Closing Bell: Range-bound benchmark ends washboard flat, cheapened us all during August

Pic via Getty Images

- ASX 200 closes about 0.06% in the green (so, really, we ended in the chartreuse) down -1.2 in August

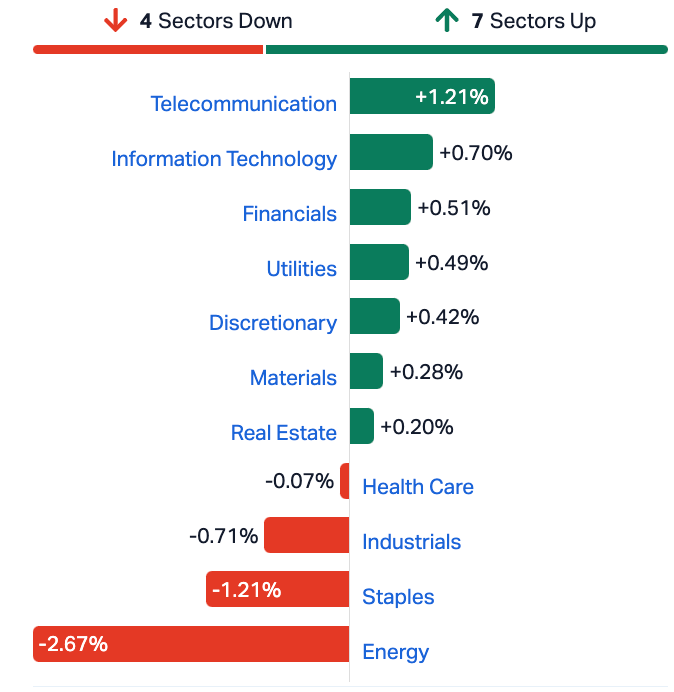

- Telco and IT Sectors offset Staples and Energy losses

- Small cap winners include 29M, CDX and HLA

Volatility, uncertainty and indecision Aussie-style were back in all their bare-breasted glory across local sharemarkets on Thursday.

This is where we were on the ASX200 with 15 minutes to bring it home for a win:

But in the end the benchmark found about 4 points to end at the closing bell +0.06% ahead – one can see traders crossing the line of demarcation about 17 times through the final session of an ambivalent August.

The better-than-expected manufacturing read out of China this morning was much worse-than-hoped in the land of the ASX mega miners.

No one wants China to ease itself into economic gear.

What we require is some more bad data followed by panic stimuli poured back into nonsensical but coal, steel and metal-rich infrastructure-to-nowhere projects.

The home benchmark was flat at lunch and looks like it needs a break to my wizened old eyes.

The slightly good news is that despite the latest manufacturing purchasing managers’ indexes wee rise, the PMI remains in contraction for a 5th straight month. Unheard of for Beijing.

Unsurprisingly, the local Energy Sector is spitting its dummy, led by an ex-divvy 9% drop in Whitehaven Coal (ASX:WHC).

A lethargic Wall Street managed to continue its end-of-August winning run four sessions in a row, but the gains were in a row and chipping away more of the market’s losses this month.

Around the grounds it’s the Communications, Financials, Real Estate and Consumer Discretionary Sectors vs losses from within the Consumer Staples, Industrials and aforementioned Energy Sectors.

Here are Thursday’s ASX sectors:

The ASX Small Ordinaries Index (XSO) ended 0.2% lower, and the ASX Emerging Companies Index (XEC) was 0.5% ahead.

RIPPED FROM THE HEADLINES

Just how bad is Qantas (ASX:QAN)?

Well, despite 8,000 scrapped flights between May and July last year, the Australian Competition & Consumer Commission (ACCC) is accusing the national non-carrier of continuing to sell tix on these services for two weeks.

They’re also getting pinged for allegedly laying about for weeks (my words not the ACCC’s) instead of getting on the blower to tell ticket holders with stupid looking faces (my words not the ACCC’s) about some 10,000 other cancelled flights (that’s the ACCC).

The watchdog will seek costs and such. Nothing within the region of making QAN not do the same thing when easy money calls.

Just how bad is Country Garden (HKG: 2007)?

Well it’s very bad. But, once upon a time, Country Garden was by far China’s best selling property developer. Last night it dropped some dastardly half year numbers, led by the hero of the dish – a mouth-watering 48.9bn yuan (Au$10.53bn) loss.

Unsurprisingly that’s the single highest-ever loss for the Country Garden, and a worrying sign that the liquidity drought rampant across China’s property sector is entering every nook and cranny.

