Closing Bell: Rising ASX markets bet on IT, more betting and lower rates as US Fed goes zero-dark-Jan 30

Via Getty

- ASX200 ends Monday 0.75pc higher

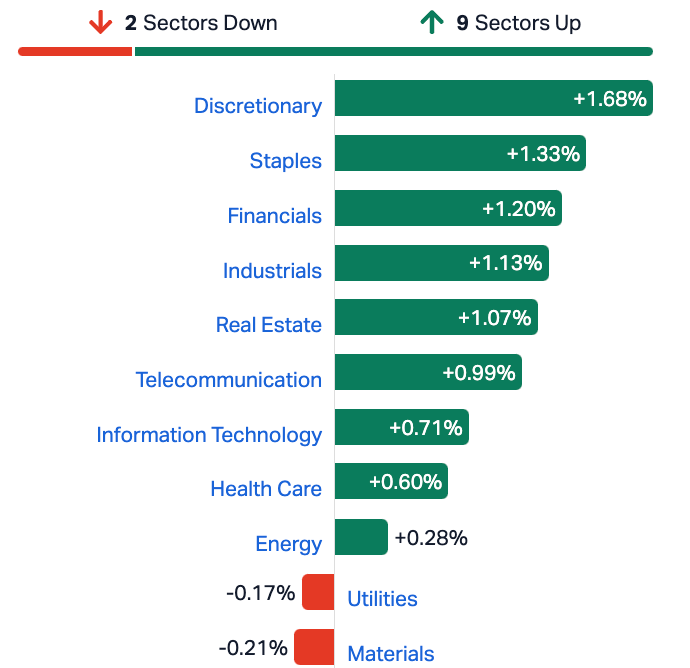

- Most sectors higher, led by Consumer and IT stocks

- Resource Mining and NZ King Salmon out front of small cap leaders

The Aussie Day week, Aussie made, Aussie holiday-shortened Monday on the Aussie sharemarket has ended positively-Aussie-ly, thanks to the good vibes which returned to Wall Street, where we get our instructions.

At 4.15pm on 22 Jan, the S&P/ASX200 was ahead 55 points or 0.75% to 7,476.5:

The lead was freed, on Friday in New York, where markets have revived recently flatlining hopes for some looming US Fed interest rate cuts.

In the local nitty-gritty, we therefore had a return of the jacked-up IT majors and the rate sensitive consumer and discretionary spending stocks.

Enter Messrs Xero (ASX:XRO), WiseTech Global (ASX:WTC) and Altium (ASX:ALU) after the big chipmakers sent the right signals after a blockbusting last session in New York.

We’re also buying what we don’t need to, with the Consumer Discretionary names cashing in.

Majors like (Retail), Harvey Norman Holdings (ASX:HVN) (up 2.4 per cent), (Gaming), Aristocrat Leisure (ASX:ALL) and (Edu Exports) IDP Education (ASX:IEL) were all stronger by between 2.8 and 5%.

Buy now, pay later cult name, Zip Co (ASX:ZIP) says it’s enjoying an 8.5% boost in transaction volumes already over Q2, and that’s given the former child-star market darling a welcome kick on Monday.

In the smaller cappy space, that provider of ‘fully integrated premium data and enhanced content and technology solutions,’ for the racing and wagering sectors,’ RAS Technology Holdings (ASX:) says it has struck a two-year deal with stake.com – one of the largest online casino and sports bookies.

The contract, RAS says has the “potential to be the most significant deal to date for RAS and will commence once Stake.com’s racing offer goes live,” which is thought to be in the first quarter of 2024.

It could be bets-to-the-death for RAS as Stake.com has had over 200 billion bets on their platform since launching in 2017 including over 100 million bets through their sports book, which launched in 2019.

They also support cryptocurrencies for betting on their platform. Oh, at last.

Materials were lower on falling iron ore majors, while lithium is depressed. I’m depressed watching it.

