Closing Bell: Miners lead ASX; Renu Energy spikes on hydrogen offer; WEB plunges over 30pc

Web Travel plunges 30pc amid declining margins. Pic: Getty Images

- ASX closes higher led by Wall Street gains

- ReNu Energy reveals partial offer for hydrogen assets

- Web Travel plunges 30pc amid declining margins

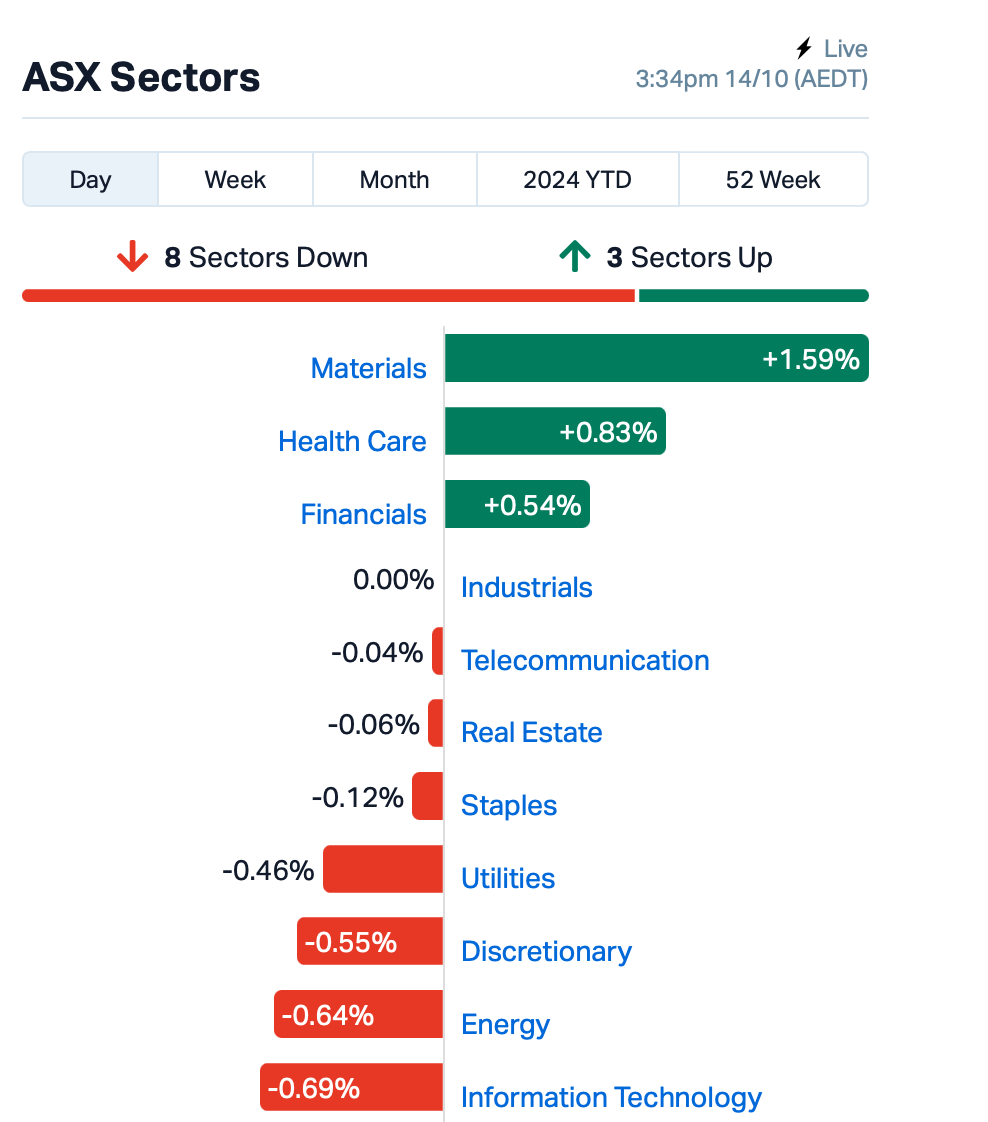

The ASX closed 0.47% higher on Monday, buoyed by strong Wall Street leads, with the S&P/ASX 200 finishing just a handful of points below last month’s record close.

Mining stocks mostly rallied – led by South32 (ASX:S32) and Fortescue (ASX:FMG) – despite a disappointing Chinese stimulus announcement on Saturday.

