Closing Bell: Maximus and Jupiter rising; Tech tops ASX after Bitcoin bags ETF

Via Getty

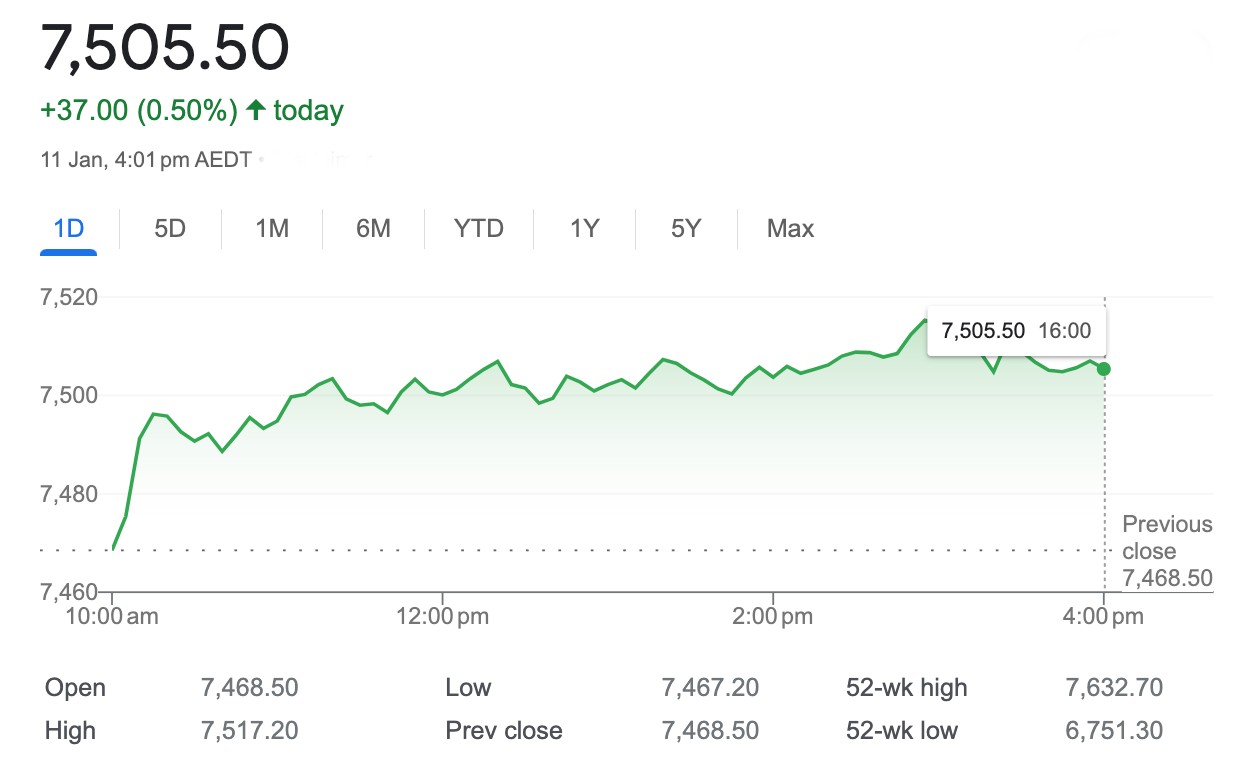

- ASX200 chalks up another solid win; Japan stocks at 34-yr highs

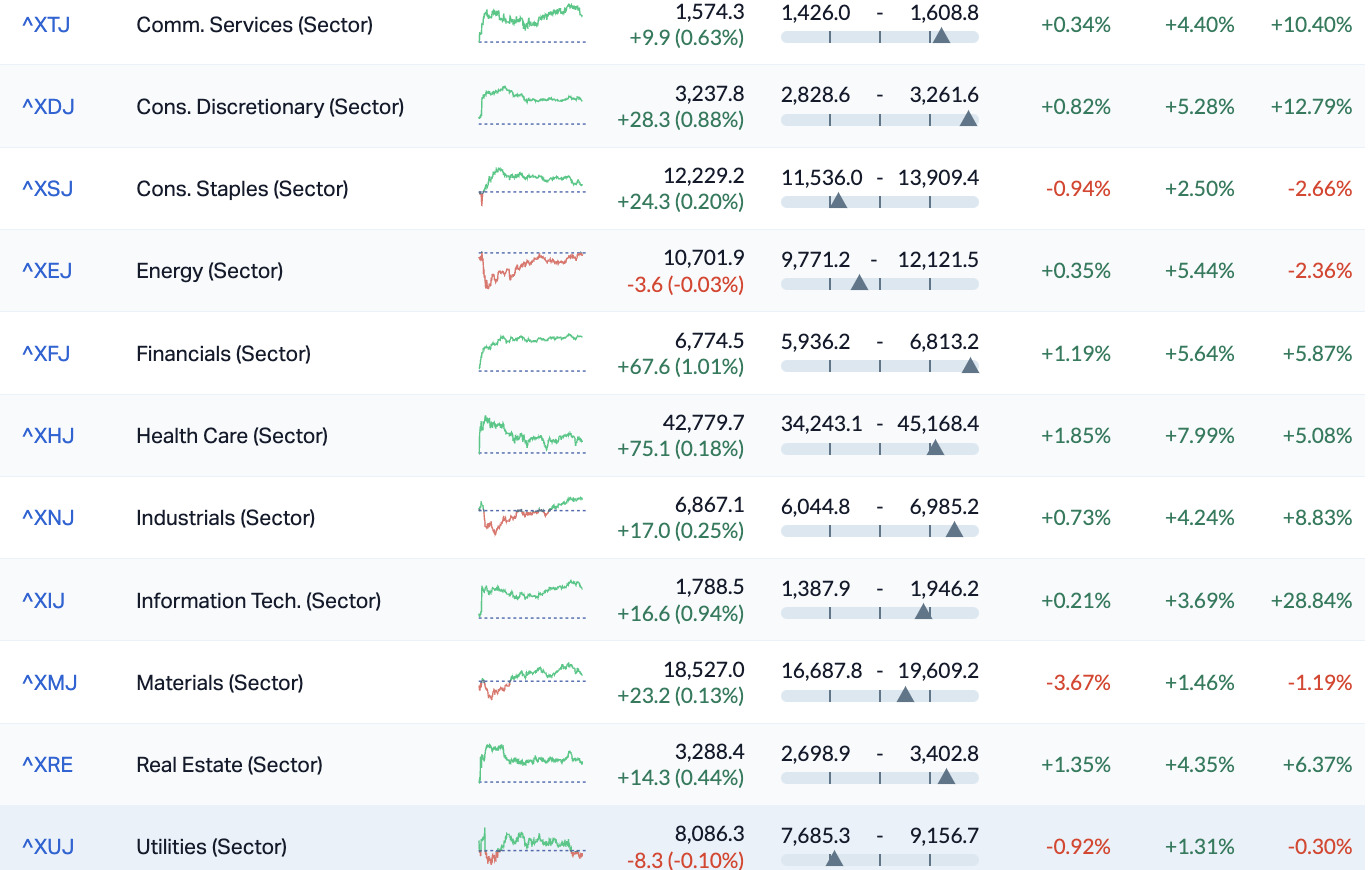

- ASX sectors all higher except Utilities

- Small cap winners led by the Romans, Jupiter and Maximus

The ASX benchmark has closed back above 7,500 points on Thursday after Wall Street traders kept faith with the Mega-Tech revival overnight, doubling down ahead of key US inflation data.

Meanwhile, after a very false start, US securities regulator the SEC has apparently really gone and approved 11 Bitcoin ETFs.

At 4pm on Thursday, the S&P/ASX200 index (XJO) was up 37 points or 0.5% to 7,505.

