Closing Bell: Seven in a row as new ASX200 record beckons

Seconds after jumping for joy, Wendy found out the hard way why humans are born with two complete sets of teeth. Pic via Getty Images.

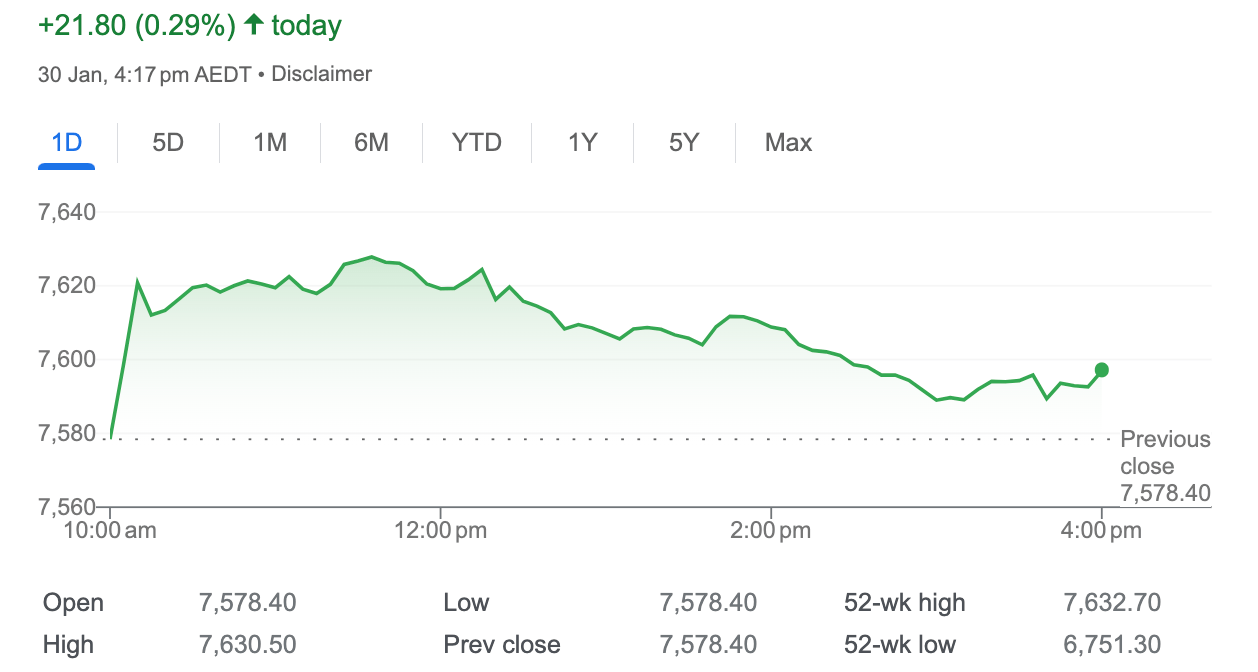

- Rising ASX 200 ends above 7,600 points, after briefly hitting near 3-year highs

