Closing Bell: Materials sector lifts ASX, with Pilbara Minerals and Strickland Metals turning heads

Two people who probably don't invest in mining stocks, earlier. (Getty Images)

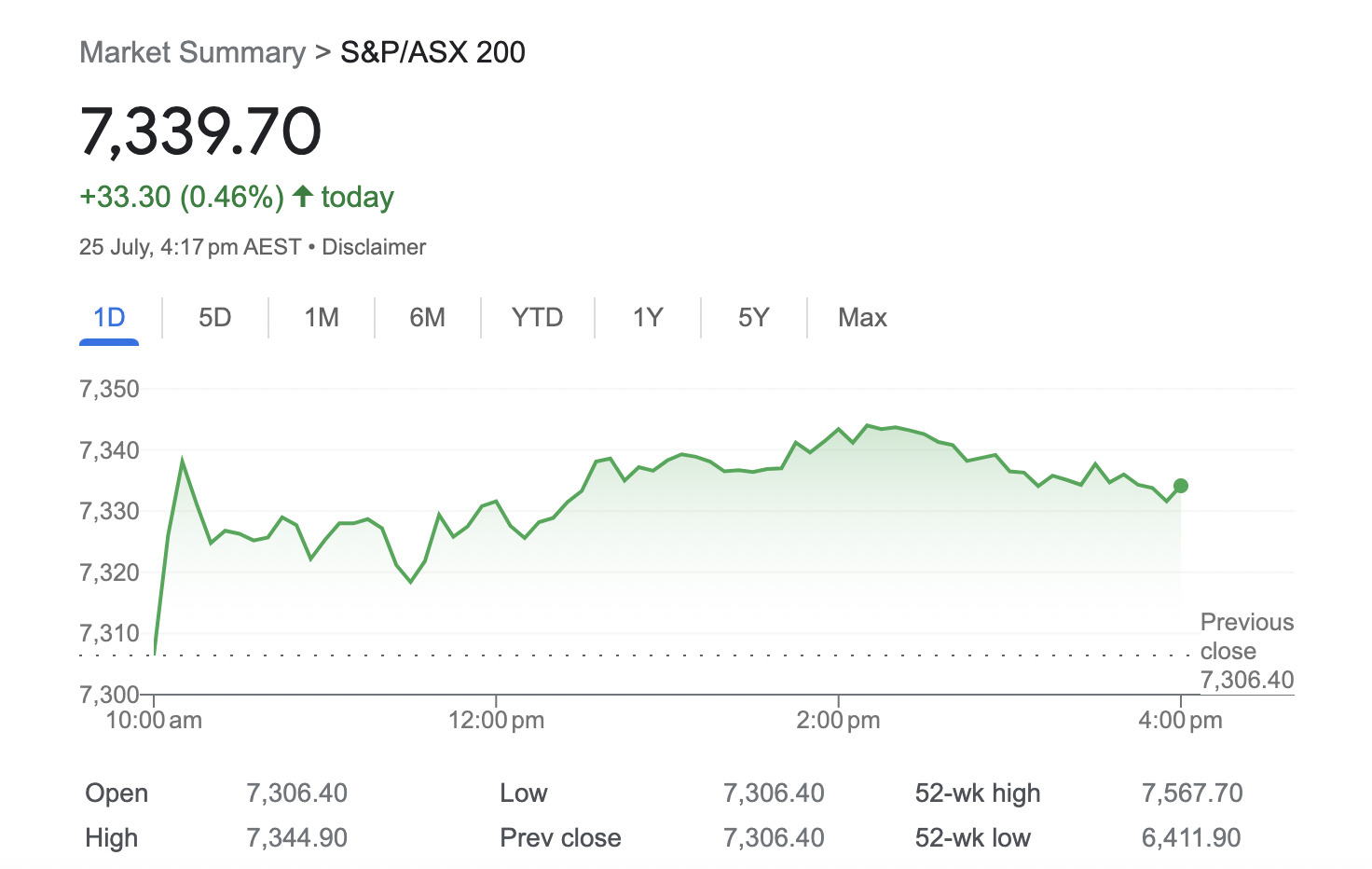

- The ASX 200 put on a much better show today, with a +0.46% gain at closing time

