Closing Bell: Tariffs burst the ASX with the potential to ’cause significant disruption’

TheASX drops as Trump tariffs fuel market jitters. Picture via Getty Images

- ASX drops as Trump tariffs fuel market jitters

- Canada and China hit back with tariffs of their own

- Suncorp, Insignia and HCW down after bad news

The ASX had a bad Tuesday after Donald Trump confirmed he was going ahead with those tariffs, leaving traders feeling a little spooked.

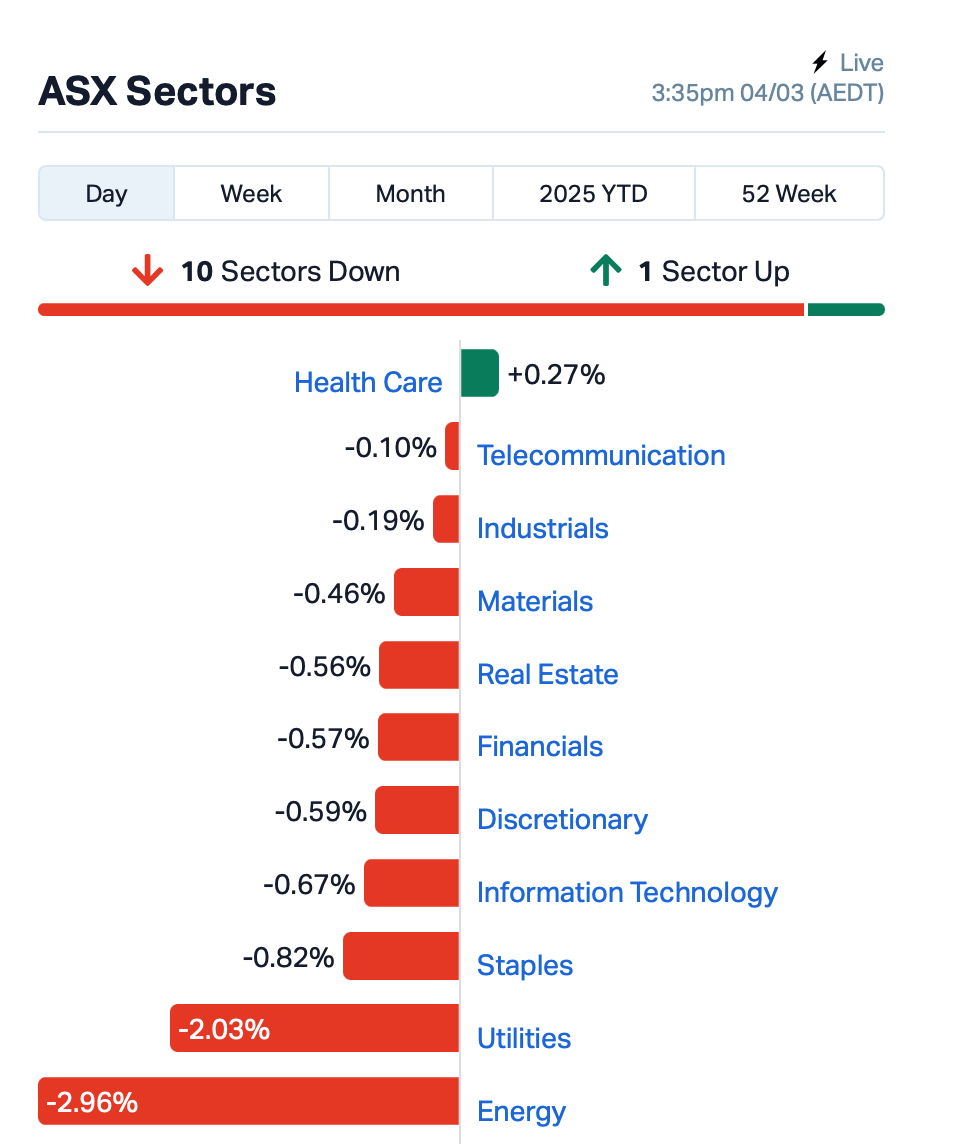

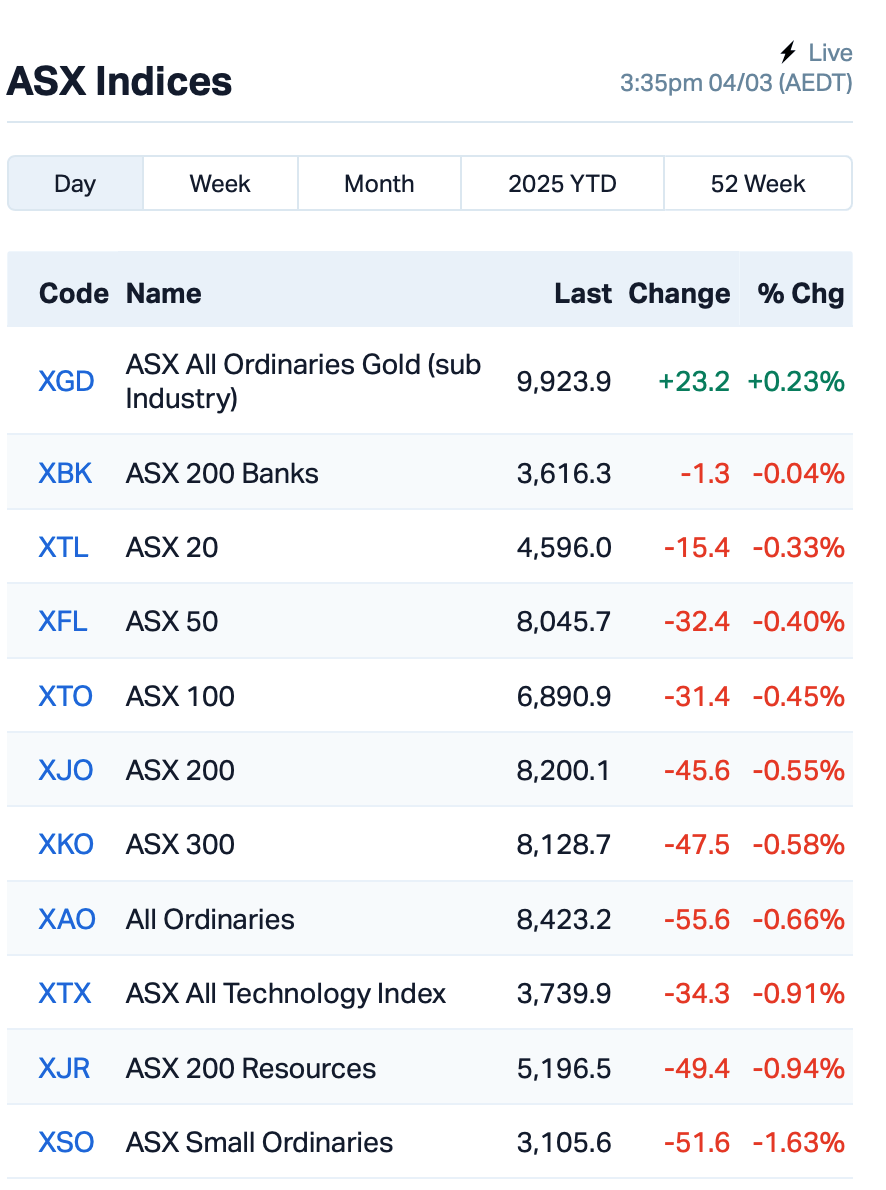

At the close of trading, the benchmark S&P/ASX 200 index slipped by 0.65%. Just for a little perspective, the index had taken a harder hit right out the gate, dropping over 1% before lunch.

Trump confirmed last night that he’d be slapping on 25% tariffs for both Canada and Mexico, plus an extra 10% levy on China.

Naturally, China wasn’t too happy about it and has already retaliated with its own tariffs on US goods.

Canada also wasn’t about to take it lying down. Prime Minister Justin Trudeau has just fired back with a counter-tariff plan, slapping 25% tariffs on US-made goods worth around $C30 billion (about $23 billion AUD).

So it’s basically a full-on trade war right now.

Franklin Templeton’s Fixed Income CIO Sonal Desai commented on the current situation, noting:

“Two of the administration’s early lines of action have the potential to cause significant disruption, and this in turn has fuelled fears of an adverse impact on economic activity.

“Tariff threats are the most obvious example… the second is cuts in public expenditure and employment driven by the new Department of Government Efficiency (DOGE).”

The tariffs also weighed on oil prices and oil stocks, with Brent crude dipping below US$71 per barrel.

Chinese stocks, particularly in Hong Kong and mainland China, fell today as investors realised the harsh reality of these tariffs.

Back on the ASX, only one sector made it out in the green – healthcare.

As for the stock movers, there were a few names on the down and out.

Suncorp Group (ASX:SUN) dropped 1.8%, following on from the previous day’s losses, largely because of worries around Tropical Cyclone Alfred. QBE Insurance (ASX:QBE) and Insurance Australia (ASX:IAG) also took more hits.

Wealth manager Insignia Financial (ASX:IFL) tumbled by 5% after it rejected a request from National Australia Bank (ASX:NAB) to pay back $200 million worth of subordinated loans, meaning it will now have to pay a higher coupon rate – about $53.5 million more, in fact.

