Closing Bell: Small caps rise, unemployment falls, more people accept life’s full of ups and downs

Pic: DKosig / iStock / Getty Images Plus via Getty Images

The Emerging Companies Index (XEC) climbed more than 2% higher on Thursday, before closing at 1.9%, while its benchmark colleague – the upmarket ASX 200 followed Wall Street’s ascendence, trading up a shade over 1% after the Fed lifted interest rates overnight.

The ASX had another wee outage today. If we weren’t so jazzed up over this employment data, I’d say heads should roll.

The S&P 500 meanwhile, ended over 2% up, the Nasdaq almost 4% – buoyed by an upbeat Fed chair Jerome Powell waxing lyrical on the US economy. That’s flowed through to the tech names at home, the sector up over 4% in the late arvo, while materials and banks also gained.

Chinese stocks went off again today now that the state council is kind of saying it won’t pick on tech companies so much and that it’ll stop the rot, should markets not act as naturally as they should.

At home, the jobless rate is looking pretty damn good. A solid beat on market expectations – and at 4.1% its at a 14 year low.

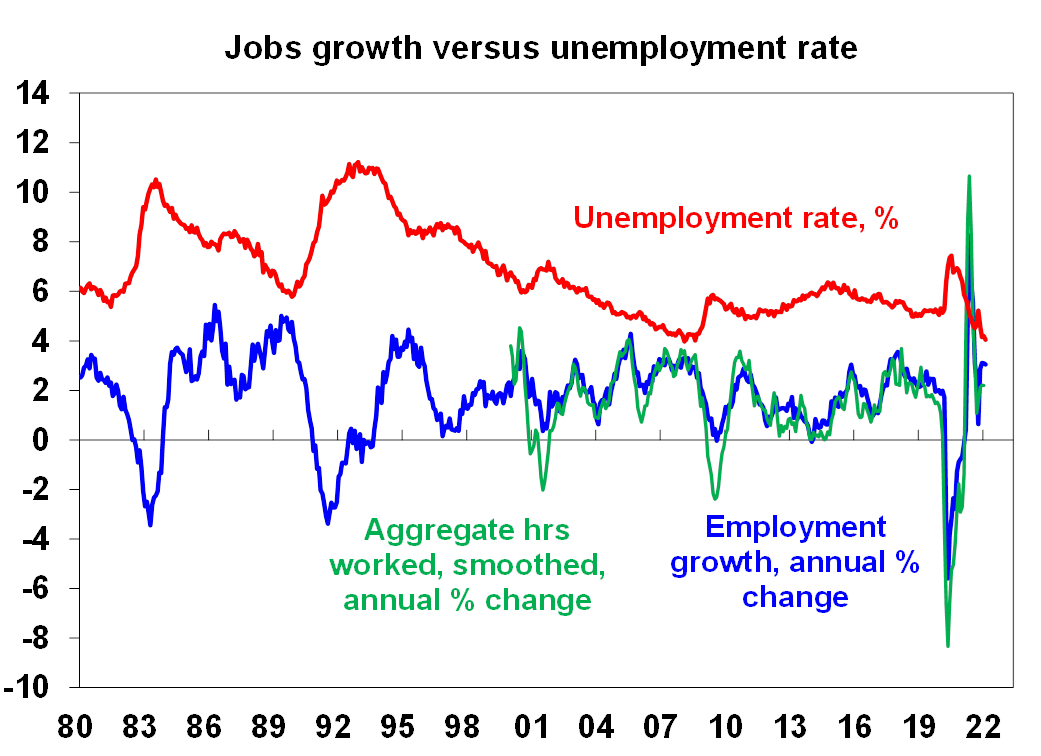

Aggregate hours worked, which stresses economists like the legend that is AMP Capital senior economist Diana Mousina – spiked back real nice (see: AMP Capital/ABC chart below).

Ms Mousina says we’re in, ‘very strong shape.’

