Closing Bell: Saturday can’t come soon enough as Small Caps fight on muscle memory alone

Pic via Getty Images

- ASX ends the week sore-arsed and red-faced

- Some shining glimmers of hope rise among wildly swinging small caps

- GUD has a ‘Guh’ moment as profit downgrade sends investors scurrying

The ASX has spent this week being led by the nose into some highly unpleasant places, rising every morning feeling momentarily refreshed before finding out that Wall Street wants us to go trudging through the sewers. Again.

Let’s talk about today – you can wander over here to catch Captain Cheddars piloting the Stockhead chopper for a bird’s eye view of the week that was later – because there were some surprises kicking about that are well worth talking about.

Today’s high-value target was auto parts maker GUD Holdings (ASX:GUD), which dropped news of a downgraded FY22 earnings guidance on the front porch of the ASX after the lights were turned off yesterday afternoon.

But investors are a canny bunch, and don’t often fall for the old “knock and run” – especially when the announcement says the company’s earnings are going leave the end-of-year envelope short by nearly 10%, around $13 million less than previously thought.

Other upward movers at the big end of the city included gold miner Evolution Mining (ASX:EVN) which added ~6.0%, while A2 Milk (ASX:A2M) managed to step around its tangle of class action lawsuits to wring just shy of 5.0% out of the market’s swollen, bruised teats.

Casting a pall over these nuggets of gold at the bottom of the bog is the spectre of the dreaded R-Word, which has led to some serious intestinal distress in the US and parts of Asia.

Abnormally large interest rate hikes from the US, UK and Switzerland in the past 24 hours have sparked fevered whisperings about recession, with JPMorgan Chase & Co’s number nerds starting to mutter about the chances of that running as high as 85%.

The previously-mentioned Wall Street fall has the Nasdaq down 4.0%, the S%P down 3.25% and the Dow down 2.42%, while in Asia, Japan’s Nikkei rallied towards the end of the day, climbing off lunchtime lows to -1.64%, as Hong Kong (+0.78%) and Shanghai (-0.02%) shrugged off international gloom.

And crypto did crypto stuff, with the cryptoiest of cryptos tiptoeing up today, but nowhere near enough to offset more than about 10% of the gut-wrenching losses we’ve seen since Monday.

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| PLG | Pearl Gull Iron | 0.06 | 58% | 2,647,917 |

| ANL | Amani Gold Ltd | 0.0015 | 50% | 5,761,854 |

| PGY | Pilot Energy Ltd | 0.024 | 33% | 3,101,660 |

| NCL | Netccentric Ltd | 0.092 | 31% | 76,262 |

| WA1 | WA1 Resources | 0.155 | 29% | 22,055 |

| YPB | YPB Group Ltd | 0.019 | 27% | 463,084 |

| XST | Xstate Resources | 0.0025 | 25% | 203,350 |

| RBX | Resource B | 0.145 | 21% | 105,914 |

| AQS | Aquis Ent Ltd | 0.12 | 20% | 11,666 |

| DCX | Discovex Res Ltd | 0.006 | 20% | 7,650,333 |

| KFE | Kogi Iron Ltd | 0.006 | 20% | 4,280,000 |

| AJL | AJ Lucas Group | 0.062 | 19% | 851,159 |

| ALY | Alchemy Resource Ltd | 0.019 | 19% | 5,317,104 |

| COO | Corum Group Limited | 0.039 | 18% | 576,588 |

| DRX | Diatreme Resources | 0.039 | 18% | 11,388,825 |

| FG1 | Flynngold | 0.13 | 18% | 139,767 |

| T3K | Tek Ocean Group | 0.135 | 17% | 34,495 |

| OEX | Oilex Ltd | 0.0035 | 17% | 354,265 |

| MAG | Magmatic Resrce Ltd | 0.064 | 16% | 604,208 |

| PSL | Paterson Resources | 0.03 | 15% | 2,772,993 |

| BUY | Bounty Oil & Gas NL | 0.008 | 14% | 155,100 |

| TKL | Traka Resources | 0.008 | 14% | 125,000 |

| GRL | Godolphin Resources | 0.105 | 14% | 152,825 |

| AVA | AVA Risk Group Ltd | 0.205 | 14% | 1,542,682 |

| HCT | Holista Colltech Ltd | 0.034 | 13% | 499,081 |

The leader board hasn’t changed all that much since lunch, with a few of the little guys punching well above their weight in a sodden, murky mess of a marketplace.

