Closing Bell: Orbiting the ASX at +220pc, TG Metals successfully separates ahead of ASX hard landing

Via Getty

- Benchmark ASX closes below 6,800 points

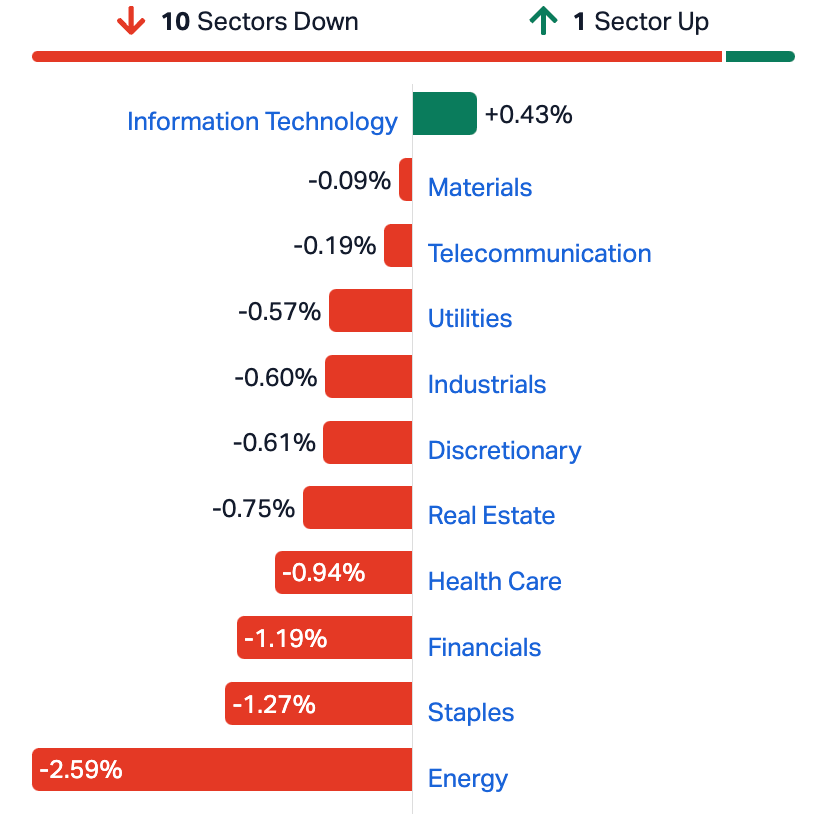

- All Sectors in red, but for IT

- Small caps led, in a very big way, by TG6

The benchmark has ended sharply lower after weak overseas leads, strong retail data and an all-round international-flavoured anxiety about the rising prices of a world at war came home to roost on Monday’s ASX.

The S&P/ASX 200 (XJO) index will start Tuesday morning at 6,773, finishing 54 points or -0.79% following broad based losses. Trading was sour to start and only got worse following strong local retail data for September most certainly digested by an already hawkish RBA, which meets on Melbourne Cup Day, Tuesday next week to determine the direction of the local cash rate.

The IT Sector was the sole gainer on Monday.

ASX SECTORS ON MONDAY

It isn’t panic stations in New York just yet, but traders are hanging on this week ahead of the US Federal Reserve’s get together on Wednesday, widely expected to hold interest rates steady. And that will largely determine how markets will move once the central bank shows it’s idea of a fair fight vs super-sticky inflation.

Bets are growing on a US recession again, with fresh US consumer spending surging in September, with high energy costs and core PCE prices rising in line with bleak forecasts.

You know it’s getting serious when even the European Central Bank (ECB) ends its furious 15-months of consecutive of hikes after a few weak PMI reads – deeming an October hike just a little too hot, even for boss Christine Lagarde.

Gold meanwhile is managing to hold its new state of reality comfortable above US$2,000 an ounce on Monday. The precious metal busted through the key level for the first time since May, over the weekend, just as Israel rolled into Gaza making the safe-haven metal look even shinier and safer.

