Closing Bell: Small caps tip and global markets teeter into the weekend

Pic: Cavan Images / Cavan via Getty Images

- Small caps slip down 3.3%, and global markets look equally wobbly

- China’s manufacturing Purchasing Managers’ Index (PMI) actually grew in September

- Alchemy Resources draws a ballot for some prospective lithium ground near big names in WA

We close out the last day of the last week of the September quarter much like we began it, with local markets unable to sidestep the weak global leads, the messy global outlook, and the now familiar global sense of pervading doom.

Here in Sydney, the benchmark heads into the final hour of trade 1.4% down, the small cap index leaking some 1.7%.

That makes the XEC small cap index short some 7% for this week, the ASX 200 looking relatively spritely at a mere 3.3% trim.

In fact, markets across the Asia-Pacific are all infected with the same symptoms, lower across the board following another sell-off on Wall Street overnight and less-than-inspiring words from an apparently relaxed British PM.

Lis Truss has been trying not to apologise for killing the British pound, economy and recovery.

In Japan, the Nikkei 225 is 2% lower, the Topix index short 1.9% and in Honkers, the Hang Seng Tech index is down over 1.2%.

Looking for some upbeat news on a Friday – the best we can manage now that Coolio is dead – China’s manufacturing Purchasing Managers’ Index (PMI) actually grew in September into positive territory at 50.1, and a decent beat on the 49.6 called by a Reuters poll.

The 50-point mark separates growth from contraction. PMI prints compare activity from month to month.

Meanwhile, the Caixin/S&P Global manufacturing Purchasing Managers’ Index, a private survey of factory activity — reported a contraction with a reading of 48.1.Caixin cited: subdued demand and lower production requirements led firms to cut back on their purchasing activity in September, the rate of decline the quickest in four months.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| SIH | Sihayo Gold Limited | 0.003 | 50% | 703,950 | $12,204,256.18 |