And, Healthco Healthcare and Wellness REIT (ASX:HCW), owned by David Di Pilla, dropped over 7% after its tenant, Healthscope, failed to pay rent on 11 of its facilities.

As a result, HCW has pulled its earnings and distribution guidance for FY25, which was set at 8.4 cents per unit, until the issue with Healthscope is sorted out.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.002 | 100% | 5,931,197 | $28,933,812 |

| ERG | Eneco Refresh Ltd | 0.015 | 50% | 100,000 | $2,723,583 |

| MOM | Moab Minerals Ltd | 0.002 | 50% | 4,000,600 | $1,566,999 |

| MPR | Mpower Group Limited | 0.011 | 38% | 890,436 | $2,749,626 |

| NGS | NGS Ltd | 0.032 | 33% | 553,405 | $3,251,588 |

| MM1 | Midasmineralsltd | 0.125 | 25% | 56,019 | $12,412,968 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 1,583,156 | $4,546,558 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 167,264 | $3,220,998 |

| IND | Industrialminerals | 0.150 | 20% | 210,695 | $10,040,313 |

| AKN | Auking Mining Ltd | 0.006 | 20% | 2,901,685 | $2,873,894 |

| AMS | Atomos | 0.006 | 20% | 4,849,125 | $6,075,092 |

| BCB | Bowen Coal Limited | 0.006 | 20% | 4,387,112 | $53,878,201 |

| GTR | Gti Energy Ltd | 0.003 | 20% | 1,083,333 | $7,469,874 |

| EGR | Ecograf Limited | 0.125 | 19% | 6,110,689 | $47,683,841 |

| IFG | Infocusgroup Hldltd | 0.020 | 18% | 41,711,883 | $3,102,769 |

| IRX | Inhalerx Limited | 0.027 | 17% | 237,037 | $4,909,309 |

| CCO | The Calmer Co Int | 0.007 | 17% | 100,071 | $15,263,749 |

| NTM | Nt Minerals Limited | 0.004 | 17% | 236,667 | $3,632,709 |

| SPQ | Superior Resources | 0.007 | 17% | 934,695 | $13,019,183 |

| TMK | TMK Energy Limited | 0.004 | 17% | 398,012 | $27,976,695 |

| BSX | Blackstone Ltd | 0.074 | 16% | 1,640,895 | $42,914,789 |

| GBZ | GBM Rsources Ltd | 0.008 | 14% | 3,383,946 | $8,197,490 |

| PXX | Polarx Limited | 0.008 | 14% | 4,763,511 | $16,628,507 |

| VAR | Variscan Mines Ltd | 0.008 | 14% | 1,423,762 | $5,480,004 |

| VEN | Vintage Energy | 0.004 | 14% | 3,783,459 | $5,843,359 |

Nutritional Growth Solutions (ASX:NGS) is making moves in the US, kicking off with Wakefern, a major grocery chain in the Northeast. It’s rolling out four Healthy Heights products in around 300 stores, which could bring in about US$750k in annual sales, the company said. NGS is also ramping up its presence in Walmart, with the distribution of its Healthy Heights shakes expanding from 762 to 972 stores, plus a new flavour (Strawberry) being added to the mix.

Auking Mining (ASX:AKN) has just struck a deal to up its stake in the Cloncurry gold project to 50%. It already had a 15% interest and will now invest $5 million by 2027 to bump that up. Orion Resources, which is buying the project’s key assets, including the Lorena processing plant, is aiming to restart mining and processing in the region, with plans to include material from nearby mines like Tick Hill. Auking said this move gives it a shot at a major role in the Cloncurry gold scene.

Ecograf (ASX:EGR) has hit a milestone with the granting of the Epanko graphite project’s “Life of Mine” Special Mining Licence (SML) from the Tanzanian government. This key approval gives EcoGraf the green light to move ahead with financing for the project, which includes a 73,000-tonne-per-year graphite processing plant. The new licence also doubles the mining area, covering a massive 18.9 square km, and positions Epanko as Africa’s largest development-ready graphite resource. EcoGraf said it plans to meet the growing demand for graphite in electric vehicle and clean energy markets.

