Closing Bell: Mega miners leave ASX with barely a thread after giving it all away on weak China data

Via Getty

- Benchmark ASX crawls back to close +0.12% in the green

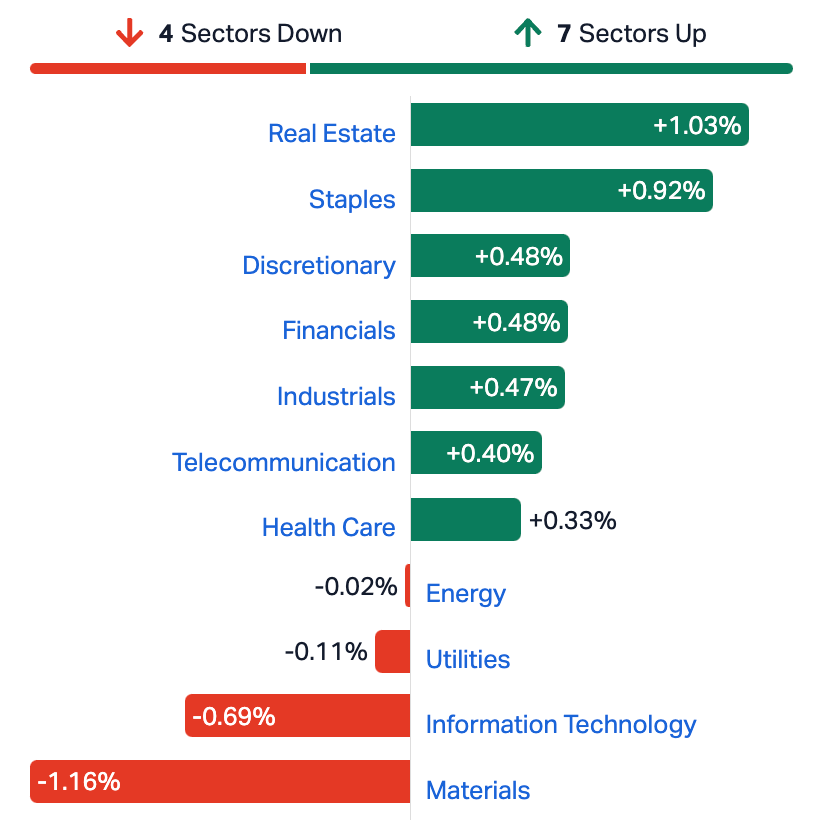

- Seven Sectors close higher, led by REITs and Consumer stocks

- Small caps led by TOY and Patriot Lithium

The benchmark has ended a good morning with a wretched afternoon, as selling across the blue-chip mining sector sucked the oxygen out of a positive overnight lead.

Sharp losses in mining stocks offset earlier gains after weak manufacturing data out of China helped put the sour back into sentiment.

The benchmark S&P/ASX 200 index closed up just 7.8 points or +0.12% to 6780 points after gaining strongly in AM trade.

China-facing ASX stocks lost heart late in the arvo after China’s October manufacturing PMI came in at its lowest pace of growth in 10 months.

The far-weaker-than hoped-for read hit local miners and resources particularly hard. The largest business on the bourse by market cap, BHP (ASX:BHP), shed almost 2% at one stage, closely tracking weaker iron ore prices.

With a big week ahead and an uncertain geopolitical disposition, the price of gold quietly quit the US$2K territory it so briefly held, for the steadier climes of circa $1,993 an ounce.

Investors pounced for equities overnight on Wall Street, but there’ll be an abundance of caution as we inch closer to more significant monetary policy moments from all sorts of major central banks this week, none more weighty than the Federal Reserve, which is set to announce its latest interest rate call on Wednesday in New York.

Here’s a Gold chart, should you need it in the next 48 hours

ASX SECTORS ON TUESDAY

IT stocks were sold off heavily in afternoon trade, while the iron ore majors weighed heavily as well. Consumer stocks, which alongside the Real Estate Sector led this morning’s gains have eased into the close, but still remained well in the green.

Chicken king Inghams (ASX:ING) jumped as high as 7% this morning after offering some sterling guidance including statutory EBITDA of circa $250mn for the first half of this fiscal year – a significant boost on the PCP.

By the close of trade 4 ASX sectors of a possible 11 made losses.

RANDOM SMALL CAP WRAP

IVC shareholders vote yes to TPG takeover

Invocare (ASX:IVC) shares are likely to remain in a trading halt on the ASX from the close of trading on Friday, after the funeral group’s shareholders green-lit TPG Capital’s $1.8bn takeover offer, as per The Australian.

IVC will pay a fully franked special dividend of 60 cents per share once the scheme becomes effective.

Shareholders approved the scheme of arrangement with the private equity giant, with an 81.01% majority at today’s scheme meeting vote, with NSW Supreme Court approval still in the post.

And still back in Bali…

Nickel Industries (ASX:NIC) MD Justin Werner says record September quarter earnings results were ‘highly pleasing’, and go a long way to capturing NIC’s financial muscle.

Justin told the ASX the company continues to deliver sustainable growth and value creation as Australia’s largest listed diversified nickel producer.

