Closing Bell: Most ASX sectors flashing red today, as RAU makes solid market debut

Most ASX sectors were flashing red today. Picture Getty

- ASX200 dropped on Friday, extending its weekly loss despite Wall Street’s highs

- Telix Pharma halted US IPO; Tabcorp jumps 10pc on NSW tax reform

- Germany works to soften EU tariffs on Chinese electric cars

The ASX200 dropped by -0.3% on Friday, taking its weekly loss to a touch over -0.4%.

Shares lost ground despite Wall Street surging to new record highs last night as investors increased their bets on companies seen as benefiting from the rise of AI.

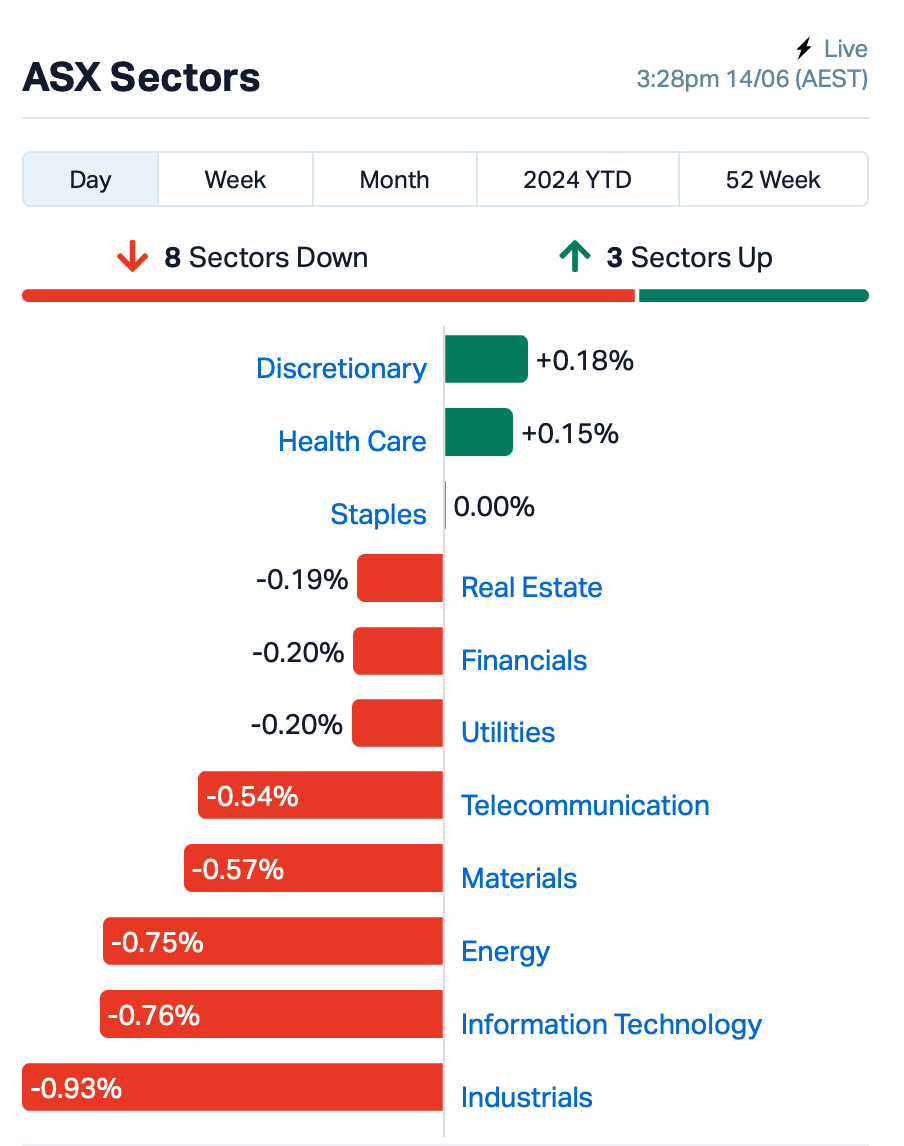

Tech, Energy, Real Estate sectors were all flashing red today, while Discretionary and HealthCare closed higher.