InFocus Group Holdings (ASX:IFG) has scored a $1.5 million deal to develop a cross-border stablecoin payment platform for GBO Assets, a company based in the Seychelles. The platform will use AI to optimise exchange rates and liquidity. Over the next two years, InFocus said it will design and launch the platform in four phases, with the total value of this project potentially reaching $1.9 million. This is just one of several big contracts InFocus has landed recently, including a $2.5 million deal to develop a digital gaming product for GBO.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.001 | -50% | 295,944 | $4,063,446 |

| CDE | Codeifai Limited | 0.001 | -50% | 7,620,324 | $6,340,628 |

| AOK | Australian Oil. | 0.002 | -33% | 9,065,000 | $3,005,349 |

| RFA | Rare Foods Australia | 0.016 | -33% | 547,493 | $6,527,598 |

| GGE | Grand Gulf Energy | 0.002 | -25% | 100,000 | $4,900,774 |

| MMR | Mec Resources | 0.003 | -25% | 100,000 | $7,399,063 |

| FG1 | Flynngold | 0.022 | -21% | 460,214 | $7,316,861 |

| BMH | Baumart Holdings Ltd | 0.040 | -20% | 50,024 | $7,237,238 |

| ERA | Energy Resources | 0.002 | -20% | 810,550 | $1,013,490,602 |

| IS3 | I Synergy Group Ltd | 0.004 | -20% | 2,416,520 | $1,981,089 |

| LOM | Lucapa Diamond Ltd | 0.014 | -18% | 1,081,139 | $7,826,324 |

| CMB | Cambium Bio Limited | 0.270 | -16% | 62,404 | $4,525,765 |

| WOA | Wide Open Agricultur | 0.011 | -15% | 2,458,313 | $6,937,926 |

| ACW | Actinogen Medical | 0.034 | -15% | 21,532,273 | $125,312,556 |

| FCT | Firstwave Cloud Tech | 0.017 | -15% | 890,470 | $34,270,374 |

| CMO | Cosmometalslimited | 0.018 | -14% | 366,243 | $2,750,850 |

| BLZ | Blaze Minerals Ltd | 0.003 | -14% | 7,620,643 | $5,484,317 |

| EM2 | Eagle Mountain | 0.006 | -14% | 94,294 | $7,945,261 |

| IPB | IPB Petroleum Ltd | 0.006 | -14% | 2,219,579 | $4,944,821 |

| IXR | Ionic Rare Earths | 0.006 | -14% | 10,026,995 | $36,668,998 |

| NPM | Newpeak Metals | 0.012 | -14% | 107,708 | $4,509,004 |

| TYX | Tyranna Res Ltd | 0.006 | -14% | 1,043,636 | $23,015,477 |

| SP3 | Specturltd | 0.013 | -13% | 702,200 | $4,622,252 |

| AEV | Avenira Limited | 0.007 | -13% | 9,311,299 | $25,421,152 |

| GLL | Galilee Energy Ltd | 0.007 | -13% | 805,152 | $4,457,543 |

Wide Open Agriculture (ASX:WOA) has released a strategic business review announcement today. WOA’s shares have copped a hit lately as the company struggles with slower-than-expected sales growth, especially after the acquisition of a German facility that’s not yet fully delivering. The company has been trying to cut costs and find ways to boost production without burning too much cash. On top of that, WOA said it’s moving its focus now to its proprietary lupin protein – a plant-based protein that’s gaining attention for its health and environmental benefits.

IN CASE YOU MISSED IT

Bhagwan Marine (ASX:BWN) has reported record revenue of $154.1 million and EBITDA of $27.3 million for H1 FY2025, driven by strong performance across its diverse and expanding portfolio. The company expects continued growth, supported by demand from energy companies, subsea expansion, larger vessel opportunities, and rising defence sector enquiries.

Brightstar Resources (ASX:BTR) has returned high-grade gold hits of up to 17.89g/t from maiden drilling at the Lord Nelson deposit within its 1.5Moz Sandstone gold project. The company is advancing a major 80,000m drilling campaign across multiple deposits, with rigs now targeting Vanguard Camp and upcoming programs at Laverton Hub and Fish underground.

Imricor Medical Systems (ASX:IMR) has submitted its second premarket approval module to the US FDA, covering manufacturing processes for seven devices. The company remains on track for full regulatory approval, with its NorthStar 3D mapping system set for US submission next under the faster 510(k) pathway.

Mithril Silver and Gold (ASX:MTH) hit 4.95m at 20.5g/t gold and 1,833g/t silver at Copalquin, where it aims to double its 529,000oz gold equivalent resource. The expanded 35,000m drilling program is ongoing and expected to conclude by the end of March.

Lanthanein Resources (ASX:LNR) has kicked off diamond drilling at its Lady Grey project in WA’s Yilgarn to test a high-priority modelled conductor plate under MLEM Survey Line #1, which aligns with a significant surface gold anomaly. Despite some delays, drilling is now underway with two planned holes to depths of 325m and 350m, using existing historical access lines.

At Stockhead, we tell it like it is. While Bhagwan Marine, Brightstar Resources, Imricor Medical Systems, Lanthanein Resources, Mithril Silver and Gold are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.