Closing Bell: Stocks and crypto rebound, gold eyes US$3k and Pilbara seals $560m lithium prize

The ASX bounced back after Trump delayed tariffs. Picture via Getty Images

- ASX bounces back after Trump delays tariffs

- Bitcoin jumps, and gold could reach US$3,000, says expert

- Pilbara finalises $560m deal to scoop Latin Resources

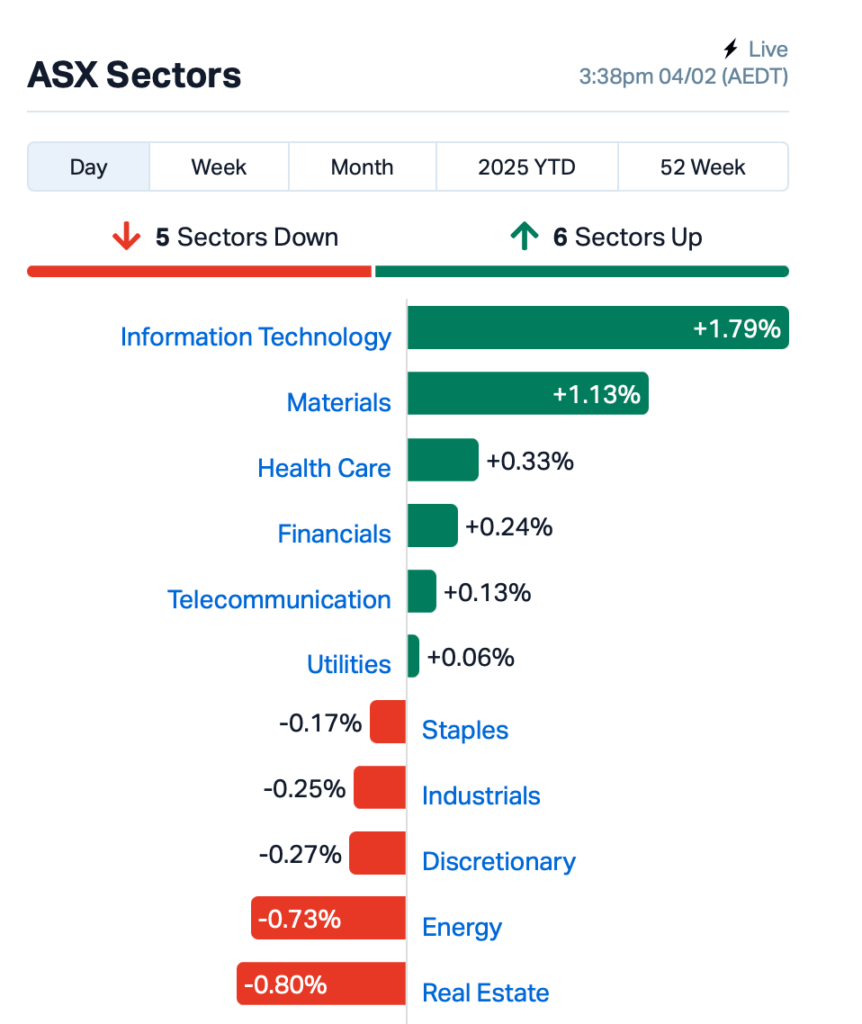

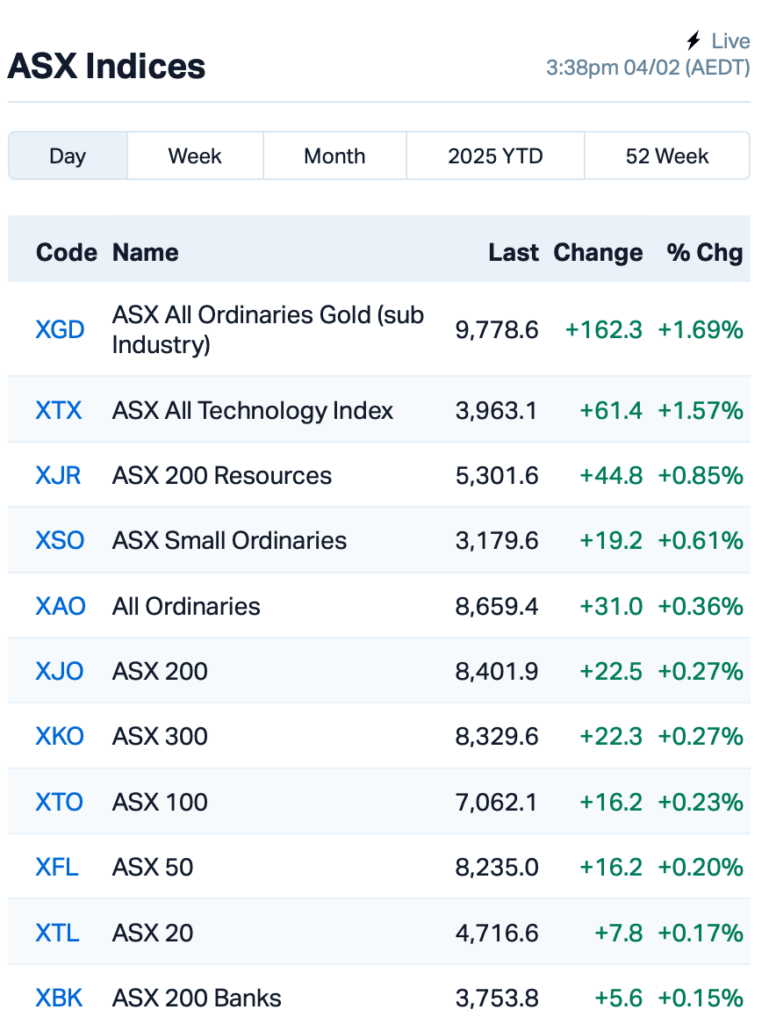

After a rough day on Monday, the ASX made a comeback today, up by 0.3% on the back of US President Trump’s decision to delay tariffs on Mexico and Canada.

Major tech stocks rallied, with WiseTech Global (ASX:WTC) up by 4%, and Technology One (ASX:TNE) jumping by 2%.

Miners, including Fortescue Metals Group (ASX:FMG), also saw strong gains, while the Aussie dollar pulled back from its four-month low, climbing back above US62¢.

Bitcoin surged back by 7%, reaching $100,296 a short while ago at the time of writing and reversing yesterday’s losses; while gold crept closer to its record high, trading at $US2,822 an ounce.

Global X ETFs analyst Justin Lin believes gold could hit US$3,000 as demand for gold ETFs surges, with Australian investors buying more gold than ever amid market uncertainty caused by Trump’s tariffs.

“A decisive breakout above US$2,800 in the coming months would reinforce the bullish trend, potentially setting up the way to reach US$3,000 by as soon as the third quarter of 2025,” Lin said.

In Asia today, Chinese stocks listed in Hong Kong popped after Trump said he’d chat with Beijing about tariffs in the next day or so, sparking hope the trade war might ease. The Hang Seng surged by as high 4% before pulling back.

And back home, this is where things stood leading up to today’s close:

In the large caps space, Seek’s (ASX:SEK) $42 million deal to acquire Xref (ASX:XF1) fell apart after the bid failed to get enough shareholder support, causing Xref’s stock to dive 22%.

ProMedicus (ASX:PME) made a splash, up 5%, after signing a $53 million contract with US healthcare network BayCare.