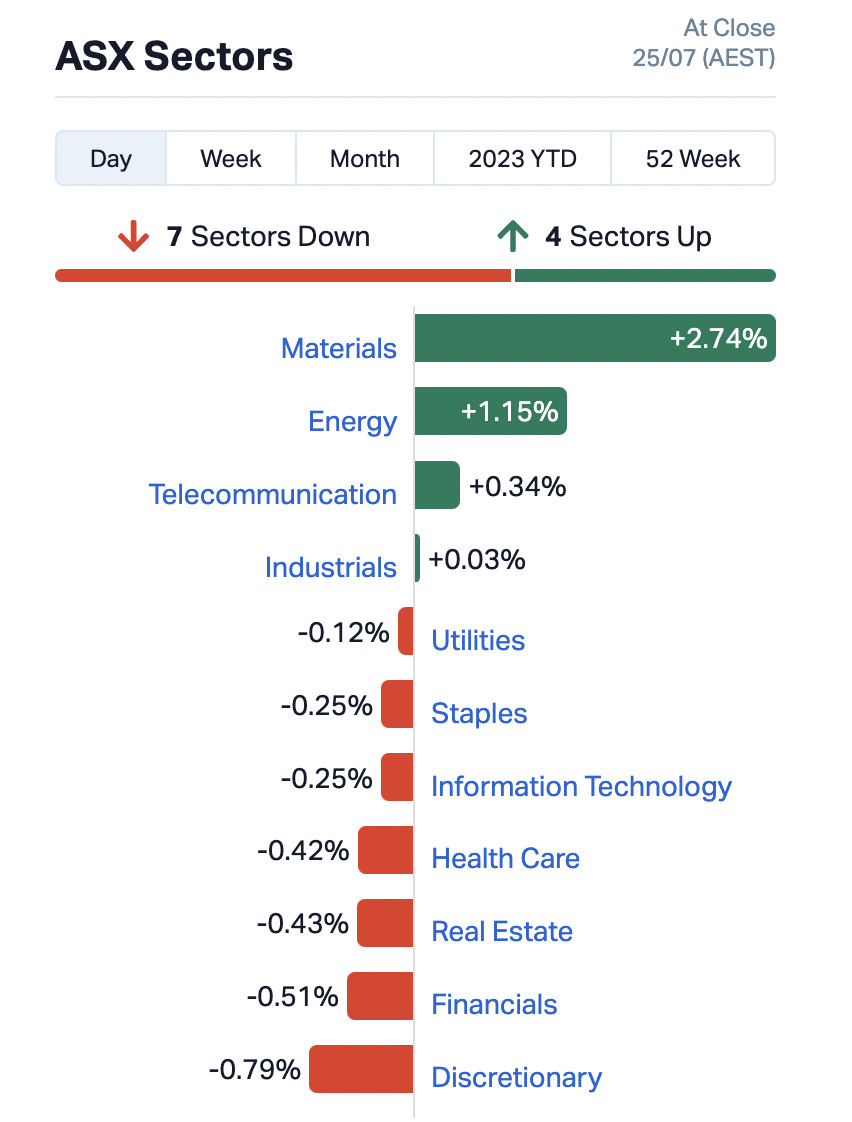

- Sectors wise, Materials turned yesterday’s frown upside down

- Notable performers today: Pilbara Minerals; DXN; Si6 Metals; Strickland Metals

It’s been a much better day on the bourse, with Materials and Energy stonks making some sweet, sick gainz.

Yesterday’s high-performing Energy sector must’ve taken the out-of-form Materials under its wing and down to the nets for a good three-hour practice yesterday evening after the close of play.

That dedication clearly rubbed off with some success for Materials today – including from at least one pretty prominent explorer…

MAKING NEWS

• Pilbara Minerals (ASX:PLS) registered a thoroughly decent 5.23% gain today. Which is not bad for a $14.65bn market capper. Everyone wants a chunk of its lithium expansion, reckons Stockhead‘s shiny, elemental phenomenon Josh Chiat.

For deep intel, you should absolutely read his Ground Breakers piece on it, and his Monsters of Rock, but just a quick recap:

Dale dug a hole.

Pilbara Minerals boss Dale Henderson that is, who revealed that more than 70 companies have thrown their hat in the ring to help develop a new lithium chemical plant from its Pilgangoora expansion.