Country Garden was thought to be pretty rock solid in the shifting sands of China’s real estate development quagmire. That kind of hit to the pocket is certainly a worry when development and property are the major driving force of China’s economy, representing well over 25% of the country’s economic activity.

Just how bad is China’s Ministry of Natural Resources?

The 2023 edition of China’s standard map was officially released on Monday and launched on the website of the standard map service hosted by the Ministry of Natural Resources. This map is compiled based on the drawing method of national boundaries of China and various countries… pic.twitter.com/bmtriz2Yqe

— Global Times (@globaltimesnews) August 28, 2023

Well, the 2023 edition of China’s “standard map,” published this week on China’s Ministry of Natural Resources website, and here via the state-run tabloid Global Times, looks ok at first glance, but then a few … irregularities become apparent.

An eagle-eyed geographer would note that China has expanded its border right across the Indian state of Arunachal Pradesh and the Aksai Chin plateau and claimed them as Chinese territory.

It also includes part of Malaysia’s maritime area off Borneo, as well as all of Taiwan and great swathes of the South China Sea along China’s mythical 9 dash line.

Malaysia, Taiwan and India have all lodged protests with various powerless and impotent bodies.

India, however, is hosting the G20 in New Delhi next week and after Indian and Chinese officials recently seemed to bury the hatchet, expect Narendra ‘Bruce Springsteen’ Modi to go full Boss on Chinese President Xi Jinping who’s expected to attend, but may well not now.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| HLA | Healthia Limited | 1.74 | 78% | 3,023,143 | $136,687,178 |

| LNU | Linius Tech Limited | 0.003 | 50% | 125,352 | $8,459,581 |

| DRE | Dreadnought Resources Ltd | 0.059 | 44% | 103,810,795 | $137,135,907 |

| NXD | Nexted Group Limited | 1.06 | 35% | 5,664,025 | $173,780,767 |

| EMU | EMU NL | 0.002 | 33% | 3,281,931 | $2,175,032 |

| NMR | Native Mineral Res | 0.056 | 27% | 1,523,156 | $7,406,459 |

| RDN | Raiden Resources Ltd | 0.03 | 25% | 108,268,168 | $49,326,454 |

| BFC | Beston Global Ltd | 0.01 | 25% | 31,828,780 | $15,976,375 |

| ICN | Icon Energy Limited | 0.005 | 25% | 2,000,000 | $3,072,055 |

| NTM | Nt Minerals Limited | 0.01 | 25% | 949,273 | $6,405,591 |

| OLI | Oliver'S Real Food | 0.02 | 25% | 325,791 | $7,051,711 |

| RML | Resolution Minerals | 0.005 | 25% | 1,500,000 | $5,029,167 |

| NOU | Noumi Limited | 0.18 | 24% | 1,209,375 | $40,180,851 |

| HMY | Harmoney Corp Ltd | 0.515 | 21% | 190,715 | $43,161,124 |

| CPM | Coopermetalslimited | 0.145 | 21% | 12,039 | $6,151,878 |

| VTI | Vision Tech Inc | 0.265 | 20% | 46,800 | $6,977,788 |

| ATP | Atlas Pearls Ltd | 0.053 | 20% | 4,642,200 | $18,826,357 |

| 29M | 29Metalslimited | 0.88 | 20% | 10,624,280 | $352,522,346 |

| APC | Aust Potash Ltd | 0.006 | 20% | 2,779,445 | $5,193,447 |

| TKL | Traka Resources | 0.006 | 20% | 1,018,880 | $4,356,646 |

| JYC | Joyce Corporation | 3.1 | 18% | 49,547 | $74,417,477 |

| BYH | Bryah Resources Ltd | 0.02 | 18% | 44,953 | $5,941,590 |

| EOF | Ecofibre Limited | 0.2 | 18% | 481,431 | $59,366,474 |

| AQD | Ausquest Limited | 0.014 | 17% | 91,407 | $9,901,791 |

| IEC | Intra Energy Corp | 0.007 | 17% | 5,697,429 | $9,724,690 |

Healthia (ASX:HLA) is still hovering about 80% higher late in the day after dropping its FY23 and announcing a Scheme Implementation Deed with Harold BidCo, a front for the takeover machine Pacific Equity Partners. The deal is for Harold to snap up 100% of the fully diluted share capital in HLA by way of a scheme of arrangement.

Harold BidCo’s offer is either $1.80 cash per Healthia share, unlisted scrip consideration or a cash/unlisted scrip consideration combo for each shareholder.

That’s not bad, being a superlative 84.6% premium to HLA’s last closing price of $0.975 per share and its 72.8% beyond HLA’s 3-month volume weighted average price.

The proposed deal is subject to shareholder approval, and reliant on no better offer turning up in the short-term.

