Closing Bell: Small Caps show fine pluck, Galileo takes down flat-earthers

Galileo Galilei via Getty

- XEC rises like a stubborn mule, up 0.5%

- XJO wobbles, equivocates somehow ends 0.2% higher

- Galileo Mining (ASX:GAL) gains circa 200%

Choppy trade – oh yes – but with Galileo Mining (ASX:GAL) coming out swinging on Wednesday morning, that Emerging Companies index sure knows how to fight when the blue chips are down.

The story here is Galileo, and we’ll get to it in a moment, but the fall-out from China’s domestic shutdown continues apace.

Today’s CPI (consumer inflation) jumped out the gates at its quickest clip in almost a year, especially since China had largely zapped inflation (in comparison to say, the US) well ahead of these unwieldy, slightly bonkers zero-COVID policies. It’s been more than five weeks since China’s economic centre of Shanghai has been sealed off from itself.

The economic damage is really starting to poke out of the skin here as Beijing’s slap-down lock-ins are tough to watch while the economic data of stifled consumption, screwed supply chains and factory closures is starting to tell.

China’s National Bureau of Statistics reports April’s measure of retail inflation, jumped 2.1 per cent.

But on the plus column, China’s CSI 300 charged ahead late in the day as Shanghai officials said COVID-19 cases more than halved.

The local bourse has closed ahead, the benchmark’s winning sectors include Health Care, Real Estate, Mining, Discretionary, Staples Utilities and Industrials,. The banks were dragged down hard by an ex-div NAB.

Meanwhile, somewhere near in WA…

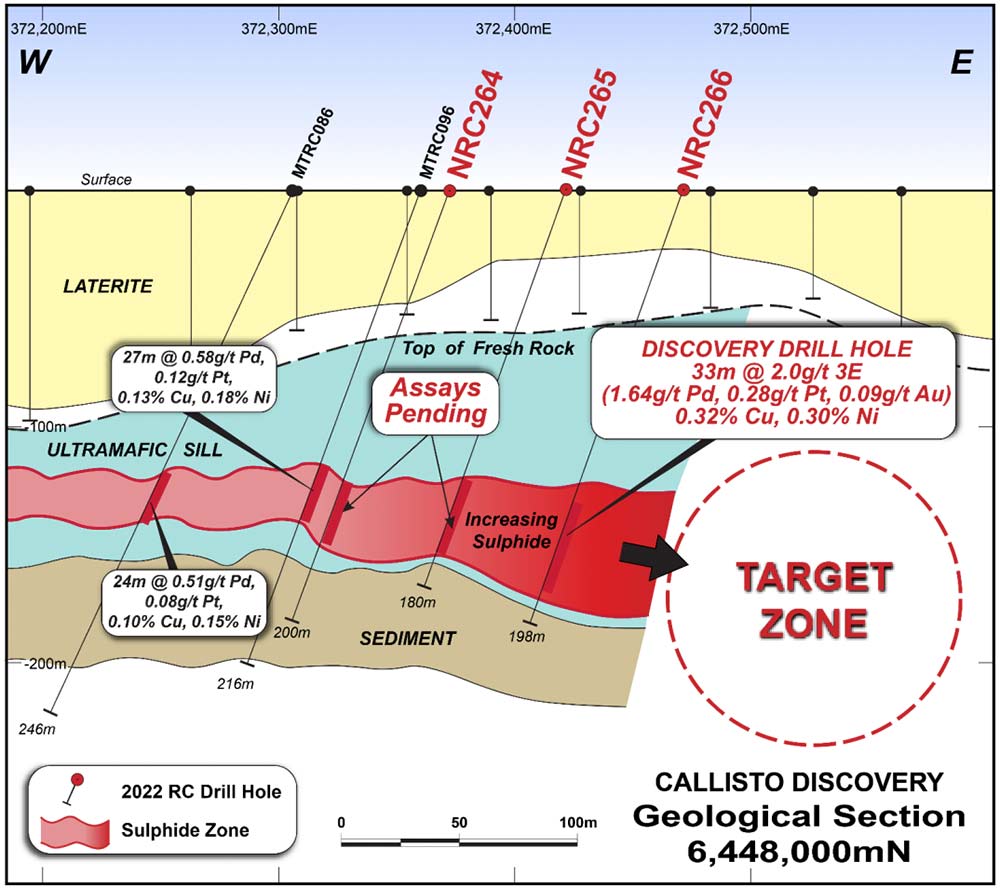

This map is readable, you can actually see that Galileo Mining haven’t even hit the juicy target zone yet:

All up, there is 5km of untested prospective strike length.