“It came as Pilbara Minerals continue to print cash in the June quarter, boosting its bank balance by 24% to $3.3 billion after selling 176,300t of spodumene in the fourth quarter, an increase of 22%,” noted Josh, adding:

“The big focus for PLS is now its move downstream, as it ramps up spodumene output at Pilgangoora to 680,000tpa and then 1Mtpa by the middle of the decade.”

• Meanwhile, a day after we decided to mention Vanguard‘s latest report on fixed-income ETF inflows, ASIC has revealed it’s taking the big-gun investment firm to the Federal Court over alleged “greenwashing”.

The Aussie financial regulatory body alleges Vanguard practised “misleading conduct” with regards to its claims about certain ESG screens applied to investments in its ASX-listed Vanguard Ethically Conscious Global Aggregate Bond Index Fund. The Australian has a bit more on that, here. As does Eddy “LARGE CAPS” Sunarto, here.

But for its part, Vanguard said it “recognises it has not lived up to the high standards it holds itself accountable to and apologises for the concern this matter may cause for our clients”.

TO MARKETS

The you-beaut, dinky-di local bourse was likely always on course for a decent day, what with Wall Street closing in a positive frame of mind overnight.

From Eddy’s Market Highlights this morning, in which he noted AMC Entertainment’s +33% jump:

“Overnight, the Dow Jones extended its winning streak to 11 straight days, rising by 0.52%. The S&P 500 was up +0.4%, and tech heavy Nasdaq climbed 0.19%.”

But as for the ASX 200, it burst out of the gates, took a lunch-time breather, then finished fairly strongly with an overall +0.46% gain.

Zooming in a tad, as previously mentioned the Materials sector came roaring back, with Energy stepping aside but still in decent shape along with the Telcos.

Most other stock sectors were trading pretty flat, however, with Discretionary taking a bit of a dip, down about 1% on the day.

Before we take you to Funky Town (aka the smaller caps), here are some standouts in the larger end of ASX City. (Bearing in mind, we already mentioned Pilbara Minerals further above.)

• Fortescue Metals Group (ASX:FMG) : +4.48% > Okay, we’re talking much larger end here. But just quickly, the Aussie exploration titan is up because… apparently exec chairman Andrew ‘Twiggy’ Forrest is in the US making noise about green hydrogen over in the White House. Can’t confirm whether Joe Biden is awake and listening, or tucked in with a warm cocoa and watching Wheel of Fortune, however.

• Sandfire Resources (ASX:SFR): +5.47% > on no particularly fresh news we’re noticing for the copper miner today.

• Chalice Mining (ASX:CHN) : +5.71% > on no fresh news.

• Sayona Mining (ASX:SYA) : +6.67% > Aside from also riding today’s Materials sector wave, nothing specifically exciting here for the lithium miner – unless you think a Change of Director’s Interest notice is exciting.

• Monadelphous Group (ASX:MND): +5.52% > The engineering company has announced it’s secured a major construction contract with Albemarle, valued at approximately $200 million and associated with the expansion of the Kemerton lithium hydroxide plant in the south west region of Western Australia. More on that here.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AUK | Aumake Limited | 0.0045 | 50% | 4,328,942 | $4,461,778 |

| CCE | Carnegie Cln Energy | 0.0015 | 50% | 50,000 | $15,642,574 |

| CLE | Cyclone Metals | 0.0015 | 50% | 1,250,000 | $10,264,505 |

| DXN | DXN Limited | 0.0015 | 50% | 5,590,000 | $1,721,315 |

| MCT | Metalicity Limited | 0.002 | 33% | 720,928 | $5,604,129 |

| SI6 | SI6 Metals Limited | 0.008 | 33% | 21,329,639 | $9,924,050 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 717,636 | $11,494,636 |

