Closing Bell: Oil’s been awful but it can’t ruin Thursday as ASX ends only 5pts lower

Via Getty

- The ASX benchmark takes a small hit

- Energy Sector recoups losses

- Small caps led by WBE

Local markets have recovered in very late trade after oil overnight touched its lowest levels in almost six months.

So. The fossils fuelled it.

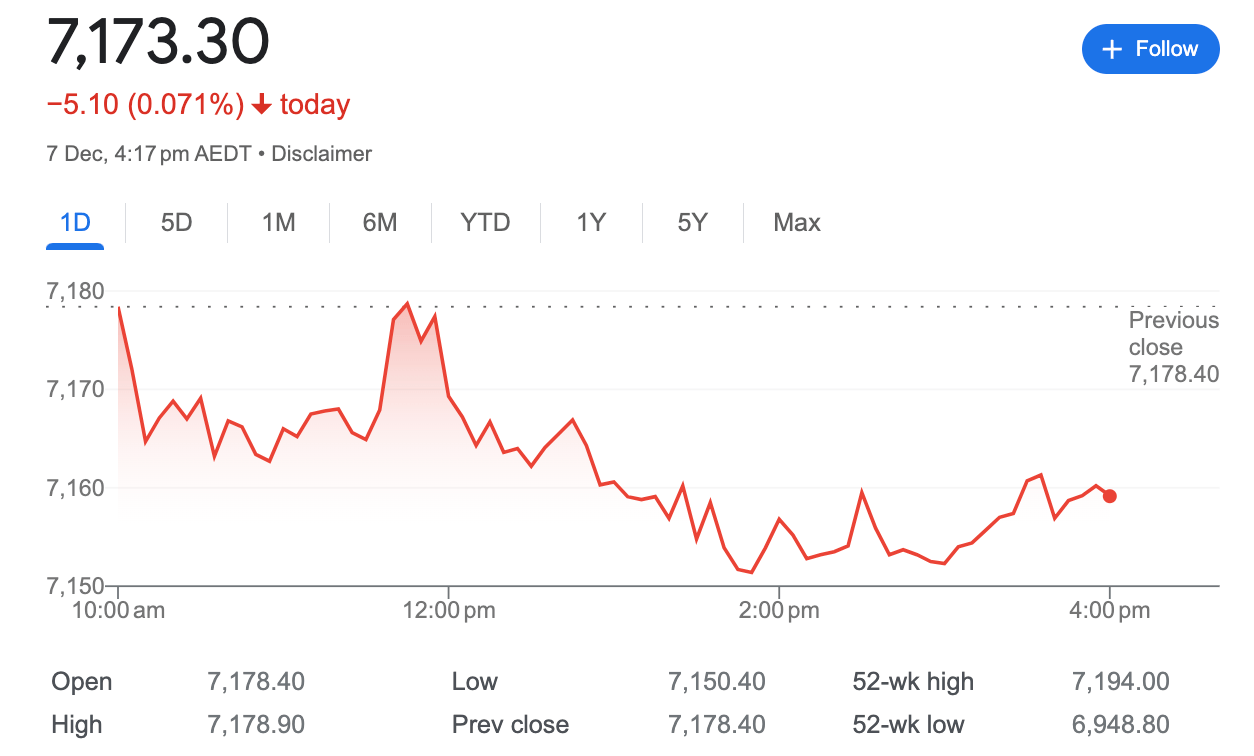

At match-out on Thursday December 7, the S&P/ASX 200 (XJO) index was down five points, or -0.07%:

So, yes the price of oil swooned overnight, yes regional markets all seemed to trace Wall Street’s overnight willies and yes local traders probably took Wednesday’s profits off the table.

But that previous session’s gain of circa +1.8% was the best day of the year on the ASX (which also says something about 2023), and considering how often we’ve heard the words uncertain and volatile and the expression weak-as-pish this year – it was surely a given that the ripper broad-based gains were likely to come at a price.

On the plus side, West Texas International has made a wee effort to get off the floor during the Thursday session in Asia…

… but on the down side oil analysts reckon this is probably just a technical rebound and prices are going to remain under pressure having lost almost a full third since peaking in late September.

And although it’s been six straight sessions of losses amid stronger supply lines, weaker demand and a more unstable geopolitical climate – falling oil prices were only the cause of today’s underwhelming ASX-ing and not the reason.

