Closing Bell: Resources to the ASX rescue, but it’s uranium that’s gone nuclear

Yummy yellow cake. Via Getty

- ASX 200 closes 0.46% higher after building up slowly all day

- Uranium goes off. Materials, Finance Sectors call the shots

- Small caps led by an all uranium cast, including

Australian shares have been lifted despite a mixed overnight lead from very mixed US investors. But while they slept fitfully, agonising over the meaning of the latest CPI read stateside, a resolute ASX went to work.

Buoyed by this morning’s jobs data and driven by enthusiastic performances from the Materials, Banks and Energy Sectors, the benchmark ended Thursday in the green by circa 0.6%.

Late to the party, but the major iron names have turned around yesterday’s losses It’s the resources sector which has supercharged business on Thursday, with the ol’ familiar big name’s like Fortescue Metals Group (ASX:FMG) up over 3.1% this morning, while buddies across coal – Whitehaven Coal (ASX:WHC) , New Hope Corp (ASX:NHC) and Yancoal Australia (ASX:YAL) – all not far behind.

But as Josh Chiat points out today in terrific detail – Thursday’s real gains have come bubbling out of the ASX uranium sector.

Global uranium prices have jumped to decade highs, up 5% after a steady climb with U3O8 – or yellowcake – trading at circa US$62.25/lb.

These are just some of the beneficiaries:

- Lotus Resources (ASX:LOT) up +7%

- Alligator Energy (ASX:AGE) up +16%

- Boss Energy (ASX:BOE) up circa +10%

- Deep Yellow (ASX:DYL) up +8%

- Paladin Energy (ASX:PDN) up +4.1%

- GTI Energy (ASX:GTR) up +12.5%

Josh says that’s the highest spot price in a decade aside from a brief bit when Russia’s invaded Ukraine and everyone thought we’d all die and there’d be dearth of the yellow earth.

“Those fears have lingered,” Josh wrote today.

“Russia is a major supplier of enriched uranium and the US is keen to secure sources outside of that market for a uranium fleet seeing an increasing number of life extensions.”