“Annual growth in employment is running at a high 3% – much higher than the 0.5% lift in the civilian working age population over the past year – which is why the unemployment rate has fallen significantly over the past year:

Ms Mousina says this reflects:

- a strong recovery in the economy after the pandemic-driven downturn in 2020 driven by significant monetary and fiscal stimulus

- closed international borders which has shut us off from the supply of foreign labour

- There is no point 3

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Description | Price | % | Volume |

|---|---|---|---|---|

| WOO | Wooboard Tech Ltd | 0.002 | 100.0% | 250,000 |

| EVE | EVE Health Group Ltd | 0.003 | 50.0% | 200,000 |

| IBX | Imagion Biosys Ltd | 0.063 | 46.5% | 71,495,609 |

| OXX | Octanex Ltd | 0.027 | 42.1% | 1,274,641 |

| ALT | Analytica Limited | 0.002 | 33.3% | 1,517,009 |

| VMG | VDM Group Limited | 0.002 | 33.3% | 357,126 |

| YPB | YPB Group Ltd | 0.002 | 33.3% | 1,150,344 |

| MAY | Melbana Energy Ltd | 0.19 | 31.0% | 52,799,674 |

| 3DA | Amaero International | 0.25 | 28.2% | 1,844,121 |

| BIT | Biotron Limited | 0.081 | 24.6% | 19,246,771 |

| EZZ | EZZ Life Science | 0.39 | 23.8% | 41,031 |

| ERW | Errawarra Resources | 0.23 | 21.1% | 324,610 |

| NES | Nelson Resources. | 0.023 | 21.1% | 422,637 |

| BSA | BSA Limited | 0.12 | 20.0% | 194,122 |

| RWD | Reward Minerals Ltd | 0.12 | 20.0% | 13,560 |

| CNJ | Conico Ltd | 0.012 | 20.0% | 634,909 |

| CT1 | Constellation Tech | 0.006 | 20.0% | 3,535,260 |

| 4DX | 4Dmedical Limited | 0.845 | 19.9% | 1,916,660 |

| BKY | Berkeley Energia Ltd | 0.4 | 19.4% | 1,295,973 |

| HPC | Thehydration | 0.285 | 18.8% | 70,124 |

| LYN | Lycaonresources | 0.415 | 18.6% | 71,482 |

| ARL | Ardea Resources Ltd | 0.97 | 18.3% | 692,795 |

| CLH | Collection House | 0.13 | 18.2% | 652,663 |

| CTE | Cryosite Limited | 0.555 | 18.1% | 217,142 |

| JRL | Jindalee Resources | 3.11 | 17.8% | 470,795 |

T’were Tuesday when Amaero International (ASX:3DA) began a study of “strategic alternatives” to maximise value for shareholders… calling up the global investment firm Guggenheim to do the heavy lifting. The stock fell about 5% on the news.

3DA promised stakeholders its work stays here in Australia, while the construction of its titanium plant remains on track. It’s up 25% today , so if I’m missing something: [email protected].

Funnily enough, and also raising on the promise of a ‘strategic review,’ is defence play Electro Optic Systems (ASX:EOS) which says Greenhill’s will go the market to test buyer appetite in the business, as EOS looks to also maximise value for shareholders. EOS was up 8% ahead of the close.

Imagion Biosystems (ASX:IBX) is developing a new non-radioactive and safe diagnostic imaging technology and has evaluated the first five patients in its study for the MagSense HER2 breast cancer imaging agent.

“We can say that there have been no safety issues reported related to the MagSense® HER2 imaging agent and that all patients have tolerated the administration and dosage of the injectable,” Monash Health principal investigator Dr Jane Fox said.

