $4.4m in annual cash flows.

The warehouse facility will be accompanied by a $9.5 million capital raising, comprised of a $1.5 million placement at 18c to strategic investor Fincap Australia, and an $8m convertible note facility with a 22.5c conversion price.

Sovereign Metals (ASX:SVM) says it’s updated the mineral resource estimate (MRE) for its Kasiya project in Malawi – and ladies and gentlemen – it’s a rather large 1.8 billion tonnes at 1.01% rutile. The largest ever.

Contained rutile at the deposit now stands at 18 million tonnes – tripling the previous MRE – while contained flake graphite by-product now stands at 23 million tonnes.

A total of 662 million tonnes, or 37%, of the total MRE reports to the indicated category with remainder in the Inferred category.

MD Dr Julian Stephens says this puts Kasiya as a Tier 1 natural rutile deposit with more than double the contained rutile as its nearest rutile peer, Sierra Rutile. Plus, the graphite by-product MRE at Kasiya places it as the second largest flake graphite deposit in the world.

“It is a really remarkable achievement by our team to have made the largest natural rutile discovery ever in just two years since initial identification,” he added.

“The JORC MRE of this scale and grade is clearly highly strategic, Tier 1 and of global significance in a market where natural rutile is in extreme supply deficit.”

The $311m market cap stock is up 33% year-to-date.

Meanwhile, up on no news at all is Mitre Mining (ASX:MMC) a freshly minted small cap with a hankering for lithium, rare earths, gold, and base metals in the mineral rich Lachlan Fold Belt of NSW.

The company is taking a “multi-commodity, multi-deposit style approach to exploration” at the flagship ‘Bateman’ project, according to MMC CEO Clinton Carey.

Last month, Mitre said that over 2,700 portable XRF readings at Batemans detailed widespread anomalous rare earths. And while XRF tech isn’t as reliable as lab assays, Reuben assures, it’s still a respectable indicator.

“The results show anomalous rare earth results extend along major structures over multiple strike lengths “generating a mineralised target area greater than 4km and up to 800m wide”, MMC said.

The $6.2m market cap stock is up ~20% year-to-date. And further assay results are pending.

Iron ore-nickel-cobalt explorer/project developer Admiralty Resources (ASX:ADY) has been largely MIA in 2022.

In February last year, ADY signed a deal to hopefully commercialise its Mariposa iron ore project in Chile.

The 420m market cap stock is up 80% year-to-date. It had $1.7m in the bank at the end of December.

Mineral Resources Limited (ASX: MIN) and JV buddy, Albemarle Corporation (NYSE: ALB) say that thanks to increasing demand for lithium they’ll likewise lift production from the Wodgina and Mt Marion spodumene mines in WA.

The miners will accelerate resumption of production from Train 2 at Wodgina with first spodumene concentrate from this train expected in July. The stock is up over 5.5% today and MinRes says preparations to recommence operations at Train 1, are going well, with first spodumene concentrate from this train now expected in May.

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| MHI | Merchant House | 0.051 | -48.0% | 741 |

| EVE | EVE Health Group Ltd | 0.0015 | -25.0% | 50,000 |

| AQC | Auspaccoal Ltd | 0.165 | -25.0% | 56,161 |

| MAP | Microba Life Sciences | 0.34 | -24.4% | 3,837,222 |

| JXT | Jaxstaltd | 0.028 | -24.3% | 9,096,273 |

| TEM | Tempest Minerals | 0.1 | -23.1% | 44,042,769 |

| BAS | Bass Oil Ltd | 0.002 | -20.0% | 6,537,185 |

| PUR | Pursuit Minerals | 0.034 | -17.1% | 37,593,460 |

| SFM | Santa Fe Minerals | 0.15 | -16.7% | 56,103 |

| ICN | Icon Energy Limited | 0.02 | -16.7% | 892,476 |

| TYX | Tyranna Res Ltd | 0.005 | -16.7% | 500,811 |

| QEM | QEM Limited | 0.235 | -16.1% | 818,037 |

| SGI | Stealth Global | 0.11 | -15.4% | 253,605 |

| GML | Gateway Mining | 0.011 | -15.4% | 6,795,293 |

| CRB | Carbine Resources | 0.023 | -14.8% | 640,820 |

| AZL | Arizona Lithium Ltd | 0.205 | -14.6% | 92,049,258 |

| LRV | Larvottoresources | 0.235 | -14.5% | 813,917 |

| BUD | Buddy Tech | 0.006 | -14.3% | 1,026,578 |

| BRX | Belararoxlimited | 0.715 | -13.9% | 762,164 |

| ENT | Enterprise Metals | 0.019 | -13.6% | 4,520,533 |

| RAB | Adrabbit Limited | 0.013 | -13.3% | 430,610 |

| GW1 | Greenwing Resources | 0.43 | -13.1% | 972,764 |

| CZL | Cons Zinc Ltd | 0.041 | -12.8% | 5,195,140 |

| B4P | Beforepay Group | 0.73 | -12.6% | 115,130 |

| AQX | Alice Queen Ltd | 0.007 | -12.5% | 1,080,000 |

Down over 16%, smart globe maker Buddy Technologies (ASX:BUD) has been asked by the ASX to justify its listing on the Exchange for the third time after it posted a half year loss of $50m earlier this year.