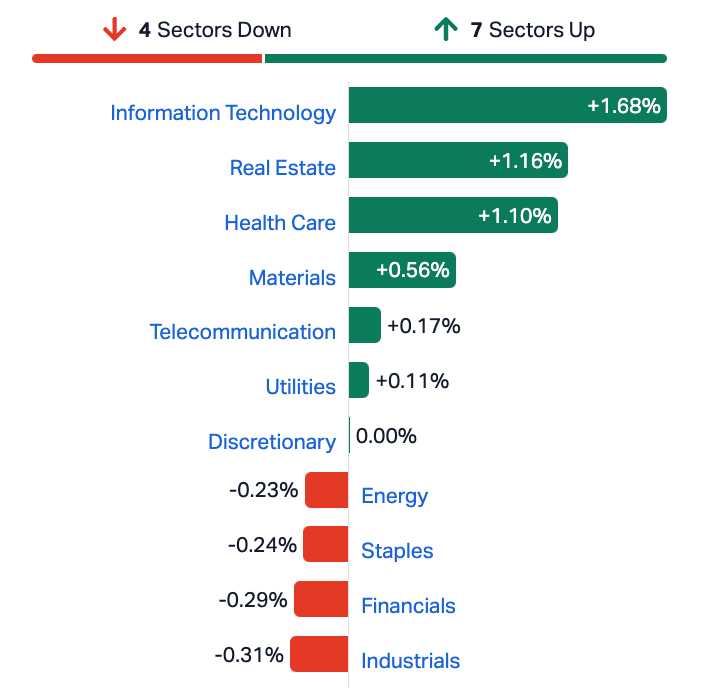

- 7 Sectors higher, led by InfoTech, Real Estate and Health stocks

- Megaport, Nickel Industries and City Chic soar as the good times rolled on

Local markets have risen on Tuesday, trimming gains after touching near 3 year highs earlier in the day.

It’s the seventh straight daily gain for the Aussie stock market – so a hat off for the longest winning streak on the ASX for more than 10 months.

At 4.15pm on 30 Jan, the S&P/ASX200 was ahead 22.0 points or 0.29% to 7,600.2.

We’re tracking the latest rally on Wall Street which delivered the S&P500 to new record highs.

The Aussie benchmark looked set to kick on after shooting over 0.55% in the morning, however the pincer movement of ordinary local retail sales and deflating post-regulatory action across China’s beleaguered share markets.

At 3pm in Sydney, the Hang Seng was almost 2% lower as investors grappled with the fallout of property giant Evergrande Group’s dissolution.

December’s retail sales, meanwhile, fell 2.7% from November, totally flubbing economist forecasts of a 1.9% decline as Aussie’s held off pre-Xmas splurging.

From the first bell this morning Local IT stocks took the bull by the horns, following the Nasdaq 100 after the creamiest index of US tech touched its own record highs.

The big winner in morning trade was our local version of a mega tech – Megaport (ASX:MP1), which was ahead about 25% at lunch and bouncing toward an impressive $2 billion market cap status.

MP1’s revenue for the quarter was $48.6mn (up $2.1mn or 5% compared to 1Q FY24) and generated positive Net Cash Flow of $6.9mn in 2Q FY24 (up $1.3mn or 23% compared to 1Q FY24, and up $18mn compared to 2Q FY23) with investors buying into the excitement.

Also doing well uptown, Justin Werner’s Indonesian-focused Nickel Industries (ASX:NIC) which jumped 23% in the AM, after unveiling an on-market share buyback worth more than $150mn

By thew close of business seven out of 11 sectors were in the green, with energy and industrials dragging.

It’s been a record breaking morning.

Fortescue (ASX:FMG) joined the other major iron ore miners in the fiesty morning rally, cracking a new record high.

On the other side of the ASX, the major banks also climbed, led by Commonwealth Bank (ASX:CBA) which broke its own intraday record high.

ASX Sector’s on Tuesday

Overnight, the Dow Jones and the S&P 500 clocked new record highs. The Nasdaq Composite also jumped 1.12%.

US500 CFD increased to an all-time high of 4931.00 Index Points. Over the past 4 weeks, United States Stock Market Index (US500) gained 3.96%, and in the last 12 months, it increased 22.72%

10 out of 11 S&P sectors finished higher, led by consumer discretionary, technology and communication services.

Reed ’em and weep from the usual suspects in mega-cap land: Tesla (4.2%), Nvidia (2.4%), Microsoft (1.4%), Meta (1.8%) and Amazon (1.3%).

US Futures were mixed in Sydney at 4pm on Tuesday.

Meanwhile in China…

Lot’s happening in Chinese markets already this week, with the China Securities Regulatory Commission (CSRC) fully suspended the lending of restricted shares for short-selling, where punters have been targeting stocks led by property giant China Vanke – China’s 3rd largest by sales volume last year – as well as the top Chinese EV maker BYD.