| T3D | 333D Limited | 0.0015 | 50% | 8,375,000 | $3,054,296.67 |

| ALY | Alchemy Resource Ltd | 0.029 | 45% | 74,260,849 | $19,061,519.10 |

| GTG | Genetic Technologies | 0.004 | 33% | 2,881,525 | $27,701,895.43 |

| PCL | Pancontinental Energ | 0.004 | 33% | 193,713 | $22,662,668.43 |

| MAG | Magmatic Resrce Ltd | 0.135 | 29% | 1,653,033 | $27,561,113.79 |

| AUK | Aumake Limited | 0.005 | 25% | 900,000 | $3,085,787.70 |

| BAT | Battery Minerals Ltd | 0.005 | 25% | 474,834 | $11,700,969.38 |

| HFY | Hubify Ltd | 0.04 | 25% | 40,000 | $15,876,361.44 |

| MGG | Mogul Games Grp Ltd | 0.0025 | 25% | 1,669,453 | $6,526,882.41 |

| TSC | Twenty Seven Co. Ltd | 0.0025 | 25% | 18,767,003 | $7,079,025.75 |

| TI1 | Tombador Iron | 0.0275 | 25% | 1,819,464 | $24,691,157.44 |

| 3DA | Amaero International | 0.11 | 24% | 847,331 | $22,773,030.31 |

| SIX | Sprintex Ltd | 0.037 | 19% | 141,606 | $7,884,984.14 |

| WR1 | Winsome Resources | 0.38 | 19% | 3,131,647 | $43,236,478.08 |

| IKE | Ikegps Group Ltd | 0.77 | 18% | 124,497 | $103,657,776.95 |

| BNL | Blue Star Helium Ltd | 0.033 | 18% | 7,312,644 | $44,412,761.62 |

| SGI | Stealth Global | 0.135 | 17% | 322,224 | $11,465,500.00 |

| AJQ | Armour Energy Ltd | 0.007 | 17% | 365,985 | $13,550,705.26 |

| CAV | Carnavale Resources | 0.007 | 17% | 100,000 | $16,311,310.37 |

| CHK | Cohiba Min Ltd | 0.007 | 17% | 179,000 | $9,765,964.85 |

| RIE | Riedel Resources Ltd | 0.007 | 17% | 142,857 | $6,430,242.37 |

| IR1 | Irismetals | 1.985 | 15% | 480,938 | $105,315,600.00 |

| ARO | Astro Resources NL | 0.004 | 14% | 2,125,500 | $17,126,434.34 |

| AWV | Anova Metals Ltd | 0.016 | 14% | 196,445 | $22,373,318.80 |

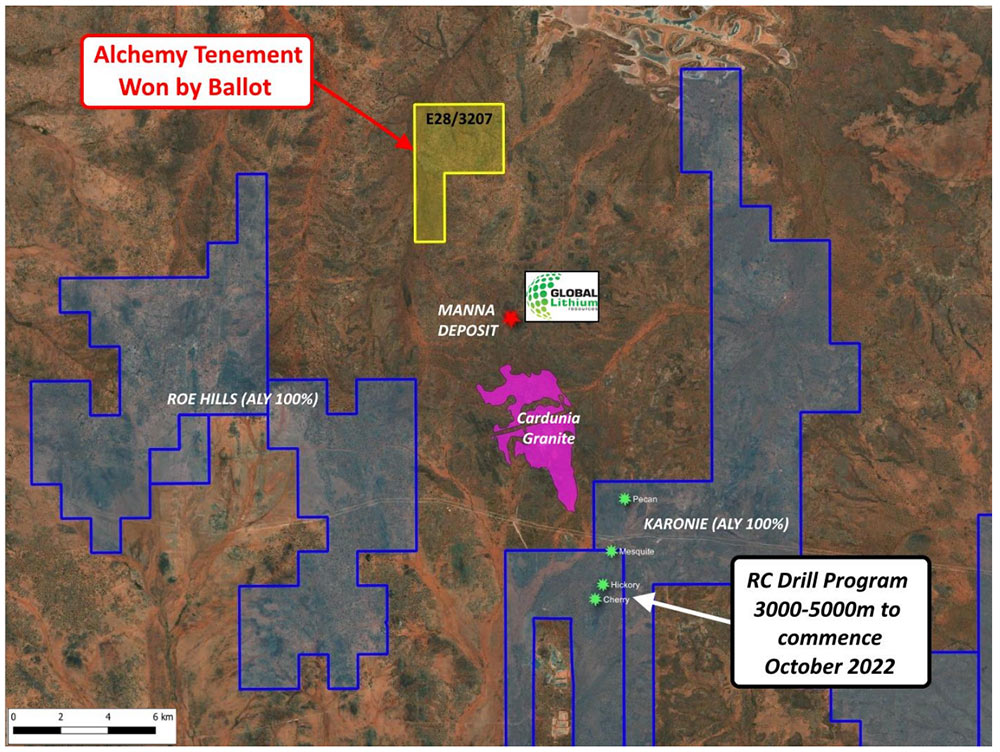

Alchemy Resources (ASX:ALY) was drawn first in a ballot for new ground along strike of Global Lithium Resources’ (ASX: GL1) 9.9Mt Manna lithium deposit and adjacent to Breaker Resources’ (ASX: BRB) 1.7Moz Lake Roe gold project.

It’s no wonder the 24.8sqkm tenement was in demand. ALY beat out “multiple parties”, the company says.

It will be added to ALY’s 1,220sqkm Karonie lithium and gold project, about 120km east of Kalgoorlie.

“The acquisition of this tenement builds on our footprint of highly prospective and strategic tenure which sits in proximity to some of the most prolific lithium and gold projects in Western Australia,” ALY CEO James Wilson says.

“The new lease covers 24.8km2 of greenstone and intrusive units and has seen limited drill testing with modern exploration methods.

“We are delighted to have secured this ground and look forward to starting work as soon as the tenement is granted.”

A maiden lithium-focussed drill program of 3,000-5,000m is set to kick off in October, initially targeting the nearby Hickory prospect.

Tombador Iron (ASX:TI1) has generated a maiden profit from its Brazilian iron ore mining operations with total production of 754kt of iron ore with sales into European and to domestic Brazilian steel markets.

The company reported revenue of $32.6m, with EBITDA of $5.6m – which CEO Gabriel Oliva says is a “satisfying outcome for our team, having produced this result from the company’s first year of iron ore sales.”

“I wish to thank our dedicated operational team for delivering this profit amid the extremely volatile environment that gripped the iron ore market with huge price fluctuations, persistent decade-high dry bulk freight rates, an energy crisis, market disruption in Europe and global inflationary pressures,” he said.

“We have ramped up to already deliver the 1.2mtpa production rates outlined in the PFS during the FY 2022 year and, subject to prevailing market conditions we plan to deliver more product to European steel mills and into the Brazilian steel industry in the year ahead in FY 2023.”

ASX SMALL CAP LOSERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RAG | Ragnar Metals Ltd | 0.028 | -30% | 11,962,746 | $15,167,395.56 |

