Closing Bell: Tech leads ASX selloff; sluggish iron ore, gold prices also weigh on miners

Tech stocks were the biggest laggards, tracking movements on the tech-heavy Nasdaq after hawkish remarks from Fed officials last night. Picture Getty

The ASX200 slipped by -0.6%, and for the week, the index was down around the same figure.

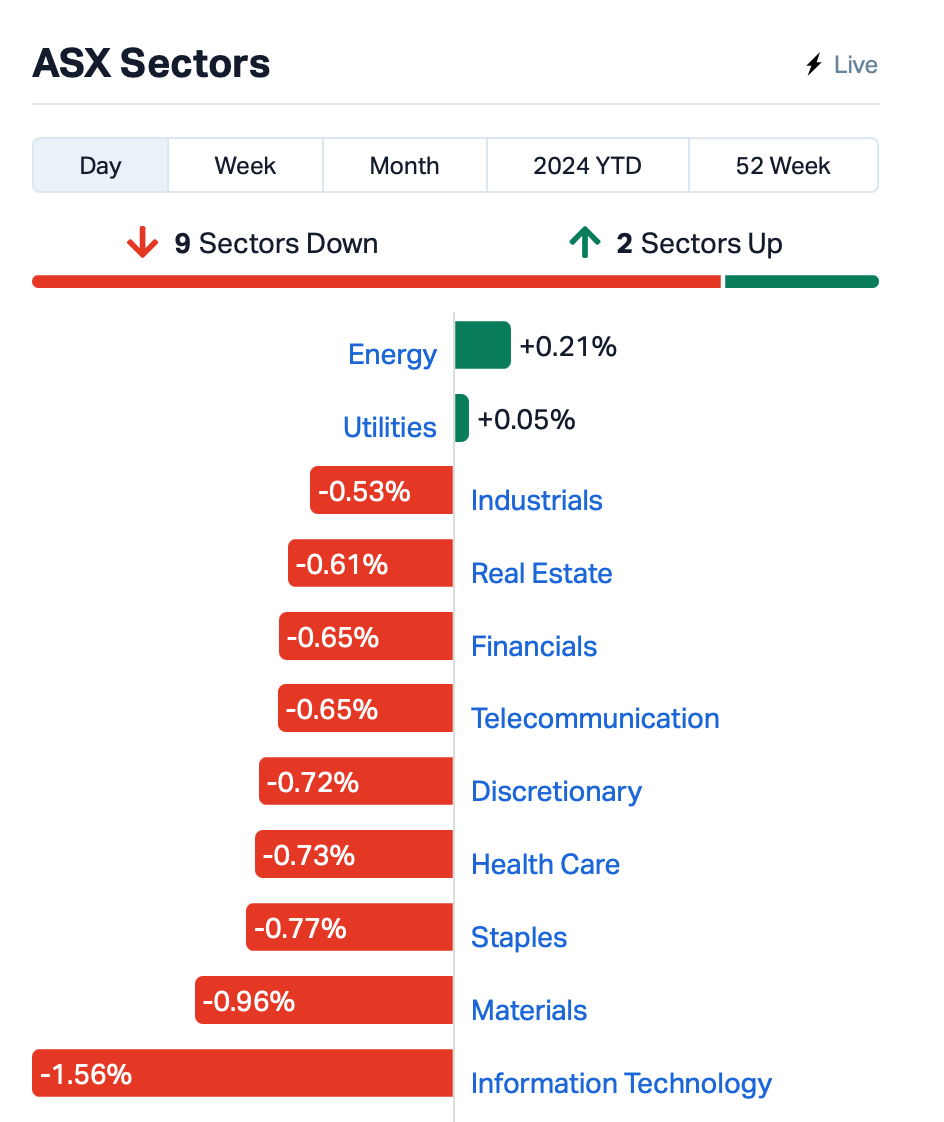

All sectors except for Energy and Utilities closed in the red on Friday.