Gold stocks were dumped again as bullion prices witnessed another 1% fall following hawkish cues from the US Fed on interest rate earlier this week.

To stock news, Telix Pharma (ASX:TLX) rose almost +1% after telling the market that it won’t proceed with its planned IPO in the U.S. due to unfavourable market conditions.

Telix’s CEO, Dr. Christian Behrenbruch, said,“While this is not our desired outcome, Telix’s strategic objectives must align with our duty to existing shareholders.”

Tabcorp (ASX:TAH) jumped +10% after welcoming the NSW Government’s plan to review and improve the state’s wagering tax system and industry funding. Tabcorp says these changes will create fair competition and modernise the industry.

Still in the large end of town, BNPL play Zip Co (ASX:ZIP) rose +9% on no specific news.

Deterra Royalties (ASX:DRR) tumbled -7% after the company made a takeover play for Trident Royalties, a British lithium mining group, for £144 million ($276 million). This deal represents Deterra’s shift from iron ore to lithium and green metals.

What else happened today?

In the region, Asian stock markets recovered some losses after the Bank of Japan decided to keep its interest rates where they are today.

Mainland Chinese shares continued to decline for the fourth week in a row.

Meanwhile, the German government is trying to stop or soften new EU tariffs on Chinese electric vehicles, according to insiders.

Berlin officials are hopeful that direct talks with China will lead to a solution before the tariffs start on July 4. On Wednesday, Brussels decided to add extra tariffs on electric cars from China, up to 48%.

This affects Chinese carmakers like BYD, Geely, and SAIC, which owns MG.

The EU accused them of unfair competition due to Chinese government subsidies and breaking WTO rules.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TD1 | Tali Digital Limited | 0.002 | 100% | 270,162 | $3,295,156 |

| BCT | Bluechiip Limited | 0.005 | 67% | 2,877,901 | $3,302,300 |

| G50 | G50Corp Ltd | 0.163 | 35% | 280,299 | $13,114,800 |

| ENT | Enterprise Metals | 0.004 | 33% | 247,952 | $2,654,163 |

| RAU | Resouro Strategic | 0.645 | 29% | 713,912 | $0 |

| CCO | The Calmer Co Int | 0.009 | 29% | 7,429,718 | $9,669,130 |

| SUM | Summitminerals | 0.370 | 28% | 6,552,143 | $16,487,117 |

| OAU | Ora Gold Limited | 0.005 | 25% | 7,116,524 | $28,564,639 |

| TMR | Tempus Resources Ltd | 0.005 | 25% | 7,114,494 | $2,923,995 |

| TX3 | Trinex Minerals Ltd | 0.003 | 25% | 1,700,000 | $3,657,305 |

| NUC | Nuchev Limited | 0.135 | 23% | 14,500 | $9,902,963 |

| RCR | Rincon | 0.080 | 21% | 8,982,455 | $19,028,175 |

| AMD | Arrow Minerals | 0.003 | 20% | 8,671,143 | $26,348,413 |

| EVR | Ev Resources Ltd | 0.006 | 20% | 3,976,388 | $6,606,357 |

| POS | Poseidon Nick Ltd | 0.006 | 20% | 1,993,886 | $18,567,674 |

| PRX | Prodigy Gold NL | 0.003 | 20% | 1,097,663 | $5,294,436 |

| PGO | Pacgold | 0.130 | 18% | 395,331 | $9,255,998 |

| NSB | Neuroscientific | 0.040 | 18% | 288,277 | $4,916,566 |

| AQX | Alice Queen Ltd | 0.007 | 17% | 1,746,639 | $4,145,940 |

| CE1 | Calima Energy | 0.007 | 17% | 20,396,198 | $3,798,485 |

| DOU | Douugh Limited | 0.004 | 17% | 240,280 | $3,246,207 |

| WML | Woomera Mining Ltd | 0.004 | 17% | 689,599 | $3,654,417 |

Enterprise Metals (ASX:ENT) was up sharply this morning, with the company in the middle of an entitlement offer to raise approximately $1.42 million (before costs), at a price of $0.004 per new share, and a $0.006 per share option expiring in two years, for eligible shareholders. Any remainders will form part of a top-up offer.