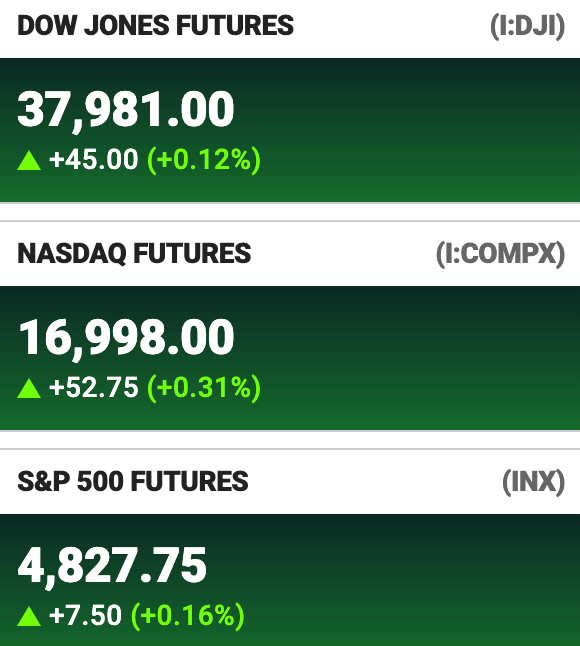

In New York, Wall Street logged another strong session continuing the upturn in tech names in anticipation of Q4 earnings season, which begins tonight.

In local news, imports hit a nine-month low as the nation’s trade surplus surged to $11.44bn in November from an upwardly revised $7.66 billion in October.

It’s the largest surplus since March last year, as ergo sum, exports rose and imports slumped.

The banks did well while consumer-facing ASX stocks made good on Wednesday’s sweetly weak inflation data and expectations of RBA rate cuts into the back half of 2024.

JB HiFi (ASX:JBH) was ahead almost 4%.

Utilities and Energy stocks were weakest, with Whitehaven Coal (ASX:WHC) and Ampol (ASX:ALD) among the worst on field.

ASX SECTORS at 3.45pm on THURSDAY

![]()

In other local company news, they’re finally taking a little cream off the top of the freshly minted Kali Metals (ASX:KM1), which momentarily clocked 90 cents on Wednesday, delivering the lithium newbie a casual circa 260% gain from inception.

After being priced for business at 25 cents a share KM1 has given up about 10% on Thursday arvo – leaving early backers like rock jock investor Chris Ellison with a mere 250% in the bank.