Mineral Resources (ASX:MIN) fell almost 8% by lunch on Monday.

Pilbara Minerals and IGO (ASX:IGO) were both down about 4-5%, too.

ASX SECTORS at 4.15pm on MONDAY

Around the ‘hood…

Regional markets were mostly higher on Monday. In Japan, markets are at 34-year highs.

Less love in China, where the Hang Seng is already 1.5% lower to start the week after the central bank (People’s Bank of China) has left the 1-year LPR at 3.45% and the 5-year LPR at 4.2% steady at historic lows.

A measurement of the business sentiment in Hongkers fell to 1 in Q1 of 2024 from 8 in Q3, the worst mood over there in near two years.

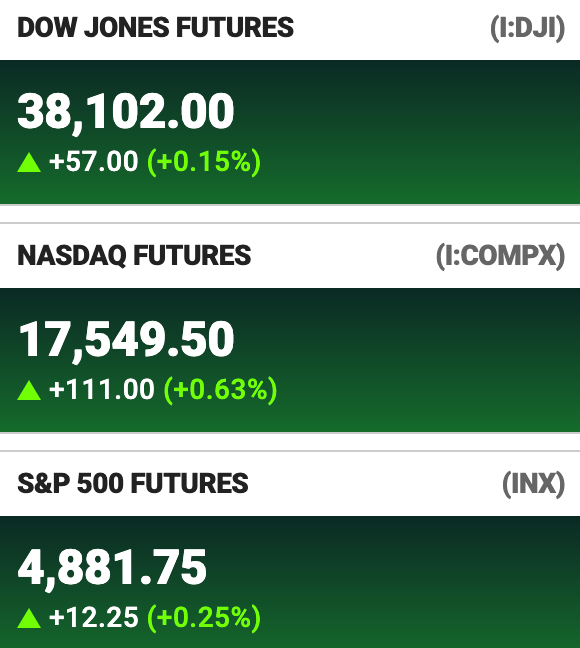

Lifting US futures have probably cauterised the bleeding, ahead of US GDP and a hopeful PCE read later this week.