| GFN | Gefen Int | 0.005 | 25% | 820,609 | $513,119 |

| AMA | AMA Group Limited | 0.14 | 22% | 5,077,811 | $123,403,075 |

| SWP | Swoop Holdings Ltd | 0.3375 | 21% | 194,736 | $57,985,948 |

| LBT | LBT Innovations | 0.024 | 20% | 152,041 | $6,915,914 |

| CMG | Criticalmineralgrp | 0.275 | 20% | 144,495 | $7,023,182 |

| CMO | Cosmometalslimited | 0.097 | 17% | 29,793 | $2,746,180 |

| CVR | Cavalierresources | 0.14 | 17% | 119,980 | $3,819,470 |

| ATH | Alterity Therap Ltd | 0.007 | 17% | 122,944 | $14,639,386 |

| RIE | Riedel Resources Ltd | 0.007 | 17% | 810,701 | $12,356,442 |

| NKL | Nickelxltd | 0.072 | 16% | 172,618 | $5,358,987 |

| WNR | Wingara Ag Ltd | 0.037 | 16% | 84,000 | $5,617,360 |

| BAS | Bass Oil Ltd | 0.115 | 15% | 834,113 | $26,839,444 |

| BOD | BOD Science Ltd | 0.115 | 15% | 462,505 | $15,312,149 |

| CUS | Coppersearchlimited | 0.23 | 15% | 4,000 | $10,558,979 |

| CHK | Cohiba Min Ltd | 0.004 | 14% | 100,000 | $7,746,355 |

| EME | Energy Metals Ltd | 0.12 | 14% | 6,804 | $22,016,748 |

| EGY | Energy Tech Ltd | 0.049 | 14% | 4,000 | $14,519,373 |

| STK | Strickland Metals | 0.042 | 14% | 10,268,892 | $58,821,064 |

Standouts:

• DXN (ASX:DXN): +50% > The Aussie techie, a data centre designer, builder and operator, has revealed a very positive quarterly report, with a highlight: modular data centre contracts in the latest quarter totalling $3.9m.

• Si6 Metals (ASX:SI6): +33% > A strong investor presentation has investors in the Botswana-focused (nickel, copper, PGE) metal heads upbeat. Strategic targeting of critical minerals sites and investor propositions a-go-go. More here.

• Strickland Metals (ASX:STK) : +14% > See Last Orders, below.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| BNO | Bionomics Limited | 0.0125 | -43% | 35,126,329 | $32,312,179 |

| CT1 | Constellation Tech | 0.002 | -33% | 2,068,446 | $4,413,601 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 1,006,543 | $9,221,169 |

| RBR | RBR Group Ltd | 0.002 | -33% | 37,717 | $4,855,214 |

| OM1 | Omnia Metals Group | 0.17 | -24% | 3,132,060 | $10,253,457 |

| CAV | Carnavale Resources | 0.0055 | -21% | 41,532,792 | $23,334,862 |

| CTN | Catalina Resources | 0.004 | -20% | 1,766,550 | $6,192,434 |

| EMU | EMU NL | 0.002 | -20% | 2,300,665 | $3,625,053 |

| GPR | Geopacific Resources | 0.016 | -20% | 4,722,376 | $16,423,822 |

| MVP | Medical Developments | 1.3 | -19% | 1,078,201 | $138,951,332 |

| ONE | Oneview Healthcare | 0.195 | -19% | 2,405,235 | $128,032,121 |

| BFC | Beston Global Ltd | 0.009 | -18% | 16,547,681 | $21,967,516 |

| BEX | Bikeexchange Ltd | 0.005 | -17% | 792,187 | $7,134,901 |

| HLX | Helix Resources | 0.005 | -17% | 856,197 | $13,938,875 |

| MXC | Mgc Pharmaceuticals | 0.0025 | -17% | 2,065,419 | $11,677,079 |

| BGT | Bio-Gene Technology | 0.083 | -16% | 50,000 | $17,651,329 |

| MEG | Megado Minerals Ltd | 0.059 | -16% | 1,454,206 | $17,811,889 |

| PXX | Polarx Limited | 0.011 | -15% | 8,755,342 | $17,600,832 |

| MPR | Mpower Group Limited | 0.017 | -15% | 103,046 | $5,874,066 |

| WMG | Western Mines | 0.545 | -15% | 437,643 | $33,462,611 |

| AUR | Auris Minerals Ltd | 0.012 | -14% | 1,183,958 | $6,672,763 |

| AWJ | Auric Mining | 0.05 | -14% | 350,631 | $7,589,856 |

| FBR | FBR Ltd | 0.019 | -14% | 11,075,523 | $81,223,523 |

| JPR | Jupiter Energy | 0.019 | -14% | 73,981 | $27,056,703 |

| GLH | Global Health Ltd | 0.165 | -13% | 34,479 | $11,029,412 |

LAST ORDERS

• In pursuit of lithium

Pursuit Minerals (ASX:PUR) is a promising explorer focused on PGE-Ni-Cu, gold and nickel projects in Australia, and its Rio Grande Sur lithium project in Argentina.