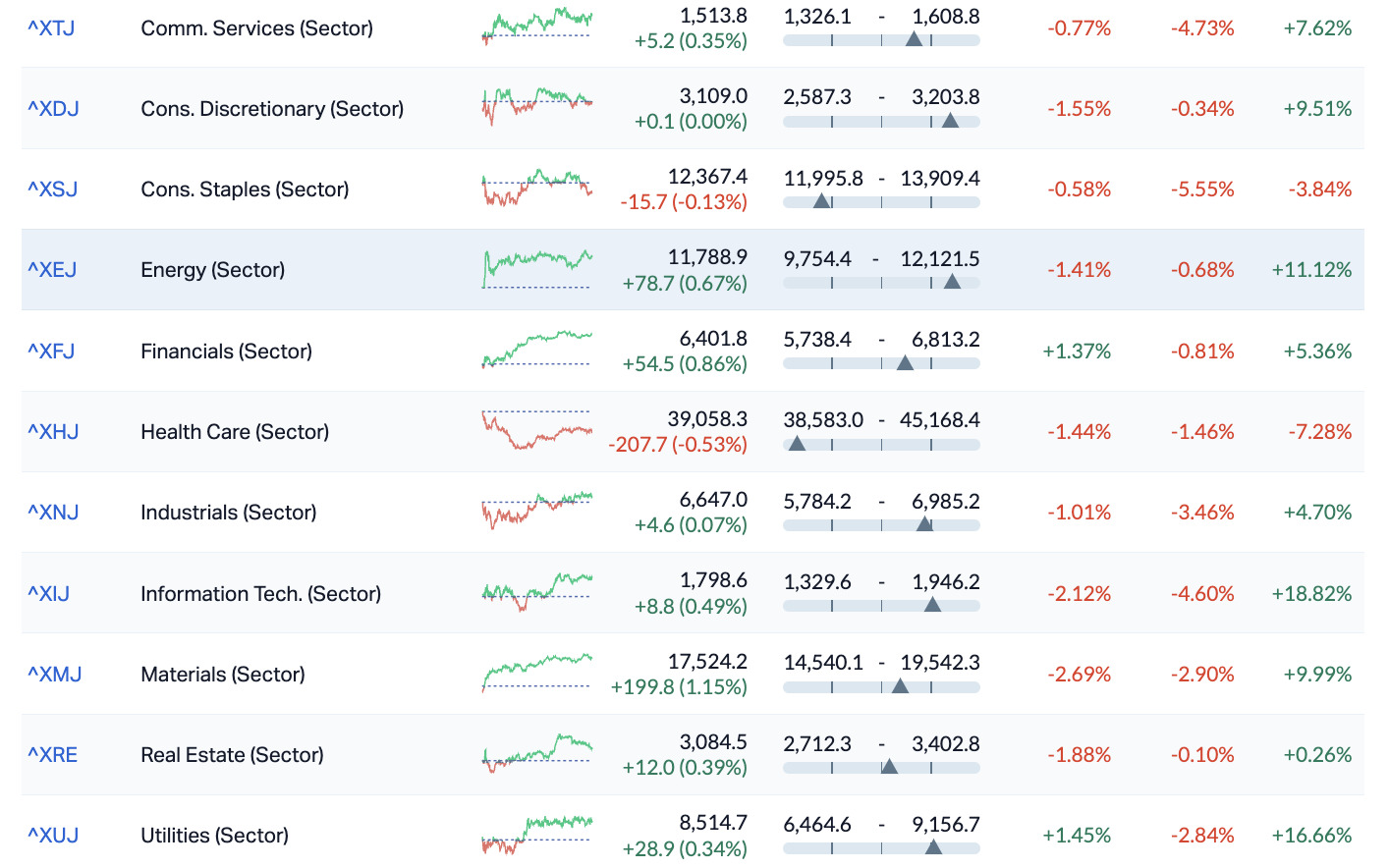

ASX Sectors on Thursday Session – Week – Month – Year

The ASX Small Ords (XSO) Index rose 0.5% and the ASX Emerging Markets (XEC) Index rose +0.3%.

RIPPED FROM THE HEADLINES

British Nasdaq hopeful, Arm has confirmed the pricing for its looming IPO at the top end of its range to raise US$4.87bn.

That’ll eclipse any similar initial public offering’s stateside in a boost major lift to long-suffering equity markets.

The Cambridge-based chip designer, ion the pocket of Japan’s SoftBank Group sold 95.5 million American depositary shares for $US51 apiece, as per Bloomberg.

Futures tied to the Dow Jones Industrial Average are climbing ahead of the first session to follow August’s CPI read.

THURSDAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| NXMR | Nexus Minerals Ltd | 0.004 | 300% | 1,554,352 | $65,091 |

| MTL | Mantle Minerals Ltd | 0.002 | 100% | 19,089,819 | $6,147,446 |

| ARE | Argonaut Resources | 0.0015 | 50% | 1,500,000 | $7,316,152 |

| MEL | Metgasco Ltd | 0.012 | 33% | 3,620,505 | $9,574,981 |

| MHI | Merchant House | 0.05 | 32% | 52,000 | $3,582,127 |

| JBY | James Bay Minerals | 0.505 | 33% | 4,303,850 | $12,329,100 |

| IPB | IPB Petroleum Ltd | 0.013 | 30% | 7,353,998 | $5,651,224 |

| SI6 | SI6 Metals Limited | 0.009 | 29% | 30,828,235 | $13,957,016 |

| BCK | Brockman Mining Ltd | 0.029 | 26% | 47,403 | $213,445,339 |

| 92E | 92Energy | 0.3325 | 25% | 1,859,769 | $28,189,402 |

| CXU | Cauldron Energy Ltd | 0.01 | 25% | 20,869,620 | $7,612,549 |

| MXC | Mgc Pharmaceuticals | 0.0025 | 25% | 210,366 | $8,855,936 |

| TOR | Torque Met | 0.33 | 25% | 2,425,699 | $25,714,815 |

| ODM | Odin Metals Limited | 0.026 | 24% | 1,824,106 | $15,731,564 |

| TAL | Talius Group Limited | 0.011 | 22% | 1,795,150 | $20,561,754 |

| SRJ | SRJ Technologies | 0.073 | 22% | 184,754 | $7,844,385 |

| GLA | Gladiator Resources | 0.017 | 21% | 3,881,904 | $8,271,156 |

| OKR | Okapi Resources | 0.105 | 21% | 2,684,769 | $18,277,483 |

| UVA | Uvrelimited | 0.15 | 20% | 773,837 | $4,087,278 |

| MOM | Moab Minerals Ltd | 0.012 | 20% | 6,614,292 | $6,819,635 |

| SIT | Site Group Int Ltd | 0.003 | 20% | 4,700,000 | $6,506,226 |

| TSL | Titanium Sands Ltd | 0.006 | 20% | 810,227 | $8,859,024 |

| FRB | Firebird Metals | 0.155 | 19% | 204,527 | $9,499,750 |

| T92 | Terrauraniumlimited | 0.125 | 19% | 380,605 | $5,418,542 |

| AMN | Agrimin Ltd | 0.22 | 19% | 48,641 | $53,345,210 |

Okapi Resources (ASX:OKR) has jumped almost 33% on this uranium business.

OKR is an Australian minerals exploration company focused in the Kimberley Goldfields of Western Australia and the Democratic Republic Congo (DRC).

But it’s long-term strategy to become ‘a new leader in North American carbon-free nuclear energy’ by developing its portfolio of top notch uranium assets, is what’s led to today’s mighty stride.

