Closing Bell: Monday on a flat ASX was cruel and unusual, ‘cept for uranium stocks

Via Getty

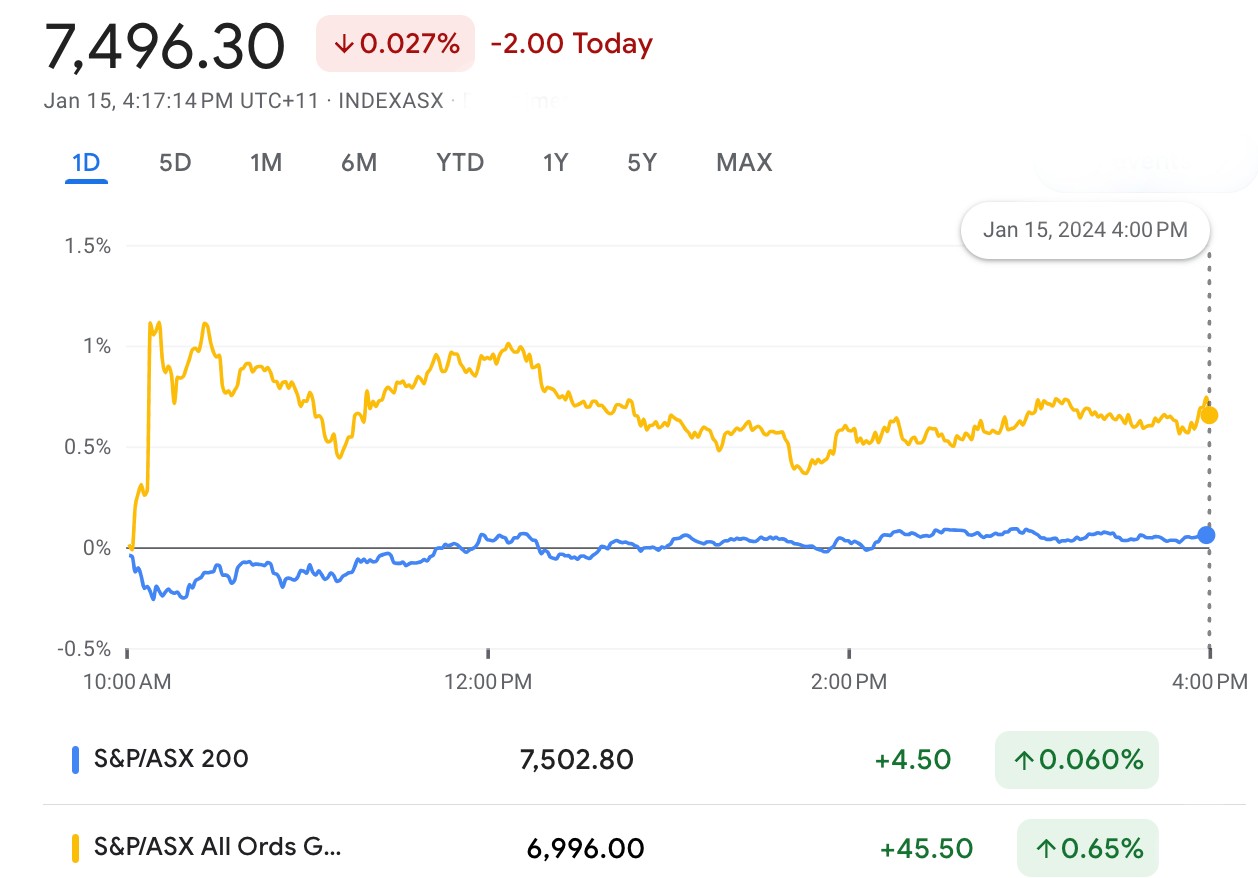

- ASX200 closes 2 points down, flatter than a ginger ale at your local RSL

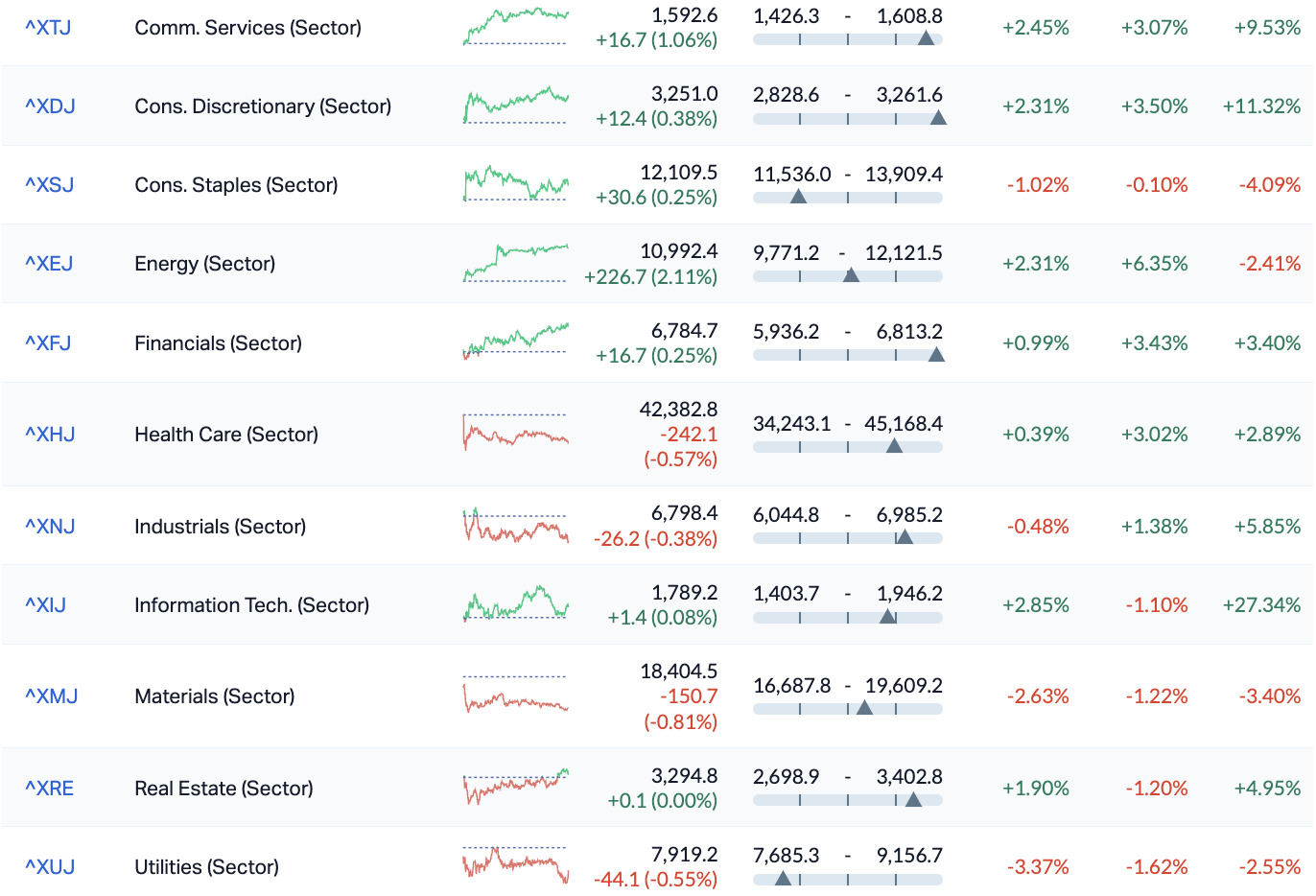

- ASX sectors dominated by Energy, up 2.11pc on rumblings of a uranium shortage

- Small cap winners led by uranium stocks, because of ‘see above’

The ASX benchmark has closed a painfully ironic, or perhaps uraniumic two points short of parity on Monday, despite a stellar performance from the Energy Sector which surged a magnificent 2.11% on an awfully dull wicket.

At 4.15pm on Monday, the S&P/ASX200 closed down just 2.00 points Monday to 7,496.30.

As the chart above shows in the garish colours of the Parramatta Eels, local gold stocks had a decent day out on the back of a terrifying weekend of geopolitics.

Even better considering that among the worst of the worst today – or at least the least performing stocks in the top 200 – bigger cap goldie Chalice Gold Mines (ASX:CHN) down 8.4%.

Over the last five sessions of (now) fruitless toil, the benchmark index is virtually unchanged, but is currently 1.8% below its 12 month high.