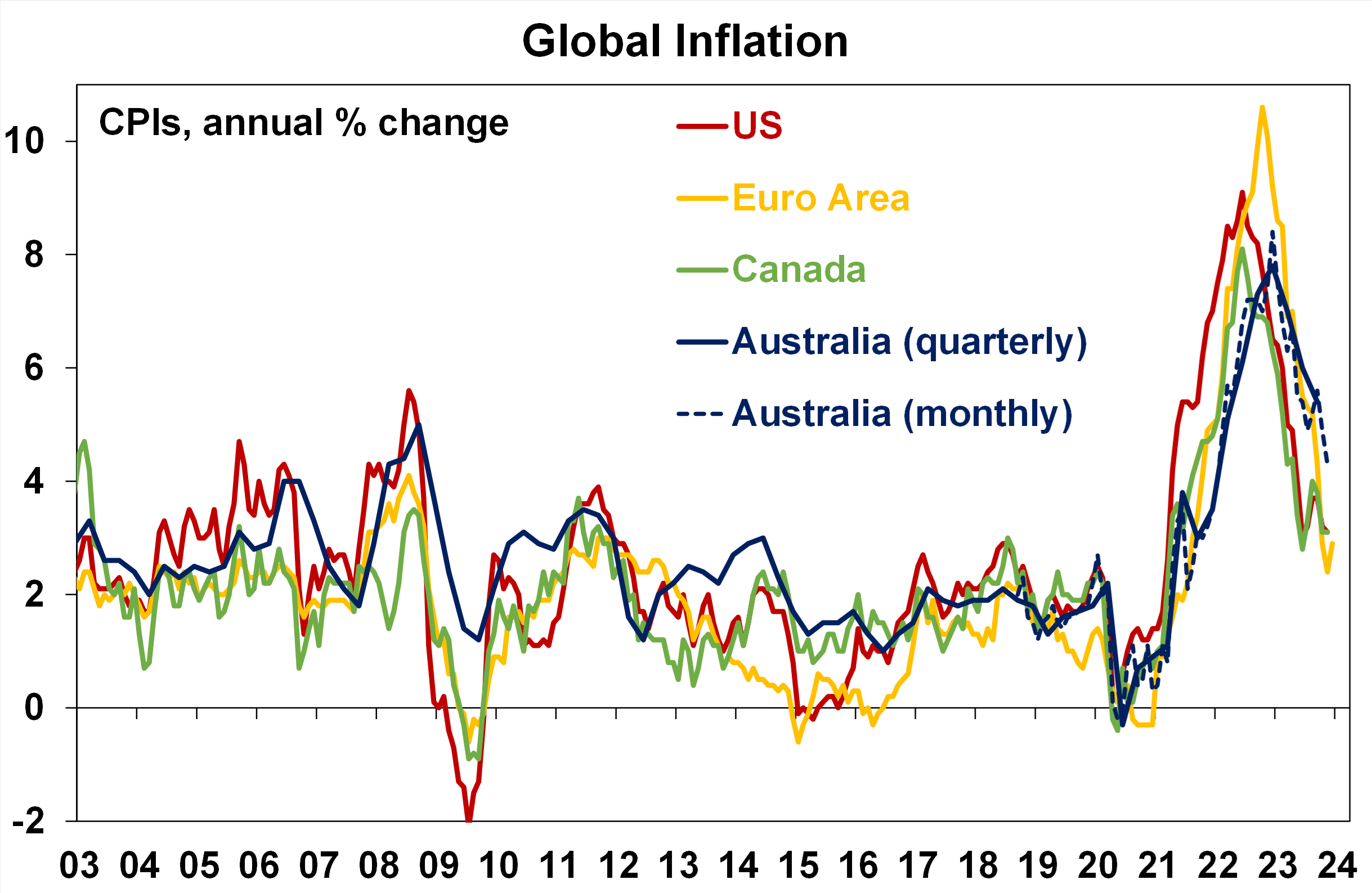

Aussie markets lifted after the monthly CPI read for November came in far more deflated than many had hoped on Wednesday, although the benchmark index failed to bite.

Dr Shane Oliver – head of investment strategy and chief economist at AMP – says there’s a lot of uncertain energy ahead of this week’s other big date with price pressures.

“I suspect the 12% or so rebound since the October low had already priced in a lot of good news. Same story with the S&P. Which leaves shares a bit vulnerable short term to a pullback as we come into the US CPI and central bank meetings later this month/early Feb.”

Shane says a lot has been made about the toppy and tailing state of Aussie inflation compared to the RotW…

However, worry warts can probably stand down on that front, AMP believes.

“Australian inflation peaked three to six months after our major peers, so it’s only natural that the decline in inflation is also occurring later than our peers – and in fact it is still following the same trajectory.

“We expect that inflation for December quarter 2023 will be comfortably under the RBA forecast of 4.5% yoy, consistent with it leaving the cash rate on hold at the next RBA meeting and rate cuts from mid-year.”

In fact, Dr Shane et al expect the December Monthly Inflation Indicator to hit 3.3% as last year’s 1.5% inflation surge – largely due to a whopping 27% mom rise in travel costs – drops out of the annual calculation.

According to math, that’ll bring our inflation down near what the US and Europeans are seeing.

Meanwhile, around the ‘hood, Asian-Pacific sharemarkets are tracking the gains on Wall Street.

The Nikkei 225 and Topix indices in Japan are nudging 34-year highs. Chew over that a moment.

Stocks are higher in South Korea, after the Bank of Korea (BoK) held rates unchanged at 3.5% for the eighth time in a row. Chew on that a little, too.

And stocks in Honkers have snapped a seemingly infinite losing streak (about five days, apparently) by jumping over 200 points or 1.4% before lunch in Hong Kong on Thursday.

Perhaps that 14-month low on Monday was a bottom of some form or shape.

Wall Street was led out the gate by the Mega-Magnifico trio of Nvidia, Meta and Microsoft, but it was the ol’ Bitcoin (BTC) which advanced with American Flair, after the news in Sydney this morning confirming the US securities regulator (SEC) had indeed approved the first US-listed exchange-traded funds (ETFs) tracking Bitcoin.

After a brief Tuesday balls-up, when the US Securities and Exchange Commission (SEC) got its X/Twitter account snatched to deliver a false dawn, now anyone can invest in BTC via exchange traded funds flinging open exposure to the world’s largest cryptocurrency without having to actually feel like you own it. ‘Cos you won’t.