RANDOM SMALL CAP WRAP

Adore Beauty (ASX:ABY) has dropped a trading update for the September (Q124) quarter, with revenue rising some 4.7% to of $47.5mn, despite tough trading conditions. The company, which calls itself “Australia’s number one pureplay online beauty retailer”, says the gains were supported by growth in active customers as well as “highly successful loyalty and promotional activity”.

Adore’s mobile app contributed 26.5% of all sales for the period, up 1.9 percentage points from June 2023.

“The Company continues to execute its refined growth strategy, launching a subscription service and onboarding in-demand consumer brands” which include names such as Nyx, Davines, Ralph Lauren, Viktor & Rolf, et al

Here’s some ABY bullies:

● Revenue of $47.5 million2, up 4.7% on the prior corresponding period (PCP)3

● Active customer4 numbers return to growth, up 1.5% on PCP to 803k

● Record 497k returning customers5, up 4.7% on PCP

● Executing on refined strategy with newly launched subscription service; mobile app now representing more than 26% of all revenue; new partner brands added; private label continues to grow

● On track to achieve EBITDA margin of 2-4% in FY24

Meanwhile, the upstart telco, Aussie Broadband (ASX:ABB) has lobbed a near $260mn offer for the software maker Symbio, in a cash and stock play via a scheme of arrangement, after completing about a month of due diligence.

The telco is now Australia’s No. 4-biggest internet provider, having overtaken Vocus Group.

It won’t be that easy for ABB and its Managing Director Phillip Britt, is in a battle with rival Superloop, which made a similar play for Symbio in August and another bid in September.

The debt-laden maker of Mismatch and Better Beer – Mighty Craft (ASX:MCL) – says it’s agreed to sell its Hills Cider operations for $3m just more than two years after buying the company as part of a massive $47m acquisition spree.

The struggling brewer is also hoping to offload more than $25m as part of its urgent turnaround plans announced in July.

Mighty Craft is divesting any non-core assets at hand in a bid to reduce its debt burden and on Monday told the ASX group revenue was up 8.5% over Q1 vs last year, but cash outflows were hit by a one-off restructuring cost, as well as staff redundancies.

US FUTURES AT 1300 IN NEW YORK

RIPPED FROM THE HEADLINES

Beijing waits on a pliant PM

It’s not the front page of the weekend edition of China’s version of the Daily Mail, but here’s the official mouthpiece’s thinking on Albo’s imminent arrival in Beijing: just do as you’re told and get it right.