Pilbara Minerals (ASX:PLS) just wrapped up its $560 million deal to snap up Latin Resources (ASX:LRS) and its Salinas lithium project in Brazil. The takeover was all in shares, with Pilbara issuing 205.5 million new shares, giving Latin investors a 6.4% stake in the company.

And, Perenti Global’s (ASX:PRN) underground mining arm, Barminco, has scored its first US contract to work on the Goldrush Project in Nevada. The deal, worth around $120 million, will see Barminco provide underground development and ground support services over the next three years. PRN’s shares jumped 1%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap LNU Linius Tech Limited 0.002 100% 532,500 $6,151,216 AYM Australia United Min 0.003 50% 268,874 $3,685,155 EEL Enrg Elements Ltd 0.002 50% 127,400 $3,253,779 H2G Greenhy2 Limited 0.003 50% 2,017,416 $1,196,368 SRN Surefire Rescs NL 0.004 33% 837,995 $7,248,923 AON Apollo Minerals Ltd 0.018 33% 2,554,991 $10,603,474 OSL Oncosil Medical 0.007 30% 14,096,923 $23,032,901 RC1 Redcastle Resources 0.009 29% 7,038,301 $5,204,968 GMN Gold Mountain Ltd 0.003 25% 1,197,851 $9,158,446 M2R Miramar 0.005 25% 1,676,085 $1,587,293 MM1 Midasmineralsltd 0.105 25% 1,214,840 $10,426,893 PIL Peppermint Inv Ltd 0.005 25% 1,671,661 $8,635,433 RLG Roolife Group Ltd 0.005 25% 100,000 $4,784,125 TAS Tasman Resources Ltd 0.005 25% 270,716 $3,220,998 GDM Greatdivideminingltd 0.450 20% 144,482 $10,540,625 ALR Altairminerals 0.003 20% 25,874,222 $10,741,860 ASP Aspermont Limited 0.006 20% 200,000 $12,350,058 ASR Asra Minerals Ltd 0.003 20% 2,615,623 $5,781,575 LML Lincoln Minerals 0.006 20% 3,510,701 $10,281,298 WOA Wide Open Agricultur 0.006 20% 405,653 $2,668,433

Predictive Discovery (ASX:PDI) just locked in a $69.2 million from the Lundin family and Zijin Mining through a strategic placement. The Lundin family’s dropping $45.1 million for a 6.5% stake, while Zijin’s putting up $24.1 million for 3.5%. This cash boost will help PDI push forward with the Bankan Gold Project’s feasibility study and regional exploration. After the placement, PDI’s cash balance will hit $98 million.