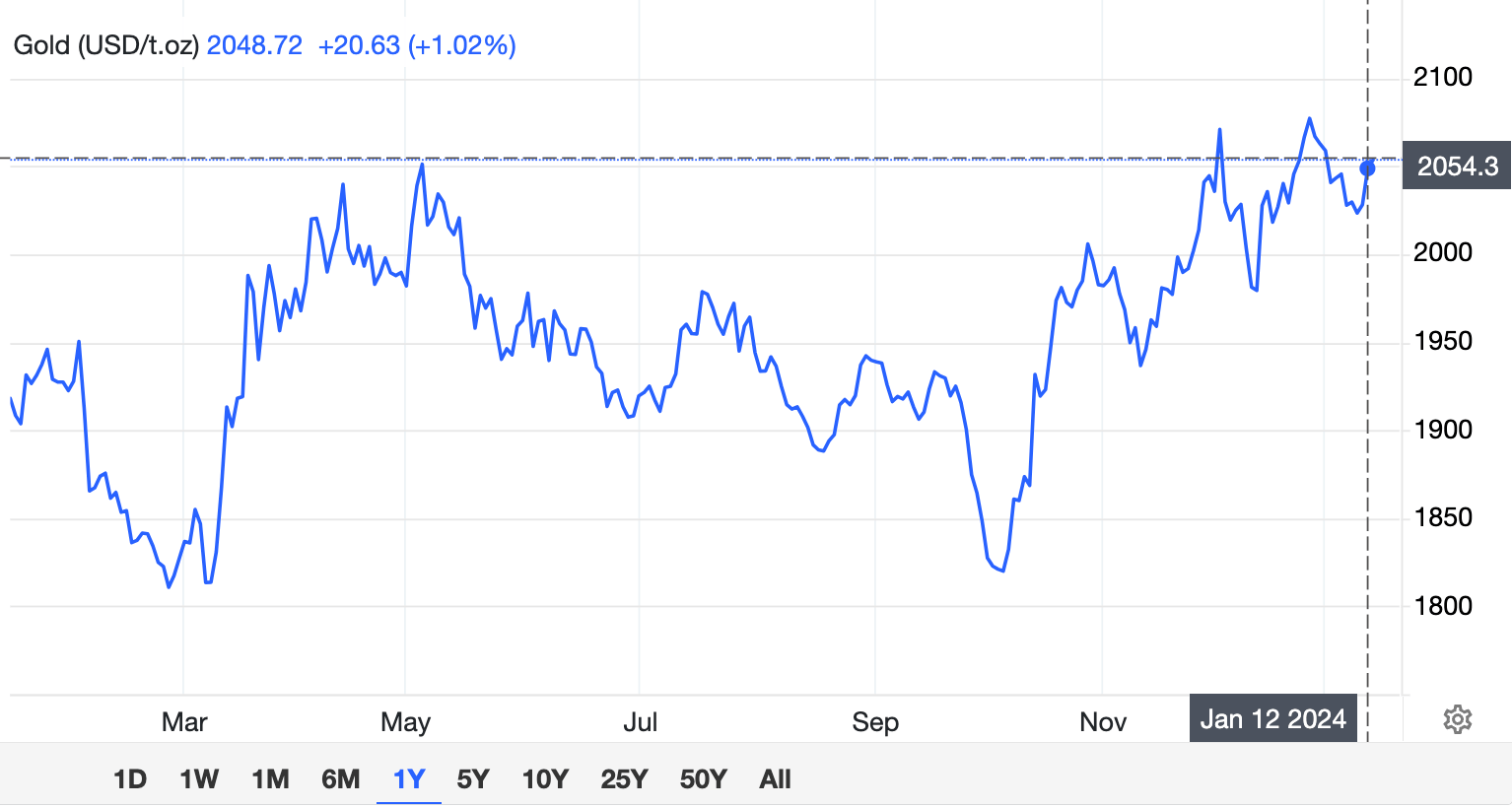

The gold spot meanwhile, eased beyond $2,050 an ounce during the Monday session.

The safe-haven surged for a 3rd straight day as escalating tensions in the Middle East drove punters back to safe-haven heaven.

Australian, Dutch and a few other mung beans were led by US and British forces to lob a few rocket strikes on Houthi targets in Yemen to apparently infuriate the region, bolster support for the Iran-Houti alliance and secure further vows not to stop threatening shipping in the Red Sea.

The Energy Sector was boosted from all corners on Monday. Oil and uranium prices were higher and local stocks enjoyed other tailwinds to maximise the sector’s returns.

The former lithium explorer White Cliff Minerals (ASX:WCN) announced plans to acquire a historical uranium project in the Northwest Territories of Canada called Radium Point.

The Iron Oxide Copper Gold Uranium (IOCGU) plus silver operation produced 13.7Mlb uranium, plus silver, copper gold, nickel and lead pre-1982.

According to this obscure document, that deputy editor Reuben Adams killed 7 men to get a hold of, Port Radium provided 11% of all the uranium used in the Manhattan project.

