Closing Bell: Smart and casual, ASX makes it five in a row; next up – rates and horse races

Via Getty

- ASX200 closes +0.28% higher

- Healthcare leads gains, ASX All Gold rises over +3%

- Small caps led by takeover target Whispir

The Australian sharemarket has ended higher on the first day of what is certain to be another week of intensely trepidatious trade.

Low volumes and nothing fancy were undoubtedly the instructions from the coaching box ahead of tomorrow’s (Tuesday) annual collision of monetary policy recalibration and drunken gambling.

Offshore gains on Friday encouraged the benchmark to re-enter the mathematical orbit of 7,000 points early this morning, before breaking through it using psychology ahead of lunch.

Handsome Wall Street leads and a fine monthly US non-farm jobs report have all but reinforced US traders’ confidence that Chair Jay Powell and the old guard running the US Federal Reserve are putting a lid on their higher-for-longer philosophy on rates, an ill-considered theorem, which killed most equity markets in September and October to death.

The October nonfarm payrolls lifted by a Goldilocksian 150k – lower than the Dow Jones consensus forecast for a 170,000 rise – and more than it takes to worry analysts over the resilience of the US economy.

This has been taken as further evidence that The Fed might be done with hiking US interest rates.

At match out, the S&P/ASX 200 Index is ahead by 19 points, or +0.28%, to above 6,977 on Monday.

Last week, the Aussie benchmark ASX200 jumped by +2.44%.

Both local small cap indices had a week for the ASX annals as well. The Small Ords (XSO) and the ASX Emerging Companies (XEC) index climbed about 1.6% higher each on Friday to end the week 3.4% and 2.2% the better.

ASX SECTORS ON MONDAY

Healthcare companies and banks roamed freely across a largely green bourse on Monday – with the Healthcare Sector sector leading gains – up 1.5%.

The sector was broadly stronger after strong performances from Messrs Resmed (up 3.5%), Fisher & Paykel Healthcare (+2%) and CSL (up 1.7%).

Health stocks have found support over the last week as bond yields retrace their gains and rate sensitive defensive stocks find buyers again.

Meanwhile, the big four Aussie banks bolstered the local bourse on Monday after Westpac announced a $1.5 billion share buyback, after its profit jumped to $7.2bn on the back of steady margins and loan growth. The other three majors all made gains around the 1% mark – ahead of a huge week for shareholders as all the major lenders drop updates.

And we’re still watching gold on Monday.

Local gold miners have delighted the crowds all day here at ASX central. Some mighty movements there have been, too – with the top end of town leading the way.

Evolution Mining (ASX:EVN) (+5.6%), Northern Star Resources (ASX:NST) (+3.1%) and Newmont Goldcorp Corporation (ASX:NEM) (+2%), just killing it.

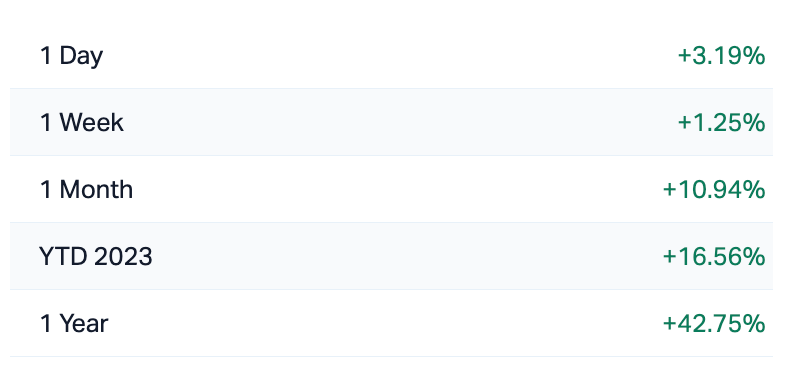

ASX All Ordinaries Gold (XGD) (4pm)

The price of gold is sitting below US$1,990 an ounce on Monday, having retreated from its multi-month highs, giving back gains from the Friday session in New York, which was driven by those wonderfully weak US jobs numbers.

The spot price has dropped the $2,000 ball now that there’s hope around rates and a containment of the war currently starring Israel-Hamas in the Middle east.