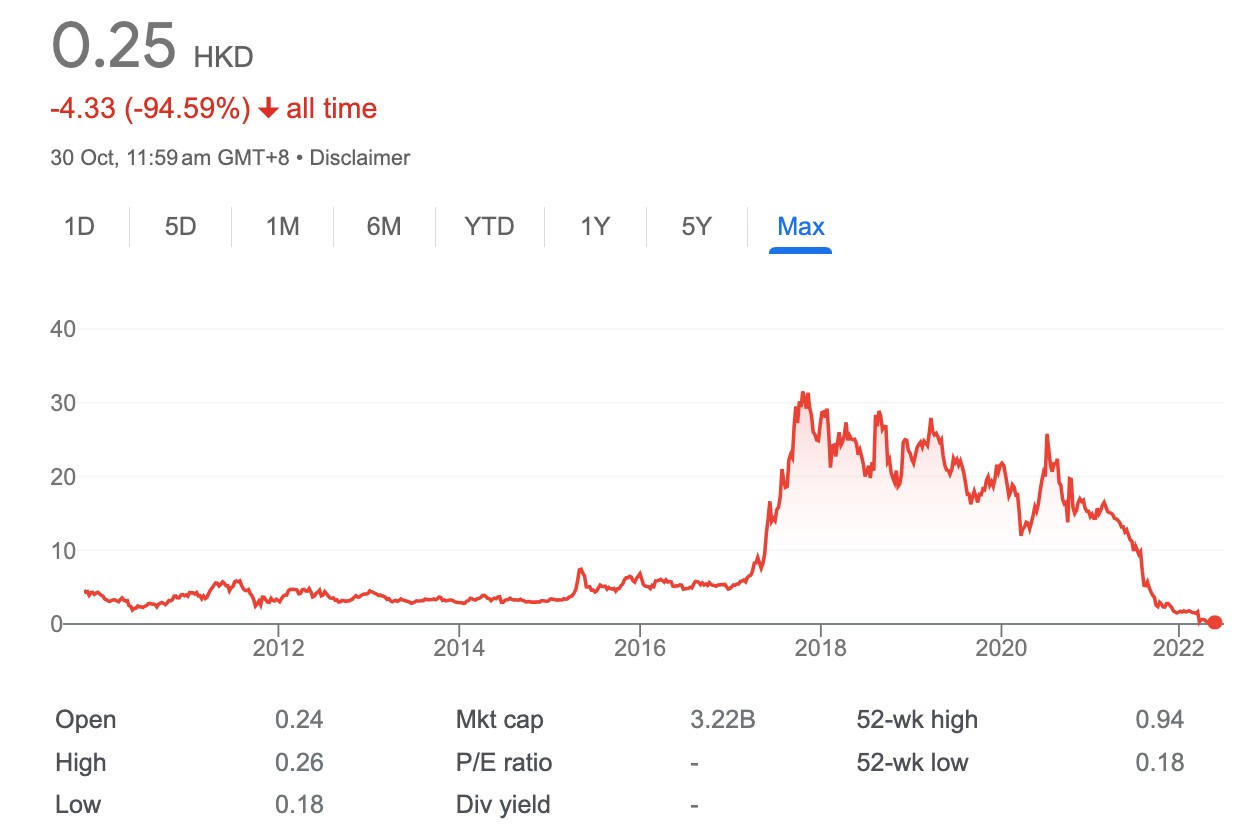

Evergrande, the micro-cap

In other small cap news, the share price of the impossibly indebted ex-Chinese property giant Evergrande clocked a fresh all-time low in Hong Kong on Monday, after a Hong Kong judge delayed the judicial procedure to chop up and apportion what little of the business remains.

Founded in 1996, the China Evergrande Group is a Chinese household name, and was once the country’s second largest in terms of by sales.

Evergrande’s shares plunged over 20% from last Friday’s close of 23.6 Hong Kong cents to the all-time low this morning HK time, before recovering to 22.2 Hong Kong cents.

Evergrande listed under the name Hengda Group, Evergrande listed in October 2009, raising US$725 million in its initial public offering (IPO) on the Stock Exchange of Hong Kong (Hang Seng) for about HKD$4.50.

Reuters reports that the Hong Kong’s High Court has pushed back the hearing to December 4, instead of today. Unless Evergrande produces a new restructuring proposal before that date, it’ll likely to be wound up.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TG6 | Tgmetalslimited | 0.335 | 219% | 22,917,993 | $4,231,662 |

| BML | Boab Metals Ltd | 0.135 | 65% | 1,208,785 | $14,305,947 |

| LRV | Larvottoresources | 0.16 | 60% | 1,320,274 | $6,725,472 |

| MTH | Mithril Resources | 0.0015 | 50% | 200,000 | $3,368,804 |

| TIE | Tietto Minerals | 0.57 | 34% | 42,156,452 | $479,268,442 |

| AHN | Athena Resources | 0.004 | 33% | 100,000 | $3,211,403 |

| DXN | DXN Limited | 0.002 | 33% | 100,111 | $2,585,010 |

| MTB | Mount Burgess Mining | 0.004 | 33% | 14,159,730 | $3,046,940 |

| JTL | Jayex Technology Ltd | 0.009 | 29% | 250,357 | $1,968,950 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 1,961,547 | $11,494,636 |