Brent crude, the global benchmark, slid more than 3.5% during the US session and while the local energy giants Messrs Woodside Energy Group (ASX:WDS), Santos (ASX:STO) and Ampol (ASX:ALD) all feel hard during the morning session, but the end of the day it wasn’t the Energy sector causing all the localised bleeding.

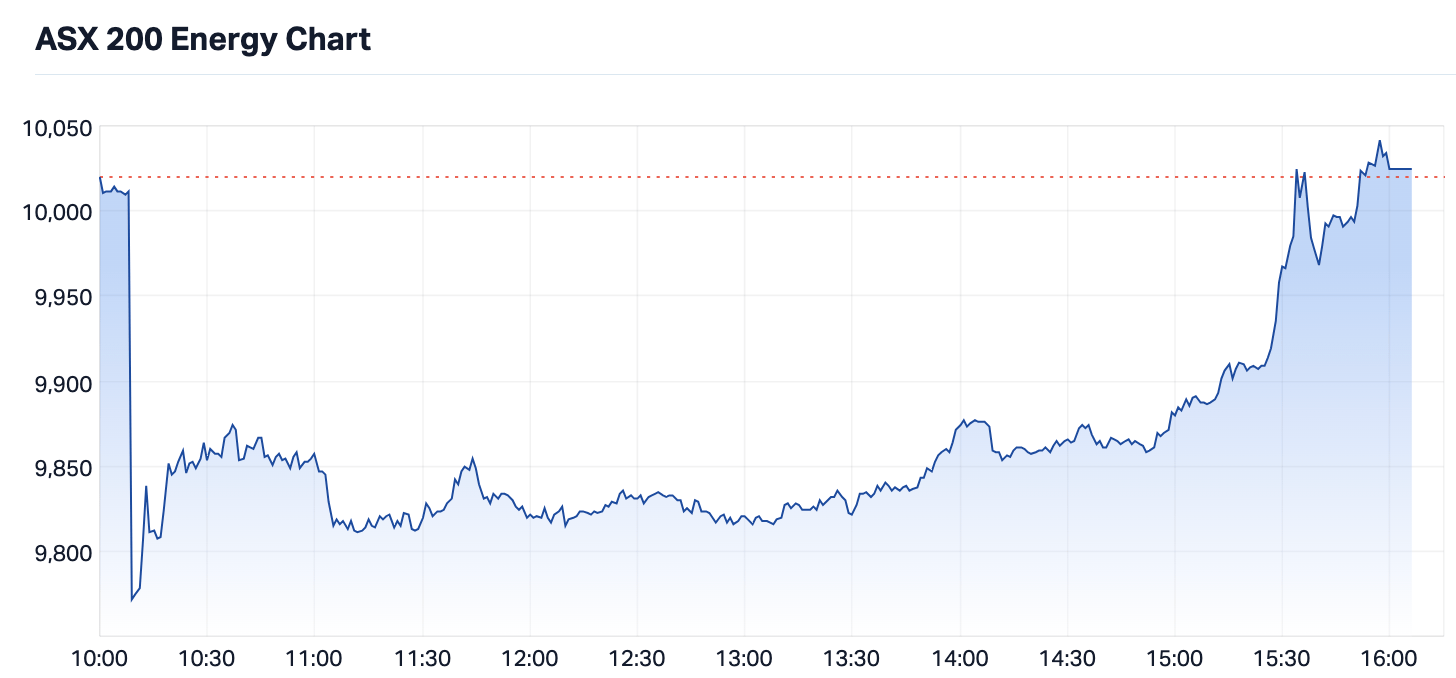

This is the ASX XEJ hitting parity after the close:

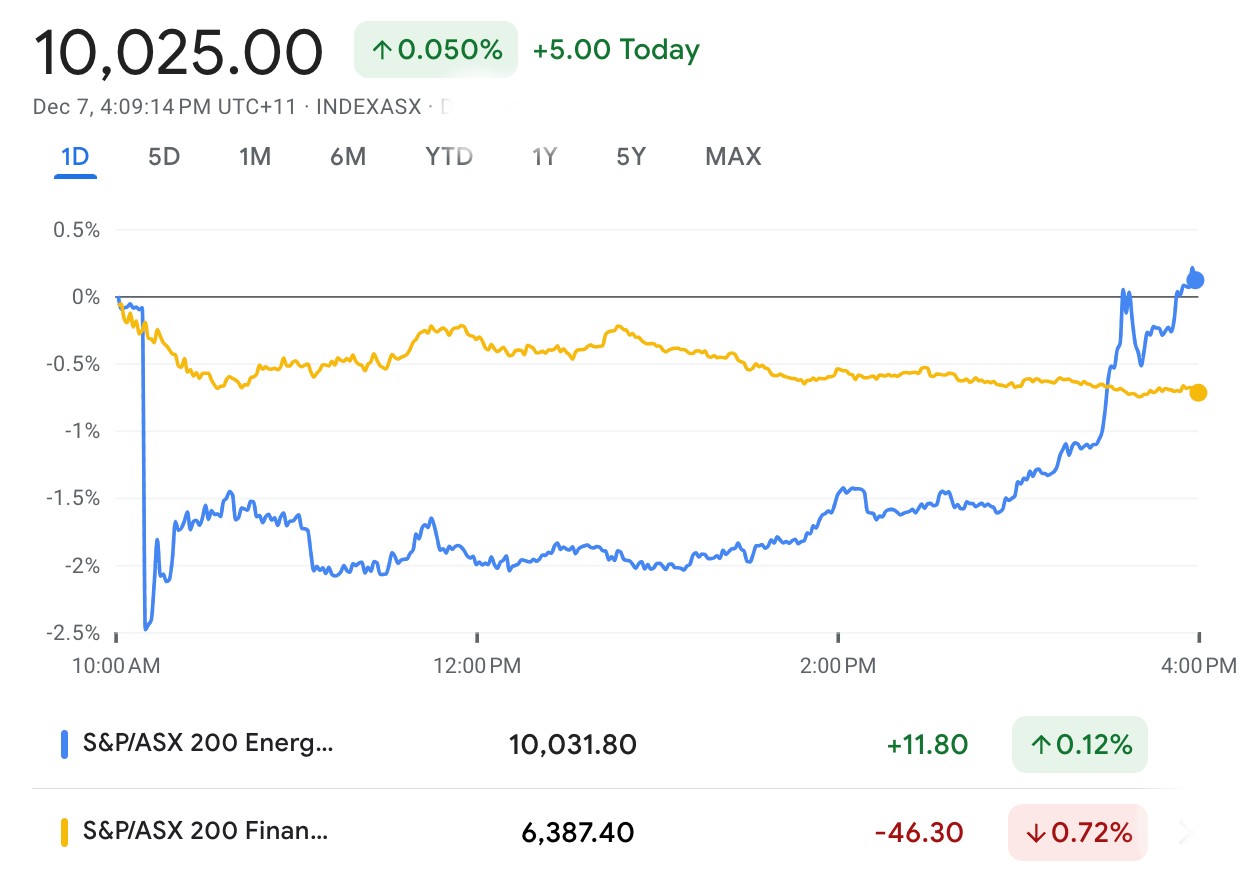

And here it is again overlapped with the market’s quiet killer – the financial sector:

With a combined market cap of around $400bn, the big 4 banks have an outsized influence on the performance of the ASX. More than 50% of all retail investors in Australia own a piece of them.

Today the financial sector showed its rarely seen interest-rate-sensitive-side.

At about 315pm, the investment bank Macquarie Group (ASX:MQG) fell -1.6% to $167.96, National Australia Bank (ASX:NAB) lost -0.6%, Australia and New Zealand Banking Group (ASX:ANZ) fell -0.5% and Commonwealth Bank (ASX:CBA) fell -0.3%.

Westpac (ASX:WBC) got up a little.

The consumer stocks also copped it on Thursday, as traders took profits out of big names, from Myer (ASX:MYR) which fell -3.2%, Aristocrat Leisure (ASX:ALL) (-1.35%) and Endeavour Group (ASX:EDV) (-1.2%).

Treasury Wine Estates (ASX:TWE) crashed almost -3%.