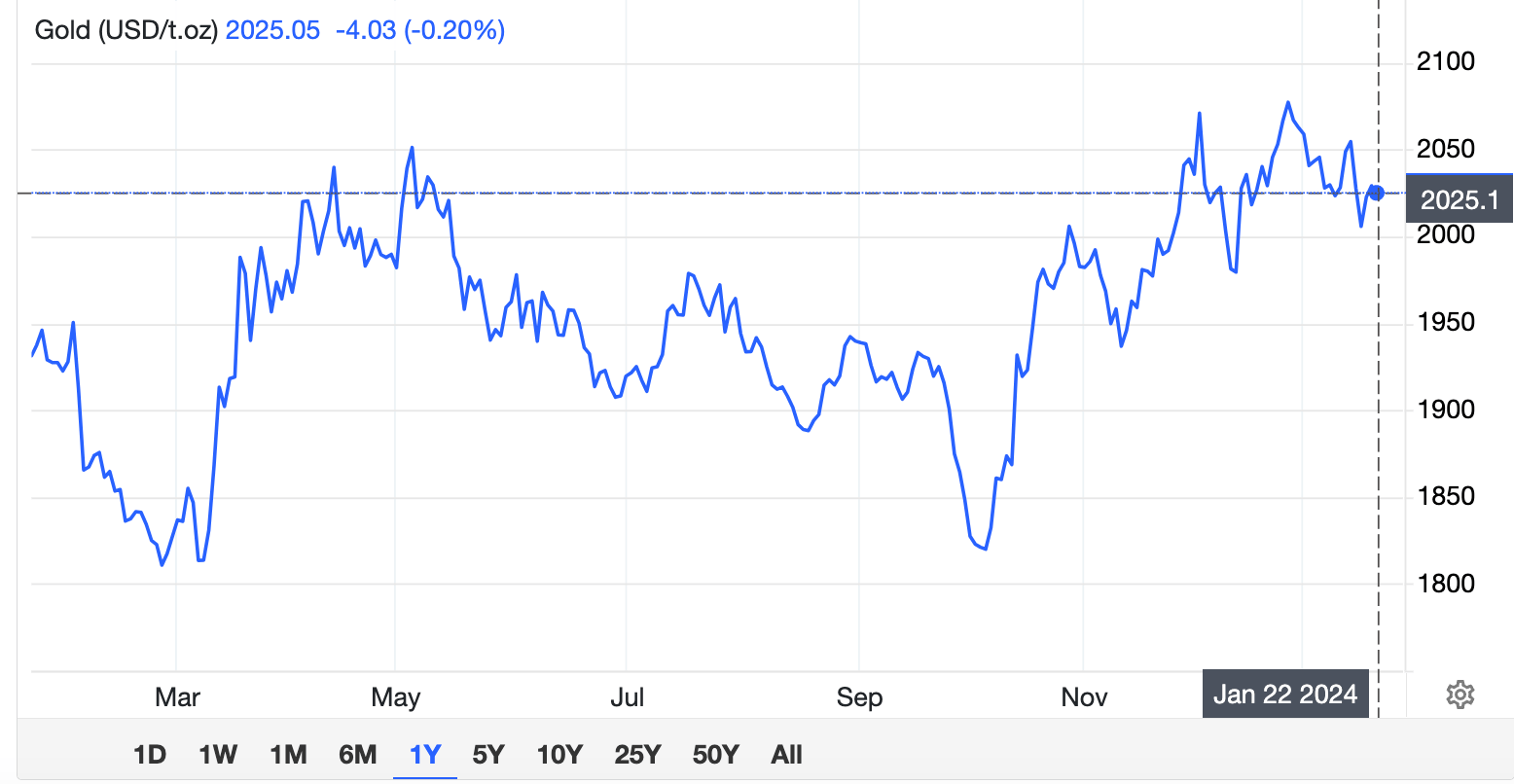

We’re watching gold…

Which lost about 1% last week as the greenback and US Treasury yields rallied on heftier-than-expected US data and some hawkish signals from Fed speakers which poured the cold water on dreams of a March rate cut.

Gold has steadied around $2,025 an ounce on Monday as investors held off ahead of big monetary policy calls in Japan and Europe this week, as well as key GDP in the US.

Markets are on tenterhooks wary of a sudden end to negative rates in Japan, while less os in the EU where my president of the ECB Christine Lagarde is expected to push back hard against trashy bets on rate cuts at anytime this year.

And in the States…

In the US, Q4 GDP and the Fed-preferred PCE inflation index drop in a few days ahead of the Fed’s policy meet next week. The good news is the FOMC chattering is over as the FEDspeaking speakers are in their media blackout until like, February 1.

Thank you. Just, thank you. But, hey, here’s a recap from last week!

Chicago Fed president Goolsbee:

“If we continue to make surprising progress faster than was forecast on inflation, then we have to take that into account in determining the level of restrictiveness.”

Atlanta Fed president Bostic:

“I’d be open to changing that outlook and my view about when we need to start cutting rates, but we need to make sure that we are well on our way to 2% before we move off of our restrictive stance.”

San Francisco Fed president Daly :

“While I think it’s appropriate for us to look forward and ask when would policy adjustments be necessary so we don’t put a stranglehold on the economy, it’s really premature to think that that’s around the corner. Do I get consistent evidence that inflation is coming down, or do I get any early signs with the labour market starting to falter? Neither one of those right now is pushing me to think that an adjustment is necessary.”

CME’s FedWatch Tool says markets now see a 47% chance of a Fed rate cut in March, down significantly from 81% a week ago.

US stock futures are higher in Sydney after the Nasdaq led a Friday rally on Wall Street during the previous session, as the S&P 500 closed at an all-time high of 4,839, adding 1.2%, while the Dow Jones surged 395 points and the Nasdaq advanced 1.7%.