Out of a trading halt and up from the get go, 29Metals (ASX:29M) says it’s successfully completed the institutional bit of its fully underwritten, 1 for 2.20 accelerated, non-renounceable entitlement offer.

29M says the Institutional Entitlement Offer will raise circa $122m (subject to reconciliations) at an offer price of $0.69 per share all of this representing a:

▪ 5.6% discount to TERP of $0.731 (this is the theoretical ex-rights price, a co’s best guess on share price value, in this case based on the last closing price on 29 August 2023); and

▪ 8.0% discount to the last closing price of $0.750 on 29 August 202329M’s MD & CEO Peter Albert, said the offer received ‘very strong support’, with eligible existing institutional shareholders going in for circa 97% of their entitlements.

“The strong demand from existing shareholders has resulted in New Shares only being allocated to existing shareholders. Proceeds from the offer will strengthen 29Metals’ financial position, ensure that the ongoing Capricorn Copper Recovery Plan is fully funded, de-risk the balance sheet and position the Company to progress near-term growth initiatives.

We encourage our eligible retail shareholders in Australia and New Zealand to consider the terms of the retail entitlement offer with their professional advisers when the retail entitlement offer opens on Wednesday, 6 September 2023.”

29M says the new shares to be issued under the Institutional Entitlement Offer ‘will rank equally with existing 29Metals shares in all respects from the date of their issue.’

Settlement of the circa 177 million New Shares is expected to happen on Thursday 7th, with the New Shares pegged to start trading on Friday, 8 September.

Dreadnought Resources (ASX:DRE) has popped after reporting massive and disseminated Ni-Cu sulphides at the Bookathanna North prospect, at the 45km long Money Intrusion part of the Mangaroon Ni-Cu-PGE Project, located in the Gascoyne Region of WA, where Dreadnought is in an earn-in agreement with its partner on the project, First Quantum Minerals.

DRE says on-site inspection shows ~14m of Ni-Cu sulphide mineralisation from 37m, including 2m of massive sulphides and 12m of disseminated sulphides. The sample’s been sent for assays, and further drilling at the site is set to take place.

The healthy food stock formerly Freedom Foods Group – but now by the far more sensible Noumi (ASX:NOU) is up over 20% on nada while Joyce Corporation (ASX:JYC) is up about the same, but had to boost revenue 12% to $144.7 million, over its just released FY23. JYC made profit after tax of some $17.7 million, allowing for a final divvy of $0.175 per share. As Gregor noted earlier today. Neato.

Finally, Cardiex (ASX:CDX) says it just dropped an amended registration statement on its Form F-1/A with the US Securities and Exchange Commission (SEC).

That brings the ASX-listed medtech a step closer to joining the Nasdaq Composite in a long-awaited double-life as a dual-listed concern.

The Form F-1/A contains amendments to the previous Form F-1 which CDX filed back on on 26 July and relates to some tweaking of the initial public offering of American Depositary Shares (ADSs) representing CardieX’s ordinary shares and the contemplated listing of those ADSs under the ticker symbol “CDEX.”

The registration statement is also being lodged with the ASX.

The offering consists of 1,333,333 ADSs representing 1mn of ordinary shares, no par value, of CardieX, deposited with JPMorgan Chase Bank.

Remember team:

“The Offering is subject to general market conditions, and there can be no assurance as to whether or when the Offering may be launched or completed, or as to the actual size or terms of the Offering.”

Roth Capital Partners is acting as lead book-running manager for the Offering, which will be made only by means of a prospectus.

CDX is up about 17% on the news.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CGO | CPT Global Limited | 0.13 | -40% | 499,191 | $9,007,933 |