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| ANL | Amani Gold Ltd | 0.001 | -33.3% | 2,790,622 |

| KEY | KEY Petroleum | 0.002 | -33.3% | 125,000 |

| AJL | AJ Lucas Group | 0.06 | -21.1% | 4,452,705 |

| CCE | Carnegie Cln Energy | 0.002 | -20.0% | 13,592,636 |

| OEX | Oilex Ltd | 0.004 | -20.0% | 10,554,764 |

| GMR | Golden Rim Resources | 0.077 | -17.2% | 1,598,742 |

| BIR | BIR Financial Ltd | 0.025 | -16.7% | 4,201,946 |

| XTE | Xtek Limited | 0.2 | -16.7% | 196,119 |

| RDN | Raiden Resources Ltd | 0.01 | -16.7% | 3,686,969 |

| SGQ | St George Min Ltd | 0.053 | -15.9% | 5,650,503 |

| 9SP | 9 Spokes Int Limited | 0.006 | -14.3% | 3,065,845 |

| IPB | IPB Petroleum Ltd | 0.012 | -14.3% | 531,000 |

| MBK | Metal Bank Ltd | 0.006 | -14.3% | 100,000 |

| PHO | Phosco Ltd | 0.12 | -14.3% | 753,055 |

| RAB | Adrabbit Limited | 0.024 | -14.3% | 19,086 |

| WNR | Wingara Ag Ltd | 0.058 | -13.4% | 25,000 |

| FHS | Freehill Mining Ltd. | 0.02 | -13.0% | 239,071 |

| AN1 | Anagenics Limited | 0.042 | -12.5% | 250,000 |

| KIL | Kiland Ltd | 1.1 | -12.0% | 105,858 |

| INP | Incentiapay Ltd | 0.015 | -11.8% | 346,336 |

| SER | Strategic Energy | 0.0265 | -11.7% | 299,340 |

| W2V | Way2Vatltd | 0.071 | -11.3% | 53,728 |

| AWV | Anova Metals Ltd | 0.016 | -11.1% | 6,914,434 |

| MRD | Mount Ridley Mines | 0.008 | -11.1% | 3,575,438 |

| 8IH | 8I Holdings Ltd | 0.13 | -10.3% | 21,008 |

Golden Rim Resources (GMR:ASX) says it’s got firm commitments from shareholders, and them key strategic and institutional investors to raise $6.3 million – $5.3 million share placement in two tranches and a $1 million share purchase plan (SPP)

The funds will go into amping up its Kada mine in West Guinea. Shares have dropped 17% on the news.

ANNOUNCEMENTS THAT YOU MAY HAVE MISSED

Small cap biotech stock Biotron (ASX:BIT) has announced its lead clinical asset BIT225 has demonstrated clinically meaningful efficacy against Covid-19, albeit in animals in a series of studies performed at The SCRIPPS Research Institute in the U.S.

The study found a significant prevention of body weight loss and absence of death in COVID-19 infected animals treated with BIT225 compared to non-treated controls. Supported by these results and an earlier study Biotron and its US advisors have submitted a proposal to the US Food and Drug Administration (FDA) to conduct human trials.

The share price in copper-zinc explorer Belararox Ltd (ASX:BRX) has risen 1.6% today after kicking off drilling at the Belara Project in central NSW.

Phase one of the drill plan comprises a total of 32 holes for 5439m and follows a detailed review of historical drill data which indicated extensions to the ore body may exist outside the current non-JORC compliant resource area.

REIT Goodman Group (ASX:GMG) has appointed global real estate executive Hilary Span as an independent director as it pursues its global business strategy. Span is currently a senior executive at NYSE-listed Boston Properties.

The Goodman Board now has circa 40% internationally-based directors which it says reflect, “its increasing global presence,” and is seeking to appoint another overseas director later this year.

TRADING HALTS

Wellnex Life Limited (ASX: WNX) – trading halt, pending an announcement regarding a supply agreement with an international consumer healthcare company

ResApp Health (ASX:RAP) – trading halt, pending the release of an announcement

regarding its COVID-19 study results.

Reach Resources Limited (ASX:RR1) – trading halt, pending an announcement regarding an acquisition and capital raising.

Melbana Energy Limited (ASX: MAY) – trading halt, pending an announcement regarding drill results

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.