Meantime, how’s this for a good looking bunch of numbers from the XGD…

RIPPED FROM THE HEADLINES

Gone South

South Korean stocks have absolutely surged on Monday after Seoul’s ban on short-selling lit a fire under Seoul markets.

The financial watchdog in South Korea has declared the ban on short-selling will remain in place until the end of June 2024.

Short-selling, BTFW, is when a trader sells borrowed shares to buy back at a lower price and pocket the difference. It’s a bet against the market and something financial authorities sometimes consider just not cricket.

Also doing well in the ‘hood are Japanese stocks. On Monday in Tokyo, the Nikkei 225 Index has climbed well over + 2%, while the broader Topix Index has gained +1.5% both clocking 7-week highs.

Chinese markets during a time of Albo

Meanwhile, with the Aussie PM making nice in Beijing, China’s benchmark Shanghai Composite found about half a per cent – not heaps – but down south, the tech heavy Shenzhen Component gained 1.5% enough to drag Chinese markets off the floor and back at the middling highs of October.

Domestically, investors are trying to tear their eyes away from Albo and look ahead to mainland trade and inflation data which drops this week aseveryone – including Albo – looks to get a better sense of the actual health of the world’s No. 2 economy.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NRZR | Neurizer Ltd - Rights 10-Nov-23 Def | 0.002 | 100% | 1,493,610 | $127,674 |

| TWER | Treasury Wine Estate - Rts16Nov23 Forusdef | 0.86 | 74% | 81,288 | $37,811,095 |

| WSP | Whispir Limited | 0.4825 | 61% | 4,197,436 | $39,291,768 |

| CLE | Cyclone Metals | 0.0015 | 50% | 21,708,476 | $10,264,505 |

| MKL | Mighty Kingdom Ltd | 0.016 | 45% | 1,671,739 | $4,624,066 |

| TG6 | Tgmetalslimited | 0.675 | 36% | 12,212,843 | $19,949,263 |

| M4M | Macro Metals Limited | 0.004 | 33% | 3,513,194 | $5,961,233 |

| PUA | Peak Minerals Ltd | 0.004 | 33% | 1,944,592 | $3,124,130 |

| 8IH | 8I Holdings Ltd | 0.012 | 33% | 30,522 | $3,216,204 |

| NSM | Northstaw | 0.065 | 33% | 688,765 | $5,886,223 |

| OZM | Ozaurum Resources | 0.13 | 31% | 3,613,629 | $15,716,250 |

| CHK | Cohiba Min Ltd | 0.0025 | 25% | 383,999 | $4,426,488 |

| GTG | Genetic Technologies | 0.0025 | 25% | 66,658 | $23,083,316 |

| LBT | LBT Innovations | 0.005 | 25% | 293,253 | $1,423,601 |

| MRQ | Mrg Metals Limited | 0.0025 | 25% | 4,220,000 | $4,411,837 |

| COV | Cleo Diagnostics | 0.205 | 24% | 1,068,775 | $12,183,188 |

| EXL | Elixinol Wellness | 0.011 | 22% | 2,604,642 | $5,682,095 |

| TRT | Todd River Res Ltd | 0.011 | 22% | 5,229,430 | $5,863,928 |

| S3N | Sensore Ltd | 0.11 | 22% | 18,929 | $3,275,392 |

| KZA | Kazia Therapeutics | 0.067 | 22% | 1,622,414 | $12,999,216 |

| CLU | Cluey Ltd | 0.088 | 21% | 60,536 | $14,717,790 |

| XGL | Xamble Group Limited | 0.06 | 20% | 56,000 | $14,207,812 |

| CTO | Citigold Corp Ltd | 0.006 | 20% | 2,542,078 | $14,368,295 |

| CXU | Cauldron Energy Ltd | 0.012 | 20% | 14,190,554 | $9,735,687 |

| ESR | Estrella Res Ltd | 0.006 | 20% | 30,737,107 | $8,795,359 |

On a dull Monday morning in Sydney, the hitherto obscure-to-me Aussie comms-platform-as-a-service (CPaaS) Soprano Design lobbed an off-market takeover play for Whispir for circa $64 million.