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Last | % | Volume |

|---|---|---|---|---|

| GAL | Galileo Mining Ltd | 0.64 | 220% | 56,539,373 |

| CNJ | Conico Ltd | 0.016 | 45% | 52,987,250 |

| SOR | Strategic Elements | 0.205 | 41% | 16,158,271 |

| CCE | Carnegie Cln Energy | 0.002 | 33% | 38,901,043 |

| GSR | Greenstone Resources | 0.036 | 29% | 4,676,556 |

| AGR | Aguia Res Ltd | 0.062 | 24% | 1,966,097 |

| HAL | Halo Technologies | 0.705 | 24% | 8,291 |

| ENX | Enegex Limited | 0.06 | 22% | 35,020 |

| MRQ | Mrg Metals Limited | 0.009 | 20% | 9,367,250 |

| EPN | Epsilon Healthcare | 0.03 | 20% | 448,693 |

| EN1DA | Engage:Bdr Limited | 0.012 | 20% | 649,600 |

| MCT | Metalicity Limited | 0.006 | 20% | 3,528,294 |

| AIV | Activex Limited | 0.049 | 20% | 258,245 |

| CR9 | Corellares | 0.043 | 19% | 223,433 |

| CPM | Coopermetalslimited | 0.37 | 19% | 422,994 |

| WC1 | Westcobarmetals | 0.155 | 19% | 251,367 |

| 3MF | 3D Metalforge | 0.025 | 19% | 243,786 |

| CMX | Chemxmaterials | 0.225 | 18% | 95,147 |

| DNK | Danakali Limited | 0.295 | 18% | 329,891 |

| GSN | Great Southern | 0.049 | 17% | 158,574 |

| AMD | Arrow Minerals | 0.0035 | 17% | 100,000 |

| CML | Chase Mining Limited | 0.014 | 17% | 375,520 |

| DDD | 3D Resources Limited | 0.0035 | 17% | 1,796,792 |

| IEC | Intra Energy Corp | 0.014 | 17% | 187,679 |

| ROG | Red Sky Energy. | 0.007 | 17% | 25,917,278 |

Yes the hands down winner is Galileo Mining (ASX: GAL) a brave little truth-teller who really gave it to the world on Wednesday.

The Mark Creasy-backed digger literally set charges under the share price and off they went at 10am Sydenham time.

As Reubs said earlier today, GAL exploded out of the blocks after sharing news of a major palladium-platinum discovery at the ‘Norseman’ project in WA.

Apparently all it took was six holes at its Callisto discovery to whack right on to a significant mineralised sulphide unit tucked nicely under an ultramafic sill.

Assays from a further five drill holes are pending, but GAL has already flagged strong geological continuity “with all drill holes intersecting disseminated sulphides”.

The discovery hole at the ‘Callisto’ prospect returned a 33m-long intersection grading 2g/t 3E (1.64g/t palladium, 0.28g/t platinum, 0.09g/t gold), 0.32% copper & 0.30% nickel from 144m.

This 33m assayed intersection occurs within a wider 55m disseminated sulphide zone (126–181m), “indicating the potential for a large mineralised system”, GAL says.

Being on a granted mining lease also means the explorer could potentially accelerate development at Callisto if resource drilling is successful.

There are already geological similarities to South Africa’s colossal ‘Platreef’ palladium-platinum-gold-rhodium-copper-nickel deposits, GAL MD Brad Underwood says.

“This an exceptional result from our Norseman project and with every drill hole undertaken so far intersecting mineralisation, we are hopeful that the initial drill hole will translate into a high-quality resource for mining,” he says.

“While we are at an early stage in the discovery process, the thick and consistent zone of mineralisation, and the extensive prospective strike length, suggests the potential for a large mineralised system.”

In addition to Callisto, GAL also has multiple PGE-nickel-copper targets at the ‘Jimberlana’ and ‘Mission Sill’ prospects to the south “that offer new opportunities for further discoveries”, Underwood says.

“Galileo remains fully funded with $8.2 million at the end of the March quarter and able to continue aggressive exploration programs at all our projects.

“We look forward to updating the market as work progresses on this exciting new West Australian discovery.”

This is the latest in string of successes for famed prospector Mark Creasy, who owns 24.6% of GAL and is now several million dollars richer at the close of trade.