NIC hit record EBITDA for the quarter, led by a strong uplift in production, earnings, sales and cash generation.

Increased production and lower costs also contributed to the record US$120.7mn.

“We are delighted to report another record quarter of 33,852 tonnes of nickel metal as we enjoyed the first full quarter of contribution from our ramped-up Oracle Nickel (ONI) operations,’’ Werner said.

RIPPED FROM THE HEADLINES

Beijing waits on a pliant PM

Japan’s 10-year government bond yield rose above 0.9%, breaching the key level for the first time in ten years as the Bank of Japan (BoJ) held rates steady at a sublime -0.1%. The Japanese yen has weakened since the call, as the BoJ also held the 10-year government bond (JGB) yield target at or around a 0%.

Japan’s Nikkei 225 index gained +1.50% after a higher than expected CPI read in Tokyo raised hopes the central bank might finally be forced to end its longstanding near-zero interest rate policy before Xmas.

On oil markets, WTI crude futures rose above $82 per barrel. The US oil benchmark lost nearly 4% on Monday as traders did the math on fears of a regional quagmire enveloping the Israel-Hamas war, which would disrupt global oil supply further.

Oil traders are also the first to feel a slight chill when – as mentioned – Chinese manufacturing activity contracts, as it did unexpectedly this month, according to data released by Beijing today.

Chinese PMI Service growth has also slowed to its weakest year-to-date.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| FZR | Fitzroy River Corp | 0.15 | 36% | 15,000 | $11,874,968 |

| TOY | Toys R Us | 0.015 | 36% | 7,207,996 | $10,807,099 |

| BLU | Blue Energy Limited | 0.019 | 36% | 33,579,409 | $25,913,630 |

| ENT | Enterprise Metals | 0.004 | 33% | 2,387,948 | $2,398,413 |

| MTH | Mithril Resources | 0.002 | 33% | 78,334 | $5,053,207 |

| EXL | Elixinol Wellness | 0.009 | 29% | 3,546,889 | $4,419,407 |

| SP8 | Streamplay Studio | 0.009 | 29% | 1,735,404 | $7,966,866 |

| CHM | Chimeric Therapeutic | 0.033 | 27% | 52,866,370 | $13,889,277 |

| B4P | Beforepay Group | 0.63 | 26% | 80,158 | $17,599,099 |

| KPO | Kalina Power Limited | 0.005 | 25% | 792,642 | $6,060,783 |

| MRQ | Mrg Metals Limited | 0.0025 | 25% | 1,488,488 | $4,411,837 |

| SIS | Simble Solutions | 0.005 | 25% | 77,000 | $2,411,803 |

| XGL | Xamble Group Limited | 0.036 | 24% | 31,000 | $8,240,531 |

| KGL | KGL Resources Ltd | 0.13 | 24% | 201,074 | $59,565,646 |

| PAT | Patriot Lithium | 0.21 | 24% | 609,533 | $10,860,875 |

| KTA | Krakatoa Resources | 0.023 | 21% | 1,636,285 | $8,263,060 |

| R3D | R3D Resources Ltd | 0.06 | 20% | 191,034 | $7,407,579 |

| EDE | Eden Inv Ltd | 0.003 | 20% | 101,374 | $8,409,092 |

| REC | Rechargemetals | 0.13 | 18% | 38,139 | $12,248,717 |

| PGM | Platina Resources | 0.027 | 17% | 1,178,457 | $14,333,148 |

| SPQ | Superior Resources | 0.027 | 17% | 3,539,025 | $42,194,736 |

| AMM | Armada Metals | 0.035 | 17% | 66,000 | $5,177,042 |

| PGY | Pilot Energy Ltd | 0.035 | 17% | 25,316,000 | $31,126,728 |

| BEX | Bikeexchange Ltd | 0.007 | 17% | 900,000 | $8,595,779 |

| KGD | Kula Gold Limited | 0.014 | 17% | 1,187,490 | $4,478,543 |

Patriot Lithium (ASX:PAT) has been climbing happily all day, pleased as it was to announce the acquisition of “multiple claim packages” in the lithium rich “Electric Avenue” region in Ontario, Canada.

This region is already blowing minds for its reputedly very high-grade lithium deposits, containing the world-class PAK-Spark Project, owned by Frontier Lithium (TSXV: FL).

Patriot already has confirmed high grade lithium mineralisation at Gorman within a 5.2km trend of outcropping pegmatites (including rock chip samples up to 3.71% Li2O and sawn channel samples of 12.8 metres at 1.3% Li2O, 5.0 metres at 2.0% Li2O and 5.0 metres at 2.0% Li2O).

With identified pegmatites on the new ground that are consistent with the Bearhead Lake Fault Zone, our geologists believe that the outcropping pegmatites identified to date may only be the ‘tip of the iceberg’.

Patriot’s new claims now adjoin and partially surround Frontier Lithium’s claims to the southeast and in combination with the Gorman Project, PAT now has more than 70km of strike over the highly prospective Bearhead Lake Fault Zone.

Shares in the Aussie flag-flyer for US giant Toys R Us (ASX:Toy) are way out in front on Tuesday, up 36% at the close, although I don’t know why right now. I’ve asked the office, so stand by.