Music attribution aggregator Jaxsta (ASX:JXT) dipped sharply, after announcing a funding deal with licensing platform Songtradr.

The deal will see Songtrader provide JXT with an interest-free loan of $1.7m, which if approved by shareholders will give Songtradr the right to provide an additional $1.3m as part of a $3m convertible note.

The note will be convertible by Songtradr into fully paid ordinary Jaxsta shares at 2.1c, a material discount to yesterday’s closing price of 3.4c.

ANNOUNCEMENTS YOU MAY HAVE MISSED

Marketing distributor Ovato (ASX:OVT) has announced it will exit heatset printing in New Zealand, blaming soaring prices and shortages.

Word is the global print industry is experiencing dramatic paper price increases and an inability to source paper over the short and medium term, which was being felt particularly across the Tasman.

Ovato said without its heatset operations, its letterbox distribution operations will also close, while sheetfed operations will become the company’s sole focus.

Tulla Resources (ASX:TUL) has announced a positive update to the Mineral Resource Estimates and Ore Reserve at the Scotia deposit, which forms part of the Scotia Mining Centre and O’Brien’s Underground at Mainfield at the Norseman Project.

Tulla said increases in the ore reserve and life of mine plan at Norseman will directly contribute to further mine life extension at Norseman. The Norseman Project Ore Reserve now stands at 12.9 Mt @ 2.2 g/t for 900,000 ounces, an increase of 49% since the October 2020 DFS (100%).

Biotech Arovella Therapeutics Ltd (ASX: ALA), has announced the US Patent and Trademark Office (USPTO) has now accepted its patent application covering anagrelide and the patent will proceed to grant.

Anagrelide is being developed for the treatment of metastatic disease in patients who have ‘certain solid tumour’ cancers.

The USPTO will grant Arovella’s Application No. 15/538,326 titled “Use of Anagrelide for Treating Cancer”. The patent adds to those granted in Europe, Japan and Australia.

TRADING HALTS

Hawthorn Resources Limited (ASX: HAW) – trading halt, pending release of an announcement to the market in relation to the execution of a joint venture agreement in relation to the Mt Bevan iron ore project.

Legacy Iron Ore Limited (ASX:LCY) – trading halt, regarding the execution of a joint venture agreement in relation to the Mt Bevan iron ore project.

Nova Minerals Limited (ASX: NVA), (OTC: NVAAF, FSE: QM3) – trading halt, pending an announcement regarding the company’s investment in Snow Lake Resources Limited.

European Lithium Limited (ASX: EUR) – trading halt, pending an announcement regarding a proposed capital raising.

Strandline Resources Limited (ASX:STA) – trading halt, pending an announcement in relation to a capital raising by way of an institutional placement, to fund the acceleration and expansion of growth projects in Australia and Tanzania.

Golden Deeps Ltd (ASX:GED) – trading halt, pending an announcement to the market in relation to a capital raising.

Hartshead Resources NL (ASX:HHR) – trading halt, pending an announcement in relation to a material update to Phase Irrecoverable gas volumes at the Company’s 100% owned Production Seaward License P2607.

Western Areas Limited (ASX: WSA) – trading halt, pending an announcement by the Company providing an update on the proposed acquisition by IGO Limited (ASX:IGO) of all of the fully paid ordinary shares in WSA, by way of a scheme of arrangement.

Okapi Resources Limited (ASX: OKR) – trading halt, pending the release of an announcement in relation to a material acquisition.

Inca Minerals Limited (ASX: ICG) – trading halt, pending an announcement on the government drill hole NDIBK04 assay results.

NDIBK04 occurs on ground which Inca is the successful applicant for an Exploration Licence EL32808 (ASX release: 6 December 2021). Geoscience Australia plan to publish these results, among with other data on their online portal today (Tuesday 5th April.)

The data has not been viewed by the Company prior to its release to the public. The Company requests that the trading halt be lifted on the earlier of the commencement of normal trading on Thursday, 7 April 2022 or when the anticipated announcement is released to the market.

Xanadu Mines Ltd (ASX:XAM) – trading halt requested in response to the Price & Volume – Query issued by the ASX this afternoon, and in order to allow Xanadu to finalise an Announcement on the Scoping Study for its Kharmagtai flagship project in Mongolia.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.