US stockmarket futures at 3.30pm on Thursday in Sydney:

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CZR | CZR Resources Ltd | 0.3 | 43% | 3,579,494 | $49,504,276 |

| CMP | Compumedics Limited | 0.375 | 39% | 505,386 | $47,833,996 |

| JPR | Jupiter Energy | 0.025 | 39% | 1,867,364 | $22,865,945 |

| EDE | Eden Inv Ltd | 0.0025 | 25% | 1,571,475 | $7,334,027 |

| SKN | Skin Elements Ltd | 0.005 | 25% | 190,900 | $2,357,944 |

| NGS | NGS Ltd | 0.016 | 23% | 4,556,955 | $3,265,956 |

| LDX | Lumos Diagnostics | 0.1 | 22% | 68,307,992 | $39,466,604 |

| MXR | Maximus Resources | 0.045 | 22% | 12,624,135 | $11,862,413 |

| ASE | Astute Metals NL | 0.04 | 21% | 294,810 | $13,547,143 |

| SHG | Singular Health | 0.047 | 21% | 2,232,273 | $5,511,100 |

| HYD | Hydrix Limited | 0.024 | 20% | 474,636 | $5,084,377 |

| PVT | Pivotal Metals Ltd | 0.024 | 20% | 2,017,734 | $13,601,116 |

| RGS | Regeneus Ltd | 0.006 | 20% | 1,164,588 | $1,532,185 |

| TMR | Tempus Resources Ltd | 0.006 | 20% | 830,000 | $1,999,884 |

| TMX | Terrain Minerals | 0.006 | 20% | 3,362,654 | $6,767,139 |

| A1G | African Gold Ltd. | 0.037 | 19% | 10,420 | $5,248,648 |

| M24 | Mamba Exploration | 0.054 | 17% | 75,936 | $2,947,785 |

| EVZ | EVZ Limited | 0.175 | 17% | 57,086 | $18,163,788 |

| EEL | Enrg Elements Ltd | 0.007 | 17% | 674,461 | $6,059,790 |

| HLX | Helix Resources | 0.0035 | 17% | 167,347 | $6,969,438 |

| VAL | Valor Resources Ltd | 0.0035 | 17% | 757,488 | $12,520,004 |

| PCL | Pancontinental Energ | 0.022 | 16% | 67,302,727 | $153,144,233 |

| SIX | Sprintex Ltd | 0.015 | 15% | 1,017,699 | $5,385,410 |

| SIO | Simonds Grp Ltd | 0.23 | 15% | 13,517 | $71,981,290 |

| GSS | Genetic Signatures | 0.5 | 15% | 77,135 | $71,738,849 |

Top of the pops for the day so far is Jupiter Energy (ASX:JPR), hyped up harder than a toddler full of GI Cordial (the proper green stuff, not the rubbish red one) after the company brought in Sproule International to evaluate the Proved, Probable and Possible reserves for Jupiter’s three oilfields in Kazakhstan and to prepare a Competent Person’s Report as to its findings.

The report came back with an upgrade to the recoverable reserves associated with Jupiter’s field, with the total Proved, Probable and Possible total now standing at 46,796,000 bbls, which the company says carries an after-tax Net Present Value of ~$US180 million.

Also out of bed early on Thursday was Maximus Resources (ASX:MXR), which says it’s just defined a number of ‘high-priority lithium targets’ at its $4.5mn Lefroy Lithium Project JV with the South Korean state mining corp KOMIR.

Maximus’ managing director, Tim Wither, says assay results returned from a completed soil-sampling program were “very encouraging”.

“These initial results from the first phase of the project-wide soil sampling campaign have defined a significant anomalous lithium trend over 5km in length, allowing us to set high-priority drill targets at the Lefroy Lithium project.

“The presence of a large 3km x 1.5km lithium-in-soil anomaly, extending from the recent discovery of spodumene-bearing pegmatites, provides more encouraging signs that the lithium-in-soil anomalies may be associated with a very large mineralised system.”

Maximus owns 100% of the Lefroy Lithium Project, with KOMIR able to farm into a stake of up to 30% by spending up to US$3 million, with Maximus retaining management of the project.

CZR Resources (ASX:CZR) came out of voluntary suspension just after lunch, bearing news that it has entered into a binding Share Sale Agreement for the sale of its wholly-owned subsidiary Zanthus Resources, which controls an 85% interest in the Robe Mesa Iron Ore Project.

The buyer is Miracle Iron Resources, which operates under parent company, Shenzhen Naao Jianglan Investment Co, which in turn is a subsidiary of Xinjiang Jiangna Mining Corporation.