Resouro Strategic Metals (ASX:RAU) made its debut on the ASX this morning, zipping out to a 30% gain before closing the day around +3% higher.

Resouro is an international player – a Canadian-based REE explorer and development company focused on projects in Brazil, including the REE and titanium Tiros Project (90% ownership) and the Novo Mundo and Santa Angela gold projects. The Tiros REE and titanium project is the company’s main focus and covers an area of roughly 450km2 in the Minas Gerais State, one of the leading mining jurisdictions in Brazil. IPO funds will be used to progress a targeted drill program at Tiros, with a significant JORC-compliant mineral resource the ambition.

Tempus Resources (ASX:TMR) has completed the acquisition of the Prescott copper and base metals project, ~100km from American West Metals’ (ASX:AW1) Storm project (17.5 Mt @ 1.2% copper and 3.4g/t silver) in Canada. Investors/shareholders rate this news, to the tune of 25% intraday, and counting. A large airborne geophysical survey is reportedly already underway at the Prescott op, which is scheduled to wrap up in mid-July. And this will be followed by a detailed geochemical mapping program, notes the company.

Pearl Gull Iron (ASX:PLG) was soaring after announcing it’s farming into an an early stage clay rare earths project in Chile, having made strategic acquisition of Huemul Holdings. This will see the company earn up to an 80% interest in NeoRe SpA’s La Marigen project, which is located in a highly prospective area for ionic adsorption clay REE in Chile. The project covers five tenements across a vast area – some 228km2 – and is situated in an underexplored mineralisation belt.

Sun Silver (ASX:SS1) said a drilling contract has been awarded for the company’s prime focus, which is the Maverick Springs silver project in Elko County, Nevada. That’s a highly prospective project with an inferred mineral resource of 292,000,000 oz AgEq at 72.4gt Ag. Alford Drilling, a well-experienced contractor based in Elko, has been hand-passed the work and the first drilling program at Maverick Springs is set to start in the upcoming weeks. Mineral deposits at Maverick Springs are still open in all directions and at deeper levels, offering several drilling opportunities to expand the resource base.

Summit Minerals (ASX:SUM) said first assay results from the company’s Equador project in Brazil have confirmed high-grade niobium and tantalum over a 1.2km strike length. Equador represents just one project within a wider niobium-rare earth tenement package covering 107.47km2 in Brazil’s Borborema Pegmatitic Province (BPP), Paraiba state, a region regarded as one of the world’s most important sources of tantalum, REEs and beryllium.

Due diligence on historical results have turned up standout samples containing 303,400ppm Nb205 (30.34%) and 15,130ppm partial rare earth oxide (1.513%) while multiple pegmatite bodies and many historical workings have been identified during multispectral analysis work.

And finally Calima Energy (ASX:CE1) has bounced back after the previously $80 million market cap company returned about $80 million to its shareholders, and sent its share price plummeting about 97% before the brakes were pulled on.

For what it’s worth, Calima says that it’s just the “market finding equilibrium” and that it was open about both the capital return, and the fact that it plans to continue operating its Paradise Field activities, with about $5-6 million in cash on hand.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXP | AXP Energy Ltd | 0.001 | -50% | 3,888,890 | $11,649,361 |