Telix Pharmaceuticals (ASX:TLX) led the healthcare sector with a 1.5% rise.

Bank stocks also rose, driven by solid earnings reports from US banks on Friday.

Oil stocks faced pressure as crude prices fell following the lacklustre briefing from China’s Finance Ministry, which offered no substantial stimulus.

“Everyone was looking for a number, but the finance minister did not give us one,” said Raymond Yeung at ANZ Bank.

Chinese inflation data released this morning, which showed a 2.8% decline in the Producer Price Index, also weighed on markets.

In stock news, Web Travel Group (ASX:WEB) plunged 30% after a trading update indicated declining EBITDA margins, despite an increase in Total Transaction Value and bookings.

Seek (ASX:SEK) rose 1% after announcing a $45 million buyout offer for Xref (ASX:XF1), which skyrocketed 52%.

Lifestyle Communities (ASX:LIC) shares fell 3% following CEO James Kelly’s resignation announcement.

Still in the large caps space, Treasury Wine Estates (ASX:TWE) rose over 1% after announcing an in-principle agreement to settle a shareholder class action initiated in 2020.

The class action, which arose after TWE revised its earnings guidance, involved allegations of misleading conduct and disclosure breaches. The settlement amount is $65 million, covered by insurance proceeds, and is pending final approval by the Supreme Court of Victoria. TWE said the settlement does not imply guilt.

Goldman upgrades China

China stocks are recovering from earlier losses this afternoon as a government briefing concluded.

There’s an emphasis from the briefing that the government will prevent officials from levying arbitrary or unlawful fines and fees on businesses.

Goldman Sachs released growth forecasts for China’s economy in 2024 and 2025 following the announcement.

Goldman now expects China’s GDP to grow by 4.9% this year, up from 4.7%, and has revised next year’s prediction to 4.7% from 4.3%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OAR | OAR Resources Ltd | 0.003 | 200% | 19,205,027 | $3,300,835 |

| RNE | Renu Energy Ltd | 0.002 | 100% | 3,280,446 | $845,245 |

| JBY | James Bay Minerals | 0.330 | 65% | 4,503,210 | $6,688,500 |

| XF1 | Xref Limited | 0.205 | 52% | 4,936,044 | $25,526,241 |

| VPR | Voltgroupltd | 0.002 | 50% | 1,452,568 | $10,716,208 |

| PAT | Patriot Lithium | 0.057 | 36% | 1,229,394 | $4,346,180 |

| ALR | Altairminerals | 0.004 | 33% | 34,000 | $12,889,733 |

| AMD | Arrow Minerals | 0.002 | 33% | 24,921,174 | $19,072,296 |

| CR1 | Constellation Res | 0.160 | 28% | 243,931 | $7,879,903 |

| NYM | Narryermetalslimited | 0.028 | 27% | 10 | $2,915,134 |

| NSM | Northstaw | 0.024 | 26% | 135,660 | $3,054,740 |

| TEG | Triangle Energy Ltd | 0.008 | 25% | 9,345,687 | $12,480,804 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 375,991 | $12,000,000 |

| EEL | Enrg Elements Ltd | 0.003 | 25% | 103,926 | $2,090,032 |

| GTI | Gratifii | 0.005 | 25% | 9,720 | $8,596,785 |

| TMK | TMK Energy Limited | 0.003 | 25% | 3,797,000 | $15,183,224 |

| NSX | NSX Limited | 0.042 | 24% | 983,291 | $15,564,553 |

| BNZ | Benzmining | 0.210 | 24% | 150,442 | $18,168,652 |

| KLI | Killiresources | 0.180 | 20% | 524,194 | $21,033,561 |

| AIV | Activex Limited | 0.006 | 20% | 500,197 | $1,077,513 |

| MVL | Marvel Gold Limited | 0.012 | 20% | 7,598,253 | $8,637,907 |

| NES | Nelson Resources. | 0.003 | 20% | 550,598 | $1,596,486 |

| SFG | Seafarms Group Ltd | 0.003 | 20% | 630,000 | $12,091,498 |

Oar Resources (ASX:OAR) rose by 200% today on no specific news, prompting the ASX to issue the company with a speeding ticket. Oar confirmed there was no insider news or anything to worry about, except for ongoing management restructuring and a renewed focus on its uranium projects.