Tech stocks were the biggest laggards, tracking movements on the tech-heavy Nasdaq after hawkish remarks from Fed officials last night.

Minneapolis Fed boss Neel Kashkari said that although the Fed has pencilled in two rate cuts, none may be implemented this year if inflation stays sticky.

“If we continue to see inflation moving sideways, then that would make me question whether we need to do those rate cuts at all,” Kashkari said. “There’s a lot of momentum in the economy right now.”

Earlier in the day, Richmond Fed President Thomas Barkin also said the US central bank has “time for the clouds to clear” on inflation before starting to cut rates.

Back on the ASX, iron ore prices are weighing on the bourse’s giant miners, BHP (ASX:BHP) and Rio Tinto (ASX:RIO), which fell -1% each.

Iron ore prices were down a further -1.5% overnight to US$98.00 a tonne, a 10-month low, as traders mulled a sluggish recovery in China.

Energy stocks meanwhile mostly climbed today after Brent crude hit above US$90/bbl as Middle East tensions escalate.

Matt Maley at Miller Tabak + told Bloomberg that if we get a direct conflict between Israel and Iran, that’s something that will likely restrict the supply of oil coming from the Middle East.

“That has not been an issue up until now, but it could become one very quickly,” he said.

ELSEWHERE…

In other markets, gold has inched lower from its all time highs yesterday, trading now at US$2,228.25.

Elsewhere in the region, most Asian stock markets also closed the week lower today on interest rate uncertainties.

China’s market is still closed for spring break, but US Treasury Secretary Janet Yellen has kicked off her latest visit to China.

The market’s focus will now turn to the March US jobs report, due to be released at 11.30pm AEDT tonight.

LARGE CAP WINNNERS TODAY:

Code Name Price % Change Volume Market Cap CEN Contact Energy Ltd 7.96 7.13 76 $1,903,424,005 RRL Regis Resources 2.05 3.27 2,921,954 $1,499,347,534 GQG GQG Partners 2.27 3.18 3,575,863 $6,497,434,799 KAR Karoon Energy Ltd 2.33 3.10 4,117,434 $1,810,802,479 ASK Abacus Storage King 1.23 2.93 408,165 $1,570,353,040 ELD Elders Limited 9.89 2.91 711,682 $1,512,325,969 TLX Telix Pharmaceutical 12.51 2.42 961,525 $3,955,917,253 VEA Viva Energy Group 3.83 2.00 3,392,087 $5,980,528,894 IRE IRESS Limited 8.07 1.89 164,337 $1,479,372,634 EMR Emerald Res NL 3.32 1.69 1,823,057 $2,040,380,184 RSG Resolute Mining 0.46 1.65 8,581,350 $968,717,756 WLE WAM Leaders Limited 1.40 1.45 635,308 $1,738,802,034 EVN Evolution Mining Ltd 3.87 1.44 4,685,724 $7,566,194,258 S32 South32 Limited 3.22 1.42 15,252,908 $14,357,749,661

Contact Energy (ASX:CEN) surged +7% on no specific news.

Fund manager GQG Partners (ASX:GQG) rose after announcing that funds under management (FUM) for 31-March has increased to $143.4bn from $137.5bn in February.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RGS | Regeneus Ltd | 0.012 | 140.00 | 22,284,696 | 1,532,185 |