And it’s another resources gem to have a decent day on the bourse, posting a 14.29% gain.

Why? It’s announced the results of its TEM survey, conducted by Quantec Geoscience, at the aforementioned Rio Grande Sur project.

And the survey says… “Highly Encouraging Preliminary Results”.

“Preliminary results received from Quantec reveal the existence of multiple low resistivity layers,” reads a published note about the findings.

“These findings strongly suggest the presence of lithium-bearing brines, as expected from historical exploration based on the sub surface conductivity,” continued Pursuit Minerals, adding:

“Importantly, the survey indicates the presence of brines below the historical drilling depth of 50- 100m, with brine shown to 250-300m.”

To put it another way… LFG.

• Saaaale of the century (one of them anyway)

Strickland Metals (ASX:STK) is another gold and copper exploration company on the rise, currently with a market cap of a shade over $65 million. Which has been added to today with a 24-hour +14% gain.

The news backing this pumpage is that Strickland’s sale of its Millrose project to gold major Northern Star Resources (ASX:NST) has reached a stage of transactional completion.

Digging deeper, Strickland is well in the black on this one, receiving a further $39 million in cash as well as a nice little sweetener of 1.5 million fully paid ordinary NST shares.

But wait, there’s more. Prior to this, Strickland also pocketed an initial cash deposit of $2 million. The beers are definitely on them. (Although don’t blame us if you’re told to bugger off when you turn up to their HQ in your “going out shirt” expecting a few frothies.)

Per its sale announcement, Strickland will now commence exploration campaigns to advance and upgrade its existing portfolio of projects.

Andrew Bray, Strickland’s CEO, said: “Completion of the Millrose sale transaction with Northern Star is a momentous step in the development of Strickland. We now have one of the strongest balance sheets in the junior exploration space, along with a portfolio of very promising, advanced exploration projects.

“Work is commencing imminently on a number of prospects at the Yandal gold project, as well as at Iroquois and the wider Earaheedy base metal project.”

• In the Navy

“In the navy, you can sail the seven seas… In the navy, you can… contract an Aussie industrial metal 3D printing company for its patented Wire Additive Manufacturing process…”

The US Navy, that is. And the Aussie company in question is AML3D (ASX:AL3).

That’s not the firm’s freshest tune, but it’s a big hit from the back catalogue and it provides some context.

The latest development is that AML3D has just been granted a European patent for said patented process (WAM®).

Why is this noteworthy? It makes it the only additive manufacturing company with a European process patent, leaving the company well positioned to target European sales opportunities.

And, while the company’s immediate focus will still remain on scaling up sales of its ARCEMY ® systems to industrial manufacturers within the US Defence, marine and aerospace industries, AML3D notes in a statement that it plans, over the medium term, to follow suit with similar sales operations to support the same type of industries in Europe.

TRADING HALTS

DMC Mining (ASX:DMM) – Run, DMC. Away from ASX trading today. (It was there.) Until a likely Thursday resumption, that is. It’s all good. The company is reportedly waiting to announce to the market a project expansion.

Panoramic Resources (ASX:PAN) – Capital raising.

Alara Resources (ASX:AUQ) – Pending an announcement regarding the entry by Alara’s 51% owned joint venture vehicle Al Hadeetha Resources LLC (AHRL) into an offtake agreement to sell copper concentrate from its Al Wash-hi Majaza Copper-Gold Project in Oman.

Readcloud (ASX:RCL) – Capital raising.

Careteq (ASX:CTQ) – Capital raising.

Critical Resources (ASX:CRR) – Capital raising.

RLF AgTech (ASX:RLF) – Regards the pending inking of a material agreement with the Commonwealth Bank of Australia in relation to the company’s carbon business.

At Stockhead we tell it like it is. While Pursuit Minerals and Strickland Metal are Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.