All I’ve got for now is that the Aussie arm of the business entered voluntary administration in 2018, shuttering some 45 stores after it failed to find a local buyer.

In 2021, ASX-listed toy punter Funtastic rescued the stores and adopted the fateful Toys“R”Us branding.

Easing back on the accelerator in afternoon play, Chimeric Therapeutics (ASX:CHM), is still doing well after the US Food and Drug Administration (FDA) has cleared its Investigational New Drug (IND) application of CHM 2101 – Chimeric’s first in class CDH17 CAR T cell therapy for gastrointestinal cancers.

The Australian firm, which says it’s among the leaders in cell therapy, plans to investigate CHM 2101 in a multi-centre, open label Phase 1A/B clinical trial for patients with advanced Colorectal Cancer, Gastric Cancer and Neuroendocrine Tumours.

Xianxin Hua, MD, PhD, and his team at the Abramson Family Cancer Research Institute at the University of Pennsylvania called it “exciting to see the advancement from discovery of the CDH17 target and CAR T therapy in preclinical studies to the initiation of clinical trials in patients with GI-cancers and neuroendocrine tumors.”

Everyone hates cancer. Up 75%.

Finally a shout out to the copper, lithium and REEs explorer, Encounter Resources (ASX:ENR), which has made a close encounter of the third kind on that list – new niobium-REE carbonatites in the West Arunta region of WA.

ENR jumped about 20% when the news dropped before lunch.

ENR says RC drilling has intersected the carbonatites at the Green and Emily targets in the south of the wholly Encounter-owned Aileron project.

Two, 200m-spaced holes have been completed in the eastern part of the Green target, hitting carbonatites that are “variably anomalous in niobium and REE”, and with the mineralised trend remaining open to the east towards a “large circular feature defined in magnetics and interpreted as a potential intrusive complex”.

At Emily, meanwhile, a magnetic low located 2km north-west of WA1 Resources’ (ASX:WA1) Luni discovery, has intersected carbonatites from ~50m depth which Encounter says were variably mineralised in niobium-REE to the end of the hole.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| 3DP | Pointerra Limited | 0.063 | -31% | 8,919,880 | $64,960,858 |

| ADY | Admiralty Resources. | 0.005 | -29% | 200,000 | $9,125,054 |

| CCE | Carnegie Cln Energy | 0.0015 | -25% | 513,570 | $31,285,147 |

| ALM | Alma Metals Ltd | 0.007 | -22% | 1,313,499 | $10,026,007 |

| AHI | Advanced Health | 0.105 | -22% | 637,498 | $29,390,036 |

| MDI | Middle Island Res | 0.018 | -22% | 1,786,465 | $3,235,139 |

| JAY | Jayride Group | 0.064 | -21% | 410,861 | $18,222,690 |

| MNS | Magnis Energy Tech | 0.059 | -20% | 20,430,645 | $88,762,863 |

| FAU | First Au Ltd | 0.002 | -20% | 1,050,000 | $3,629,983 |

| RGS | Regeneus Ltd | 0.004 | -20% | 462,486 | $1,532,185 |

| WC8 | Wildcat Resources | 0.7 | -19% | 33,354,942 | $895,130,574 |

| NRX | Noronex Limited | 0.009 | -18% | 2,229,756 | $4,161,319 |

| XPN | Xpon Technologies | 0.033 | -18% | 21,479 | $6,341,101 |

| RAD | Radiopharm | 0.083 | -17% | 978,760 | $23,931,304 |

| CTQ | Careteq Limited | 0.025 | -17% | 40,000 | $6,663,686 |

| DAF | Discovery Alaska Ltd | 0.015 | -17% | 2,000 | $4,216,225 |

| NRZ | Neurizer Ltd | 0.025 | -17% | 3,586,694 | $38,302,177 |

| CRB | Carbine Resources | 0.005 | -17% | 988,294 | $3,310,427 |

| GMN | Gold Mountain Ltd | 0.005 | -17% | 2,118,015 | $13,614,472 |

| RIE | Riedel Resources Ltd | 0.005 | -17% | 290,000 | $12,356,442 |

| AX8 | Accelerate Resources | 0.038 | -16% | 4,383,020 | $20,970,099 |

| BML | Boab Metals Ltd | 0.115 | -15% | 562,167 | $23,552,474 |

| BSE | Base Res Limited | 0.12 | -14% | 6,500,839 | $164,921,659 |

| ICN | Icon Energy Limited | 0.006 | -14% | 578,287 | $5,376,096 |

| M4M | Macro Metals Limited | 0.003 | -14% | 200,000 | $6,954,772 |

TRADING HALTS

Pioneer Lithium (ASX:PLN) – Pending a response to an ASX price query

Jade Gas Holdings (ASX:JGH) – Pending an announcement to be made by the Company to the market in ‘connection with Jade’s financing initiatives’

Magnum Mining (ASX:MGU) – Pending “it releasing an announcement”

K2Fly (ASX:K2F) – Pending an announcement regarding a capital raising pursuant to a placement and strategic review

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.