| RLC | Reedy Lagoon Corp. | 0.005 | 25% | 38,750 | $2,466,734 |

| FL1 | First Lithium Ltd | 0.37 | 23% | 2,751,331 | $21,015,500 |

| AWJ | Auric Mining | 0.059 | 23% | 888,129 | $6,281,260 |

| 1ST | 1St Group Ltd | 0.011 | 22% | 1,168,631 | $12,752,921 |

| HAL | Halo Technologies | 0.195 | 22% | 291,983 | $20,719,234 |

| FND | Findi Limited | 0.625 | 21% | 314,985 | $18,982,185 |

| CTQ | Careteq Limited | 0.03 | 20% | 393,483 | $5,553,072 |

| CRB | Carbine Resources | 0.006 | 20% | 292,207 | $2,758,689 |

| EEL | Enrg Elements Ltd | 0.006 | 20% | 460,000 | $5,049,825 |

| LRL | Labyrinth Resources | 0.006 | 20% | 3,517,797 | $5,937,719 |

| YPB | YPB Group Ltd | 0.003 | 20% | 460,000 | $1,858,654 |

| KLI | Killiresources | 0.066 | 20% | 220,046 | $3,276,628 |

| MGT | Magnetite Mines | 0.375 | 19% | 36,241 | $24,235,647 |

| STM | Sunstone Metals Ltd | 0.019 | 19% | 5,575,170 | $49,311,758 |

| OBM | Ora Banda Mining Ltd | 0.16 | 19% | 8,761,304 | $229,898,556 |

TG Metals (ASX:TG6) is up almost 220% after announcing first drill holes into the Burmeister lithium soil anomaly within the Lake Johnson Project intersected high grade mineralisation up to 2.28% Li2O.

Five of the six holes completed intersected pegmatite with all pegmatite intervals hosting lithium mineralisation in spodumene.

TG Metals CEO, David Selfe called the numbers exceptional.

“(The) initial drilling results especially since we have only tested such a small part of the soil anomaly.

“There appears to be multiple pegmatites with consistent widths of between 8 to 12 metres, that are completely mineralised with spodumene. The targeted soil geochemical anomaly is very large and remains open, particularly to the east. The next phase of drilling will begin shortly and is proposed to test both the lateral and depth potential of this lithium pegmatite system.”

TG6 is planning for an immediate follow up drilling campaign.

This is what they found:

- First drill holes into Burmeister lithium soil anomaly intersect high grade mineralisation up to 2.28% Li2O

- Five of the six holes completed intersected pegmatite with all pegmatite intervals hosting lithium mineralisation in spodumene

- An average assay grade of 1.46% Li2O returned for fresh pegmatite – with down-hole widths of between 9m and 12m

- The Burmeister lithium soil anomaly covers an area of 4.5km by 1.7km – with drilling completed on two lines 200m apart

- Drilling to recommence immediately

Larvotto Resources (ASX:LRV) jumped, perhaps as Barry Fitz outlined news of its stunner of a deal to acquire the Hillgrove gold-antimony mine near Armidale in NSW for the knockdown price of $8 million, including $4.89m in replacement environmental bonds.

As Our Barry says: “It is a rare thing for a junior explorer to have a 1 million-ounce plus gold resource under its belt within two years of listing.”

The acquisition comes just ahead of Larvotto’s second anniversary on the ASX. For the vast majority of juniors, the two year anniversary comes up without a resource being established, and with funds from the IPO running out.

Larvotto’s Hillgrove acquisition breaks that pattern and means the stock is set for a re-rating as it sets about re-establishing Hillgrove as a significant producer from its high-grade 1.4 million ounce gold equivalent resource (1 million ounces of gold and 90,000 tonnes of high-value antimony).

Cosmos Exploration (ASX:C1X) has jumped after an update on exploration activities at its prospective Corvette Far East Lithium Project and Lasalle Project, located in Canada’s James Bay, near the CV5 lithium discovery by Patriot Battery Metals (ASX:PMT).