OncoSil Medical (ASX:OSL) has scored a big win in Germany, with 120 hospitals now able to negotiate funding for its pancreatic cancer treatment device under the country’s innovation funding program. That’s a 43% jump from last year, showing growing demand and recognition for OncoSil. The device, which was given “Positive Status 1” in 2021, recently got the green light for clinical testing.

Altair Minerals’ (ASX:ALR) shares doubled after announcing that it was acquiring the high-grade Venatica Copper Project in Peru – a major expansion of its portfolio. Located on the prolific Andahuaylas-Yauri Porphyry Belt, Venatica spans 337km² and sits near major mines like Las Bambas, which produces 2% of global copper.

The project features large-scale copper targets, with surface samples showing grades up to 7% copper, and a history of small-scale mining with high-grade ore. With strong local support and established infrastructure, Altair said Venatica offers significant potential for high-grade discoveries.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap EDE Eden Inv Ltd 0.001 -50% 13,137 $8,219,762 AUH Austchina Holdings 0.002 -25% 4,398,000 $4,800,767 PRM Prominence Energy 0.003 -25% 24,500 $1,556,706 VPR Voltgroupltd 0.002 -25% 5,609,588 $21,432,416 XF1 Xref Limited 0.120 -23% 11,160,251 $29,758,488 PUA Peak Minerals Ltd 0.012 -20% 27,772,344 $38,281,654 FHS Freehill Mining Ltd. 0.004 -20% 1,300,000 $15,392,639 MEL Metgasco Ltd 0.004 -20% 436,914 $7,287,934 MOH Moho Resources 0.004 -20% 10,002 $3,582,373 PRX Prodigy Gold NL 0.002 -20% 1,141,834 $7,937,639 BM8 Battery Age Minerals 0.080 -18% 2,654,552 $10,017,592 ERA Energy Resources 0.003 -17% 341,396 $1,216,188,722 MRD Mount Ridley Mines 0.003 -17% 100,000 $2,335,467 TIG Tigers Realm Coal 0.003 -17% 506,331 $39,200,107 VMM Viridismining 0.330 -16% 895,154 $29,670,139 ADN Andromeda Metals Ltd 0.006 -14% 1,706,968 $24,001,094 CTN Catalina Resources 0.003 -14% 31,578 $4,606,917 MRQ Mrg Metals Limited 0.003 -14% 1,849,252 $9,542,815 SER Strategic Energy 0.006 -14% 9,247,016 $4,697,233 STM Sunstone Metals Ltd 0.006 -14% 5,692,819 $36,050,025 NRX Noronex Limited 0.013 -13% 50,000 $7,495,311 TNC True North Copper 0.300 -13% 773,407 $43,414,461

AustChina Holdings (ASX:AUH) has locked in a deal to acquire Penwortham Exploration, which holds some sweet gold-antimony and base metals projects in Tasmania’s top-tier mining areas. The Sulphide Creek Gold-Antimony Project has a high-grade antimony (66.6%) and the Mersey VMS Base Metals Project has copper and gold. AustChina plans to modernise exploration on these historic sites, which have a rich mining history. The company will pay $25k in cash and issue 300 million shares to Penwortham’s shareholders, with a six-month hold on those shares.

IN CASE YOU MISSED IT

Trigg Minerals (ASX:TMG) has grown its antimony footprint in NSW with the acquisition of the historic Bukkulla Mine and an extension to the Nundle Goldfield in the New England Orogen. This increases TMG’s holdings to 1026km², complementing an existing portfolio that includes the 29,902t Wild Cattle Creek antimony resource at Achilles, plus the Taylors Arm and Spartan projects. The company will soon start geophysical surveys, sampling, and drilling, to assess Bukkulla’s depth extensions and high-priority targets in Nundle.

Wellnex Life (ASX:WNX) has secured Therapeutic Goods Administration (TGA) authorisation for its Liquid Paracetamol plus Caffeine Soft Gel, adding to its three existing market approvals. It comes as the company continues to progress a dual listing on the London Stock Exchange to attract institutional and retail investment as part of its global expansion strategy.

New World Resources (ASX:NWC) has secured the services of experienced permitting specialist John Stefka as its environment and community manager, based in Kingman, Arizona. Stefka previously led permitting at the Moss gold mine near New World’s Antler copper project, and now his appointment will support the company’s efforts to secure state and federal permits in 2025, with early construction set to begin later this year.

At Stockhead, we tell it like it is. While Trigg Minerals, Wellnex Life and New World Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.