The new ban makes it harder for short sellers to get ahold of the shares to place their various bets in the hope it’ll all contribute to the stability of investor sentiment, which is far from stable.

China’s real estate slump, however, continues to dig a hole all its own across the world’s no. 2 biggest economy – on Monday a court in HK ordered the debt-laden China Evergrande to be put out of its misery and be wound up.

Chinese equities surged last week after the country’s central bank cut the reserve requirement ratio for lenders and pledged more targeted stimulus to come. But the rally started to fizzle out on Friday and regulators stepped in today to announce fresh restrictions on short selling after the recent informal measures failed to spur much of a rebound.

At 3pm in Sydney, the Shanghai Composite was about 0.5% in the red while the tech heavy Shenzhen Component was more than 1% lower, both mainland indices extending losses from the previous session as investors continued to grapple with the fallout from Evergrande’s liquidation order.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| EMU | EMU NL | 0.0015 | 50% | 5,504,907 | $2,024,771 |

| ATH | Alterity Therapeutics | 0.0055 | 38% | 40,597,501 | $15,245,305 |

| IS3 | I Synergy Group Ltd | 0.008 | 33% | 439,670 | $1,824,482 |

| PRX | Prodigy Gold NL | 0.004 | 33% | 1,108,947 | $5,253,323 |

| VAL | Valor Resources Ltd | 0.004 | 33% | 1,446,072 | $12,520,004 |

| DCL | Domacom Limited | 0.013 | 30% | 23,000 | $4,355,018 |

| AXN | Alliance Nickel Ltd | 0.039 | 30% | 464,071 | $21,775,188 |

| MP1 | Megaport Limited | 12.4 | 27% | 3,188,212 | $1,556,240,642 |

| CC9 | Chariot Corporation | 0.48 | 26% | 220,736 | $30,926,816 |

| CCX | City Chic Collective | 0.545 | 25% | 3,905,023 | $100,885,237 |

| IEC | Intra Energy Corp | 0.0025 | 25% | 1,000,000 | $3,321,563 |

| NAE | New Age Exploration | 0.005 | 25% | 250,000 | $7,175,596 |

| RLC | Reedy Lagoon Corp. | 0.005 | 25% | 259,400 | $2,478,163 |

| DXB | Dimerix Ltd | 0.215 | 23% | 3,859,785 | $75,835,466 |

| NIC | Nickel Industries | 0.7275 | 21% | 26,917,187 | $2,571,485,928 |

| ARV | Artemis Resources | 0.018 | 20% | 3,117,783 | $25,367,942 |

| AD1 | AD1 Holdings Limited | 0.006 | 20% | 972,612 | $4,493,242 |

| BPP | Babylon Pump & Power | 0.006 | 20% | 1,198,065 | $12,497,745 |

| CHK | Cohiba Minerals | 0.003 | 20% | 16,601,335 | $6,325,575 |

| CRB | Carbine Resources | 0.006 | 20% | 289,101 | $2,758,689 |

| ECT | Environmental Clean Tech | 0.006 | 20% | 76,734 | $14,321,552 |

| KNM | Kneomedia Limited | 0.003 | 20% | 840,000 | $3,833,178 |

| OMX | Orange Minerals | 0.024 | 20% | 121,574 | $1,715,003 |

| TIG | Tigers Realm Coal | 0.006 | 20% | 400,000 | $65,333,512 |

| RHY | Rhythm Biosciences | 0.13 | 18% | 444,923 | $24,325,685 |

Take a bow, City Chic Collective (ASX:CCX), because you are back in the box seat for small caps on Tuesday – jumping circa 23% on news that the company has weathered a difficult six months that saw cost-cutting, inventory clearing and a headcount reduction result in a dip in revenue to ~$53.8 million for it’s Australia/New Zealand sector, down 32% on PCP.

Similarly, revenue fell to ~$52.0 million – down 26% in PCP – for its Americas division, but despite how that looks, it’s actually good news for the company.