The news put CZR up more than 47% in a matter of minutes.

Elsewhere, Compumedics (ASX:CMP) climbed nicely throughout the day, after delivering a business update this morning telling the market that the company is likely to have increased its revenues by about to a record $26 million in H1 FY24, up by roughly 35% on PCP.

Coal from Aspire Mining’s (ASX:AKM) Ovoot project in Mongolia has been designated super high quality, or “fat”, making it ideal for producing coke, which is used in the smelting of iron ore.

“We are very excited by this confirmation which places our coal into the ‘fat coal’ market, which will attract a hard coking coal premium,” AKM’s Sam Bowles says. “In recognition of the distinctly unique qualities of this coal, the company will be branding the coal produced from the OCCP as Toson Coal.

“In Mongolian, ‘Toson’ is an adjective meaning ‘fat’ or ‘fatty’.”

Elsewhere, Singular Health (ASX:SHG) has received its first binding enterprise licence order for 5,000 annual licences of the 3Dicom Patient software in the US.

Details of the enterprise sale are “commercial-in-confidence”, but SHG says revenue generated from this order “exceeds the total direct-to-consumer sales of the 3Dicom software in 2023 of ~A$50,000 by more than 40%”.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TD1 | Tali Digital Limited | 0.001 | -50% | 10,085,007 | $6,590,311 |

| REY | REY Resources Ltd | 0.105 | -42% | 10,473 | $38,109,157 |

| CAQ | CAQ Holdings Ltd | 0.007 | -30% | 5,000 | $7,177,863 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | 296,358 | $4,267,580 |

| IEC | Intra Energy Corp | 0.003 | -25% | 5,979,640 | $6,643,126 |

| ME1 | Melodiol Glb Health | 0.0015 | -25% | 2,216,760 | $9,457,648 |

| MKT | The Market Limited | 0.21 | -25% | 5,300 | $89,872,323 |

| CPO | Culpeominerals | 0.1 | -23% | 12,863,692 | $15,153,107 |

| RR1 | Reach Resources Ltd | 0.0035 | -22% | 36,751,313 | $14,446,337 |

| ATH | Alterity Therap Ltd | 0.004 | -20% | 96,594 | $19,056,631 |

| CHK | Cohiba Min Ltd | 0.002 | -20% | 1,000,000 | $6,325,575 |

| DGR | DGR Global Ltd | 0.021 | -19% | 67,000 | $27,136,030 |

| LLI | Loyal Lithium Ltd | 0.33 | -19% | 1,617,341 | $33,731,364 |

| NWM | Norwest Minerals | 0.0265 | -17% | 1,470,786 | $9,202,224 |

| AMM | Armada Metals | 0.025 | -17% | 329,682 | $6,240,000 |

| RLF | Rlfagtechltd | 0.1 | -17% | 108,400 | $11,000,027 |

| CCZ | Castillo Copper Ltd | 0.005 | -17% | 1,795,042 | $7,797,032 |

| HXG | Hexagon Energy | 0.01 | -17% | 16,000 | $6,154,991 |

| MCT | Metalicity Limited | 0.0025 | -17% | 567,931 | $13,455,161 |

| PHL | Propell Holdings Ltd | 0.011 | -15% | 15,700 | $1,564,622 |

| AMD | Arrow Minerals | 0.006 | -14% | 31,625,459 | $24,316,356 |

| LRL | Labyrinth Resources | 0.006 | -14% | 166,666 | $8,312,806 |

| RML | Resolution Minerals | 0.003 | -14% | 45,000 | $4,409,989 |

| STM | Sunstone Metals Ltd | 0.012 | -14% | 2,201,468 | $48,828,288 |

| MCM | Mc Mining Ltd | 0.13 | -13% | 2,488 | $61,183,612 |

TRADING HALTS

White Cliff Minerals (ASX:WCN) – pending the release of an announcement relating to an acquisition of an advanced exploration project.

Surefire Resources (ASX:SRN) – pending the announcement of a Memorandum of Understanding Agreement for the development of the Victory Bore project.

Laramide Resources (ASX:LAM) – pending the release of an announcement relating to the results of an independent Preliminary Economic Assessment for one of the company’s projects in the US.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.