WA1 Resources (ASX:WA1) added to its morning gains, moving from +42% up to around 50% towards the close of play, as investors chasing some losses caught wind of the company’s “very encouraging” soil sample results in the lead up to drilling in early July and kept piling in as the day wore on.

Tek-Ocean Group (ASX:T3K) also kept marching on after lunch, nudging towards a 22% gain for the day, on news that it’s moved offices to a new HQ – the real estate deal of the century, if it’s been able to send its price climbing that quickly.

And a last minute “hey guys, look at me!” has come in from what is fast becoming the Stockhead newsroom’s favourite form of roughie entertainment, Pearl Gull Iron (ASX:PLG).

Today saw PLG recover some of the losses it took on the gains that it’s made for no readily identifiable reason (aside from a shift in iron ore prices, but still… ???) since the beginning of June.

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| BMH | Baumart Holdings Ltd | 0.105 | -42% | 3,117 |

| EVE | EVE Health Group Ltd | 0.001 | -33% | 171,859,232 |

| DCN | Dacian Gold Ltd | 0.115 | -32% | 26,701,931 |

| KWR | Kingwest Resources | 0.065 | -29% | 5,400,746 |

| SIX | Sprintex Ltd | 0.051 | -29% | 1,672 |

| WMC | Wiluna Mining Corp | 0.345 | -28% | 1,511,569 |

| WBE | Whitebark Energy | 0.0015 | -25% | 19,958,577 |

| IMR | Imricor Med Sys | 0.115 | -23% | 2,343,629 |

| RCR | Rincon | 0.115 | -23% | 26,000 |

| HUM | Humm Group Limited | 0.45 | -22% | 10,053,202 |

| MBK | Metal Bank Ltd | 0.004 | -20% | 120,000 |

| GUD | G.U.D. Holdings | 7.73 | -20% | 4,550,117 |

| GRE | Greentechmetals | 0.28 | -19% | 19,978,605 |

| IND | Industrialminerals | 0.325 | -19% | 316,723 |

| RHT | Resonance Health | 0.057 | -19% | 820,675 |

| TSL | Titanium Sands Ltd | 0.011 | -19% | 499,124 |

| AYA | Artryalimited | 0.46 | -18% | 1,080,312 |

| ODM | Odin Metals Limited | 0.014 | -18% | 591,126 |

| MHI | Merchant House | 0.062 | -17% | 41,700 |

| M2R | Miramar | 0.082 | -17% | 275,243 |

| NUC | Nuchev Limited | 0.22 | -17% | 35,357 |

| 8IH | 8I Holdings Ltd | 0.1 | -17% | 2,200 |

| HPR | High Peak Royalties | 0.05 | -17% | 40,000 |

| ONE | Oneview Healthcare | 0.125 | -17% | 660,694 |

| 1ST | 1St Group Ltd | 0.005 | -17% | 357,018 |

ANNOUNCEMENTS YOU MAY’VE MISSED

Hiding among the flurry of Friday notices is an update from Tamawood Limited (ASX:TWD) about its all scrip takeover offer for 100% of the fully paid shares in AstiVita Limited (ASX:AIR). Tamawood says that a deafening round of silence after its “speak now, or forever hold your peace” call for objections by AstiVita shareholders means it’s time to forge ahead with its plans. Rumour has it the slogan “First AstiVita, then the world” is on every whiteboard in the building in anticipation – so we’d like to be the first on record to welcome our new Tamawood overlords.