Reubs says, in typically phine gernalism that the $16m capped WCN, is now looking to divest various Australian assets. It was up a casual 30% in early Monday trade.

Companies like Global Uranium and Enrichment (ASX:GUE) gained in the double digits combining – GUE offloaded its 80% stake in the Maggie Hays Hill lithium project for $2.1m in cash and shares to Intra Energy (ASX:IEC), while other traders just went the full speculation in names like ENRG Elements (ASX:EEL).

Elsewhere, Brent and WTI prices were up 2% last week, building on the 3% of the previous week.

Cashing in this time was blue chip Santos with a win in the Federal Court for progressing its key $5.3bn Barossa LNG project.

Santos (ASX:STO) has been banking on the Barossa development with a lot of that goodwill baked into STO’s mid-term share price.

ASX SECTORS at 4pm on MONDAY

![]()

In the US, Wall Street ended the Friday session mixed and muddled after (PPI) the Producer Prices Index unexpectedly declined 0.1% month-over-month during December, upending a lot of pent up emotion around US inflation, in flamed after the previous day’s higher than expected CPI and thumbing its nose at market forecasts of a 0.1% rise.

The major averages ended with the Dow short some 0.31%, while the S&P 500 and Nasdaq Composite inched up 0.08% and 0.02%, respectively.

The inflation data – dropping amid the initial big bank reports for earnings Q4 – would seem to contradict the 24 hours of living again with rising CPI results and rekindled, renewed, reinvigorated and reanimated momentarily dormant hopes for the gradual convergence of inflation towards the US Fed’s target of blah blah blah … you’ve stopped listening, haven’t you?

In short – Wall Street traders are still wrestling with inflation and looks like doing it for some time when trade again begins after tonight’s public holiday.

For now, US stock futures are slightly higher in holiday-thinned trade as most traders were out for Martin Luther King Day.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| YPB | YPB Group Ltd | 0.002 | 100% | 885,993 | $790,461 |

| T92 | Terra Uranium Ltd | 0.2 | 48% | 2,771,177 | $7,693,620 |

| CXU | Cauldron Energy Ltd | 0.051 | 38% | 37,712,812 | $41,915,046 |

| MOM | Moab Minerals Ltd | 0.008 | 33% | 12,254,627 | $4,271,781 |

| YOJ | Yojee Limited | 0.004 | 33% | 2,720,676 | $3,917,956 |

| TZL | TZ Limited | 0.033 | 32% | 488,510 | $6,418,953 |

| ERA | Energy Resources | 0.058 | 32% | 3,908,685 | $974,525,164 |

| EEL | Enrg Elements Ltd | 0.013 | 30% | 33,478,510 | $10,099,650 |

| GTR | Gti Energy Ltd | 0.013 | 30% | 27,297,490 | $20,499,471 |

| WCN | White Cliff Minerals | 0.013 | 30% | 40,541,569 | $12,768,593 |

| CXM | Centrex Limited | 0.084 | 29% | 1,592,483 | $44,295,176 |

| VAL | Valor Resources Ltd | 0.0045 | 29% | 71,597,008 | $14,606,672 |

| KNB | Koonenberrygold | 0.055 | 28% | 36,395 | $5,149,211 |

| 1AE | Auroraenergymetals | 0.165 | 27% | 3,205,170 | $20,696,901 |

| PEN | Peninsula Energy Ltd | 0.1325 | 26% | 46,767,645 | $132,353,061 |

| ASV | Assetvisonco | 0.01 | 25% | 116,345 | $5,806,693 |

| GTI | Gratifii | 0.01 | 25% | 500,001 | $10,874,239 |

| INP | Incentiapay Ltd | 0.005 | 25% | 1,000,000 | $5,110,859 |

| IVX | Invion Ltd | 0.005 | 25% | 356,086 | $25,686,529 |

| MDI | Middle Island Res | 0.018 | 20% | 568,369 | $3,264,810 |

| AKM | Aspire Mining Ltd | 0.18 | 20% | 707,618 | $76,145,548 |

| OAR | OAR Resources Ltd | 0.003 | 20% | 3,000,000 | $6,609,319 |

| TMR | Tempus Resources Ltd | 0.006 | 20% | 2,358,833 | $1,999,884 |

| LPE | Locality Planning | 0.043 | 19% | 494,977 | $6,487,359 |

| BSN | Basinenergylimited | 0.185 | 19% | 1,702,284 | $9,653,401 |

Infini Resources (ASX:I88) was the name on everyone’s lips at the end of the day, with the market newbie making a stunning debut after listing this morning and going gangbusters pretty much all day.