OFC, it’s the monster US Tech Sector led by microchip makers such as Taiwan Semiconductor’s better-than-expected forecast which have cast the die on recent gains.

The chipmaker-next-door, Nvidia also clocked a new record high of $594.91 with a 4.2% rise, Advanced Micro Devices leapt by 7.1%, and Texas Instruments up by 4%.

For the week, the S&P 500 rose 1.1%, the Nasdaq jumped by 2%, and the Dow Jones ended 0.5% higher.

Here’s where US Futures are at 4pm on Monday in Sydney.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ZIP | ZIP Co Ltd | 0.74 | 17% | 58,118,771 | $639,460,418 |

| PNV | Polynovo Limited | 1.71 | 8% | 2,610,942 | $1,094,018,910 |

| A2M | The A2 Milk Company | 4.58 | 6% | 4,128,748 | $3,123,078,371 |

| 360 | Life360 Inc. | 7.44 | 5% | 445,109 | $1,453,763,854 |

| IEL | Idp Education Ltd | 21.92 | 4% | 1,023,627 | $5,845,060,431 |

| BGA | Bega Cheese Ltd | 3.72 | 4% | 701,160 | $1,087,128,457 |

| SGR | The Star Ent Grp | 0.51 | 4% | 5,263,488 | $1,405,653,630 |

| MGH | Maas Group Holdings | 3.85 | 4% | 177,104 | $1,216,599,157 |

| AWC | Alumina Limited | 1.045 | 4% | 7,341,931 | $2,916,189,824 |

| QAL | Qualitaslimited | 2.38 | 3% | 26,760 | $686,078,693 |

| SQ2 | Block | 101.295 | 3% | 76,597 | $3,426,906,430 |

| OCL | Objective Corp | 12.45 | 3% | 20,540 | $1,147,266,233 |

| AUB | AUB Group Ltd | 29.63 | 3% | 98,382 | $3,113,409,406 |

| MAF | MA Financial Group | 5.735 | 3% | 214,427 | $991,524,869 |

| GNE | Genesis Energy Ltd | 2.37 | 3% | 23,243 | $2,471,672,646 |

| SDF | Steadfast Group Ltd | 5.78 | 3% | 2,338,542 | $6,206,290,687 |

| PWH | Power Holdings Limited | 10.13 | 3% | 118,680 | $989,768,690 |

| CCP | Credit Corp Group | 16.61 | 3% | 151,134 | $1,100,641,062 |

| ALL | Aristocrat Leisure | 43.74 | 3% | 873,348 | $27,417,428,714 |

| HPI | Hotel Property | 2.82 | 3% | 173,674 | $536,736,291 |

| BKW | Brickworks Limited | 28.465 | 2% | 131,387 | $4,234,507,206 |

| HM1 | Hearts and Minds | 2.53 | 2% | 320,848 | $565,141,977 |

| PRU | Perseus Mining Ltd | 1.79 | 2% | 2,031,798 | $2,403,736,923 |

| HLS | Healius | 1.355 | 2% | 1,397,707 | $962,038,832 |

| DTL | Data#3 Limited | 9.32 | 2% | 299,337 | $1,410,901,064 |

Resource Mining Corporation (ASX:RMI) made early ground, climbing about 30% with gains most likely being driven by a sluggish market response to its news from last week about assay results from the Liparamba diamond drill program in Tanzania.

Resource told the market on 17 January that drilling had uncovered anomalous Ni-Cu values within a number of the drill holes, with 0.35-0.40% Ni and 0.20-0.23% Cu sulphide mineralisation occurring at 133-135m in hole LPDD009 among the highlights.

Also appearing to move belatedly was New Zealand King Salmon (ASX:NZK), staging a recovery from sharp end-of-the-week losses, on the heels of news that the company has received notice of a positive ‘aquaculture decision’ for Blue Endeavour from Fisheries New Zealand – which, in short, means that the project can go ahead.