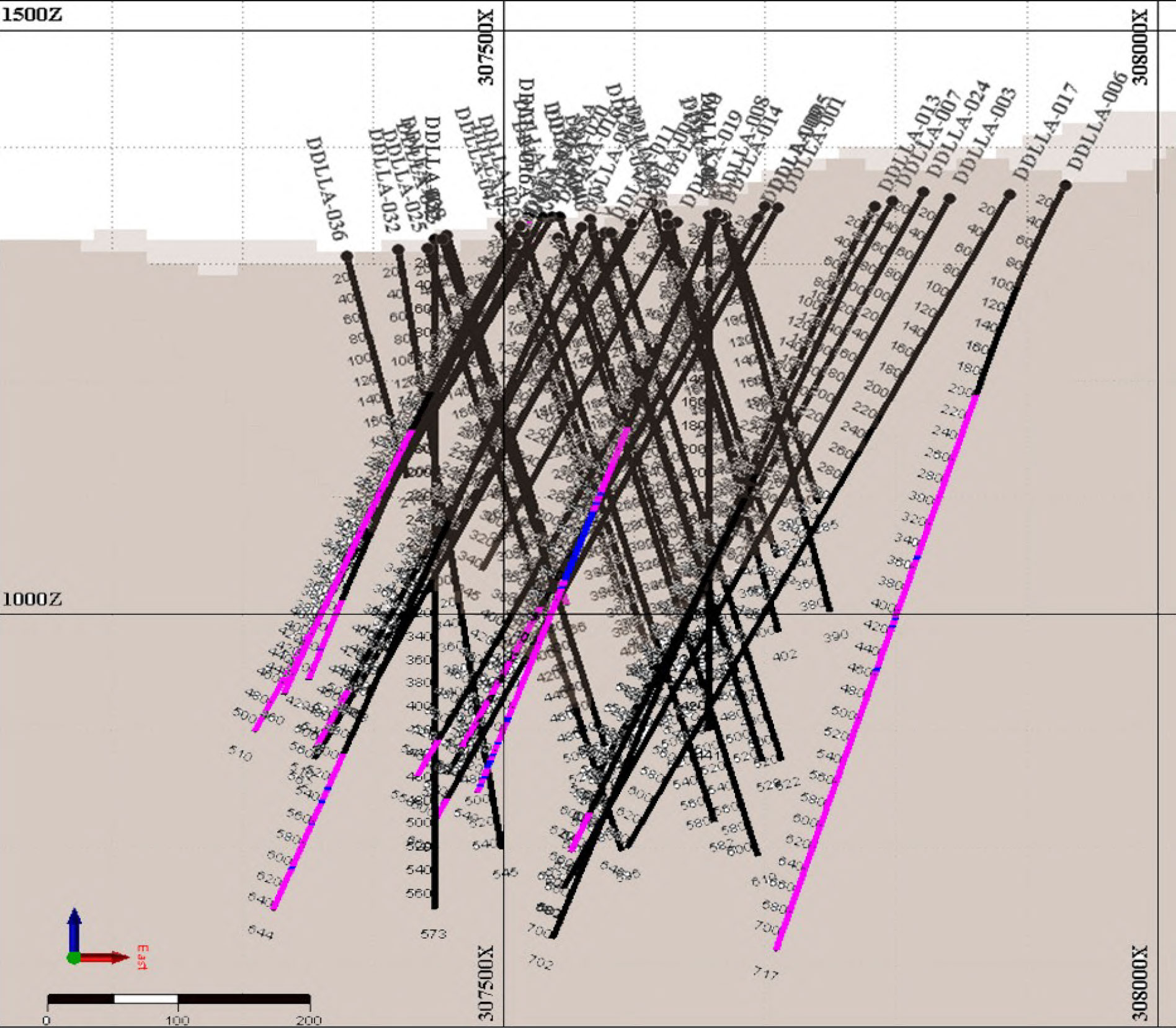

A Highly Commended Announcement Award for today goes to Southern Hemisphere Mining (ASX:SUH), for sharing some good news about assay results from a batch of historical lithium drill samples left behind by previous tenants, including a best result of 31m at 0.57% CuEq from 0m depth. However, it was this glorious chart that came with the announcement that had half the Stockhead newsroom needing to lie down for a bit. An abstract masterpiece, breathtaking in its impenetrable complexity – we dare not stare directly at it, lest we all go mad:

Last on the list today, and helping to keep the ASX mailroom busy, was Cazaly Resources (ASX:CAZ), which has updated the market with news that it’s started poking thumping-great-big holes in the ground at Halls Creek. Cazaly has set up its drills near the Mount Angelo North Cu-Zn-Ag Resource to target another massive sulphide deposit called Moses Rock, leaving investors smiling and Biblical scholars absolutely outraged.

TRADING HALTS

Trajan Group Holdings (ASX:TRJ) – Acquisition of analytical consumables manufacturer Chromatography Research Supplies.

Future Metals NL (ASX:FME) – Mineral resource estimate announcement pending

Elixir Energy Limited (ASX:EXR) – Signing of a joint Memorandum of Understanding

Bowen Coking Coal Limited (ASX:BCB) – Significant funding facility in relation to the acquisition of the Burton Lenton Project.

Mayur Resources Limited (ASX:MRL) – Proposed transaction relating to its Mayur Renewables business.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.