| RIL | Redivium Limited | 0.0045 | 50.00 | 557,610 | 8,192,564 |

| HHR | Hartshead Resources | 0.007 | 40.00 | 29,112,821 | 14,043,411 |

| ENX | Enegex Limited | 0.025 | 38.89 | 39,800 | 6,640,488 |

| HCD | Hydrocarbon Dynamic | 0.004 | 33.33 | 1,975,261 | 2,425,747 |

| EXR | Elixir Energy Ltd | 0.092 | 29.58 | 36,284,959 | 80,418,171 |

| TZL | TZ Limited | 0.025 | 25.00 | 26,914 | 5,135,162 |

| SIX | Sprintex Ltd | 0.016 | 23.08 | 1,740,114 | 6,114,046 |

| YRL | Yandal Resources | 0.135 | 22.73 | 205,649 | 29,458,838 |

| NYR | Nyrada Inc. | 0.12 | 22.45 | 4,388,482 | 17,582,053 |

| OMA | Omegaoilgaslimited | 0.175 | 20.69 | 642,325 | 39,627,991 |

| SLM | Solismineralsltd | 0.12 | 20.00 | 1,015,168 | 7,807,725 |

| ESR | Estrella Res Ltd | 0.006 | 20.00 | 166,666 | 8,796,859 |

| MOH | Moho Resources | 0.006 | 20.00 | 700,000 | 2,695,891 |

| OSL | Oncosil Medical | 0.006 | 20.00 | 22,089,456 | 11,277,706 |

| PRX | Prodigy Gold NL | 0.003 | 20.00 | 182,000 | 4,852,353 |

| BNZ | Benzmining | 0.155 | 19.23 | 182,350 | 14,466,137 |

| GAS | State GAS Limited | 0.155 | 19.23 | 119,961 | 35,649,483 |

| CDD | Cardno Limited | 0.47 | 18.99 | 557,752 | 15,428,962 |

| XPN | Xpon Technologies | 0.02 | 17.65 | 165,000 | 5,161,339 |

| 1MC | Morella Corporation | 0.0035 | 16.67 | 153,930 | 18,536,398 |

| BNL | Blue Star Helium Ltd | 0.007 | 16.67 | 320,730 | 11,653,592 |

| EMP | Emperor Energy Ltd | 0.014 | 16.67 | 185,316 | 4,088,850 |

| FGL | Frugl Group Limited | 0.007 | 16.67 | 868,965 | 8,938,647 |

| SCN | Scorpion Minerals | 0.028 | 16.67 | 152,000 | 9,826,949 |

The big news for Friday came via Regeneus (ASX:RGS), after it announced that it has successfully completed a big merger with Cambium Medical Technologies sending Regeneous shares up +180%. The merger will also see a name change for the entity, and there’s been paperwork lodged with the ASX to rebrand to Cambium Bio (ASX:CBL), while work on the company’s leading collaboration, the development of Elate Ocular, a novel biologic for dry eye disease, continues.

Elixir Energy (ASX:EXR) also had a solid day, revealing that the company decided to test the free-flowing capacity of the Lorelle Sandstone between 4,200 and 4,217 metres, following a recent successful suite of Diagnostic Formation Integrity Tests (DFITs) conducted at Daydream-2. The fresh testing has been deemed a success, with a maximum rate of 2.3 Million Standard Cubic Feet Per Day (MMSCFPD) and stabilised flow rate of 1.3 MMSCFPD (through a 20/64 choke), which the company understands is the deepest unstimulated flow of gas in onshore Australia East of the Perth Basin.

And Biotron (ASX:BIT) has dropped some happy-happy news on the market, announcing that preliminary analyses of data from the BIT225-010 Phase 2 clinical trial of the company’s lead antiviral drug BIT225 provide confirmation, and extension, of the positive results of previous trials in people infected with HIV-1.

Estrella Resources (ASX:ESR) announced that results from initial rock-chip samples are in, which the company says were taken before the granting of Exploration and Evaluation Licences and Reconnaissance Permits for ESR in Timor-Leste. The samples were then brought back to Australia for further analysis. And that turned up an assay result of 60.8% manganese – one of four samples taken during initial limited reconnaissance. Estrella also notes that multiple manganese exposures have been documented across the 503.7km2 leases in Lautém with no modern exploration undertaken.

Tungsten Mining (ASX:TGN) has been conducting infill RC drilling at Mulgine Hill East, which has defined significant molybdenum-tungsten mineralisation over 520 metres of strike. What else? Project engagement with potential partners is reportedly progressing.