| AUK | Aumake Limited | 0.002 | -33% | 133,042 | $5,743,220 |

| JAY | Jayride Group | 0.012 | -29% | 168,695 | $4,017,255 |

| AVE | Avecho Biotech Ltd | 0.003 | -25% | 145,000 | $12,677,188 |

| PUR | Pursuit Minerals | 0.003 | -25% | 3,176,831 | $11,775,886 |

| VML | Vital Metals Limited | 0.003 | -25% | 764,902 | $23,580,268 |

| VPR | Voltgroupltd | 0.002 | -25% | 198,199 | $21,432,416 |

| NWF | Newfield Resources | 0.105 | -25% | 34,991 | $131,698,408 |

| HHR | Hartshead Resources | 0.007 | -22% | 4,889,424 | $25,278,139 |

| MSI | Multistack Internat. | 0.007 | -22% | 2,200 | $1,226,735 |

| WBE | Whitebark Energy | 0.011 | -21% | 1,263,278 | $2,688,005 |

| CRR | Critical Resources | 0.008 | -20% | 819,682 | $17,803,503 |

| MCT | Metalicity Limited | 0.002 | -20% | 4,091,567 | $11,214,632 |

| SIH | Sihayo Gold Limited | 0.002 | -20% | 6,666 | $30,510,640 |

| HXG | Hexagon Energy | 0.014 | -18% | 570,450 | $8,719,570 |

| 1MC | Morella Corporation | 0.003 | -17% | 3,182,455 | $18,536,398 |

| BXN | Bioxyne Ltd | 0.005 | -17% | 8,693,300 | $12,279,872 |

| ESR | Estrella Res Ltd | 0.005 | -17% | 720,890 | $10,556,231 |

| HCT | Holista CollTech Ltd | 0.005 | -17% | 115,549 | $1,672,800 |

| LPD | Lepidico Ltd | 0.003 | -17% | 982,801 | $25,767,358 |

| TTI | Traffic Technologies | 0.005 | -17% | 129,400 | $5,837,311 |

| BCC | Beam Communications | 0.130 | -16% | 22,743 | $13,395,398 |

| OPT | Opthea Limited | 0.375 | -16% | 4,496,391 | $296,098,821 |

| APL | Associate Global | 0.105 | -16% | 142,168 | $7,061,553 |

| AX8 | Accelerate Resources | 0.042 | -16% | 395,506 | $31,037,697 |

IN CASE YOU MISSED IT

Equinox Resources (ASX:EQN) has significantly expanded surface field work at the wider Campo Grande rare earths project in Brazil after a maiden drill campaign.

Magnetic Resources’ (ASX:MAU) diamond drilling has extended a 400m-long ultramafic zone at depth at the Lady Julie North deposit within its Laverton gold project.

Sun Silver (ASX:SS1) has awarded the drill contract to Alford Drilling to kick off its inaugural drilling program at its Maverick Springs silver-gold project in Nevada, USA

LTR Pharma (ASX:LTP) and Alpine Capital have won IPO of the year at the Australian Stockbrokers Foundation awards after the company burst onto the scene in December with its innovative SPONTAN nasal spray treatment for erectile dysfunction.

Just last week the company announced strong initial bioequivalence trial results which showed the product achieves rapid absorption and faster onset of action (between 9-12 minutes) compared to existing gold-standard oral therapies which can take over an hour to take effect. LTR is currently trading around +300% on its listing price.

Corazon Mining (ASX:CZN) has announced plans to acquire three high grade zinc-copper-gold deposits near its flagship Lynn Lake nickel-copper-cobalt project in Canada.

Impact Minerals (ASX:IPT) has nabbed a $354,000 research and development rebate for the financial year ending June 2023. The funds add to the $3.725m raised from a recent placement and exercise of options – and means the company is fully funded as it looks to complete the pre-feasibility study for its Lake Hope high purity alumina project. Impact’s managing director Dr Mike Jones said the unique mineralogy and patented and proprietary processing techniques for the project have allowed the company to claim back a significant proportion of expenditures through the Research and Development Tax Incentive program.

“Although this rebate covers all of our projects, we had only had the Lake Hope project for three months of the 2023 financial year,” he said.

“We anticipate being able to claim an increasing amount of our expenditures on Lake Hope as we continue to develop this exciting project”.

And Meteoric Resources (ASX:MEI) has vastly increased the certainty of its Caldeira project in Brazil after defining a significant measured and indicated resource of 85Mt at 3,034ppm TREO for the Capão do Mel deposit.

TRADING HALTS

NeuRizer (ASX:NRZ) – pending an announcement regarding an ASX Price Query.

PPK Group (ASX:PPK) – pending an announcement regarding an impending decision of the Supreme Court of New South Wales in the matter of Flynn & Anor v PPK Group Limited & Anor.

Emmerson Resources (ASX:ERM) – pending an announcement in relation to a material update on the timing of our joint venture partner’s mill construction at Tennant Creek.

Corazon Mining (ASX:CZN)– pending an announcement regarding a capital raising.

At Stockhead, we tell it like it is. While Corazon Mining, Meteoric Resources, Impact Minerals, LTR Pharma, Equinox Resources, Magnetic Resources and Sun Silver are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.