ReNu Energy (ASX:RNE) has partially disclosed a behind-doors offer for its hydrogen assets including Tasmanian green hydrogen project that was recently awarded an $8m grant from the Tasmanian Government based on delivering green hydrogen to customers. The receipt of a non-binding indicative offer for its hydrogen subsidiary, Countrywide Hydrogen, generated investor interest.

James Bay Minerals (ASX:JBY) made headlines today with a surprise $2.4 million acquisition of the high-grade Independence gold project in Battle Mountain, Nevada. Known for its extensive landholdings in the James Bay region, JBY has focused on lithium in Quebec but is shifting to gold as lithium prices cool and gold hits record highs of around $2,650/oz.

The Independence project features the Skarn deposit, which has a resource of 796,000 oz at 6.53 g/t gold, with potential for further expansion. Located near Nevada Gold Mines’ Phoenix project and 16 km south of Battle Mountain, the site has shown promising new high-grade discoveries, including a notable hit of 24.4 m at 9.11 g/t gold.

The acquisition terms include $2.4 million in shares for an initial 51.54% stake, with the option to acquire the remaining 48.46% over the next two years.

Xref (ASX:XF1) was up after announcing that it is set to be acquired by jobs platform Seek (ASX:SEK). XF1 said it had entered into an exclusivity deed with SEK following receipt of a non-binding indicative offer to acquire all of its shares for 21.81 cents in cash/share, by way of a scheme of arrangement.

Patriot Lithium (ASX:PAT) was up on news. But recently, Patriot announced it was acquiring the Katwaro copper project in Zambia. PAT’s move into copper aligns with its strategy to diversify and enhance its battery metals portfolio. The company is currently conducting due diligence on Katwaro and plans to resume exploration at its lithium projects as conditions improve in spring.

Clarity Pharmaceuticals (ASX:CU6) is set to launch a phase III trial in the US for diagnosing recurrent prostate cancer, following positive feedback from the FDA. The Amplify trial will enrol around 220 patients with rising prostate-specific antigen levels, and will utilise Clarity’s 64Cu-SAR-bisPSMA PET imaging device.

Meanwhile, the Australian Government has given a special status to Chalice Mining’s (ASX:CHN) Gonneville Project in Western Australia. This project is critical for producing critical minerals like nickel, copper, and platinum, which are needed for clean energy and urban development. With this status, Chalice will receive extra help from the government to get the necessary approvals faster. The project is located on farmland about 70km northeast of Perth, and is currently in the planning stage.

Monsters of Rock: Chalice makes recovery run as Feds back critical minerals

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| WEB | WEB Travel Group Ltd | 4.620 | -34% | 25,585,279 | $2,759,488,410 |

| IR1 | Irismetals | 0.260 | -29% | 1,450,365 | $50,775,143 |

| D3E | D3 Energy Limited | 0.090 | -28% | 154,197 | $9,934,376 |

| 1TT | Thrive Tribe Tech | 0.002 | -25% | 13,582 | $1,223,243 |

| TMX | Terrain Minerals | 0.003 | -25% | 2,288,164 | $7,200,115 |

| TYX | Tyranna Res Ltd | 0.003 | -25% | 392,432 | $13,151,701 |

| YAR | Yari Minerals Ltd | 0.003 | -25% | 125 | $1,929,431 |

| WBE | Whitebark Energy | 0.007 | -22% | 84,321 | $2,271,001 |

| IMI | Infinitymining | 0.030 | -21% | 581,471 | $5,158,277 |

| 88E | 88 Energy Ltd | 0.002 | -20% | 3,841,926 | $72,334,530 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 82,000 | $2,516,434 |

| RMX | Red Mount Min Ltd | 0.008 | -20% | 80,992 | $3,873,578 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 18,237 | $11,058,736 |

| STM | Sunstone Metals Ltd | 0.007 | -19% | 22,612,193 | $34,607,229 |

| BCM | Brazilian Critical | 0.009 | -18% | 8,508,698 | $9,138,134 |

| CUL | Cullen Resources | 0.005 | -17% | 324,813 | $4,160,411 |

| CYQ | Cycliq Group Ltd | 0.005 | -17% | 30,000 | $2,673,100 |

| CZN | Corazon Ltd | 0.005 | -17% | 1,600,000 | $4,007,434 |

| H2G | Greenhy2 Limited | 0.005 | -17% | 829,800 | $3,589,105 |

| IBG | Ironbark Zinc Ltd | 0.003 | -17% | 24,000 | $5,500,943 |

| OPL | Opyl Limited | 0.020 | -17% | 50,000 | $4,097,151 |

Infinity Mining (ASX:IMI) has completed a private placement of 106 million shares priced at 1.9c each, a ~31% discount to the 30-day volume weighted average price, to raise $2m. Proceeds will be allocated to advancing gold and copper exploration projects from the GMH, EVGE, and Cangai project acquisitions, as well as existing projects.