The result is in line with the strategic decisions the company has made in an effort to get the business back on track, with inventory expected to be approximately $39.5 million at the end of H1 FY24, down 27% from July when the company was massively overstocked and struggling.

Similarly, a happy news story from LiveHire (ASX:LVH) helped it to a prize-winning gain in early trade, with the company reporting Q2 positive Net Operating Cashflow of $0.8m, and clearly very grateful for the $1.4 million R&D refund that pushed it into positive territory.

Delivery platform Zoom2u Technologies (ASX:Z2U) has also delivered a quarterly this morning, showing that group revenue for Q2 FY24 is at $1.6 million, 37% higher on PCP, which was good enough news to get investors in behind a climb of around 18% through the morning.

Late in the day, there were a couple of bolters – namely nickel chaser Alliance Nickel (ASX:AXN) , and US-based lithium hunters Chariot Corporation (ASX:CC9), both of which managed to snag ~30% worth of gains despite a notable lack of news.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| MKL | Mighty Kingdom Ltd | 0.007 | -42% | 13,697,438 | $5,711,085 |

| AOA | Ausmon Resorces | 0.002 | -33% | 13,250,000 | $3,176,998 |

| CT1 | Constellation Tech | 0.002 | -33% | 209,141 | $4,424,201 |

| RR1 | Reach Resources Ltd | 0.002 | -33% | 5,970,701 | $9,630,891 |

| WEC | White Energy Company | 0.034 | -32% | 10,164 | $5,661,767 |

| AMT | Allegra Medical | 0.031 | -30% | 167,741 | $5,262,885 |

| HMD | Heramed Limited | 0.017 | -29% | 1,034,324 | $7,710,341 |

| AUG | Augustus Minerals | 0.058 | -28% | 598,139 | $6,729,600 |

| KOR | Korab Resources | 0.011 | -27% | 1,694,520 | $5,505,750 |

| STM | Sunstone Metals Ltd | 0.009 | -25% | 5,443,226 | $41,852,819 |

| ME1DA | Melodiol Global Health | 0.017 | -23% | 1,258,258 | $5,201,706 |

| RMI | Resource Mining Corp | 0.024 | -23% | 127,006 | $17,432,782 |

| BNL | Blue Star Helium Ltd | 0.018 | -22% | 34,473,004 | $44,672,101 |

| PVW | PVW Res Ltd | 0.045 | -21% | 107,046 | $5,780,072 |

| 1MC | Morella Corporation | 0.004 | -20% | 603,387 | $30,893,997 |

| ASV | Asset Vision Co | 0.008 | -20% | 145,000 | $7,258,366 |

| M4M | Macro Metals Limited | 0.002 | -20% | 812,500 | $6,167,694 |

| NES | Nelson Resources | 0.004 | -20% | 2,250,000 | $3,067,972 |

| PUA | Peak Minerals Ltd | 0.002 | -20% | 900,000 | $2,603,442 |

| YOJ | Yojee Limited | 0.002 | -20% | 1,004,143 | $6,363,858 |

| LEL | Lithenergy | 0.345 | -20% | 508,139 | $44,294,300 |

| EMS | Eastern Metals | 0.029 | -19% | 5,625 | $2,967,345 |

| AW1 | American West Metals | 0.15 | -19% | 6,028,436 | $80,819,036 |

| 29M | 29 Metals | 0.42 | -17% | 7,918,782 | $354,164,242 |

| KNB | Koonenberry Gold | 0.05 | -17% | 76,347 | $7,184,945 |

TRADING HALTS

Brazilian Rare Earths (ASX:BRE) – pending the announcement of maiden exploration results from the Monte Alto Phase 1 diamond drilling program.

Propel Funeral Partners (ASX:PFP) – pending an announcement regarding an institutional placement and a follow-on share purchase plan.

NSX (ASX:NSX) – pending the release of an announcement to the market in relation to a capital raising involving a placement and entitlement offer.

Pan Asia Metals (ASX:PAM) – pending the release of an announcement in relation to a proposed equity raise by way of a placement.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.