The company represents a portfolio of eight projects, covering uranium and lithium in a mix of brownfield and greenfield assets in Canada and Western Australia, including the Portland Creek Uranium Project, the Paterson Lake Lithium Project and the Tinco Uranium Project.

The company recently IPO’d for $5.5 million at 20 cents/share, but has hit the ground running at an exceptional clip to finish the day up more than 100% – well out in front of the rest of the field.

Uranium was also the buzzword driving the second-place getter for Monday… Terra Uranium (ASX:T92) has also hit some solid gains, off the back of news that it has staked two 100% owned uranium claims covering 8,118ha along the Cable Bay Sheer Zone in the prolific Athabasca Basin, Canada.

The new claims, which are held 100% by Terra Uranium, are situated on the west side of Pasfield Lake, between the company’s existing Pasfield and Parker Projects, in an area that Terra firmly believes to be highly prospective for uranium mineralisation.

And market minnow TZ (ASX:TZL) has stalked into third place on Monday, after delivering a quarterly report to the market that outlines key points of the Company’s fiscal 2024 Q2 performance, including net cash from operating activities for this quarter was a positive inflow of $775,000.

That result includes TZ hitting its margin target of 50% in overall performance, and the company progressing well towards its $3.6 million annual revenue target, thanks to recurring revenue levels of $277,000 per month.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LNU | Linius Tech Limited | 0.002 | -33% | 7,674,820 | $14,817,722 |

| KTA | Krakatoa Resources | 0.019 | -30% | 8,185,662 | $12,746,895 |

| TAR | Taruga Minerals | 0.008 | -27% | 10,191,550 | $7,766,295 |

| BP8 | Bph Global Ltd | 0.0015 | -25% | 2,491,564 | $3,671,126 |

| LVH | Livehire Limited | 0.044 | -24% | 342,438 | $21,136,018 |

| RLG | Roolife Group Ltd | 0.007 | -22% | 1,050,000 | $6,503,023 |

| BCA | Black Canyon Limited | 0.105 | -22% | 40,475 | $9,469,097 |

| OSM | Osmond Resources | 0.07 | -22% | 46,875 | $4,220,644 |

| CPO | Culpeo Minerals | 0.079 | -21% | 16,242,491 | $13,429,073 |

| NIS | Nickelsearch | 0.055 | -20% | 8,510,527 | $14,734,429 |

| PKO | Peako Limited | 0.004 | -20% | 4,500,000 | $2,635,424 |

| FRB | Firebird Metals | 0.11 | -19% | 90,993 | $19,218,789 |

| IBX | Imagion Biosys Ltd | 0.25 | -18% | 162,425 | $9,957,198 |

| CZN | Corazon Ltd | 0.014 | -18% | 605,550 | $10,465,164 |

| DCL | Domacom Limited | 0.015 | -17% | 836,899 | $7,839,032 |

| KNM | Kneomedia Limited | 0.0025 | -17% | 836,061 | $4,599,814 |

| TMX | Terrain Minerals | 0.005 | -17% | 166,000 | $8,120,567 |

| OLL | Openlearning | 0.016 | -16% | 890,106 | $5,089,512 |

| CY5 | Cygnus Metals Ltd | 0.099 | -16% | 1,235,132 | $34,258,199 |

| TNC | True North Copper | 0.081 | -16% | 1,257,406 | $31,744,779 |

| MRZ | Mont Royal Resources | 0.11 | -15% | 38,424 | $11,053,873 |

| AYT | Austin Metals Ltd | 0.006 | -14% | 166,755 | $8,588,123 |

| IBG | Ironbark Zinc Ltd | 0.006 | -14% | 3,460,971 | $11,157,108 |

| TX3 | Trinex Minerals Ltd | 0.006 | -14% | 1,589,455 | $10,409,173 |

| VRC | Volt Resources Ltd | 0.006 | -14% | 342,474 | $28,910,747 |

TRADING HALTS

Lykos Metals -LYK (ASX) – pending an announcement regarding a capital raising.

Cosmo Metals (ASX:CMO) – pending an announcement regarding a proposed project acquisition and capital raising.

Australian Pacific Coal (ASX:AQC) – pending an announcement in connection with funding for the Dartbrook Project.

EQ Resources (ASX:EQR) – pending the release of information relating to a material acquisition with European tungsten producer Saloro S.L.U and a $25 million placement to Oaktree by EQR at 9c per share.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.