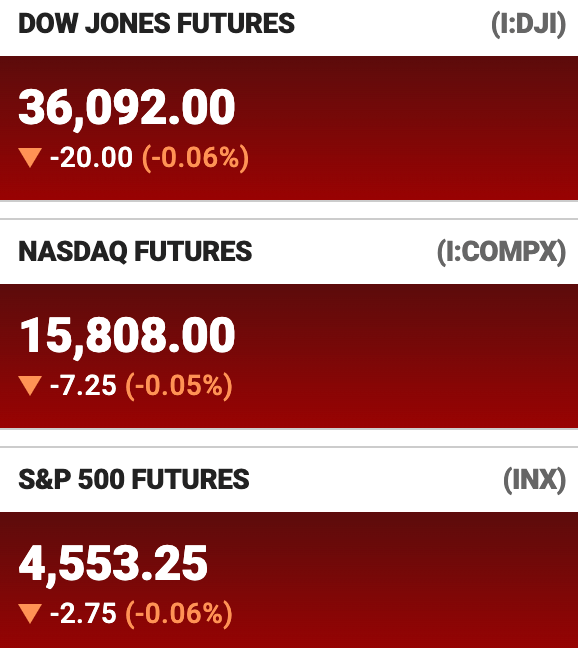

Overnight in New York, the S&P 500 is still at near 22-month highs, despite falling -0.42%, for a hat trick of straight declines – its first since October.

The Dow fell -0.21% and the Nasdaq lost -0.6%.

In our neck of the woods, the ratings agencies had another outsized impact on regional markets. The sentiment for risk all but soured once investors both in China and beyond got word that Moody’s – having made headlines on Wednesday for slashing China’s government credit ratings – then took the sword to Chinese state-owned firms and state-run banks warning of potential downgrades, which in this environment is as good as a downgrade.

Despite extreme volatility in commodities, such as oil and gold, iron ore has remained a beacon of stability, trading at around $129 per tonne.

Fortescue added 1.06% to $25.34. Rio gained 0.88% to $127.56, bolstered by news that the giant Simandou iron ore mine in Guinea will come online in 2025, a year earlier than expected.

Mineral Resources gained 0.67% to $60.14, and BHP added 0.11% to $47.27.

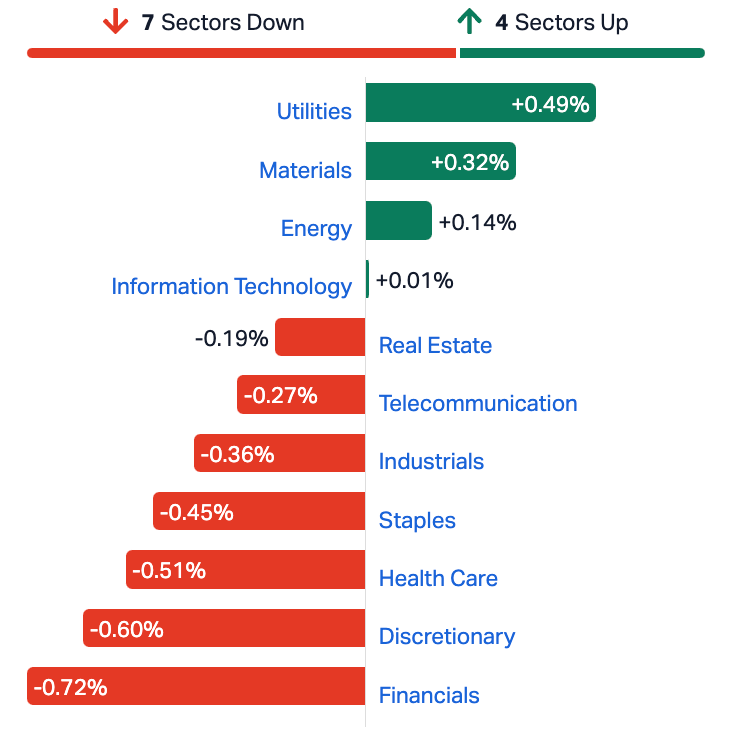

ASX SECTORS ON THURSDAY

Trade surplus

More national accounts revelations today as Australia’s trade surplus widened in October to $7.1bn, so says the local Bureau of Stats today.

Exports were up 0.4% while imports fell 1.9%.

Allowing for seasonal swings, goods export earnings rose by just 0.4%, while the 2.3% rise in metals and materials exports was largely offset by falls in te export values of coal, coke and briquettes (-4.0%) and other mineral fuels (-4.6 %).

Around the ‘hood…

Share markets here and in Japan, South Korea, Hong Kong and on mainland China have all begun or finished lower on Thursday.

Oil gets snakey

So briefly back to this.

The US EIA data shows US gasoline inventories jumped by 5.4 million barrels last week, that’s because either the maths person is just terrible at counting (which admittedly seems unlikely but not impossible) or it really is the outsized increase that no one foresaw.