Multi-commodity explorer Eclipse Metals (ASX:EPM) is up after announcing it has secured $2.3 million in funding from institutional investor Pioneer Resources Partners to fund exploration and general working capital.

Gold explorer Tietto Minerals (ASX:TIE) is also on the winners list – up 34% – after receiving an off-market takeover offer from Zhaojin Capital to acquire all shares it doesn’t already own in the company for 58 cents/share or a 38% premium to the last close.

Zhaojin started building up its holding in TIE last year and is the company’s second biggest shareholder behind Chijin International HK, with around 7% of its shares.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| IS3 | I Synergy Group Ltd | 0.006 | -40% | 100,000 | $2,890,804 |

| NZS | New Zealand Coastal | 0.002 | -33% | 1,613,548 | $5,001,030 |

| NMT | Neometals Ltd | 0.235 | -25% | 4,615,627 | $174,292,000 |

| ADR | Adherium Ltd | 0.003 | -25% | 400,000 | $19,997,633 |

| AXP | AXP Energy Ltd | 0.0015 | -25% | 5,101,253 | $11,649,361 |

| ME1 | Melodiol Glb Health | 0.003 | -25% | 143,795,080 | $14,127,894 |

| MTL | Mantle Minerals Ltd | 0.003 | -25% | 29,484,061 | $24,589,783 |

| PNR | Pantoro Limited | 0.03 | -25% | 114,733,794 | $208,161,221 |

| BSE | Base Res Limited | 0.135 | -21% | 5,506,418 | $200,262,015 |

| ERW | Errawarra Resources | 0.14 | -20% | 3,117,318 | $12,163,200 |

| AMT | Allegra Orthopaedics | 0.049 | -18% | 19,950 | $7,176,662 |

| RGL | Riversgold | 0.009 | -18% | 2,820,039 | $10,463,876 |

| CPM | Coopermetalslimited | 0.1 | -17% | 247,100 | $6,386,118 |

| NWF | Newfield Resources | 0.1 | -17% | 245,501 | $105,845,669 |

| NWM | Norwest Minerals | 0.03 | -17% | 95,074 | $10,352,502 |

| KPO | Kalina Power Limited | 0.005 | -17% | 2,985,946 | $9,091,175 |

| MHC | Manhattan Corp Ltd | 0.005 | -17% | 5,800,000 | $17,621,879 |

| NAG | Nagambie Resources | 0.02 | -17% | 350,000 | $13,961,432 |

| RML | Resolution Minerals | 0.005 | -17% | 168,116 | $7,543,751 |

| RB6 | Rubixresources | 0.13 | -16% | 167,120 | $8,455,250 |

| RRR | Revolverresources | 0.105 | -16% | 158,301 | $32,453,033 |

| AQD | Ausquest Limited | 0.011 | -15% | 115,923 | $10,726,940 |

| KAI | Kairos Minerals Ltd | 0.017 | -15% | 18,651,577 | $52,418,244 |

| SBR | Sabre Resources | 0.041 | -15% | 8,638,741 | $13,991,337 |

| HMD | Heramed Limited | 0.053 | -15% | 878,096 | $17,329,880 |

TRADING HALTS

West Wits Mining (ASX:WWI) – Regarding a proposed capital raising

Paradigm Biopharmaceuticals (ASX:PAR) – Pending an announcement in relation to a capital raising

Gateway Mining (ASX:GML) – Pending an announcement in relation to a capital raising

Rent.com.au (ASX:RNT) – Pending an announcement in relation to a capital raising

Pilot Energy (ASX:PGY) – Pending an announcement regarding a material partnering initiative into which it expects to enter in connection with the Mid West Clean Energy Project (Potential Transaction).

Gold Hydrogen (ASX:GHY) – Pending the release of an announcement regarding exploration results from its maiden drilling program

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.