Soprano it turns out has already been lugging some 15% of Whispir shares around town and is run by the former Appen (ASX:APX) boss Mark Brayan and with private equity backing probably thought the offer for little Wispir was a done deal.

Not so.

The cloud-comms tech firm, was onto it in a flash this morning – telling shareholders not to move a muscle while the board thinks of a better number than the all-cash 48¢ a pop offer.

What Soprano might do with Whispir’s automated digital comms software, which runs across the usual gamut – SMS, Telegram, Whatsapp, voice and stuff, chatbots, normal bots, all bots and clunky old email – is uncertain. Probably something to do with tech, business and comms.

For now, all we know is Brayan’s communications design firm thinks the deal is unconditional and Whispir doesn’t.

Mighty Kingdom (ASX:MKL) meanwhile, has reported a September quarter without any massive holes blown through it by the universe. A welcome change.

Quarterly Games revenue of $2m is a sterling +38% increase pcp), whie the game developer says ongoing contracts – with cool set ups like East Side Games, Google and Spinmaster – has driven ‘continued growth in baseline revenue to ensure long term sustainability.’

Better yet, the MK’s cost control strategy has resulted in a -13% cut in quarter-on-quarter expenses, combining to reflect a -31% reduction in costs compared to the pcp.

There’s been drama all round for MK, but the business and the people innit seem to be able to show decisiveness under heaps of pressure and still deliver improvement in key performance measures.

MK says there’s more ‘key initiatives focused on business development pipeline and conversion working alongside operational efficiencies and cost management are improving financial performance.’

“In addition, the recent appointment of Simon Rabbitt as Interim CEO, a successful capital raise and the announcement of a strategic review process are critical steps to further MK’s growth and business turnaround.”

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| REM | Remsensetechnologies | 0.038 | -34% | 270,500 | $5,701,985 |

| KNM | Kneomedia Limited | 0.002 | -33% | 1 | $4,514,356 |

| RBR | RBR Group Ltd | 0.002 | -33% | 2 | $4,855,214 |

| TGH | Terragen | 0.02 | -29% | 1,326,160 | $10,334,272 |

| AHN | Athena Resources | 0.003 | -25% | 1 | $4,281,870 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 522,371 | $31,285,147 |

| DCX | Discovex Res Ltd | 0.0015 | -25% | 1 | $6,605,136 |

| LNU | Linius Tech Limited | 0.0015 | -25% | 1,020,000 | $9,044,581 |

| MGTR | Magnetite Mines - Rights 09-Nov-23 | 0.003 | -25% | 29,428 | $83,744 |

| NNG | Nexion Group | 0.012 | -25% | 596,999 | $3,236,926 |

| SIH | Sihayo Gold Limited | 0.0015 | -25% | 1 | $24,408,512 |

| TMR | Tempus Resources Ltd | 0.009 | -25% | 9,640,861 | $4,115,074 |

| BVR | Bellavistaresources | 0.095 | -24% | 12,590 | $6,017,305 |

| HPR | High Peak Royalties | 0.05 | -23% | 175,000 | $13,523,881 |

| AD1 | AD1 Holdings Limited | 0.004 | -20% | 100,000 | $4,112,845 |

| DOU | Douugh Limited | 0.004 | -20% | 507,977 | $5,338,545 |

| ERL | Empire Resources | 0.004 | -20% | 1 | $5,564,675 |

| FAU | First Au Ltd | 0.002 | -20% | 1 | $3,629,983 |

| LSR | Lodestar Minerals | 0.004 | -20% | 2,435,689 | $10,116,987 |

| ROO | Roots Sustainable | 0.004 | -20% | 24,529 | $766,562 |

| SFG | Seafarms Group Ltd | 0.004 | -20% | 126,396 | $24,182,996 |

| HMD | Heramed Limited | 0.033 | -18% | 690,376 | $11,180,568 |

| EEL | Enrg Elements Ltd | 0.005 | -17% | 24,000 | $6,059,790 |

| SI6 | SI6 Metals Limited | 0.005 | -17% | 1,004,224 | $11,963,157 |

| OSX | Osteopore Limited | 0.042 | -16% | 56,901 | $7,745,932 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.