The toppiest forecasts predicted US inventories to surge around 1 million barrels, not to make up for the last two and a half months of declines.

They reckon it’s weaker demand. I suspect bad math. Not evil math, mind you.

Because the BEA data showed US crude exports were near a record 6 million barrels a day (bpd) in October, with flows to Europe and Asia steadily increasing.

Then there’s, OPEC which pumped some 27.81mn bpd in November, down by 90K from October, according to Reuters.

Last week, OPEC+ members announced additional cuts of 2.2mn bpd, but more than 1.3mn were extensions of voluntary reductions by Saudi Arabia and Russia.

Futures tied to the 3 major US indices are almost at universal parity ahead of the Thursday open in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| EMU | EMU NL | 0.0015 | 50% | 16,719,948 | $1,667,521 |

| FAU | First Au Ltd | 0.003 | 50% | 22,014,265 | $3,323,987 |

| KBC | Keybridge Capital | 0.077 | 45% | 381,781 | $10,988,905 |

| M4M | Macro Metals Limited | 0.004 | 33% | 25,000 | $7,401,233 |

| WBE | Whitebark Energy | 0.025 | 32% | 1,188,606 | $2,804,281 |

| IVZ | Invictus Energy Ltd | 0.215 | 34% | 42,012,534 | $206,531,871 |

| NGY | Nuenergy Gas Ltd | 0.023 | 28% | 110,262 | $26,657,199 |

| RC1 | Redcastle Resources | 0.014 | 27% | 6,496,323 | $3,143,626 |

| BSN | Basinenergylimited | 0.125 | 25% | 220,600 | $6,228,000 |

| HLX | Helix Resources | 0.005 | 25% | 90,000 | $9,292,583 |

| MRQ | Mrg Metals Limited | 0.0025 | 25% | 2,312,527 | $4,411,837 |

| INV | Investsmart Group | 0.16 | 23% | 484 | $18,548,463 |

| KP2 | Kore Potash PLC | 0.011 | 22% | 847,526 | $6,021,518 |

| ZIP | ZIP Co Ltd.. | 0.5075 | 21% | 41,242,802 | $380,474,223 |

| BCK | Brockman Mining Ltd | 0.029 | 21% | 21,814 | $222,725,571 |

| CTQ | Careteq Limited | 0.029 | 21% | 1,378,326 | $5,330,949 |

| EWC | Energy World Corpor. | 0.018 | 20% | 4,749,534 | $46,183,819 |

| LRL | Labyrinth Resources | 0.006 | 20% | 733,230 | $5,937,719 |

| SKN | Skin Elements Ltd | 0.006 | 20% | 60,348 | $2,947,430 |

| GHY | Gold Hydrogen | 0.935 | 18% | 2,549,630 | $44,969,188 |

| OAK | Oakridge | 0.06 | 18% | 182,149 | $897,570 |

| RIL | Redivium Limited | 0.007 | 17% | 98,161 | $16,385,129 |

| TMR | Tempus Resources Ltd | 0.007 | 17% | 1,189,638 | $2,057,537 |

| RNE | Renu Energy Ltd | 0.015 | 15% | 3,045,577 | $5,817,358 |

| CR1 | Constellation Res | 0.115 | 15% | 250,000 | $4,990,543 |

The Board of Whitebark Energy (ASX:WBE) has taken decisive action on Thursday saying they no longer need their interim CEO.

Dr. Simon Brealey is no longer with the Company, the Board announced to the ASX, thanking Simon for his service and wishing him well for the future.

“The Board remains focused on delivering a positive outcome for shareholders under its strategic review process and will consider the requirements for a replacement CEO. The Company will continue to update the market when this process is complete.”

So… they might’ve found a CEO, or no longer need a CEO… either way, it was a good call. Up +32%.

Redcastle Resources (ASX:RC1) did good on Thursday.

The $3.7m market capper completed an RC drilling campaign at its 100% owned Queen Alexandra prospect that involved drilling 37 holes, totalling 1,937m, on an area of 20m x 20m.

Samples were then sent off to a Kalgoorlie lab to ascertain gold content, and assays indeed confirm the presence of consistent, shallow gold mineralisation.

As Robert Badman mused to me not moments ago: High-fives all round – they’re definitely not out there wasting their time.