| FGL | Frugl Group Limited | 0.011 | -27% | 749,206 | $3,039,782.93 |

| KEY | KEY Petroleum | 0.0015 | -25% | 503,981 | $3,935,856.25 |

| MTH | Mithril Resources | 0.0045 | -25% | 7,291,358 | $17,641,398.25 |

| HPC | Thehydration | 0.1 | -23% | 25,000 | $18,701,261.80 |

| NYR | Nyrada Inc. | 0.1 | -23% | 579,522 | $20,281,131.00 |

| GMN | Gold Mountain Ltd | 0.007 | -22% | 19,414,025 | $11,008,342.53 |

| SW1 | Swift Networks Group | 0.012 | -20% | 10,900 | $8,861,198.13 |

| CLE | Cyclone Metals | 0.002 | 0% | 4,380,000 | $15,291,842.46 |

| SHH | Shree Minerals Ltd | 0.008 | -20% | 1,625,167 | $12,384,868.92 |

| ALM | Alma Metals Ltd | 0.01 | -17% | 1,021,933 | $10,376,067.08 |

| AQX | Alice Queen Ltd | 0.0025 | -17% | 260,000 | $6,600,750.28 |

| OAR | OAR Resources Ltd | 0.005 | -17% | 1,122,064 | $13,026,227.39 |

| HIQ | Hitiq Limited | 0.055 | -17% | 146,120 | $7,468,308.08 |

| 5EA | 5Eadvanced | 2.02 | -14% | 1,517,963 | $675,405,119.60 |

| AUH | Austchina Holdings | 0.006 | -14% | 120,000 | $14,257,829.12 |

| RAN | Range International | 0.006 | -14% | 100,015 | $6,575,032.24 |

| TOY | Toys R Us | 0.024 | -14% | 1,911,691 | $24,132,113.15 |

| CZL | Cons Zinc Ltd | 0.019 | -14% | 4,531,251 | $8,521,871.89 |

| TGN | Tungsten Min NL | 0.081 | -13% | 117,675 | $73,136,527.30 |

| PEC | Perpetual Res Ltd | 0.027 | -13% | 283,120 | $16,641,336.27 |

| DOC | Doctor Care Anywhere | 0.061 | -13% | 544,088 | $15,905,407.70 |

| PYR | Payright Limited | 0.083 | -13% | 1,667 | $7,430,350.62 |

| ANX | Anax Metals Ltd | 0.056 | -13% | 540,594 | $25,960,202.24 |

| KRR | King River Resources | 0.014 | -13% | 2,767,285 | $24,856,399.15 |

Ragnar Metals (ASX:RAG) says its intersected visual magmatic sulphides which confirm the potential and scale of its Tullsta nickel project in Sweden.

The company says phase 1 drilling demonstrates the potential scale of the Granmuren system, with visual logs due one the final hole of Phase 1 is completed.

THINGS YOU MAY HAVE MISSED ON FRIDAY

Titan Minerals’ (ASX:TTM) says maiden drilling at Copper Ridge is off to a good start with the first diamond hole intersecting “significant intervals” of sulphide mineralisation.

Hole CRDD22-001 – completed to a depth of 530m, returned “long intervals of altered and stock-work veined porphyry with chalcopyrite, molybdenum and pyrite typically seen in porphyry copper deposits.

“TTM is approximately one third of the way through our initial drilling program at Copper Ridge, according to CEO Matther Carr.

“It is highly encouraging that observations by our experienced geologists note long intervals of altered and stock-work veined porphyry with chalcopyrite, molybdenum and pyrite of the likes typical in porphyry copper deposits.

“We eagerly await the receipt of assay results. Meanwhile, our drilling continues at the Copper Ridge Porphyry and Meseta Gold prospects,” Carr added

A big day for Pure Hydrogen (ASX:PH2) reaching a terms sheet with PepsiCo for the trial of a hydrogen fuel cell prime mover and another deal with BKL Auto for hydrogen product resales.

Under the terms sheet, PH2 will supply PepsiCo with a Hydrogen Fuel Cell 160kW 6 x 4 Prime Mover for use at one of the latter’s preferred delivery points in Brisbane from mid-2023.

Additionally, PH2 will provide additional hydrogen supply as required, including refuelling along with repair and maintenance services.Should PepsiCo determine that the prime mover has a commercial use-case, it may order further hydrogen powered vehicles over the period 2023-25.

Meanwhile, the Aussie-listed clean-tech innovator signed a global Master Supply Agreement (MSA) with top Aussie commercial vehicle firm BLK Auto Pty Ltd (BLK) – a key step in PH2’s ambition to spearhead the supply of hydrogen fuelled vehicles worldwide.

TRADING HALTS

My Rewards International (ASX:MRI) – apparently the halt has been requested “to ensure there is not a false or disorderly market ahead of a planned pro-rata rights issue to existing shareholders.”

Kinetiko Energy (ASX:KKO) – pending a capital raising.

Vanadium Resources (ASX:VR8) – pending an announcement regarding the release of the Definitive Feasibility Study in relation to its Steelpoortdrift Vanadium Project in South Africa,

Paradigm Biopharmaceuticals (ASX:PAR) – The company has received biomarker and clinical data from an independent contract research organisation (CRO) relating to its phase II PARA_008 clinical trial. The company is requesting a trading halt so it has time to analyse the data and prepare an ASX Announcement and webinar presentation on the data, to be released to the market on Tuesday 4 October 2022.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.