As mentioned, RAS Technology Holdings (ASX:) had big news, revealing that it’s entered into a partnership with global online casino and sportsbook Stake.com, which will see RTH provide an all-in-one “racing solution” to enable them to launch a racing offering to their extensive global customer base.

PharmAust (ASX:PAA) climbed well, too, as the market continued to digest its big news from last week that the company has partnered with leading MND/ALS clinical study design and statistical analysis specialists Berry Consultants, to get its Phase 2/3 study for monepantel in patients with Motor Neurone Disease (MND)/ Amyotrophic Lateral Sclerosis (ALS) off the ground.

Dateline Resources (ASX:DTR) informed the market that drilling is well underway at the company’s Colosseum Gold Mine in California, with the first hole now complete, which should allow Dateline to test down plunge extensions previous exploratory hole CM23-08, as well as test a revised sedimentary breccia model at the site.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ZIP | ZIP Co Ltd | 0.74 | 17% | 58,118,771 | $639,460,418 |

| PNV | Polynovo Limited | 1.71 | 8% | 2,610,942 | $1,094,018,910 |

| A2M | The A2 Milk Company | 4.58 | 6% | 4,128,748 | $3,123,078,371 |

| 360 | Life360 Inc. | 7.44 | 5% | 445,109 | $1,453,763,854 |

| IEL | Idp Education Ltd | 21.92 | 4% | 1,023,627 | $5,845,060,431 |

| BGA | Bega Cheese Ltd | 3.72 | 4% | 701,160 | $1,087,128,457 |

| SGR | The Star Ent Grp | 0.51 | 4% | 5,263,488 | $1,405,653,630 |

| MGH | Maas Group Holdings | 3.85 | 4% | 177,104 | $1,216,599,157 |

| AWC | Alumina Limited | 1.045 | 4% | 7,341,931 | $2,916,189,824 |

| QAL | Qualitaslimited | 2.38 | 3% | 26,760 | $686,078,693 |

| SQ2 | Block | 101.295 | 3% | 76,597 | $3,426,906,430 |

| OCL | Objective Corp | 12.45 | 3% | 20,540 | $1,147,266,233 |

| AUB | AUB Group Ltd | 29.63 | 3% | 98,382 | $3,113,409,406 |

| MAF | MA Financial Group | 5.735 | 3% | 214,427 | $991,524,869 |

| GNE | Genesis Energy Ltd | 2.37 | 3% | 23,243 | $2,471,672,646 |

| SDF | Steadfast Group Ltd | 5.78 | 3% | 2,338,542 | $6,206,290,687 |

| PWH | Power Holdings Limited | 10.13 | 3% | 118,680 | $989,768,690 |

| CCP | Credit Corp Group | 16.61 | 3% | 151,134 | $1,100,641,062 |

| ALL | Aristocrat Leisure | 43.74 | 3% | 873,348 | $27,417,428,714 |

| HPI | Hotel Property | 2.82 | 3% | 173,674 | $536,736,291 |

| BKW | Brickworks Limited | 28.465 | 2% | 131,387 | $4,234,507,206 |

| HM1 | Hearts and Minds | 2.53 | 2% | 320,848 | $565,141,977 |

| PRU | Perseus Mining Ltd | 1.79 | 2% | 2,031,798 | $2,403,736,923 |

| HLS | Healius | 1.355 | 2% | 1,397,707 | $962,038,832 |

| DTL | Data#3 Limited | 9.32 | 2% | 299,337 | $1,410,901,064 |

TRADING HALTS

Spenda (ASX:SPX) – pending an announcement in relation to the proposed investment in the Company by Capricorn Society.

NGX (ASX:NGX) – pending an announcement regarding an update on the transfer of the Malingunde licence in Malawi.

Freehill Mining (ASX:FHS) – pending release of an announcement regarding a capital raising and the acquisition of material processing plant and equipment to facilitate project expansion.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.