Some RC1 bullies:

• Gold intersections in the upper 20m which increase in grade with depth and plunge to the southeast.

• Mineralisation (combo of subvertical and horizontal structuring) continuity on section and with a strike extent of 200m.

• Preliminary metallurgical testwork (using a concentrated leach method) reports a subsample from the 2022 high-grade sample RRC151at 115m as having a metallurgical recovery of 92% for gold.

Out front, on Thursday (but I’m not getting into it) is Keybridge Capital run by activist shareholder Nicholas Bolton.

The circa +40% gain is something to do with Southern Cross Media but my brain.

Oh. My brain.

I’d say check their website, but why put yourself through it?

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| YPB | YPB Group Ltd | 0.001 | -50% | 33,600 | $1,580,923 |

| CHK | Cohiba Min Ltd | 0.002 | -33% | 6,855,437 | $6,639,733 |

| KNM | Kneomedia Limited | 0.002 | -33% | 60,000 | $4,599,814 |

| POD | Podium Minerals | 0.002 | -33% | 1,545,095 | $242,891 |

| VPR | Volt Power Group | 0.001 | -33% | 11 | $16,074,312 |

| YOJ | Yojee Limited | 0.004 | -33% | 3,880,804 | $7,835,911 |

| AMD | Arrow Minerals | 0.0015 | -25% | 1,741,025 | $6,047,530 |

| MCT | Metalicity Limited | 0.0015 | -25% | 11,392,957 | $8,502,172 |

| FME | Future Metals NL | 0.04 | -22% | 1,518,603 | $22,111,206 |

| ZMI | Zinc of Ireland NL | 0.015 | -21% | 28,052 | $4,049,741 |

| EVR | Ev Resources Ltd | 0.0095 | -21% | 4,109,133 | $11,455,060 |

| GIB | Gibb River Diamonds | 0.027 | -21% | 70,000 | $7,191,321 |

| GTG | Genetic Technologies | 0.002 | -20% | 662,081 | $28,854,145 |

| KPO | Kalina Power Limited | 0.004 | -20% | 201 | $9,529,606 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 41,013,121 | $19,462,207 |

| RBR | RBR Group Ltd | 0.002 | -20% | 1 | $4,046,012 |

| TMX | Terrain Minerals | 0.004 | -20% | 250,000 | $6,767,139 |

| HAL | Halo Technologies | 0.125 | -19% | 150,279 | $20,071,758 |

| WMG | Western Mines | 0.295 | -18% | 434,525 | $24,050,357 |

| OLY | Olympio Metals Ltd | 0.115 | -18% | 240,678 | $8,903,930 |

| AM7 | Arcadia Minerals | 0.076 | -17% | 284,300 | $10,032,609 |

| MDI | Middle Island Res | 0.015 | -17% | 958,693 | $3,917,772 |

| ESR | Estrella Res Ltd | 0.005 | -17% | 2,236,127 | $10,556,231 |

| FTC | Fintech Chain Ltd | 0.01 | -17% | 4,000 | $7,809,235 |

| ICN | Icon Energy Limited | 0.005 | -17% | 1,836 | $4,608,082 |

TRADING HALTS

4D Medical (ASX:4DX) – pending an announcement by the Company to the market regarding a proposed capital raising and an acquisition.

Rhinomed (ASX:RNO) – pending an announcement by Rhinomed in relation to an application to be removed from the official list of ASX.

Talius Group (ASX:TAL) – pending an announcement to the ASX in relation to a proposed capital raising.

Flynn Gold (ASX:FG1) – pending an announcement regarding a material acquisition and capital raising.

Green Technology Metals (ASX:GT1) – pending an announcement regarding a capital raising.

Argent Minerals (ASX:ARD) – pending an announcement regarding a capital raising.

Pantera Minerals (ASX:PFE) – pending an announcement regarding a material project transaction in the Smackover region, USA, and a capital raising.

Nordic Nickel (ASX:NNL) – pending an announcement to the market in relation to a proposed capital raising.

MetalsGrove Mining (ASX:MGA) – pending the release of an announcement in relation to material acquisitions.

Austin Metals (ASX:AYT) – pending an announcement in connection with an acquisition of Project and capital raising.

Ironbark Zinc (ASX:IBG) – pending an announcement regarding a potential acquisition and a capital raising.

Winsome Resources (ASX:WR1) – pending release of a maiden Mineral Resource Estimate.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.