| AVW | Avira Resources Ltd | 0.001 | -33% | 10 | $3,200,685 |

| KEY | KEY Petroleum | 0.001 | -33% | 350,000 | $2,951,892 |

| MPP | Metro Perf.Glass Ltd | 0.096 | -29% | 600 | $25,026,042 |

| ANO | Advance Zinctek Ltd | 0.815 | -26% | 265,216 | $68,674,891 |

| AXP | AXP Energy Ltd | 0.0015 | -25% | 1,484,418 | $11,649,361 |

| PEN | Peninsula Energy Ltd | 0.091 | -24% | 54,550,098 | $150,846,000 |

| MYX | Mayne Pharma Ltd | 3.68 | -23% | 889,849 | $404,102,868 |

| EMT | Emetals Limited | 0.007 | -22% | 4,803,338 | $7,650,000 |

| NXS | Next Science Limited | 0.51 | -22% | 664,952 | $139,613,587 |

| MRI | Myrewardsinternation | 0.012 | -20% | 1,817,234 | $6,245,221 |

| NSM | Northstaw | 0.048 | -20% | 79,900 | $7,207,620 |

| AJQ | Armour Energy Ltd | 0.1 | -20% | 21,720 | $12,890,014 |

| BTE | Botalaenergyltd | 0.1 | -20% | 130,000 | $6,664,583 |

| BP8 | Bph Global Ltd | 0.002 | -20% | 55,229 | $3,336,824 |

| CTN | Catalina Resources | 0.004 | -20% | 1,899,358 | $6,192,434 |

| OPN | Oppenneg | 0.008 | -20% | 625,000 | $11,166,796 |

| TML | Timah Resources Ltd | 0.032 | -20% | 89,903 | $3,550,390 |

| ECG | Ecargo Hldg | 0.038 | -17% | 64,809 | $28,301,500 |

| RCL | Readcloud | 0.05 | -17% | 94,859 | $7,310,237 |

| EEL | Enrg Elements Ltd | 0.005 | -17% | 14,617 | $6,059,790 |

| IVX | Invion Ltd | 0.005 | -17% | 677,475 | $38,529,793 |

| MXC | Mgc Pharmaceuticals | 0.0025 | -17% | 18,946,251 | $11,677,079 |

| WMG | Western Mines | 0.4 | -16% | 1,788,707 | $28,762,595 |

| DTI | DTI Group Ltd | 0.016 | -16% | 3,500 | $8,522,477 |

Aussie uranium miner Peninsula Energy (ASX:PEN) has dropped off the cliff by about 25% on Thursday after revealing its Lance Projects in Wyoming won’t be back mining and developing uranium until late 2024, under a new, but achingly disappointing life of mine plan.

Before the revelation, everyone was expecting the company’s flagship Lance Project – “a modern, large-scale, long-life, constructed and fully permitted project – one of the largest US uranium projects in size and scale boasting a defined JORC (2012) resource of 53.7Mlbs U3O8,” (that’s according to the PEN website) – to be back doing its thing… about now actually (scheduled for mid-2023).

LAST ORDERS

Classic Minerals (ASX:CLZ) has ticked another box by today adopting an Environmental, Social, and Governance (ESG) framework with 21 core metrics and disclosures as per the World Economic Forum (WEF).

WA-based Classic holds a pipeline of projects and recently achieved first gold pour at its flagship Kat Gap gold project, ~170km south of Southern Cross in WA, which has an indicated resource of 20,488oz @ 2.5g/t and an inferred resource of 60,139oz @ 2.19g/t.

Stage 1 production will see Classic trial mine a good portion of the oxide component of the indicated resource down to a depth of 45m over the next eight weeks.

CEO, Dean Goodwin, told the ASX this morning that CLZ was long committed to the principles of ESG and building ESG credentials.

“In mid-2023, we made a commitment to commence reporting on the Environmental, Social, and Governance (ESG ) disclosures of the Stakeholder Capitalism Metrics (SCM) of the World Economic Forum (WEF).

“We are in the process of making ESG disclosures in the form of a set of universal, comparable ESG metrics focused on people, planet, prosperity and principles of governance that organisations can report on regardless of industry or region.”

Goodwin added that CLZ planned to use the universal ESG framework to align mainstream reporting on performance against ESG indicators.

“By integrating ESG metrics into our governance, business strategy, and performance management process, we diligently consider all pertinent risks and opportunities in running our business.

“We continue to look for opportunities for further transparency on the topics which are material to our business,” Goodwin said.

To keep aligned with evolving ESG mandates, the digger is adopting SocialSuite’s ESG Go as it provides small to mid-cap companies with a platform to complete their increasingly complex and oft onerous ESG reporting in fairly structured, standardised – and globally recognised – order.

CLZ currently holds tenements across two major regional exploration areas in minerals-rich West Australia covering approximately 578 km².

Classic’s ground is in areas with identified high grade gold and base metal targets. Classic’s flagship Kat Gap gold project has been the focus of the majority of its recent exploration effort and is strategically located some 170km south of Southern Cross and also some 50km south of the company’s Forrestania gold project.

TRADING HALTS

Somnomed (ASX:SOM) – Pending an announcement regarding a proposed capital raise

Star Minerals (ASX:SMS) – Pending an announcement regarding a capital raise

AMA Group (ASX:AMA) – Pending an announcement regarding a capital raise

Okapi Resources (ASX:OKR) – Pending an announcement regarding a capital raise

Emyria (ASX:EMD) – Pending an announcement regarding a capital raise

Frontier Energy (ASX:FHE) – Pending an announcement regarding a plan of arrangement.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.