Likewise, Sunstone Metals (ASX:STM) raised $4m after completing an oversubscribed share purchase plan priced at 0.5c each. Directors had decided to accept oversubscriptions to the full amount subscribed so that all shareholders who subscribed can participate to the full extent of the application submitted.

IN CASE YOU MISSED IT

Alma Metals (ASX:ALM) has committed to the Stage 3 farm-in of its Briggs copper project in Queensland after successful completing the Stage 2 requirements. Briggs hosts more than 1Mt of contained copper just 60km from the deep-water port of Gladstone and close to multiple high-power voltage power lines, a heavy haulage railway, gas pipelines and major roads.

Metallurgical testwork has confirmed that ionic adsorption clays rich in rare earths are present at Equinox Minerals (ASX:EQN) Campo Grande in Brazil. This work has achieved recoveries of up to 80% total rare earth oxides.

Imricor Medical Systems (ASX:IMR) has updated progress on several regulatory initiatives supporting new device approvals in Europe and the US with the US Food and Drug Administration completing a review of its first premarket approval module ahead of schedule.

Legacy Minerals’ (ASX:LGM) rock chip sampling returns up to 9.32% copper, confirms widespread oxide copper at the Crystal Hill prospect, indicating that the Rockley project could host mineralisation similar to the nearby Racecourse porphyry copper deposit and giant Cadia-Ridgeway deposit.

D3 Energy (ASX:D3E) has wrapped up drilling and completed the RBD12 well in Free State, South Africa, which hit a total depth of 594m. The well was drilled to assess the reservoir’s long-term deliverability and to collect additional data on helium and methane concentrations. D3E says at the completion of drilling, gas was flowing to surface. The wellhead has now been installed and production testing will begin in the coming weeks after the testing of RBD01 and once RBD12 has stabilised following drilling operations.

Vertex Minerals (ASX:VTX) has appointed Chris Hamilton to the role of general manager operations for the Hill End Reward gold mine in NSW, spearheading the transition from development to mining operations. Hamilton has more than 24 years of underground mine operational and technical experience including key roles in NSW goldmines and brings significant underground mining and management experience through CSA, Peak, Hera, and Tritton mines.

“We’re pleased to welcome Chris to the Vertex team, his extensive underground hard rock mining, operations and leadership experience can only bode well for the success of the high-grade Reward gold mine,” VTX executive chairman Roger Jackson said.

Reward is considered one of Australia’s highest grade gold deposits with 419,000t grading 16.72g/t gold – or 225,200oz of contained gold – with a higher confidence indicated resource of 141,000t at 15.54g/t, or 70,500oz of contained gold.

Zeotech (ASX:ZEO) has raised $1.82m by way of a heavily supported placement to non-related party investors, deemed ‘sophisticated investors’, at an issue price of $0.03c. Funds from the initiative ensures Zeotech is well funded to execute its near-term strategic initiatives throughout 2024 and beyond. Zeotech is focused on becoming Australia’s first large-scale producer of high reactivity metakaolin for the low-carbon concrete and cement markets.

Proceeds will be spent towards advancing feasibility and front-end engineering design (FEED) studies associated with the Toondoon kaolin project, helping to accelerate Toondoon ML mining plan works, conducting a Metakaolin Life Cycle Analysis (LCA), and other project activities.

TRADING HALTS

Titomic (ASX: TTT) – Cap raise

MTM Critical Metals (ASX: MTM) – Cap raise

Australian Strategic Materials (ASX: ASM) – Award of an Australian government grant

Trigg Minerals (ASX: TMG) – Cap raise

Aurum Resources (ASX: AUE) – A material acquisition

Xanadu Mines (ASX: XAM) – Updated Mineral Resource Estimate and Maiden Ore Reserve and completion of the Pre-Feasibility Study for the Kharmagtai Project

Mako Gold (ASX: MKG) – A potential control transaction

Siren Gold (ASX: SNG) – An unsolicited non-binding indicative offer

At Stockhead, we tell it like it is. While Anax Metals, New World Resources, Regener8 Resources, Sunshine Metals and Trigg Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.