Also climbing higher is Strategic Elements (ASX:SOR) really having fun, up over 40% and looking comfy.

SOR’s action came after it reported that its fully owned subsidiary AAM and research partner The University of New South Wales has succeeded in generating electricity from moisture. SOR says this firmly establishes the technology as a world leader globally, and also broadens its potential use in electronics with enhanced power requirements.

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| IPTRA | Impact Minerals - Rights 13-May-22 | 0.001 | -50% | 7,194,907 |

| BGT | Bio-Gene Technology | 0.155 | -26% | 3,669,132 |

| ARE | Argonaut Resources | 0.003 | -25% | 14,397,433 |

| GGX | Gas2Grid Limited | 0.002 | -20% | 60,000 |

| VOL | Victory Offices Ltd | 0.08 | -19% | 95,316 |

| HIQ | Hitiq Limited | 0.072 | -18% | 322,500 |

| AUZ | Australian Mines Ltd | 0.13 | -17% | 6,291,164 |

| BEL | Bentley Capital Ltd | 0.082 | -17% | 52,873 |

| FGL | Frugl Group Limited | 0.015 | -17% | 229 |

| HVM | Happy Valley | 0.05 | -17% | 314,161 |

| MHK | Metalhawk. | 0.2 | -17% | 352,199 |

| CTO | Citigold Corp Ltd | 0.005 | -17% | 4,261,658 |

| TMK | TMK Energy Limited | 0.01 | -17% | 5,094,252 |

| HPP | Health Plant Protein | 0.13 | -16% | 15,000 |

| FRM | Farm Pride Foods | 0.135 | -16% | 37,500 |

| LNK | Link Admin Hldg | 4.22 | -15% | 29,101,022 |

| CVV | Caravel Minerals Ltd | 0.22 | -15% | 112,686 |

| LAM | Laramide Res Ltd | 0.765 | -15% | 500 |

| HCT | Holista CollTech Ltd | 0.03 | -14% | 114,094 |

| OEX | Oilex Ltd | 0.003 | -14% | 2,410,743 |

| PYR | Payright Limited | 0.12 | -14% | 12,791 |

| TSC | Twenty Seven Co. Ltd | 0.003 | -14% | 1,700,159 |

| TGH | Terragen | 0.155 | -14% | 232,111 |

| REC | Rechargemetals | 0.3 | -13% | 230,122 |

| MMI | Metro Mining Ltd | 0.02 | -13% | 22,807,473 |

The giant German chemical firm, BASF, has done a total runner on Aussie-listed Bio-Gene Technology (ASX:BGT).

The pair were tinkering together with BGT’s stored grain pest program, but now BASF has said it won’t continue with the program for “internal reasons.”

That’s a bit cloak and dagger not that it matters – in the end – BGT has taken a big hit to the share price and is short a giant partner.

Bio-Gene says it’s still upbeat with the new data and will continue to work with Department of Agriculture & Fisheries Queensland Government and the Grains Research & Development Corporation to advance the program.

ANNOUNCEMENTS YOU MAY’VE MISSED

Future Metals (ASX:FME) has announced CEO Jardee Kininmonth has been appointed to the board. Kininmonth was appointed CEO of the Future Metals, which focused on platinum group metals (PGMs) On January 31.

The company has also appointed Tom O’Rourke as company secretary and chief financial officer to ultimately replace long-serving finance director and company secretary Aaron Bertolatti.

ASIC has filed proceedings against nickel-cobalt play Australian Mines (ASX:AUZ) and its managing director Ben Bell, alleging misleading claims around project funding and offtake agreements were made in 2018.

“The Originating Process claims various declarations, a civil pecuniary penalty against the company and managing director to be fixed by the Court and a disqualification order against the managing director for such period as the Court considers appropriate,” AUZ says.

“The company intends to defend the proceedings.”

Bell has resigned as a Director of the Company, but has been assigned a new role, which includes assisting with the transition to the incoming chief executive officer.

Digital wealth advisory platform InvestSMART (ASX:INV) has announced it has entered into a deal to dispose of its entire shareholding in AWI Ventures Pty Ltd for $3.2 million to venture capital firm Marbruck Investments Limited.

InvestSMART holds a portfolio of venture capital investments on its balance sheet in the AWI Ventures entity as a result of seeding several fintech startups in 2014 and 2015. InvestSMART wants to re-invest proceeds in growing its core business of helping Australians with their financial future and to satisfy regulatory requirements.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.