Okapi’s case for developing uranium projects in North America reduces to several converging factors:

#1) the clean energy movement will have to embrace nuclear power

#2) uranium supply is not sufficient to meet future demand, and

#3) the USA is investing billions in reigniting its nuclear energy capabilities and along with it, domestic uranium supply.

Okapi’s wave today is basically No #2 – the increasingly positive outlook for uranium demand which has driven the price to decade highs, after the World Nuclear Association released its forecasts for 2023 through to 2040.

But Okapi has strong strategic positions in #3) as well, more specifically in North America’s most prolific uranium districts – the Tallahassee Creek Uranium District in Colorado, and Canada’s Athabasca Basin, which currently supplies about 20% of the world’s uranium. In the US, our flagship Tallahassee Uranium Project in Colorado has a JORC Resource of 49.8Mlbs U3O8 (average grade of 540ppm U3O8).

Okapi also has the high-grade Rattler Uranium Project in Utah, and the Maybell Uranium Project in Colorado which boasts historical production of 5.3 million pounds of U308 (average grade 1,300ppm).

The share’s are up 30%

Terra Uranium (ASX:T92) another Aussie uranium explorer is leading the daily resources pack with a roughly 28% gain.

Terra is focused on exploring for heavy metal in Canada’s Athabasca Basin and it’s been particularly encouraged by the results from its first hole drilled at its Parker Lake project where it recently turned up a peak grade of 32.5 parts per million over 0.2 metres in diamond drilling.

Terra Uranium Executive Chairman, Andrew Vigar commented on this about a week ago with:

“The presence of anomalous uranium and pathfinders in our first drill hole at Parker is very encouraging and bears similarities to that recently reported from IsoEnergy’s Hawk Project on the Cable Bay Shear Zone 40km to the north east.

“We have only just begun to orientate ourselves on this fertile structure, having brought all the scientific data up to modern standards suitable for targeting of a major uranium discovery in this new domain”.

Mini-cap oil and gas hunter Metgasco (ASX:MEL) has jumped over 30% this afternoon.

The minnow has long held licences out in South Australia’s Cooper Basin gas riches and it says it’s finally kicked into production out of the Odin-1 gas well at its joint venture project.

THURSDAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MTH | Mithril Resources | 0.001 | -50% | 280,000 | $6,737,609 |

| MEB | Medibio Limited | 0.001 | -33% | 200,000 | $9,151,116 |

| KEY | KEY Petroleum | 0.0015 | -25% | 3,999,980 | $3,935,856 |

| TD1 | Tali Digital Limited | 0.0015 | -25% | 100,067 | $6,590,311 |

| TEM | Tempest Minerals | 0.009 | -25% | 26,614,283 | $6,136,602 |

| GTG | Genetic Technologies | 0.002 | -20% | 60,000 | $28,854,145 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 1,176,102 | $19,462,207 |

| PNX | PNX Metals Limited | 0.002 | -20% | 199,999 | $13,451,562 |

| TKL | Traka Resources | 0.004 | -20% | 500,000 | $4,356,646 |

| WCN | White Cliff Min Ltd | 0.008 | -20% | 5,397,899 | $12,570,186 |

| BUY | Bounty Oil & Gas NL | 0.0065 | -19% | 6,640,575 | $10,964,008 |

| YOJ | Yojee Limited | 0.009 | -18% | 3,190,866 | $12,487,250 |

| KNB | Koonenberrygold | 0.041 | -18% | 1 | $3,787,822 |

| RCE | Recce Pharmaceutical | 0.48 | -17% | 1,013,854 | $103,617,508 |

| CMX | Chemxmaterials | 0.1 | -17% | 40,069 | $6,369,226 |

| AMD | Arrow Minerals | 0.0025 | -17% | 29,235 | $9,071,295 |

| EDE | Eden Inv Ltd | 0.0025 | -17% | 23,417,900 | $10,090,911 |

| HOR | Horseshoe Metals Ltd | 0.01 | -17% | 1,491,259 | $7,721,744 |

| RML | Resolution Minerals | 0.005 | -17% | 715,116 | $7,543,751 |

| POS | Poseidon Nick Ltd | 0.0185 | -16% | 30,500,709 | $81,579,908 |

| A3D | Aurora Labs Limited | 0.024 | -14% | 823,021 | $6,882,626 |

| AOA | Ausmon Resorces | 0.003 | -14% | 1,000,000 | $3,392,513 |

| BFC | Beston Global Ltd | 0.006 | -14% | 77,646,002 | $13,979,328 |

| CHK | Cohiba Min Ltd | 0.003 | -14% | 2,434,802 | $7,746,355 |

| IMI | Infinitymining | 0.12 | -14% | 25,674 | $10,871,194 |

TRADING HALTS

DevEx Resources (ASX:DEV) – Pending announcements in response to an ASX price query and drilling results for the Kennedy Project, Queensland and Nabarlek Project, NT

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.