Kula Gold (ASX:KGD) has identified significant gold prospectivity at its Brunswick project in WA near a historical production area after rock chipping and mapping returned assays of up to 11.19g/t gold.Brunswick sits within the Donnybrook-Bridgetown Shear Zone just 35km from Greenbushes, the world’s largest hard rock lithium mine.

Pancreatic cancer treatment device company OncoSil Medical (ASX:OSL) continues to expand, with the first Austria-based patients receiving treatments involving the OncoSil device.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MRD | Mount Ridley Mines | 0.001 | -33.33 | 1,000,000 | $11,677,324 |

| MRQ | Mrg Metals Limited | 0.002 | -25.00 | 326,923 | $5,050,237 |

| ZMI | Zinc of Ireland NL | 0.015 | -25.00 | 363,296 | $4,262,886 |

| VAL | Valor Resources Ltd | 0.048 | -22.58 | 2,718,015 | $11,380,796 |

| AEV | Avenira Limited | 0.007 | -22.22 | 84,290,985 | $19,733,144 |

| FGR | First Graphene Ltd | 0.062 | -20.51 | 934,157 | $51,421,634 |

| H2G | Greenhy2 Limited | 0.008 | -20.00 | 250,000 | $4,187,558 |

| MCT | Metalicity Limited | 0.002 | -20.00 | 10,110,189 | $11,212,634 |

| MSI | Multistack Internat. | 0.004 | -20.00 | 181 | $681,520 |

| PKO | Peako Limited | 0.004 | -20.00 | 444,600 | $2,635,424 |

| OLL | Openlearning | 0.017 | -19.05 | 199,738 | $5,625,251 |

| SEG | Sports Ent Grp Ltd | 0.190 | -17.39 | 4,000 | $60,892,130 |

| AYT | Austin Metals Ltd | 0.005 | -16.67 | 501,616 | $7,711,148 |

| CAV | Carnavale Resources | 0.005 | -16.67 | 209,333 | $20,541,310 |

| CYQ | Cycliq Group Ltd | 0.005 | -16.67 | 4,594,733 | $2,145,100 |

| EMT | Emetals Limited | 0.005 | -16.67 | 210,000 | $5,100,000 |

| MHC | Manhattan Corp Ltd | 0.003 | -16.67 | 2,000,000 | $8,810,939 |

| ODE | Odessa Minerals Ltd | 0.005 | -16.67 | 616,771 | $6,259,695 |

| RR1 | Reach Resources Ltd | 0.003 | -16.67 | 359,671 | $9,836,169 |

| SGC | Sacgasco Ltd | 0.010 | -16.67 | 2,265,865 | $9,356,245 |

| TAS | Tasman Resources Ltd | 0.005 | -16.67 | 162,044 | $4,276,016 |

| YAR | Yari Minerals Ltd | 0.005 | -16.67 | 2,275 | $2,894,147 |

| DTM | Dart Mining NL | 0.039 | -15.22 | 2,255,027 | $10,468,663 |

| M2R | Miramar | 0.012 | -14.29 | 1,700,410 | $2,084,174 |

| OAU | Ora Gold Limited | 0.006 | -14.29 | 6,027,442 | $40,642,006 |

IN CASE YOU MISSED IT – PM Edition

Alma Metals (ASX:ALM) is raising up to $2.77m to fund further resource extension and infill drilling at its Briggs, Mannersley and Fig Tree Hill copper project in Central Queensland. The capital raising consists of a committed $1.77m placement and a share purchase plan to raise up to a further $1m.

TRADING HALTS

Bulletin Resources (ASX:BNR) – pending an announcement in relation to an update on its Ravensthorpe lithium project.

Alice Queen (ASX:AQX) – pending an announcement by the Company to the market regarding a strategic capital raising.

Coolabah Metals (ASX:CBH) – pending an announcement regarding a material capital raising.

At Stockhead, we tell it like it is. While Alma Metals is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.